Table of contents

- Main points

- Things you need to know about this release

- UK current account deficit narrows due mainly to a narrowing in the deficit on total trade

- Trade deficit narrows due to rise in exports of goods

- Primary income account deficit narrows to 3-year low

- Current account with EU and non-EU countries

- Financial account flows of investment

- International investment position reaches record high

- Quarterly revisions to the current account balance as a percentage of GDP

- Quality and methodology

1. Main points

The UK’s current account deficit was £12.1 billion in Quarter 4 (Oct to Dec) 2016, a narrowing of £13.6 billion from a revised deficit of £25.7 billion in Quarter 3 2016, due predominantly to a sharp narrowing in the deficit on Trade; the deficit in Quarter 4 equated to 2.4% of gross domestic product (GDP) at current market prices, down from 5.3% in Quarter 3.

The total trade deficit narrowed to £4.8 billion in Quarter 4 2016, following a sharp widening of the deficit in Quarter 3 2016 (£14.8 billion); this narrowing was predominantly due to an increase in the exports of goods of £7.6 billion.

The primary income deficit narrowed from £4.3 billion in Quarter 3 2016 to a three year low of £1.0 billion in Quarter 4 2016; this is due mainly to the surplus on direct investment balance widening to £6.3 billion along with the deficit on portfolio investment balance narrowing to £4.6 billion in Quarter 4 2016.

A current account deficit of £19.5 billion was recorded with the EU in Quarter 4 2016 whilst a surplus of £7.4 billion was recorded with non-EU countries.

The international investment position recorded UK net assets of £468.5 billion at the end of Quarter 4 2016.

2. Things you need to know about this release

In accordance with the National Accounts Revisions Policy, the revision period for this release is open from Quarter 1 (Jan to Mar) 2016.

A brief introduction to the UK Balance of Payments provides an overview of the concepts and coverage of the UK Balance of Payments using the Balance of Payments Manual sixth edition.

The Balance of payments (BoP) Quality and Methodology Information (QMI) document is available on our website.

See our website for an overview of how movements in foreign exchange rates can impact the balance of payments and international investment position.

During 2016 there have been numerous large acquisitions of UK companies by foreign investors, most notably in Quarter 4 (Oct to Dec) 2016. Some of the impacts on the accounts are outlined in section 7, the financial account. Further information can also be found in the Merger and Acquisitions statistical bulletin and accompanying short article.

Back to table of contents3. UK current account deficit narrows due mainly to a narrowing in the deficit on total trade

In Quarter 4 2016, the UK current account deficit was £12.1 billion, the smallest deficit since Quarter 1 2012 (£11.4 billion). The Quarter 4 2016 deficit equates to 2.4% of gross domestic product (GDP) at current market prices. This was a narrowing from the deficit of £25.7 billion (5.3% of GDP) in Quarter 3 2016 (Figure 1). The narrowing in the current account deficit was due mostly to a narrowing in the deficits on total trade. In addition, there was also a narrowing in the deficit on the primary income and secondary income accounts.

Figure 1: UK balances as a percentage of gross domestic product

Quarter 1 (Jan to Mar) 2014 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 1: UK balances as a percentage of gross domestic product

Image .csv .xlsThe narrowing in the trade in goods deficit of £7.6 billion led to a trade in goods deficit of £31.6 billion or 6.4% of GDP. This was due to exports increasing by £7.6 billion (see section 4 for more information).

In addition to the narrowing in the trade in goods deficit there was a narrowing in the deficit on primary income to £1.0 billion (or 0.2% of GDP) in Quarter 4 2016, compared with a deficit of £4.3 billion (or 0.9%) in Quarter 3 2016 (see section 5 for more information). Additionally there was a £2.4 billion widening in the trade in services surplus due to a larger increase in exports than imports.

Notes for: UK current account deficit narrows due mainly to a narrowing in the deficit on total trade

- Throughout this release Quarter 1 refers to January to March, Quarter 2 refers to April to June, Quarter 3 refers to July to September, and Quarter 4 refers to October to December.

4. Trade deficit narrows due to rise in exports of goods

Figure 2: UK trade in goods and services balances (seasonally adjusted)

Quarter 1 (Jan to Mar) 2014 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 2: UK trade in goods and services balances (seasonally adjusted)

Image .csv .xlsThe total trade deficit narrowed by £10.0 billion to £4.8 billion in Quarter 4 2016, following a sharp widening of the deficit in Quarter 3 2016; this narrowing was predominantly due to an increase in the exports of goods, which increased by £7.6 billion in Quarter 4 2016 (Figure 2). Of this £7.6 billion, £2.5 billion can be attributed to increases in exports of goods categorised as erratic commodities (for example, non-monetary gold, aircraft), with a further £1.6 billion attributed to exports of oil. Of the additional £3.5 billion increase in exports other than erratic and oil series, there was a large increase to the exports of machinery (£1.0 billion), with many other smaller increases elsewhere.

The trade in services surplus widened by £2.4 billion to £26.8 billion in Quarter 4 2016 (Figure 2) due to exports of other business services increasing £2.4 billion in Quarter 4 2016.

Please note: Erratic series are defined as a specific group of commodities that are both volatile and high in value so impact the overall trade in goods balance. These are defined as ships, aircraft, precious stones, silver and non-monetary gold.

Notes for: Trade deficit narrows due to rise in exports of goods

- Throughout this release Quarter 1 refers to January to March, Quarter 2 refers to April to June, Quarter 3 refers to July to September, and Quarter 4 refers to October to December.

5. Primary income account deficit narrows to 3-year low

Figure 3: UK primary income account balances (seasonally adjusted)

Quarter 1 (Jan to Mar) 2014 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 3: UK primary income account balances (seasonally adjusted)

Image .csv .xlsThe primary income deficit narrowed from £4.3 billion in Quarter 3 2016 to £1.0 billion in Quarter 4 2016 (Figure 3), with receipts rising by £1.9 billion while payments fell by £1.3 billion. The narrowing of the deficit in Quarter 4 2016 was due to the balance on direct investment widening to a surplus of £6.3 billion along with the balance on portfolio investment narrowing to a deficit of £4.6 billion.

The value of earnings on UK foreign direct investment (FDI) abroad (credits) has increased over each quarter of 2016, whereas the value of earnings on inward FDI (debits) has remained broadly constant. Figure 4 shows FDI debits have been relatively constant, fluctuating between £10 billion and £16 billion per quarter since the start of 2011. At the same time, the values of FDI credits have fallen from an average of £26.2 billion per quarter in 2011 to £16.3 billion per quarter in 2016. These trends made the balance of FDI earnings (the difference between credits and debits) a deficit in Quarter 4 of 2015 and Quarter 1 2016. The balance on earnings returned to a surplus from the second quarter onwards, leading to a surplus on earnings for the whole of 2016 (of £9.5 billion). This is similar to the level achieved in 2015 (£9.1 billion) and suggests that the longer-term downward trend in net FDI earnings may have flattened, which was supported by the value of UK credits increasing over 2016.

Figure 4: Quarterly foreign direct investment earnings (seasonally adjusted)

Quarter 1 (Jan to Mar) 2011 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 4: Quarterly foreign direct investment earnings (seasonally adjusted)

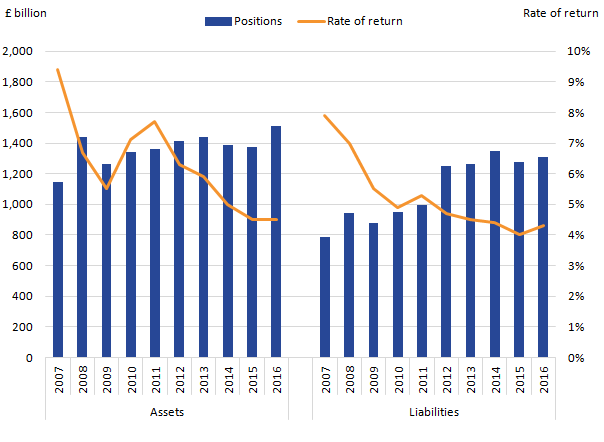

Image .csv .xlsThe implied rate of return reflects the relationship between the stock of foreign direct investment (FDI) and the earnings on that stock. The stocks of both UK FDI assets (held overseas) and UK FDI liabilities (foreign-owned direct investments in the UK) have been largely constant over the past few years (Figure 5). The values of assets and liabilities both increased in 2016 compared with 2015, with the increase in assets (£133.6 billion) exceeding that of liabilities (£33.6 billion). The smaller proportional increase in FDI credits compared with FDI assets means the implied rate of return on UK outward FDI remains the same at 4.5% in 2015 and 2016; both are notably lower than the 7.7% implied rate of return estimated in 2011. The implied rate of return on UK FDI liabilities appears broadly constant relative to assets, varying between 4.0% and 4.7% in each year since 2012.

Figure 5: UK direct investment positions and rates of return (non-seasonally adjusted)

2007 to 2016

Source: Office for National Statistics

Notes:

- Rates of return are calculated using the income data from Table G and a rolling average of the international investment position from Table K.

Download this image Figure 5: UK direct investment positions and rates of return (non-seasonally adjusted)

.png (27.9 kB) .xls (28.7 kB)We published more detailed analysis of FDI statistics in a review of UK FDI statistics, which explores some of the factors behind the trends in implied rates of return and the impact of exchange rate changes on UK FDI among other topics.

Notes for: Primary income account deficit narrows to 3-year low

- Throughout this release Quarter 1 refers to January to March, Quarter 2 refers to April to June, Quarter 3 refers to July to September, and Quarter 4 refers to October to December.

6. Current account with EU and non-EU countries

A current account deficit of £19.5 billion was recorded with the EU in Quarter 4 2016, compared with a deficit of £22.7 billion in Quarter 3 2016 (Figure 6). This was due mainly to total primary income switching from a deficit of £1.6 billion in Quarter 3 2016 to a surplus of £1.1 billion in Quarter 4 2016. Additionally the deficit on secondary income narrowed from £3.7 billion in Quarter 3 2016 to a deficit of £2.1 billion in Quarter 4 2016.

Figure 6: UK current account balances with EU and non-EU countries (seasonally adjusted)

Quarter 1 (Jan to Mar) 2014 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 6: UK current account balances with EU and non-EU countries (seasonally adjusted)

Image .csv .xlsThe current account balance with non-EU countries switched from a deficit of £3.0 billion in Quarter 3 2016 to a surplus of £7.4 billion in Quarter 4 2016. This was due mainly to the movements in erratic items widening the total trade surplus from £2.6 billion in Quarter 3 2016 to a surplus of £13.6 billion in Quarter 4 2016. The deficit on primary income narrowed slightly from £2.7 billion in Quarter 3 2016 to £2.2 billion in Quarter 4 2016. Slightly offsetting these was a widening in the deficit on secondary income from £2.9 billion in Quarter 3 2016 to £4.1 billion in Quarter 4 2016.

Notes for: Current account with EU and non-EU countries

- Throughout this release Quarter 1 refers to January to March, Quarter 2 refers to April to June, Quarter 3 refers to July to September, and Quarter 4 refers to October to December.

7. Financial account flows of investment

Figure 7: UK financial account balances (not seasonally adjusted)

Quarter 1 (Jan to Mar) 2014 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

- Total includes reserve assets.

Download this chart Figure 7: UK financial account balances (not seasonally adjusted)

Image .csv .xlsThe total financial account showed a net inflow (that is, more money flowing into the UK) of £53.0 billion in Quarter 4 2016 compared with a net inflow of £27.3 billion in Quarter 3 2016 (Figure 7).

The large inflow on the financial account balance is due to direct investment recording a net inflow of £109.7 billion in Quarter 4 2016, compared with a net inflow of £28.6 billion in Quarter 3 2016.

The comparatively large net inflow on the financial account balance leads to an unusually large net errors and omissions (see section notes) figure for Quarter 4 2016, which is because we do not yet have all the information necessary. All the evidence available at this points suggests that the large inflow of direct investment seen in Quarter 4 2016 appears to not have been completely reflected in other areas of the financial account. In practice, we capture the different parts of an acquisition through a mix of survey and administrative data. Combined with the usual financial transactions the dilution of an acquisition as it filters through the various parts of the accounts as shareholders receive their payment and then possibly re-invest make it difficult to trace all parts of the deal. In a sense, the large net errors and omissions presented for Quarter 4 2016 reflects unallocated flows, which have yet to feed through some of our other survey and administrative data. As more data and information becomes available on the nature of any such deals, we expect these unallocated flows to be captured more completely, which will naturally lead to a reduction of the net errors and omissions for Quarter 4 2016.

Looking at direct investment annually, UK direct investment overseas (foreign direct investment (FDI) outflows) were negative in 2014 and 2015. This indicates that UK investors abroad were disinvesting in those years (Figure 8). UK FDI outflows became positive once again in 2016 (£30.4 billion) and were comparable with the value of flows in 2013 (£28.6 billion).

FDI inflows to the UK were broadly constant from 2012 to 2015, which is similar to the constant values of UK debits and liabilities; FDI inflows averaged £31.4 billion per year over that period. However, the value of FDI inflows in 2016 increased considerably, reaching £227.7 billion. Part of this increase in FDI inflows reflects a small number of very high value mergers and acquisitions that completed in 2016, as outlined earlier in this section and also in the Mergers and Acquisitions statistical bulletin and accompanying short article on Provisional statistics on mergers and acquisitions involving UK companies for 2016.

Figure 8: UK direct investment flows (not seasonally adjusted)

2011 to 2016

Source: Office for National Statistics

Download this chart Figure 8: UK direct investment flows (not seasonally adjusted)

Image .csv .xlsPortfolio investment recorded a switch from a net inflow to a net outflow (that is, more money flowing out of the UK) of £8.1 billion in Quarter 4 2016 due to the net disinvestment by non-residents of £24.7 billion.

Financial derivatives and employee stock options showed net settlement receipts of £0.1 billion in Quarter 4 2016 following net settlement receipts of £29.3 billion in Quarter 3 2016.

Other investment in Quarter 4 2016 recorded a net outflow (that is, more money flowing from the UK) of £49.7 billion compared with a net outflow of £42.2 billion in Quarter 3 2016.

Reserve assets showed net disinvestment of £1.2 billion in Quarter 4 2016.

Notes for: Financial account flows of investment

The net errors and omissions within the balance of payments accounts represent an imbalance between the financial account and the sum of the current account and capital account. Errors and omissions can occur between the different data sources used and compilation practices.

Throughout this release Quarter 1 refers to January to March, Quarter 2 refers to April to June, Quarter 3 refers to July to September, and Quarter 4 refers to October to December.

8. International investment position reaches record high

Figure 9: UK net international investment position (not seasonally adjusted)

Quarter 1 (Jan to Mar) 2014 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 9: UK net international investment position (not seasonally adjusted)

Image .csv .xlsThe international investment position showed net external assets (that is, assets exceed liabilities) of £468.5 billion at the end of Quarter 4 2016, compared with net external assets of £190.6 billion at the end of Quarter 3 2016 (Figure 9). This is the largest net external asset position since records began in Quarter 4 1977. As highlighted in section 7, the financial account, the impact of some of the recent takeover deals may not be fully reflected in the international accounts at this stage until full details of the structure of the deal are known.

Despite total UK assets falling by £43.5 billion, the drop in UK external liabilities (£321.4 billion) widened the gap between the two and led to the increase in the net international investment position. UK external liabilities decreased in Quarter 4 2016 to £10,632.1 billion, the lowest level since Quarter 1 2016. This was due to decreases in UK liabilities in portfolio investment, financial derivatives and other investment and partly offset by an increase in direct investment.

Meanwhile, the fall in UK assets was due mainly to a decline in financial derivatives, with the latest figure dropping by £217.2 billion to £2,503.0 billion (the lowest value in four quarters). Reserve assets also declined during the quarter. All the other types of UK financial assets increased during the quarter, which can partly be linked to the weakness of sterling increasing their value. As most UK assets are held in foreign currency, a fall in the pound will lead to an increase in the sterling value of the UK assets already held.

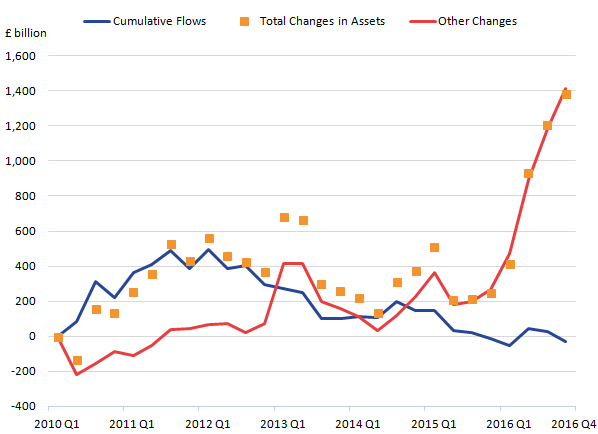

Figure 10: Factors that impact the movement of total UK assets abroad (not seasonally adjusted)

Quarter 1 (Jan to Mar) 2010 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

- Figure 10 is compiled from data that can be found in the financial account (Table J) and the international investment position (Table K). The series are derived using the direct investment, portfolio investment and other investment series.

Download this image Figure 10: Factors that impact the movement of total UK assets abroad (not seasonally adjusted)

.png (15.6 kB) .xls (27.6 kB)Figure 10 shows the cumulative change in the end of quarter valuation of UK financial assets abroad. For this piece of analysis we have only used direct investment, portfolio investment and other investment. Financial derivatives have not been included due to their volatility and reserve assets due to their comparatively small size. Most of the assets will be held in the foreign currency of the country that they are invested in and need converting back to sterling. Plotted against the changes in assets are the cumulative flows or net transactions (blue line), which in the early periods up until Quarter 3 2014 are the main reason for changes in UK foreign assets. This indicates that the changes in the asset level are due mainly to investor actions, either buying or selling assets.

Other changes (red line) impact the asset valuations and can include, for example, foreign currency movements, asset price movements, reclassifications and write-offs. While other changes show little impact in the early periods, they are the main reason for changes in asset levels from Quarter 1 2015. One reason for their increased impact will be the devaluation of sterling from around Quarter 3 2015 (see Figure 11). Another reason will be the increased market valuations of foreign stock markets, some of which ended at their highest level for 2016. The impacts of other changes are highlighted in some recent periods where UK investors have been net sellers of foreign assets but have still seen the value of their assets increased.

We have previously published an article summarising the impact of exchange rates on direct investment abroad.

A similar outcome is observed with UK liabilities to foreign investors albeit slightly less pronounced as direct investment and portfolio investment liabilities will already be valued in sterling. They will however, still have the impact of revaluations as the UK stock market increases in value, ending the year on a high. Other investment will be impacted by the devaluation of sterling, as a substantial amount of UK other investment liabilities are held in foreign currency.

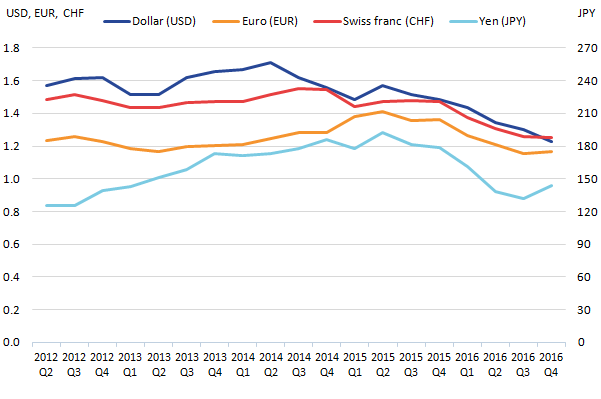

Figure 11: Sterling exchange rates with major trading partners

Quarter 2 (Apr to Jun) 2012 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this image Figure 11: Sterling exchange rates with major trading partners

.png (14.4 kB) .xls (28.7 kB)Figure 11 presents sterling exchange rates against the currencies of major trading partner countries at the close of markets at each quarter end. During Quarter 4 2016, sterling depreciation slowed and still stands almost 15% lower than a year ago compared with a basket of foreign currencies. Sterling only showed a noticeable depreciation against the United States dollar while it actually appreciated against the Japanese yen in the latest quarter.

The stock of UK assets and liabilities with the rest of the world can be influenced by movements in exchange rates and price revaluations. Table 1 summarises which type of investment is impacted by these changes.

Table 1: Revaluation impacts on investments

| Assets | Liabilities | |||

| Exchange rate movements | Price revaluations | Exchange rate movements | Price revaluations | |

| Direct Investment | Impact | Impact | No impact | Impact |

| Portfolio Investment | ||||

| Equities | Impact | Impact | No impact | Impact |

| Debt Securities | Impact | Impact | No impact | Impact |

| Other Investment | ||||

| Deposits | Impact | No impact | Impact | No impact |

| Loans | Impact | No impact | Impact | No impact |

| Source: Office for National Statistics | ||||

Download this table Table 1: Revaluation impacts on investments

.xls (26.6 kB)Notes for: International investment position reaches record high

- Throughout this release Quarter 1 refers to January to March, Quarter 2 refers to April to June, Quarter 3 refers to July to September, and Quarter 4 refers to October to December.

9. Quarterly revisions to the current account balance as a percentage of GDP

Table 2 shows revisions to the current account balance as a percentage of GDP quarterly from Quarter 1 2016 to Quarter 3 2016.

Revisions in this publication are due to late or revised survey data and a reassessment of seasonal adjustment factors, which could have impacted the current account and GDP. There are no changes to methods or annual benchmark data in this release.

Table 2: Balance of payments revisions to current account balance as a percentage of gross domestic product, Quarter 4 (Oct to Dec) 2016

| % | |||

| Period | Current account balance as a percentage of GDP previously published | Current account balance as a percentage of GDP latest estimate | Revisions to total current account balance as a percentage of GDP (percentage points) |

| 2016 Q1 | -4.9 | -5.4 | -0.5 |

| 2016 Q2 | -4.6 | -4.3 | 0.3 |

| 2016 Q3 | -5.2 | -5.3 | -0.1 |

| Source: Office for National Statistics | |||

Download this table Table 2: Balance of payments revisions to current account balance as a percentage of gross domestic product, Quarter 4 (Oct to Dec) 2016

.xls (26.6 kB)10. Quality and methodology

The Balance of payments (BoP) Quality and Methodology Information (QMI) document contains important information on:

the strengths and limitations of the data and how it compares with related data

uses and users of the data

how the output was created

the quality of the output including the accuracy of the data