Table of contents

- Main points

- Overall taxes and benefits reduced inequality of household income between poorest and richest people in financial year ending 2018

- Effects of taxes and benefits on household income data

- Glossary

- Measuring these data

- Strengths and limitations

- More about household income

- You may also be interested in

1. Main points

Before taxes and benefits, the richest one-fifth of people had an average household income of £88,200 in the financial year ending (FYE) 2018, based on estimates from the Living Costs and Food Survey.

The ratio of average household income of the richest one-fifth of people (before taxes and benefits) compared with the poorest one-fifth (£7,900) was 11.2 in FYE 2018, continuing the downward trend from 15.5 in FYE 2008.

Overall, taxes and benefits lead to income being shared more equally; after all taxes and benefits are taken into account, the ratio between the average household income of the richest and poorest fifth of people (£65,500 and £18,900 respectively) is reduced to less than 4.

Cash benefits were most effective at reducing income inequality in FYE 2018, although their effect has diminished over the past seven years; this partly reflects the fall in their value relative to incomes before taxes and benefits.

Direct taxes (such as income tax) are progressive in reducing income inequality; with the richest one-fifth paying 30.9% of their income in direct taxation, compared with 14.7% for the poorest one-fifth of people.

However, indirect taxes (such as Value Added Tax (VAT) and alcohol duties) can be considered both regressive or broadly neutral; the poorest one-fifth of people paid the equivalent of 27.1% of their household disposable income in indirect taxation, compared with 14.3% for the richest one-fifth of people. However, the incidence of indirect taxes on expenditure – which they are levied on – is more evenly balanced; the poorest one-fifth of people paid 19.2% compared with 17.1% for the richest one-fifth.

The proportion of people living in households receiving more in benefits than they paid in taxes fell from 49.6% to 47.9% in FYE 2018, continuing the downward trend since FYE 2010.

This article introduces a number of improvements to how we measure and analyse the underlying data including: moving the analysis from a household to person level, presenting Experimental Statistics that adjust for under-reporting of the very rich, and the inclusion of estimates of adult social care; more details can be found in our accompanying blog.

2. Overall taxes and benefits reduced inequality of household income between poorest and richest people in financial year ending 2018

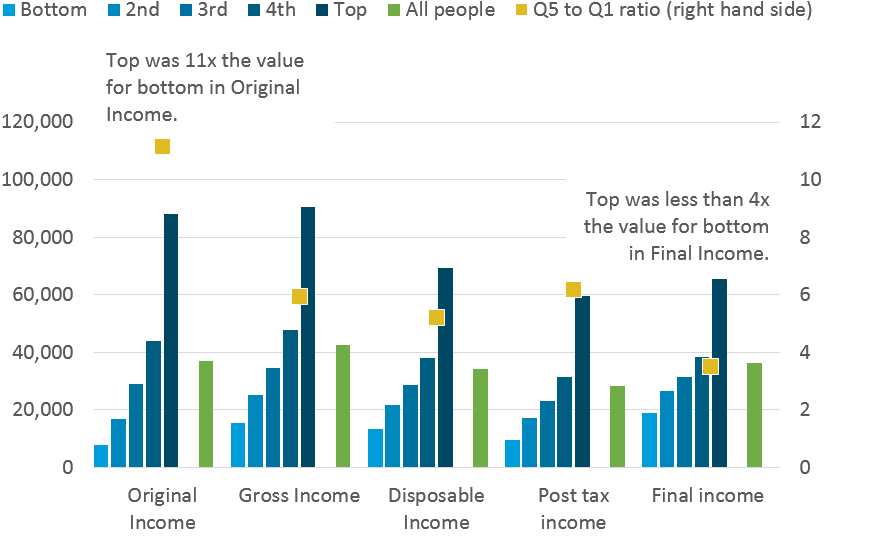

Figure 1: Taxes and benefits lead to household income being shared more equally between people

Household original, gross, disposable, post-tax and final income, equivalised, by quintile group, and Q5 to Q1 ratio, all individuals, UK, 2017 to 2018

Source: Office for National Statistics - Living Costs and Food survey

Download this image Figure 1: Taxes and benefits lead to household income being shared more equally between people

.png (23.4 kB)Overall, taxes and benefits lead to household income being shared more equally between people. In the financial year ending (FYE) 2018, before taxes and benefits, the richest one-fifth of people had an average household original income 11.2 times larger than the income of the poorest one-fifth – £88,200 compared with £7,900, after adjusting for household size and composition.

This ratio has fallen in recent years, from a peak of 15.5 in FYE 2008, indicating that the inequality of original income has been falling. This is explored in more detail further in the bulletin. Original income includes income from employment, private pensions and investments.

The receipt of cash benefits and payment of direct taxes reduces income inequality between the poorest and richest 20% of people. The average household disposable income of the richest one-fifth of people was 5.2 times larger than the income of the poorest one-fifth – £69,400 compared with £13,300 (Figure 1). After indirect taxes (for example, Value Added Tax (VAT), alcohol duties and so on) and benefits-in-kind (for example, state education, National Health Service) are taken into account, the ratio further reduces to 3.5.

Figure 2: The richest one-fifth of people live in households that pay more in tax than they receive in benefits, while the poorest 20% receive more in benefits than they pay in taxes

Summary of the effects of taxes and benefits by quintile groups1, UK, financial year ending 2018

Source: Office for National Statistics - Living Costs and Food survey

Notes:

- Individuals are ranked by their equivalised household disposable incomes, using the modified Organisation for Economic Co-operation and Development (OECD) scale.

Download this chart Figure 2: The richest one-fifth of people live in households that pay more in tax than they receive in benefits, while the poorest 20% receive more in benefits than they pay in taxes

Image .csv .xlsTo better understand how taxes and benefits reduce the income gap between the richest and poorest, Figure 2 summarises the net positions (in terms of benefits received and taxes paid by households) of each income quintile group. The poorest one-fifth of people live in households that received relatively large amounts of both cash benefits and benefits-in-kind and were net recipients in FYE 2018. Richer households, on the other hand, paid more in taxes – both direct and indirect – and received less in benefits, meaning the people in the top income quintile were net contributors.

As reported in the Average household income, UK: financial year ending 2018 bulletin, the average income of the poorest one-fifth of the population – when ranked by equivalised household disposable income – contracted by 1.6%. The average income of the richest one-fifth, on the other hand, increased by 4.7%.

Figure 3: Average household income of the poorest 20% of people fell in the financial year ending 2018, driven mainly by a fall in the value of cash benefits they received

Contribution to change in household disposable income by quintile groups1, UK, financial year ending 2017 to financial year ending 2018

Source: Office for National Statistics - Living Costs and Food survey

Notes:

- Income from employment is equal to the sum of wages and salaries, and self-employment income.

- Individuals are ranked by their equivalised household disposable incomes, using the modified Organisation for Economic Co-operation and Development (OECD) scale.

- Incomes are adjusted for inflation using the Consumer Prices Index including owner occupiers’ housing costs (CPIH) excluding Council Tax.

Download this chart Figure 3: Average household income of the poorest 20% of people fell in the financial year ending 2018, driven mainly by a fall in the value of cash benefits they received

Image .csv .xlsLooking at this in more detail, Figure 3 examines the contribution to change in unequivalised household disposable income between FYE 2017 and FYE 2018. Overall, there was a 10.4% decline in the average real value of benefits (excluding state pensions) households received. As highlighted in Figure 2, the bottom income quintile has a greater reliance on cash benefits. The fall in the average real value of benefits (excluding state pensions) of the bottom income quintile contributed negative 4.6 percentage points to the 3.9% decline in average unequivalised household disposable income.

Many working-age benefits, such as Jobseeker’s Allowance, Child Benefit and Housing Benefit, are held at FYE 2016 cash values from FYE 2017 to FYE 2020, meaning their value is falling in real terms. Pensioner, disability, sickness and carer benefits, including Personal Independence Payment, Carer’s Allowance and the Employment and Support Allowance Support Group component are excluded from this freeze.

In addition, a benefit cap is in place in England, Scotland and Wales, which restricts the amount of certain benefits that most working-age households can receive. Any household receiving more than the cap has their Housing Benefit reduced to bring them back within the limit. This benefit cap was introduced in Northern Ireland from 31 May 2016 with a “Welfare Supplementary Payment” paid to any households with children in who have their Housing Benefit reduced due to the cap.

The basic State Pension increased in line with the “triple guarantee” (or “triple lock”) that was introduced in FYE 2013. This ensures that it increases by the highest of the increase in earnings, price inflation (as measured by the Consumer Prices Index) or 2.5%. From April 2017, the basic State Pension increased by 2.5% (as neither inflation nor earnings growth was greater than 2.5%) from £119.30 to £122.30 per week.

Overall, income from employment (wages and salaries, and self-employment) increased by 6.7% in real terms, contributing to growth in disposable income for the second, third, and top income quintiles. This is likely to be due to increasing employment over this period.

Cash benefits were most effective at reducing income inequality in FYE 2018

There are various measures to assess how inequality of household income has changed over time. While one approach is to compare the ratio of income of the average household incomes of the richest and poorest one-fifth of people, as presented in the previous section, another widely used measure is the Gini coefficient.

Gini coefficients can vary between 0% and 100% and the lower the value, the more equally household income is distributed. One of the advantages of the Gini coefficient is that it considers the whole distribution, rather than just the top and bottom.

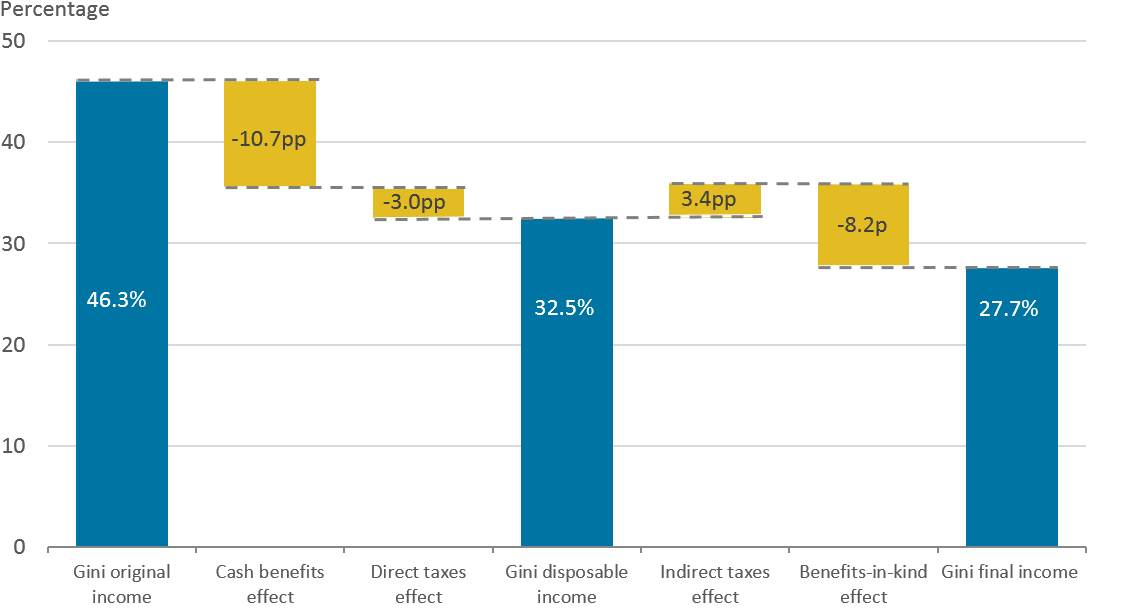

Figure 4: Cash benefits were most effective at reducing income inequality in the financial year ending 2018

Cash benefits had the largest effect on reducing income inequality in the financial year ending 2018, reducing the Gini coefficient from 46.3% for original income to 35.4% for gross income.

Source: Office for National Statistics - Living Costs and Food survey

Notes:

- pp – percentage points.

- Original income includes all sources of income from employment, private pensions, investments and other non-government sources. The receipt of cash benefits is then added to original income and direct taxes are subtracted to estimate disposable income. Indirect taxes (for example, VAT, alcohol duties and so on) are then subtracted and finally benefits-in-kind (for example, state education, National Health Service) are added to estimate final income.

- Incomes are equivalised using the modified Organisation for Economic Co-operation and Development (OECD) equivalisation scale.

Download this image Figure 4: Cash benefits were most effective at reducing income inequality in the financial year ending 2018

.png (21.1 kB)Figure 4 highlights how each stage of redistribution – from cash benefits, to direct and indirect taxes, and finally benefits-in-kind – work together to affect income inequality. Overall, the full effect of all taxes and benefits is to reduce income inequality in FYE 2018, with the Gini coefficient falling by 18.6 percentage points from 46.3% on an original income basis, to 27.7% on a final income basis.

Cash benefits have the largest effect on reducing income inequality, in FYE 2018, reducing the Gini coefficient by 10.7 percentage points from 46.3% for original income to 35.6% for gross income. Direct taxes act to further reduce it, by 3.0 percentage points to 32.5%. The addition of indirect taxes increases the Gini coefficient of income by 3.4 percentage points, which is more than offset by the addition of benefits-in-kind.

| Effect on Gini coefficient (pp) | ||

|---|---|---|

| Income | Expenditure* | |

| Cash benefits | -10.7 | |

| Direct taxes | -3.0 | |

| Indirect taxes | 3.4 | 0.8 |

| Benefits-in-kind | -8.2 | |

Download this table Table 1: Effect of taxes and benefits on Gini coefficient on different measures of income and expenditure, UK, financial year ending 2018

.xls .csvWhile it is important to consider the redistributive impact of indirect taxes on income, enabling a full judgement of the effectiveness of taxes and benefits system, there is a strong argument for also considering their impact on expenditure inequality.

Indirect taxes are directly levied on expenditure and, as previously explored in An expenditure-based approach to poverty in the UK (PDF, 824.3KB), some households can have temporarily low periods of income, which do not necessarily impact upon their consumption, and living standards. As a consequence, the indirect taxes that those households pay as a proportion of their income will be lower than as a proportion of their expenditure. This effect appears to be playing a role, as Table 1 highlights that the impact of indirect taxes on the Gini coefficient of expenditure is less pronounced on an expenditure basis compared with income (0.8 and 3.4 percentage points respectively).

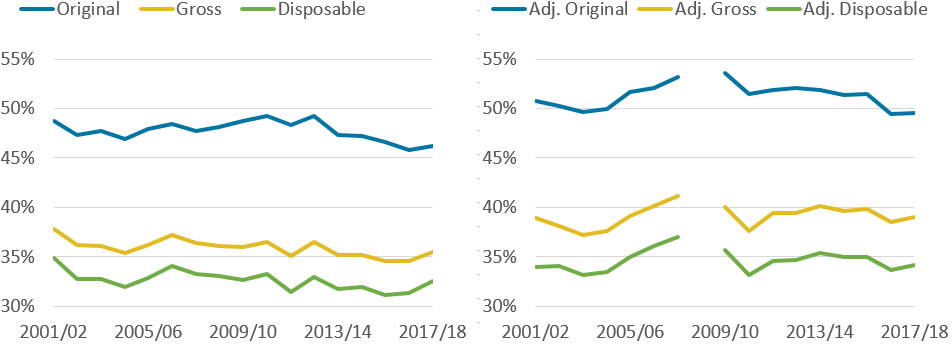

Figure 5: Inequality of original income has fallen by 3.0 percentage points between financial year ending 2011 and financial year ending 2018

Gini coefficients for different income measures, UK, 1977 to financial year ending 2018

Source: Office for National Statistics - Living Costs and Food survey

Notes:

- Original income includes all sources of income from employment, private pensions, investments and other non-government sources. The receipt of cash benefits is then added to original income to estimate gross income, and then direct taxes are subtracted to estimate disposable income. Indirect taxes (for example, VAT, alcohol duties and so on) are further subtracted to form post-tax income, and finally benefits-in-kind (for example, state education, National Health Service) are added to estimate final income.

- Incomes are equivalised using the modified Organisation for Economic Co-operation and Development (OECD) equivalisation scale.

- 2017 to 2018 represents the financial year ending 2018 (April to March), and this applies for all other years expressed in this format.

Download this chart Figure 5: Inequality of original income has fallen by 3.0 percentage points between financial year ending 2011 and financial year ending 2018

Image .csv .xlsWhile The effects of taxes and benefits on income inequality: 1977 to financial year ending 2015 bulletin provides more detail on historical trends in income inequality, Figure 5 presents some important changes that have emerged over recent years. In particular, the inequality of original income has fallen by 3.0 percentage points between FYE 2011 and FYE 2018. This has not been matched by equivalent falls in the inequality of gross, or disposable income – falling by 0.9 and 0.7 percentage points respectively over this period.

The fall in original income for all households is observed for people living in both non-retired and retired households separately. For non-retired people, this likely reflects changes in the labour market over recent years, with rising employment driving an increase in the average number of working people in households towards the bottom of the distribution.

The smaller fall in inequality of gross income for those living in non-retired households is likely explained by an observed fall in the value of cash benefits received relative to households’ original incomes. This is likely to be due partly to the rising employment levels mentioned previously but may also reflect the cash terms freeze since FYE 2017 (and 1% uprating for three financial years prior to this) in many working-age benefits (discussed in more detail earlier on).

The fall in inequality of original income for retired people coincides with a period in which the number of recipients of private pensions has increased, acting to reduce income disparities between richer and poorer retired people.

Figure 6: Effectiveness of cash benefits at reducing income inequality has diminished over the past seven years

Change in Gini coefficients due to cash benefits and taxes, UK, 1977 to financial year ending 2018

Source: Office for National Statistics - Living Costs and Food survey

Notes:

- 2017 to 2018 represents the financial year ending 2018 (April to March), and this applies for all other years expressed in this format.

Download this chart Figure 6: Effectiveness of cash benefits at reducing income inequality has diminished over the past seven years

Image .csv .xlsCash benefits and direct taxes remain progressive in financial year ending 2018

In FYE 2018, cash benefits composed a larger proportion of the poorest one-fifth of people’s income – 52.5% of average household disposable income, falling to 2.9% for the richest one-fifth of people. This means that cash benefits continued to be progressive in FYE 2018.

Similarly, direct taxes were progressive, with the richest one-fifth paying 30.9% of their income, compared with 14.7% for the poorest one-fifth.

Figure 7: The incidence of indirect taxes varies across the income distribution depending on whether measured as a proportion of income or expenditure

Indirect taxes as a proportion of disposable income and expenditure, all people, UK, financial year ending 2018

Source: Office for National Statistics - Living Costs and Food survey

Notes:

- Individuals are ranked by their equivalised household disposable incomes, using the modified Organisation for Economic Co-operation and Development (OECD) scale.

- Duties include duty on tobacco, duty on beer and cider, duty on wines and spirits, duty on hydrocarbon oils, and Vehicle Excise Duty.

- Expenditure is calculated to be consistent with disposable income.

Download this chart Figure 7: The incidence of indirect taxes varies across the income distribution depending on whether measured as a proportion of income or expenditure

Image .csv .xlsThe people in the richest income quintile paid an average of £12,300 in indirect tax in FYE 2018, 2.7 times that of the poorest group (£4,600). This reflects greater expenditure on goods and services subject to these taxes by higher income households. While the richest one-fifth of people paid more indirect taxes than the poorest one-fifth, they paid less as a proportion of their income. The poorest one-fifth paid the equivalent of 27.1% of their household disposable income in indirect tax on average, compared with 14.3% for the richest one-fifth of people, meaning that indirect taxes are regressive when considered on this basis.

To provide a complete picture of the effects of taxes and benefits, it is important to consider the redistributive effects of indirect taxes in terms of income, but it is also useful to analyse them in relation to expenditure. This reflects the fact that the amount of indirect taxes that households pay is determined by their expenditure rather than their income. Figure 5 shows that when expressed as a percentage of expenditure, the proportion paid in indirect taxes declines less sharply when moving up the distribution.

Benefits-in-kind are progressive and decrease income inequality. Benefits-in-kind are goods and services provided by the government to households that are either free at the time of use or at subsidised prices, such as education and health services. These goods and services can be assigned a monetary value based on the cost to the government, which is then allocated as a benefit to individual households.

Those in the poorest one-fifth of the income distribution received benefits-in-kind equivalent to £12,900 per household, driven largely by contributions from education services (49.5%) and the National Health Service (NHS) (42.9%). Those in the richest one-fifth of the income distribution, on the other hand, received benefits-in-kind equivalent to £7,700 per household, again with the NHS (60.9%) and education (30.4%) as the largest contributors.

The poorest one-fifth of people received more benefit-in-kind from education in total and, therefore, as a proportion of their income. This is largely because households towards the bottom of the income distribution have, on average, a larger number of children in state education. Our current methodology for allocating NHS spending to individuals is based on age and sex. Given that there are no substantial differences in the composition of households, in terms of age and sex, across the income distribution, NHS spending is allocated fairly evenly.

Households towards the bottom of the income distribution receive more in benefits-in-kind from adult social care

A new development in these statistics covering FYE 2018 is the introduction of new measures for the distribution of benefits-in-kind arising from publicly provided adult social care. Adult social care is the personal care and practical support provided to adults with physical or learning disabilities, or physical or mental illnesses, as well as support for their carers.

This could be for personal care (such as eating, washing, or getting dressed) or for domestic routines (such as cleaning or going to the shops). The forms of support we account for exclude residential care – about 37% of total adult social care in FYE 2018 – due to effects of taxes and benefits statistics covering only the private household population.

The methodology for measuring the distribution of adult social care benefit was developed with the National Institute for Economic and Social Research (NIESR) as part of the Economic Statistics Centre of Excellence. The effects of taxes and benefits on household income, financial year ending 2018: technical report provides more detail on the methodology used for measuring the distribution of adult social care.

Figure 8: The poorest 20% of people received the largest proportion of income from adult social care in the financial year ending 2018, with the richest 20% receiving the least

Average amount of adult social care per household, and as a proportion of disposable income by income quintile, UK, financial year ending 2018

Source: Office for National Statistics - Living Costs and Food survey

Notes:

- Individuals are ranked by their equivalised household disposable incomes, using the modified Organisation for Economic Co-operation and Development (OECD) scale.

Download this chart Figure 8: The poorest 20% of people received the largest proportion of income from adult social care in the financial year ending 2018, with the richest 20% receiving the least

Image .csv .xlsFigure 8 highlights that the poorest 20% of people had the highest proportion of income from adult social care in the financial year ending 2018, with the richest 20% receiving the least. Households in the second income quintile received the most in total (£900), reflecting their increased likelihood to be in receipt of benefits related to disability, which we use to allocate this benefit-in-kind. The richest households received the least (£300) in FYE 2018 due to these households being least likely to receive disability-related benefits.

As the method to allocate adult social care across the income distribution is relatively new, we welcome feedback on the approach taken and results by email at hie@ons.gov.uk. Following feedback, we aim to update our historical datasets to include adult social care, enabling a better understanding of its distributional consequences over time.

Proportion of people living in households receiving more in benefits than they pay in tax has fallen over recent years

In FYE 2018, 47.9% of individuals lived in households receiving more in benefits (including in-kind benefits such as education) than they paid in taxes (direct and indirect) (Figure 9). This continues the decline from 53.1% since FYE 2011, but is still above levels recorded just before the economic downturn starting in FYE 2008.

Figure 9: In the financial year ending 2018, 47.9% of individuals lived in households receiving more in benefits than they paid in taxes

Proportion of individuals receiving more in benefits than they are paying in tax, UK, 1977 to financial year ending 2018

Source: Office for National Statistics - Living Costs and Food survey

Notes:

- 2017 to 2018 represents the financial year ending 2018 (April to March), and this applies for all other years expressed in this format.

- Incomes are adjusted for inflation using the Consumer Prices Index including owner occupiers’ housing costs (CPIH) excluding Council Tax.

Download this chart Figure 9: In the financial year ending 2018, 47.9% of individuals lived in households receiving more in benefits than they paid in taxes

Image .csv .xlsIn FYE 2018, 39.6% of non-retired people received more in benefits than they paid in taxes, down from a peak of 45.4% in FYE 2011.

In contrast, there was a slight increase in FYE 2018 in the proportion of retired people living in households receiving more in benefits than they pay in taxes, up to 86.1% from 85.1% in FYE 2017. Retired people, on average, receive more benefits than they pay in tax due mainly to their reliance on the State Pension, which is classed as a cash benefit in this analysis.

Figure 10: Households whose head is aged 64 years and over received more in benefits than they paid in taxes on average in the financial year ending 2018

Effects of taxes and benefits by age of head of household, UK, financial year ending 2018

Source: Office for National Statistics - Living Costs and Food survey

Notes:

The household reference person is the householder who: owns the household accommodation; is legally responsible for the rent of the accommodation; has the household accommodation as an emolument or perquisite; or has the household accommodation by virtue of some relationship to the owner who is not a member of the household. If there are joint householders, the household reference person will be the one with the higher income. If the income is the same, then the eldest householder is taken.

A previous version of this chart included a series "All cash benefits". This has now been removed.

Download this chart Figure 10: Households whose head is aged 64 years and over received more in benefits than they paid in taxes on average in the financial year ending 2018

Image .csv .xlsThe fact that retired people are increasingly likely to receive more benefits than they pay in taxes is in Figure 10, showing how the effects of taxes and benefits change across the life course. On average in FYE 2018, households whose head is aged under 65 years paid more in taxes than they received in benefits (both cash and in-kind). Those aged between 50 and 54 years paid the most in taxes (£21,500), while those aged between 60 and 64 years received the least in benefits (£7,200). Households whose head is aged 79 years and over paid the least in taxes (£6,100) and received the most in benefits (£21,100).

For households with a head of household aged 65 years and over, State Pension and Pension Credit were the largest components of their cash benefits, followed by the benefits derived from the National Health Service, which tend to increase with age. The benefits derived from education peak with a household head aged between 40 and 44 years, because these households have the most children on average.

Experimental Statistics highlight that adjusting top incomes for under-reporting increases impact of taxes in reducing income inequality

As presented in the article, Using tax data to better capture top earners in household income inequality statistics, published in February 2019, we are developing a top income adjustment for effects of taxes and benefits (ETB) to address issues of under-reporting and under-coverage at the top of the income distribution. These adjustments tend to increase the amount of measured income for the very richest people and therefore increase levels of inequality.

| Gini on original income (%) | Change in Gini due to cash benefits (pp) | Change in Gini due to direct taxes | Gini on disposable income (%) | |

|---|---|---|---|---|

| Unadjusted ETB data | 46.3 | -10.7 | -3.0 | 32.5 |

| Adjusted ETB data | 49.5 | -10.5 | -4.8 | 34.2 |

| Impact of adjustment | 3.3 | 0.2 | -1.8 | 1.7 |

Download this table Table 2: Comparing effectiveness of cash benefits and direct taxes before and after introduction of adjustment for top incomes, UK, financial year ending 2017 to financial year ending 2018

.xls .csvTable 2 compares the impact on the Gini coefficient due to cash benefits, and direct taxes, in terms of the change in the Gini coefficient. It highlights that the adjustment increases the impact of direct taxes on reducing income inequality, but not enough to completely offset the increase in inequality of original income. The change in the impact on cash benefits is negligible as people who have had their incomes adjusted are not likely to be in receipt of benefits.

Figure 11: Impact of taxes in reducing income inequality increases when incomes are adjusted for under-reporting

Impact of top income adjustment on Gini coefficient of various measures of income, UK, financial year ending 2001 to financial year ending 2018

Source: Office for National Statistics - Living Costs and Food survey

Notes:

- 2017 to 2018 represents the financial year ending 2018 (April to March) and this applies for all other years expressed in this format.

- Incomes are adjusted for inflation using the Consumer Prices Index including owner occupiers’ housing costs (CPIH) excluding Council Tax.

- Adjusted incomes for financial year ending 2009 are missing as no Survey of Personal Incomes (SPI) dataset is available for that year.

Download this image Figure 11: Impact of taxes in reducing income inequality increases when incomes are adjusted for under-reporting

.png (27.9 kB)While the introduction of a top income adjustment increases measured inequality on an original, gross and disposable basis, there is relatively little effect on trends over time (Figure 11). As discussed in the previous section, the introduction of a top income adjustment results in a larger fall in inequality when the effect of direct taxes is taken into account for all years.

In FYE 2011, the effect of direct taxes using adjusted data lowers the Gini on disposable income to a comparable level measured on the unadjusted data. As explored in the article Using tax data to better capture top earners in household income inequality statistics, published in February 2019, this is probably due to the introduction of a 50% top tax rate for FYE 2012, which resulted in people forestalling their income (see The Exchequer effect of the 50 per cent additional rate of income tax article).

These statistics, which present adjustments for top incomes to address under-reporting and under-coverage, are experimental and we welcome feedback by email at hie@ons.gov.uk. Following wider consultation, we aim to implement an adjustment in our headline statistics covering the reference period FYE 2019.

Back to table of contents3. Effects of taxes and benefits on household income data

Effects of taxes and benefits on household income

Dataset | Released on 30 May 2019

Tables 1 to 23 in the Effects of taxes and benefits on household income data provide more information on average values of main income components, taxes and benefits, and household characteristics of retired and non-retired households in the UK. Data are available for quintile and decile groups, country and region and tenure type.

4. Glossary

Stages in the redistribution of income

The five stages are:

household members begin with income from employment, private pensions, investments and other non-government sources; this is referred to as “original income”

households then receive income from cash benefits; the sum of cash benefits and original income is referred to as “gross income”

households then pay direct taxes; direct taxes, when subtracted from gross income, is referred to as “disposable income”

indirect taxes are then paid via expenditure; disposable income minus indirect taxes is referred to as “post-tax income”

households finally receive a benefit from services (benefits-in-kind); benefits-in-kind plus post-tax income is referred to as “final income”

Note that at no stage are deductions made for housing costs.

Progressive and regressive taxes and benefits

A tax is progressive when high-income groups face a higher average tax rate than low-income groups. If those with higher incomes pay a higher amount but still face a lower average tax rate, then the tax is considered regressive; similarly, cash benefits are progressive where they account for a larger share of low-income groups’ income.

Equivalisation

Comparisons across different types of individuals and households (such as retired and non-retired, or rich and poor) or over time are made after income has been equivalised. Equivalisation is the process of accounting for the fact that households with many members are likely to need a higher income to achieve the same standard of living as households with fewer members. Equivalisation considers the number of people living in the household and their ages, acknowledging that while a household with two people in it will need more money to sustain the same living standards as one with a single person, the two-person household is unlikely to need double the income.

This analysis uses the modified Organisation for Economic Co-operation and Development (OECD) equivalisation scale (PDF, 165KB).

Back to table of contents5. Measuring these data

This release provides estimates of the redistributive role of taxes and benefits on household income and inequality. These data are from our Living Costs and Food Survey (LCF), a voluntary sample survey of around 5,000 private households in the UK. These statistics are assessed fully compliant with the Code of Practice for Statistics and are therefore designated as National Statistics. The derivation of household income, and its components, is based on international best practice, following as close as possible guidelines laid out in The Canberra Group Handbook on Household Income Statistics (2011).

For the first time, these statistics are produced on an individual rather than a household level. This means that income quintiles, for example, are derived by ordering people, rather than households, on an equivalised household disposable income basis. This method is consistent with the statistics reported in Average household income, UK: financial year ending 2018 and Household income inequality, UK: financial year ending 2018, and ensures the variance in household size across the income distribution is better accounted for.

We are currently working on transforming our data on the distribution of household finances. The first part of this work has concentrated on combining the samples from the LCF and another of our household surveys, the Survey on Living Conditions (SLC), and harmonising the income collection in these questionnaires. This will result in a dataset formed of a sample of around 17,000 households. This first stage of work was carried out during financial year ending (FYE) 2018. Work is currently under way to quality assure these data before publishing initial results later this year.

In addition, the Office for National Statistics (ONS) is working towards linking data from administrative and other non-survey sources, including HM Revenue and Customs’ (HMRC’s) Real Time Information (RTI) and the Department for Work and Pensions’ (DWP’s) benefits data. Although these other sources also have their own limitations, by using them together with surveys we should be able to produce better data on household income. More information on our plans for transforming our household finance statistics is available in the article Transformation of ONS household financial statistics: ONS statistical outputs workplan, 2018 to 2019.

Back to table of contents6. Strengths and limitations

As with all survey-based sources, the data are subject to some limitations. The Living Costs and Food Survey (LCF) is known to suffer from under-reporting at the top and bottom of the income distribution as well as non-response error (see the Effects of taxes and benefits on household income Quality and Methodology Information (QMI) report for further details of the sources of error). We are exploring adjustments as presented in Using tax data to better capture top earners in household income inequality statistics for the under-reporting and under coverage of the richest people.

Further, as these data are based on a survey of the private household population, they do not include those living in communal establishments such as care homes and student halls of residence, as well as some core groups of the homeless populations.

The Department for Work and Pensions (DWP) also produces an analysis of the UK income distribution in its annual Households below average income (HBAI) publication, using data from its Family Resources Survey (FRS). While the FRS is subject to the same limitations as other survey sources, it benefits from a larger sample size (approximately 19,000 households) than the LCF and, as such, will have a higher level of precision than ETB estimates.

In addition, HBAI includes an adjustment for “very rich” households to correct for the under-reporting using data from HM Revenue and Customs’ (HMRC’s) Survey of Personal Incomes (SPI). As mentioned earlier, we are in the process of investigating top-income adjustment for these statistics. These differences make HBAI a better source for looking at income-based analysis that does not need a longer time series (the FRS data are available from financial year ending (FYE) 1995) and when looking at smaller subgroups of the population, particularly at the upper end of the income distribution.

Back to table of contents7. More about household income

The effects of taxes and benefits on household income, financial year ending 2018: technical report

Released 30 May 2019

Provides further detail on how the effects of taxes and benefits on household income estimates are produced. This report also provides further information on the measurement of income inequality.

Households below average income (HBAI)

Released 28 March 2019

The Department for Work and Pensions produces statistics on the number and percentage of people living in low-income households in the UK.

Average household income and Household income inequality

Bulletins | Released 26 February 2019

Two separate bulletins providing first survey-based estimates of average household income, and income inequality for financial year ending 2018.

Transformation of ONS household financial statistics: ONS statistical outputs workplan, 2018 to 2019

Article | Released 20 June 2018

Information on our plans for transforming ONS’s Household Finance Statistics, including combining the samples from the Living Costs and Food Survey and the Survey on Living Conditions. It also looks at how we are working towards using administrative data from HM Revenue and Customs and the Department for Work and Pensions.

Using tax data to better capture top earners in household income inequality statistics

Article | Released 26 February 2019

Experimental Statistics examining the impact of replacing incomes at the very top of the distribution with tax records information contained within HMRC’s Survey on Personal Incomes (SPI).

8. You may also be interested in

A guide to sources of data on earnings and income

Article | Updated 4 February 2019

Further information on other sources of income and earnings data, including the appropriate uses of and limitations of each data source.

Employee earnings in the UK

Statistical bulletin | Updated 25 October 2018

Important measures of employee earnings, using data from the Annual Survey of Hours and Earnings (ASHE). Figures are presented mainly for full-time employees, although some detail for part-time workers is also included.

Centre for Equalities and Inclusion

Article | Updated April 2019

The Centre for Equalities and Inclusion aims to improve the evidence base for understanding equity and fairness in the UK today, enabling new insights into important policy questions. We are a multi-disciplinary convening centre based at the Office for National Statistics, bringing together people interested in equalities data and analysis from across central and local government, academia, business and the third sector.

Personal and economic well-being in the UK: April 2019

Statistical bulletin | Updated 11 April 2019

Estimates looking across both personal well-being (January to December 2018) and economic well-being (October to December 2018) in the UK. This bulletin is part of a new series on "people and prosperity" introduced in February 2019.

Wealth in Great Britain Wave 5: 2014 to 2016

Statistical bulletin | Updated 1 February 2018

Main results from the fifth wave of the Wealth and Assets Survey covering the period July 2014 to June 2016.

Family spending in the UK: April 2017 to March 2018

Statistical bulletin | Updated 24 January 2019

Average weekly household expenditure on goods and services in the UK, by region, age, income, economic status, socio-economic class and household composition.