Table of contents

- Main points

- Things you need to know about this release

- The total UK trade deficit widened by £0.4 billion to £6.4 billion in the three months to February 2018

- The UK trade in goods deficit widened with the EU and narrowed with non-EU countries in the three months to February 2018

- Decreases in export volumes had the largest impact on the widening of the trade in goods deficit in the three months to February 2018

- The total UK trade deficit narrowed by £12.9 billion to £27.5 billion in the 12 months to February 2018, due mainly to a widening of the UK’s trade surplus in services

- The UK trade in goods deficit narrowed with the EU and widened with non-EU countries in the 12 months to February 2018

- What are the revisions to trade values since our last release?

- Links to related statistics

- Quality and methodology

1. Main points

The total UK trade deficit (goods and services) widened by £0.4 billion to £6.4 billion in the three months to February 2018; excluding erratic commodities it widened by £1.0 billion to £7.5 billion.

The £0.4 billion widening of the total trade deficit was due mainly to a £2.1 billion fall in non-EU goods exports, partially offset by increases of £0.9 billion in EU goods and £0.4 billion in total services exports in the three months to February 2018.

Movements in goods exports were largely offset by imports, therefore there was little change in the goods deficit with EU or non-EU countries, which widened by £0.2 billion and narrowed by £0.1 billion respectively in the three months to February 2018.

The goods deficit widened by £0.1 billion in the three months to February 2018; the balances for fuels and unspecified goods widened by £1.9 billion and £0.6 billion respectively, offsetting a £1.4 billion and £0.8 billion narrowing of the machinery and transport equipment, and chemicals balances respectively.

Decreases in export volumes had the largest impact on the widening of the trade in goods deficit in the three months to February 2018.

Comparing the 12 months to February 2018 with the same period in 2017, the total trade deficit narrowed by £12.9 billion to £27.5 billion; the services surplus widened by £11.1 billion to £108.3 billion and the goods deficit narrowed by £1.8 billion to £135.8 billion.

The UK trade in goods deficit with the EU narrowed by £2.9 billion to £94.4 billion and with non-EU countries widened by £1.1 billion to £41.4 billion in the 12 months to February 2018.

Revisions to the total trade (goods and services) balance during January 2017 to December 2017 are due mainly to revisions to services exports; upward revisions to the total trade balance in January 2018 are due largely to a £0.6 billion downward revision to imports of goods.

2. Things you need to know about this release

In order to put more context around UK trade figures and to help explain some of the longer-term trends, we are now including a 12-month comparison of the trade figures in the UK trade bulletin. This measure compares the 12 months running up to the current period with the 12 months to the same period a year ago, for example, for the latest period this will be the 12 months to February 2018 compared with the 12 months to February 2017.

Unless otherwise stated, all trade values discussed in this release are in current prices. The time series dataset also includes chained volume measures (series for which the effects of inflation have been removed) and these are indexed to form the volume series presented in the publication tables.

Data are supplied by over 30 sources, including several administrative sources; HM Revenue and Customs (HMRC) covering trade in goods is the largest. For trade in services, data are less timely than trade in goods estimates and are sourced mainly from survey data and a variety of administrative sources. The services data are processed quarterly, so monthly forecasts are made to provide a complete trade total. The most recent monthly data can therefore be considered more uncertain.

Trade statistics for any one month can be erratic. For that reason, we recommend comparing the latest three months against the preceding three months and the same three months of the previous year.

Oil and other “erratic” commodities can make a large contribution to trade in goods, but often mask the underlying trend in the export or import values due to their volatility. The “erratics” series includes ships, aircraft, precious stones, silver and non-monetary gold. Non-monetary gold can have a particularly large impact on growth rates, due to the large volumes of gold traded on the London markets. Therefore, we also publish data exclusive of these commodities, which may provide a better guide to the emerging trade picture.

In accordance with the National Accounts Revisions Policy, data in this release have been revised from January 2017 to January 2018 for services and for January 2018 for goods data.

The UK Statistics Authority suspended the National Statistics designation of UK trade on 14 November 2014. We have now responded to all of the specific requirements of the reassessment of UK trade and are in the final stages of providing evidence to the Authority. We are undertaking a programme of improvements to UK trade statistics in line with the UK trade development plan that will also address anticipated future demands. While delivering against this plan, we will continue to work with the Office for Statistics Regulation team to regain National Statistics status for UK trade statistics. We welcome feedback on this development plan.

Back to table of contents3. The total UK trade deficit widened by £0.4 billion to £6.4 billion in the three months to February 2018

The total UK trade deficit (goods and services) widened by £0.4 billion to £6.4 billion in the three months to February 2018 (Figure 1). This is a relatively small movement in the UK trade balance, which across the past 12 months has ranged between a £2.8 billion narrowing in the three months to October 2017 and a £3.2 billion widening in the three months to January 2018.

Goods and services both contributed to the widening of the trade deficit in the three months to February 2018. The UK’s surplus in services narrowed by £0.3 billion to £27.8 billion, while the deficit in goods widened by £0.1 billion to £34.2 billion.

Total imports and exports (goods and services) both declined, although exports fell by a larger amount in the three months to February 2018; exports fell by £0.7 billion to £158.4 billion while imports declined by £0.3 billion to £164.8 billion.

When erratic commodities are excluded, the UK trade deficit widened by £1.0 billion to £7.5 billion in the three months to February 2018. The widening was due mainly to trade in goods exports decreasing by £0.6 billion to £80.3 billion, partially offset by a £0.4 billion increase in services exports. Total (goods and services) imports increased by £0.8 billion to £160.3 billion. Given that total exports decreased while total imports increased, the trade deficit excluding erratic commodities widened.

Figure 1: Three-month on three-month UK trade balances, August 2013 to February 2018

Source: Office for National Statistics

Download this chart Figure 1: Three-month on three-month UK trade balances, August 2013 to February 2018

Image .csv .xls4. The UK trade in goods deficit widened with the EU and narrowed with non-EU countries in the three months to February 2018

Figures 2 and 3 show the value contribution of goods exports and imports to and from EU and non-EU countries respectively in the three months to February 2018.

The UK trade in goods deficit widened by £0.2 billion with the EU and narrowed by £0.1 billion with non-EU countries in the three months to February 2018; exports and imports of goods to and from the EU increased, while exports and imports to and from non-EU countries decreased.

Exports of goods to the EU increased by £0.9 billion in the three months to February 2018 (Figure 2). The increase in exports of £0.4 billion for machinery and transport equipment had the largest contribution to the rise, followed by increases of £0.1 billion of fuels and £0.1 billion of chemicals.

Exports of goods to non-EU countries declined across most commodities, which resulted in an overall £2.1 billion fall in non-EU exports in the three months to February (Figure 2). The largest contributors to the decline were £0.9 billion of unspecified goods (including non-monetary gold), £0.8 billion of fuels and £0.4 billion of miscellaneous manufactures.

Figure 2: Contribution of goods exports to total EU and non-EU exports, three months to February 2018 on previous three months to November 2017

Source: Office for National Statistics

Download this chart Figure 2: Contribution of goods exports to total EU and non-EU exports, three months to February 2018 on previous three months to November 2017

Image .csv .xlsGoods imports increased by £1.1 billion from the EU (Figure 3), which was slightly larger than the £0.9 billion increase in exports to the EU (Figure 2) in the three months to February 2018. The main contribution to the rise in imports from the EU was a £0.7 billion increase in imports of fuels, followed by increases of £0.3 billion in machinery and transport equipment, £0.2 billion of miscellaneous manufactures and £0.2 billion of material manufactures. The main offset to the rise in imports came from a £0.2 billion decline of imports of chemicals.

The £2.1 billion decline in non-EU exports of goods (Figure 2) was matched by a slightly larger £2.2 billion decrease in non-EU imports in the three months to February 2018 (Figure 3). The fall in imports was caused mainly by falls of £1.6 billion for machinery and transport equipment and £0.5 billion for miscellaneous manufactures. The main commodity offsetting the overall decline in imports was a £0.6 billion rise in imports of fuels.

Figure 3: Contribution of goods imports to total EU and non-EU imports, three months to February 2018 on previous three months to November 2017

Source: Office for National Statistics

Download this chart Figure 3: Contribution of goods imports to total EU and non-EU imports, three months to February 2018 on previous three months to November 2017

Image .csv .xls5. Decreases in export volumes had the largest impact on the widening of the trade in goods deficit in the three months to February 2018

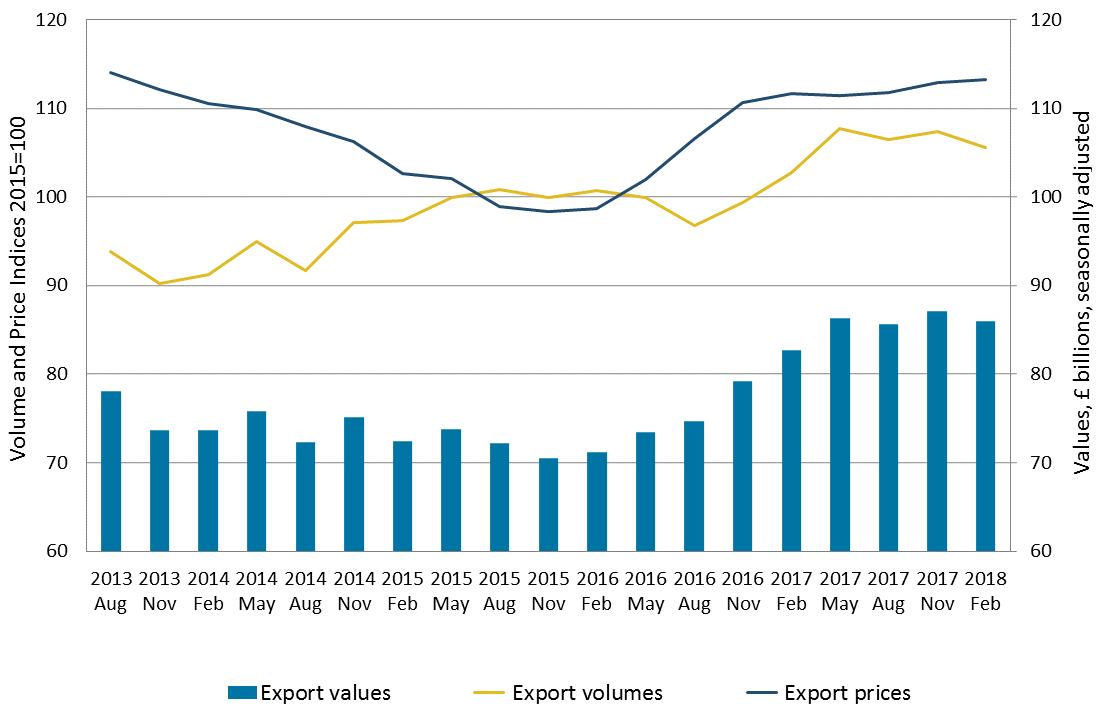

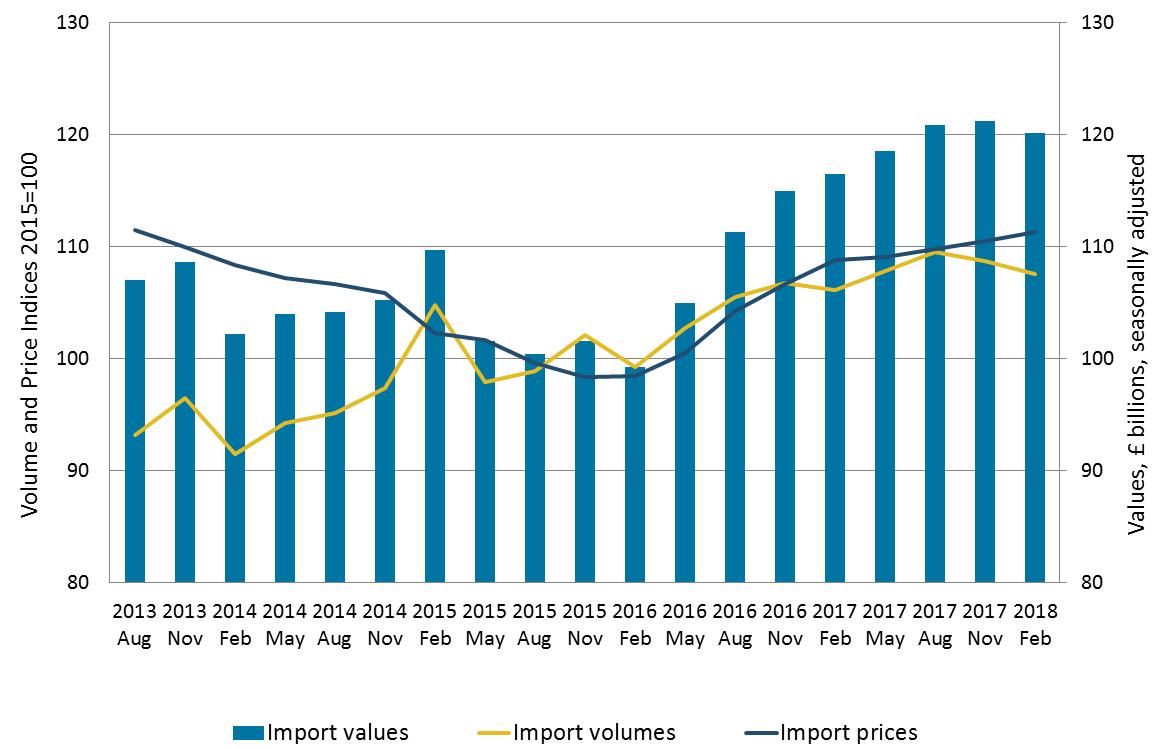

Figures 4 and 5 show the three-month on three-month UK goods export and import values, volumes and prices respectively from August 2013 to February 2018.

The £1.2 billion decrease in the value of total goods exports to £86.0 billion was due to volume decreases in the three months to February 2018. Total goods export volumes decreased by 1.6% while total goods export prices rose by 0.4%. The decrease in export volumes follows a 0.8% increase in export volumes in the three months to November 2017.

The £1.1 billion decrease in the value of total goods imports to £120.2 billion was due to volume decreases in the three months to February 2018. Total goods import volumes decreased by 1.1%, while total goods import prices rose by 0.8%. The decrease in import volumes is the second consecutive three-month decrease.

The combined effect of slightly larger decreases in total goods export volumes in comparison with decreases in total goods import volumes, while prices remained relatively flat, was a £0.1 billion widening of the trade in goods deficit to £34.2 billion. This coincides with an increase in the value of sterling in the three months to February 2018.

While simple economic theory suggests an increase in the value of sterling should result in an increase in export prices (exports decreasing in competitiveness) and a decrease in import prices, in practice the impact of a sterling change is likely to be much more complex. Our Economic review has detailed the economic theory of the expected impact of sterling exchange rate movements on export and import volumes and prices.

Although the increase in total goods import prices may appear contrary to economic theory, while increases in export prices are in line with economic theory, it is important to note that prices are reported in sterling for the UK rather than foreign currency terms. As detailed in the Economic review, changes in prices (on a sterling basis) are likely to be largely attributable to the amount of trade conducted on a foreign currency basis (with EU and non-EU countries) as price changes are lagged in the short-term – therefore, it is possible there may be no change in the price in foreign currency terms.

Figure 4: Three-month on three-month UK goods export values, volumes and prices, August 2013 to February 2018

Source: Office for National Statistics

Download this image Figure 4: Three-month on three-month UK goods export values, volumes and prices, August 2013 to February 2018

.png (50.2 kB) .xlsx (18.2 kB)

Figure 5: Three-month on three-month UK goods import values, volumes and prices, August 2013 to February 2018

Source: Office for National Statistics

Download this image Figure 5: Three-month on three-month UK goods import values, volumes and prices, August 2013 to February 2018

.png (49.8 kB) .xlsx (18.2 kB)The volume of goods exported to non-EU countries decreased by 4.2%, which was partially offset by a 1.2% increase in goods exports to EU countries in the three months to February 2018. This follows a 4.6% increase in export volumes to non-EU countries and a 3.0% decrease in export volumes to EU countries in the three months to November 2017.

The volume of goods imported from non-EU countries decreased by 4.0%, while goods volumes imported from the EU increased by 1.3% over the same period. This follows a 1.1% decrease in non-EU import volumes and a 0.2% decrease in EU import volumes in the three months to November 2017.

The decreases in export volumes to non-EU countries, partially offset by increases in goods exports to EU countries, had the largest contribution to the total trade in goods deficit widening (by £0.1 billion to £34.2 billion).

Back to table of contents6. The total UK trade deficit narrowed by £12.9 billion to £27.5 billion in the 12 months to February 2018, due mainly to a widening of the UK’s trade surplus in services

In order to add more context around UK trade figures and to help us explain some of the longer-term trends, we have included a 12-month comparison of the trade figures (Figure 6). For more information on this please refer to the Things you need to know about this release section.

The UK trade deficit (goods and services) narrowed by £12.9 billion to £27.5 billion in the 12 months to February 2018 (compared with the 12 months to February 2017) – Figure 6. The narrowing of the total deficit was due to a £11.1 billion widening of the UK’s trade surplus in services to £108.3 billion and a £1.8 billion narrowing of the goods deficit to £135.8 billion.

Total UK exports increased by a larger amount than imports in the 12 months to February 2018 (Figure 6). Total exports rose by 10.4% (£59.4 billion) to £627.6 billion compared with total imports, which increased by 7.6% (£46.5 billion) to £655.1 billion. Goods exports rose by 11.3% (£34.9 billion) to £345.0 billion compared with goods imports, which rose by 7.4% (£33.1 billion) to £480.8 billion. Services exports rose by 9.5% (£24.5 billion) to £282.6 billion, while services imports rose by 8.3% (£13.4 billion) to £174.2 billion.

Figure 6: 12-month on 12-month UK trade balances, February 2016 to February 2018

Source: Office for National Statistics

Download this chart Figure 6: 12-month on 12-month UK trade balances, February 2016 to February 2018

Image .csv .xls7. The UK trade in goods deficit narrowed with the EU and widened with non-EU countries in the 12 months to February 2018

Figures 7 and 8 show the value contribution of goods exports and imports to and from EU and non-EU countries respectively in the 12 months to February 2018.

The UK trade in goods deficit with the EU narrowed by £2.9 billion to £94.4 billion and with non-EU countries widened by £1.1 billion to £41.4 billion in the 12 months to February 2018.

Exports of machinery and transport equipment was the main cause of the £1.8 billion narrowing of the trade in goods deficit in the 12 months to February 2018. Exports of machinery and transport equipment rose by 8.6% to £10.8 billion, while imports rose by 3.5% to £6.1 billion, leading to a £4.7 billion narrowing of the deficit in UK trade of machinery and transport equipment to £43.8 billion.

The UK trade position for machinery and transport equipment with non-EU countries moved to an overall surplus in the 12 months to February 2018, with a balance increase of £1.2 billion to £0.5 billion; the last time there was a surplus in trade of machinery and transport equipment with non-EU countries was in the 12 months to September 2017. The UK trade deficit for machinery and transport equipment with the EU narrowed by £3.5 billion to £44.7 billion.

Unspecified goods (£0.6 billion), fuels (£0.4 billion), crude materials (£0.3 billion) and beverages and tobacco (£0.2 billion) also contributed to the narrowing of the trade in goods deficit in the 12 months to February 2018. Exports of unspecified goods to non-EU countries increased by £1.0 billion, while imports increased by £0.5 billion.

The largest offsetting factor to the narrowing of the trade in goods deficit was imports of material manufactures, which increased by £5.7 billion to £51.8 billion in the 12 months to February 2018. Exports of material manufactures increased by £3.9 billion to £30.9 billion. This led to a £1.8 billion widening of the trade deficit in material manufactures to £21.0 billion; an increase to imports of £2.8 billion from non-EU countries was the main factor for the widening deficit, as increases of exports (£2.5 billion) and imports (£2.9 billion) to and from the EU largely offset each other.

Figure 7: Contribution of goods exports to total EU and non-EU exports, 12 months to February 2018 on previous 12 months to February 2017

Source: Office for National Statistics

Download this chart Figure 7: Contribution of goods exports to total EU and non-EU exports, 12 months to February 2018 on previous 12 months to February 2017

Image .csv .xls

Figure 8: Contribution of goods imports to total EU and non-EU imports, 12 months to February 2018 on previous 12 months to February 2017

Source: Office for National Statistics

Download this chart Figure 8: Contribution of goods imports to total EU and non-EU imports, 12 months to February 2018 on previous 12 months to February 2017

Image .csv .xls8. What are the revisions to trade values since our last release?

In accordance with the National Accounts Revisions Policy, services data in this release have been revised from January 2017 and trade in goods data have been revised for January 2018 (Figure 9).

Revisions to the total trade balance (goods and services) as a result of services data revisions were mainly downwards (widening of the deficit) from January 2017 to August 2017, with the largest downward revisions occurring in May and June 2017 (£0.1 billion respectively). Services data revisions were upwards (narrowing of the deficit) from September 2017 to January 2018. Services revisions from January 2017 to January 2018 were due mainly to revisions to services exports.

The trade in goods revisions in January 2018 were due largely to a £0.6 billion downward revision to imports, which were larger than downward revisions to goods exports. This was due mainly to a £0.3 billion downward revision to fuels. Revisions to goods exports were down by £0.5 billion, due mainly to a £0.4 billion downward revision to total manufactured (semi-manufactured and finished manufactured) exports.

The downward revisions in goods exports were more than offset by downward revisions to goods imports and upward revisions to the trade in services surplus (by £28 million) in January 2018. This resulted in an upward revision to the total trade balance of £0.1 billion in January 2018.

Figure 9: Revisions to UK trade balances, January 2017 to January 2018

Source: Office for National Statistics

Download this chart Figure 9: Revisions to UK trade balances, January 2017 to January 2018

Image .csv .xls10. Quality and methodology

Trade is measured through both imports and exports of goods and/or services. Data are supplied by over 30 sources including several administrative sources, HM Revenue and Customs (HMRC) being the largest.

This monthly release contains tables showing the total value of trade in goods together with index numbers of volume and price. Figures are analysed by broad commodity group (values and indices) and according to geographical area (values only). In addition, the UK trade statistical bulletin also includes early monthly estimates of the value of trade in services.

Further qualitative data and information can be found in the attached datasets. This includes data on:

Detailed methodological notes are published in the UK Balance of Payments, The Pink Book 2017.

The UK trade methodology web pages have been developed to provide detailed information about the methods used to produce UK trade statistics.

The UK trade Quality and Methodology Information report contains important information on:

the strengths and limitations of the data and how it compares with related data

uses and users of the data

how the output was created

the quality of the output including the accuracy of the data