1. Main points

UK labour productivity as measured by output per hour fell by 1.2% from the third to the fourth calendar quarter of 2015 and was some 14% below an extrapolation based on its pre-downturn trend.

By contrast, output per worker and output per job were both broadly unchanged between the third and fourth quarters. On all 3 measures, labour productivity was about half a per cent higher in Quarter 4 2015 than in the same quarter of 2014.

Output per hour in services fell by 0.7% on the previous quarter but was 1.1% higher than a year earlier. Output per hour in manufacturing fell by 2.0% on the previous quarter and was 3.4% lower than a year earlier.

Whole economy unit labour costs were 0.4% higher in Quarter 4 than the previous quarter and 1.3% higher than the same quarter last year, as earnings and other labour costs have outpaced productivity. Unit wage costs in manufacturing grew by 0.4% on the previous quarter and by 3.6% compared with Quarter 4 2014.

Back to table of contents2. Interpreting these statistics

This release reports labour productivity estimates for the fourth quarter (October to December) of 2015 for the whole economy and a range of sub-industries, together with selected estimates of unit labour costs. Labour productivity measures the amount of real (inflation-adjusted) economic output that is produced by a unit of labour input (measured in this release in terms of workers, jobs and hours worked) and is an important indicator of economic performance.

Labour costs make up around two-thirds of the overall cost of production of UK economic output. Unit labour costs are therefore a closely watched indicator of inflationary pressures in the economy.

Output statistics in this release are consistent with the latest Quarterly National Accounts published on 31 March 2016. Labour input measures are consistent with the latest Labour Market Statistics as described further in the 'General commentary' and 'Quality and Methodology' sections below.

Whole economy output (measured by gross value added GVA) increased by 0.6% in the fourth quarter of 2015, while the Labour Force Survey (LFS) shows that the number of workers and jobs increased by 0.7% and 0.5% respectively while hours worked increased by 1.7% over this period. This combination of movements in outputs and labour inputs implies that labour productivity across the whole economy decreased by 1.2% in terms of output per hour, while output per worker was unchanged and output per job increased by 0.1%.

Differences between growth of output per worker and output per job reflect changes in the ratio of jobs to workers. This ratio decreased a little in Quarter 4 2015. Differences between these measures and output per hour reflect movements in average hours per job and per worker. Between quarter 3 and quarter 4 average hours per worker increased from 31.9 to 32.2 hours per week, reflecting faster growth of full-time employment than part-time employment as well as increases in average hours in both types of employment.. For this reason, output per hour is a more comprehensive indicator of labour productivity and is the main focus of the commentary in this release.

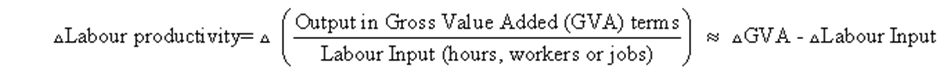

This equation explains how labour productivity is calculated and how it can be derived using growth rates for GVA and labour inputs.

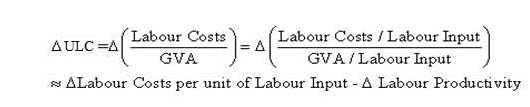

Unit labour costs (ULCs) reflect the full labour costs, including social security and employers’ pension contributions, incurred in the production of a unit of economic output, while unit wage costs (UWCs) are a narrower measure, excluding non-wage labour costs. Growth of ULCs can be decomposed as:

This equation explains how ULCs are calculated and how it can be derived from growth of labour costs per unit of labour (such as labour costs per hour worked) and growth of labour productivity.

In the fourth quarter, whole economy output per hour fell by 1.2% and ULCs grew by 0.4%. Plugging these values into the ULC equation and re-arranging yields an implied decrease of approximately 0.8% in labour costs per hour. This implied movement differs from our other information on labour remuneration such as Average Weekly Earnings (AWE) and Indices of Labour Costs per Hour (ILCH), chiefly because the labour cost component includes estimated remuneration of self- employed labour, which is not included in AWE and ILCH.

Note: Throughout this release, Q1 is Quarter 1 January to March, Q2 Quarter 2 April to June, Q3 Quarter 3 July to September and Q4 Quarter 4 October to December.

Back to table of contents3. General commentary

Productivity estimates in this release are derived from estimates of output of goods and services and of labour inputs; the latter measured in terms of workers, jobs (‘productivity jobs’) and hours worked (‘productivity hours’). In general, estimates of output and of labour inputs are measured independently of one another, with labour productivity calculated as the ratio of the 2 estimates, although there are some activities where, in the absence of direct measures of output, labour inputs are used as a proxy, with productivity either assumed to be unchanged over time (as in public administration and defence) or assumed to move in line with the productivity trend in a measurable equivalent activity (as in a few small components of the index of services).

Growth of output per hour in 2015 (1.0%) was the strongest since 2011 and would have been stronger still but for a strong upturn in seasonally adjusted average hours worked in the final quarter, reversing a dip in average hours worked in the previous quarter. Output per hour in manufacturing fell by 2.1% in 2015, giving up most of the improvement in productivity in the previous year. Although there was some productivity growth in 2015 in agriculture, non-manufacturing production and construction, most of the ‘heavy lifting’ was accounted for by the service sector, where output per hour grew by 1.4%.

In this respect 2015 continued the pattern of recent years. Output per hour across the service sector has grown in each year since 2009 (albeit only marginally so in 2010 and 2012). By contrast, manufacturing output per hour has fallen in 3 of the 6 years since 2009 and was lower in 2015 than in 2010.

Figure 1: Contributions to growth of whole economy output per hour, UK

Annual, 1998 to 2015

Source: Office for National Statisitcs

Notes:

- ABDE refers to Agriculture, Forestry and Fishing (section A), Mining and Quarrying (section B), Electricity, Gas, Steam and Air Conditioning Supply (section D) and Water Supply, Sewerage, Waste Management and Remediation Activities (section E).

- Allocation represents the contribution to the total change in output per hour due to movements in resources between industries, reflecting differences in productivity levels and movements in relative prices. For further information see ‘New developments in ONS labour productivity estimates.

Download this chart Figure 1: Contributions to growth of whole economy output per hour, UK

Image .csv .xlsFigure 1 shows contributions to annual growth of output per hour in which the contributions of individual industries are computed by holding relative prices and industry weights constant and the ‘allocation’ component reflects the combined effect of movements in relative prices and movements in labour shares across industries.

The positive contribution in 2015 from ABDE reflects strong output per hour growth in industry B (mining and quarrying), combined with higher than average levels of productivity in this sector despite lower oil prices.

The small negative allocation contribution in 2015 reflects the impact of a shift in the share of hours worked from ABDE to non-financial services.

Figure 2: Whole economy unit labour costs, year on year changes and contributions,quarter 1 (Jan to Mar) 2008 to quarter 4 (Oct to Dec) 2015, UK

Seasonally adjusted,

Source: Office for National Statistics

Notes:

- Labour cost per hour estimates in Figure 2 can differ from estimates published in the Index of Labour Costs per Hour (ILCH) ONS release. The main conceptual difference is that ILCH measures costs of employees only, whereas Figure 2 includes labour costs of the self employed.

Download this chart Figure 2: Whole economy unit labour costs, year on year changes and contributions,quarter 1 (Jan to Mar) 2008 to quarter 4 (Oct to Dec) 2015, UK

Image .csv .xlsFigure 2 shows annual changes in ULCs since Quarter 1 2008, with the bars representing the decomposition of ULC changes into changes in labour costs per hour and changes in output per hour. The latter have been reversed in sign, so a negative bar represents positive productivity growth.

Growth of labour costs per hour accelerated in the middle of 2015 before easing back in the final quarter, allowing growth of whole economy ULCs to fall a little despite the slowing in annual productivity growth. This trend in labour costs per hour is also apparent in the Index of Labour Costs per Hour, which shows labour costs per hour excluding bonuses and arrears growing by 2.1% in the year to Quarter 4 and also, though to a lesser extent, in average weekly earnings growth.

Analysis of ULC growth by industry (Experimental Statistics, available in Sectional Unit Labour Costs, shows a continuation of the recent trend for ULC growth in manufacturing to outpace ULC growth in services. In 2015, the respective growth rates were 2.4% (manufacturing) and 1.4% (services). Since 2008, manufacturing ULC growth has averaged 1.5% per year (2.3% per year since 2010) compared with growth of 0.8% for services. This mainly reflects the relative weakness of manufacturing productivity.

This contrasts sharply with the pre-downturn pattern. Over the period 1997 to 2007, ULC growth in manufacturing was 0.4% per year on average, compared with 3% per year for services. Combined with static or falling prices for manufacturing recorded in 2014 and 2015, the upward trend in manufacturing ULCs implies a narrowing of profit margins.

Back to table of contents4. Whole economy labour productivity measures

This release contains estimates for whole economy output per worker, output per job and output per hour worked. It also contains estimates for market sector output per worker and output per hour worked. We publish an index of market sector gross value added (GVA) as part of the Quarterly National Accounts (CDID L48H), based on weightings of industry level GVA. The main industries with sizeable non-market shares are industries L (real estate) and OPQ (government services). Estimates of market sector workers are derived by subtracting workers in central and local government from the LFS total. Estimates of hours worked are based on LFS micro-data which record employment in a range of non-market institutions such as charities and government agencies.

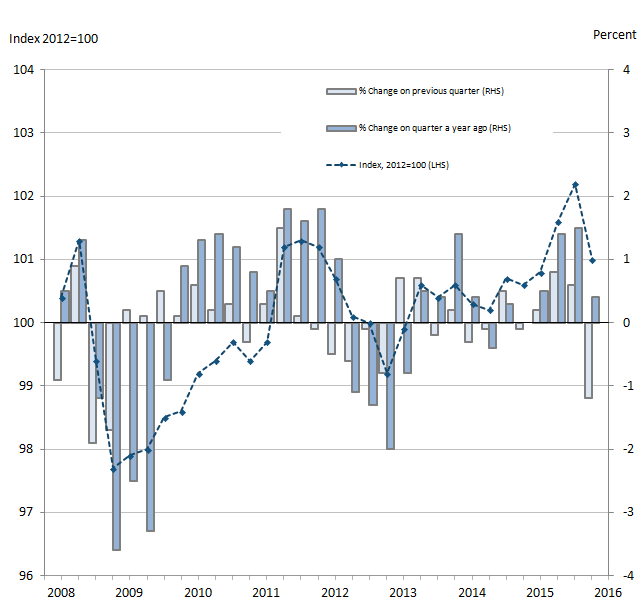

Figure 3: Whole economy output per hour

Seasonally adjusted, UK, quarter 1 (Jan to Mar) 2008 to quarter 4 (Oct - Dec) 2015

Source: Office for National Statistics

Download this image Figure 3: Whole economy output per hour

.png (29.0 kB) .xls (20.0 kB)As shown in Figure 3, in Quarter 4 2015 output per hour fell by 1.2%, the largest quarter on quarter fall since Quarter 4 2008. This decline primarily reflects a sharp quarterly increase in hours worked, as shown in Figure 4. Jobs also increased in Quarter 4 albeit at a pace more commensurate with the growth of GVA. As noted in the general commentary above, the difference between growth rates of jobs and hours worked partly reflects a statistical adjustment to average hours.

Figure 4: Components of productivity measures, quarter 1 (Jan to Mar) 2008 to quarter 4 (Oct - Dec) 2015, UK

Seasonally adjusted

Source: Office for National Statistics

Download this chart Figure 4: Components of productivity measures, quarter 1 (Jan to Mar) 2008 to quarter 4 (Oct - Dec) 2015, UK

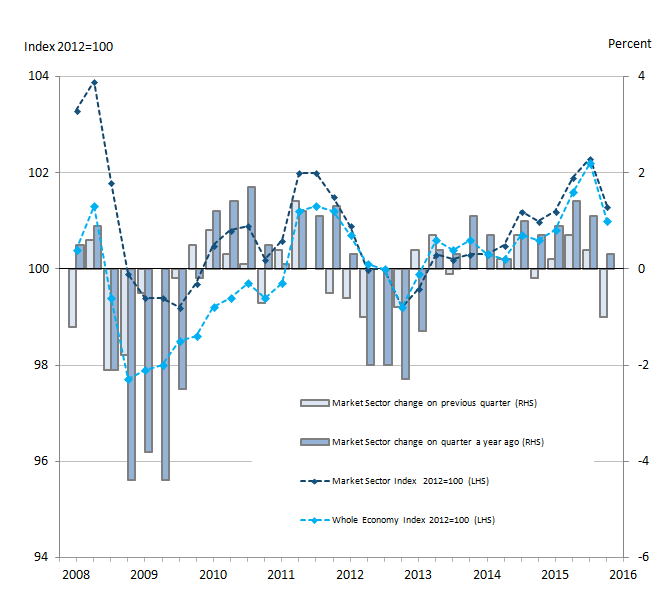

Image .csv .xlsFigure 5 shows market sector output per hour as index levels and changes alongside the equivalent index for the whole economy. Since the market sector constitutes the bulk of the economy (over 80% in terms of hours worked) it is not surprising that the 2 series are closely related. However, close investigation of the time series since 1997 reveals some differences in trend growth rates pre- and post-downturn. The market sector series grew a little faster than the whole economy series prior to the economic downturn (2.3% per annum versus 2.1% over the period Q1 1997 to Q1 2008) but has grown a little slower since the downturn (0.3% per annum versus 0.5% over the period Q2 2009 to Q4 2015).

Figure 5: Market sector output per hour worked

Seasonally adjusted, UK, quarter 1 (Jan to Mar) 2008 to quarter 4 (Oct - Dec) 2015

Source: Office for National Statistics

Download this image Figure 5: Market sector output per hour worked

.png (37.4 kB) .xls (28.7 kB)5. Manufacturing labour productivity measures

Figure 6: Contributions to growth of manufacturing output per hour, UK

Annual, 1998 to 2015

Source: Office for National Statistics

Notes:

- CA-CD + CM refers to Food products, beverages and tobacco (CA), Textiles, wearing apparel & leather (CB), Wood & paper products & printing (CC) and Coke & refined petroleum products (CD). CM refers to Other Manufacturing.

- CE,CF refers to Chemical and Pharmaceutical products.

- CG,CH refers to Rubber, plastics & other non-metallic minerals (CG), Basic metals and metal products (CH).

- CI-CL refers to Computer products, Electrical equipment (CI,CJ), Machinery & equipment (CK) and Transport equipment (CL) .

- Allocation represents the contribution to the total change in output per hour due to movements in resources between industries, reflecting differences in productivity levels and movements in relative prices. For further information see ‘New developments in ONS labour productivity estimates.

Download this chart Figure 6: Contributions to growth of manufacturing output per hour, UK

Image .csv .xlsFigure 6 shows output per hour in manufacturing in terms of annual changes and decomposed into contributions of broad component industries. Here the allocation element captures the effect of changes in output shares and relative prices within manufacturing. Prior to the economic downturn, most component industries made positive contributions to manufacturing productivity in most years.

Since 2011, however, the picture has become more variable – all of the component industries in Figure 6 have made both positive and negative contributions over the last 5 years, and the allocation effect has also been variable.

The weakness of manufacturing productivity since 2011 has been a defining feature of the UK productivity puzzle, notwithstanding a ‘false dawn’ in 2014. As shown in Figure 7 this chiefly reflects remarkably strong manufacturing employment and hours worked.

Figure 7: Components of manufacturing productivity measures, quarter 1 (Jan to Mar) 2008 to quarter 4 (Oct to Dec) 2015, UK

Seasonally adjusted

Source: Office for National Statistics

Download this chart Figure 7: Components of manufacturing productivity measures, quarter 1 (Jan to Mar) 2008 to quarter 4 (Oct to Dec) 2015, UK

Image .csv .xlsMore information on the labour productivity of sub-divisions of manufacturing is available in table 3 and 4 of Labour Productivity Tables 1-10 and R1, and in the tables at the end of the pdf version of this statistical bulletin. Care should be taken in interpreting quarter on quarter movements in productivity estimates for individual sub-divisions, as small sample sizes of the source data can cause volatility.

In annual terms, output per hour fell in 2015 in 7 of the 10 manufacturing industries identified in the labour productivity system, including machinery and equipment (down 11.2%), textiles etc (down 8.6%) and rubber, plastics etc (down 8.0%). The only industries to record positive productivity growth in 2015 were basic metals etc (up 3.2%), chemicals and pharmaceuticals (up 2.4%) and transport equipment (up 2.0%).

Back to table of contents6. Services labour productivity measures

Figure 8: Contributions to growth of services output per hour, UK

Annual, 1998 to 2015

Source: Office for National Statistics

Notes:

- GHI refers to Wholesale and retail trade; repair of motor vehicles and motorcycles (G), Transportation and storage (H) and Accommodation and food service activities (I).

- J refers to Information and communication.

- K refers to Financial and insurance activities.

- L refers to Real Estate activities.

- MN refers to Professional, scientific and technical activities (M), Administrative and support service activities (N).

- OPQ refers to Government Services.

- RSTU refers to Other Services.

- Allocation represents the contribution to the total change in output per hour due to movements in resources between industries, reflecting differences in productivity levels and movements in relative prices. For further information see ‘New developments in ONS labour productivity estimates.

Download this chart Figure 8: Contributions to growth of services output per hour, UK

Image .csv .xlsFigure 8 provides a decomposition of growth of output per hour in services. Here the pattern since 2011 has also been weak by pre-downturn standards, though less so than in manufacturing. One noteworthy feature of this representation of the data is the comparatively large allocation contributions in a number of years. This chiefly reflects shifts in resources to and from financial services, where the level of productivity is relatively large. Allocation has usually had a positive impact on output per hour across services apart from in 2009 and 2011. The negative allocation contribution in 2015 was the largest on record and reflects resource shifts towards service industries with lower levels of productivity.

Figure 9: Components of services productivity measures, quarter 1 (Jan to Mar) 2008 to quarter 4 (Oct - Dec) 2015, UK

Seasonally adjusted

Source: Office for National Statistics

Download this chart Figure 9: Components of services productivity measures, quarter 1 (Jan to Mar) 2008 to quarter 4 (Oct - Dec) 2015, UK

Image .csv .xlsMore information on labour productivity of services industries is available in Tables 5 and 6 of Labour Productivity, Q4 2015: Tables 1-10 and R1 and in the tables at the end of the PDF version of this statistical bulletin.

In general, the dispersion of labour productivity growth rates across service industries is less pronounced than within manufacturing. But the dispersion of productivity “levels” is more pronounced. In interpreting productivity levels it should be borne in mind that labour productivity in industry L (real estate) is affected by the National Accounts concept of output from owner-occupied housing, which adds to the numerator but without a corresponding component in the denominator.

Over 2015 as a whole, output per hour grew in 8 of the 11 service industries identified in the labour productivity system, including other services (up 6.3%) and information and communication (up 5.4%). Output per hour is estimated to have fallen marginally in 2015 in accommodation and food services (-0.5%) and financial services (-0.3%). The only service industry to record a sizeable fall in output per hour was arts, entertainment etc (-3.7%).

Back to table of contents7. What’s changed in this release?

Revisions

Compared with the previous edition published on 23 December 2015, gross value added (GVA) estimates have been revised back to Quarter 1 2015 and component level estimates of jobs and hours have been revised from Quarter 3 2015. The process of seasonal adjustment generates some slight revisions to productivity estimates from Quarter 4 2014.

Table A summarises differences between first published estimates for each of the statistics in the first column with the estimates for the same statistics published 3 years later. This summary is based on 5 years of data, that is, for first estimates of quarters between Quarter 1 2008 and Quarter 4 2012, which is the last quarter for which a 3-year revision history is available. The averages of these differences with and without regard to sign are shown in the right hand columns of the table. These can be compared with the estimated values in the latest quarter (Quarter 4 2015) shown in the second column. Additional information on revisions to these and other statistics published in this release is available in the <> dataset of this release.

Table A: Revisions analysis, quarter 1 (Jan to Mar) 2008 to quarter 4 (Oct to Dec) 2015, UK

| Whole economy | |||

| Revisions between first publication and estimates five years later (Relating to Period: 2008Q1 - 2012Q4) | |||

| Change on quarter a year ago | Value in latest period (per cent) | Average over 5 years (bias) | Average over 5 years without regard to sign (average absolute revision) |

| Output per worker | 0.5 | 0.2 | 1.0 |

| Output per job | 0.6 | 0.2 | 0.9 |

| Output per hour | 0.4 | 0.1 | 0.8 |

| Unit labour costs | 1.3 | -0.3 | 1.2 |

| Unit wage costs | 1.4 | -0.6 | 1.2 |

| Source: Office for National Statistics | |||

Download this table Table A: Revisions analysis, quarter 1 (Jan to Mar) 2008 to quarter 4 (Oct to Dec) 2015, UK

.xls (25.6 kB)This revisions analysis shows that whole economy labour productivity growth estimates have tended to be revised up very slightly over time (on a year-on-year basis). Growth of unit labour costs and unit wage costs has tended to be revised downwards. Were the average revisions to apply to the current release, growth of output per hour in the year to the fourth quarter of 2015 would be revised from 0.4% to 0.5% over the next 3 years. Growth of unit labour costs would be revised from 1.3% to 1.0%, while growth of unit wage costs would be revised from 1.4% to 0.8% over the same period.

A research note, ‘sources of revisions to labour productivity estimates’ is available on the archived version of our website.

Other developments

For the first time, this statistical bulletin is published as part of a package of material relating to productivity including, summaries of recently published estimates and an article describing proposed new quarterly estimates of public service productivity. We welcome your views on these developments. Feedback can be sent to productivity@ons.gov.uk or by telephone to Adam Foote on +44 (0)1633 456282.

This release contains historic estimates consistent with Blue Book 2015 for series in Tables 1 and 2. In using these estimates, you should bear in mind that they are compiled from a range of different sources (as described in the notes to the historic data table) and are not necessarily of comparable quality as the estimates in the main tables.

This release also contains a new table of contributions to growth of output per hour. This table provides more granularity than summarised in Figures 1, 6 and 8. At the present time the table contains annual estimates only. We welcome your feedback on the value of this table and whether there is interest in adding quarterly estimates.

Lastly we have made a small change to the coverage of service industries in Tables 5 and 6, to change the definition of CDIDs DJJ6 and DJV9 from industry S to the slightly broader S-U.

Back to table of contents8. Quality and methodology

This statistical bulletin presents labour productivity estimates for the UK. More detail can be found on the productivity measures page on our website. Index numbers are referenced to 2012=100, are classified to the 2007 revision to the Standard Industrial Classification (SIC) and are seasonally adjusted. Quarter on previous quarter changes in output per job and output per hour worked for some of the manufacturing sub-divisions and services sections should be interpreted with caution as the small sample sizes used can cause volatility.

A revised and updated Quality and Methodology Information report for labour productivity was published in March 2012. This report describes the intended uses of the statistics presented in this publication, their quality and methods used to produce them. It also includes more information on the uses and limitations of labour productivity estimates.

Notes on sources

The measure of output used in these statistics is the chain volume (real) measure of gross value added (GVA) at basic prices, with the exception of the regional analysis in Table 9, where the output measure is nominal GVA (NGVA). These measures differ because NGVA is not adjusted to account for price changes; this means that if prices were to rise more quickly in one region than the others, then this would be reflected in apparent improved measured productivity performance in that region relative to the others. At the whole economy level, real GVA is balanced to other estimates of economic activity, primarily from the expenditure approach. Below the whole economy level, real GVA is generally estimated by deflating measures of turnover; these estimates are not balanced through the supply-use framework and the deflation method is likely to produce biased estimates. This should be borne in mind in interpreting labour productivity estimates below the whole economy level.

Labour input measures used in this bulletin are known as 'productivity jobs' and 'productivity hours'. Productivity jobs differ from the workforce jobs (WFJ) estimates published in Table 6 of the ONS Labour Market statistical bulletin, in 3 ways:

- to achieve consistency with the measurement of GVA, the employee component of productivity jobs is derived on a reporting unit (RU) basis, whereas the employee component of the WFJ estimates is on a local unit (LU) basis; this is explained further below

- productivity jobs are scaled so industries sum to total LFS jobs – note that this constraint is applied in non-seasonally adjusted terms; the nature of the seasonal adjustment process means that the sum of seasonally adjusted productivity jobs and hours by industry can differ slightly from the seasonally adjusted LFS totals

- productivity jobs are calendar quarter average estimates whereas WFJ estimates are provided for the last month of each quarter

Productivity hours are derived by multiplying employee and self-employed jobs at an industry level (before seasonal adjustment) by average actual hours worked from the LFS at an industry level. Results are scaled so industries sum to total unadjusted LFS hours, and then seasonally adjusted.

Industry estimates of average hours derived in this process differ from published estimates (found in Table HOUR03 in the Labour Market Statistics release) as the HOUR03 estimates are calculated by allocating all hours worked to the industry of main employment, whereas the productivity hours system takes account of hours worked in first and second jobs by industry.

Whole economy unit labour costs are calculated as the ratio of total labour costs (that is, the product of labour input and costs per unit of labour) to GVA. Further detail on the methodology can be found in Revised methodology for unit wage costs and unit labour costs: explanation and impact.

Manufacturing unit wage costs are calculated as the ratio of manufacturing average weekly earnings (AWE) to manufacturing output per filled job. On 28 November 2012 we published Productivity Measures: Sectional Unit Labour Costs describing new measures of unit labour costs below the whole economy level, and proposing to replace the currently published series for manufacturing unit wage costs with a broader and more consistent measure of unit labour costs.

Other data on productivity

We publish International comparisons of labour productivity in levels and growth rates for the G7 countries. More international data on productivity are available from the OECD, Eurostat, and the Conference Board.

We publish experimental estimates of Multi-factor productivity (MFP), which decompose output growth into the contributions that can be accounted for by labour and capital inputs. In these estimates, the contribution of labour is further decomposed into quantity (hours worked) and quality dimensions.

We also publish experimental indices of labour costs per hour. These differ from the concept of labour costs used in the unit labour cost estimates in this release. The main difference is that experimental indices of labour costs per hour relate to employees only, whereas unit labour costs also include the labour remuneration of the self-employed.

Lastly, we publish a range of Public sector productivity measures and related articles. These measures define productivity differently from that used in our labour productivity and MFP estimates. Further information can be found in Phelps (2010) and in an information note published on 4 June 2015.

More information on the range of our productivity estimates can be found in the ONS Productivity Handbook. Publication policy

Details of the policy governing the release of new data are available from the UK Statistics Authority.

Back to table of contents