Table of contents

1. Summary

In September 2019, we adopted a gross presentation of funded pensions in the public sector finances (PSF) publications. This approach improves transparency of fiscal statistics by including balance sheets and a full set of transactions of publicly controlled pension administrators, and with them pension funds, within the statistical public sector boundary.

The presentation of pensions in PSF statistics is complicated by the need to balance exhaustiveness and transparency against the risk of distorting the main fiscal aggregates such that the meaning of the statistics is not impaired. The PSF statistics provide important information on the UK Government financial position. They enable the government, economists, financial analysts and the wider public to monitor public sector expenditure, revenue, investments, borrowing and debt. The main aggregates (such as public sector current budget deficit and public sector net financial liabilities, and previously public sector net borrowing and public sector net debt) are used by the government in their fiscal targets.

The question of whether funded pensions should be presented on a net basis or a gross basis has existed since the adoption of the present statistical framework, the European System of Accounts 2010 (ESA 2010), in 2014. Historically, we followed the net approach, which reflected the government’s exposure to accumulated deficit of pension schemes but implicitly considered pension administrators themselves (and their investment assets and gross actuarial liabilities) to be outside of the public sector boundary. Following a consultation with the Public Sector Technical Advisory Committee and a further public consultation, we have adopted a different, gross presentation, recognising all assets and liabilities of pension administrators on the public sector balance sheet.

This change, predominantly but not exclusively presentational in nature, has greatly increased the volume of assets recorded on the public sector balance sheet but consolidated many inter-public sector balances and transactions. While the consolidation itself is neutral, fiscal aggregates do not always account for assets and liabilities symmetrically. Additionally, the inclusion of pension administrators under the gross presentation leads to recognition of their costs. Not all of these costs are passed on to pension managers under the net presentation. As a result, the move from net to gross recording does impact the fiscal aggregates, most notably public sector net debt (PSND), but also public sector current budget deficit (PSCDB), public sector net borrowing (PSNB) and public sector net financial liabilities (PSNFL).

This article explains the changes implemented in the public sector finances and the impact of these changes on the fiscal aggregates. It explains both the theory and practice behind our calculation of pension scheme estimates and highlights some differences in the treatment of unfunded pension schemes.

Back to table of contents2. Context

2.1. Treatment of pensions in economic statistics

Pension estimates appear in various sets of statistics produced on a national accounts basis by the Office for National Statistics (ONS). These include the core UK National Accounts publications such as the Blue Book, the supplementary dataset on accrued-to-date pension entitlements in social insurance -- UK National Accounts Table 29 -- and in fiscal statistics.

Revised treatment of pensions was one of the main innovations of the United Nations' System of National Accounts 2008 (2008 SNA) and its European interpretation, the European System of Accounts 2010 (ESA 2010). Under both frameworks, the functions of funded pension schemes are deemed to be performed by two separate types of institutional units -- pension administrators (units with responsibility over pension funds themselves) and pension managers (typically employers or units acting on behalf of former employers).

In the UK National Accounts presentation, pension administrators, and with them total assets and total liabilities of funded pension schemes, are normally recorded in the pension fund subsector of financial corporations, with no distinction between privately and publicly controlled units. Pension administrators do not bear the ultimate responsibility for the provision of pension benefits. It is borne by pension managers. Therefore, where appropriate, net liabilities, often referred to as the pension fund deficit outside of the national accounts framework, are recorded in the institutional sectors to which the associated pension managers are classified, including general government.

In simple terms, net liabilities measure the amount of accumulated shortfall or surplus of assets in relation to total pension liabilities. This subdivision of pension schemes into a pension administrator and pension manager applies to both defined benefit schemes and defined contribution schemes, although in the latter case the liabilities of the pension manager are zero by design.

In specific circumstances, one institutional unit can combine functions of both the manager and the administrator. In those situations, which are rare across funded schemes in the UK owing to the country's regulatory framework, all flows and balances are recorded in the sector to which the unit is classified. The Pension Protection Fund is an example of a unit exercising the functions of both the manager and the administrator.

Special rules also apply to unfunded pension schemes, which are very prominent in the public sector but relatively rare in the wider economy. Under the unfunded structure, the functions of the administrator and the manager are also deemed to be performed by a single unit, or at least within a single institutional sector in the example of large public sector schemes that cover employees of multiple organisations, such as the Civil Service pension schemes or the NHS pension scheme. As a result, all unfunded public sector schemes are recorded in the government sector.

The ESA 2010 framework considers obligations under unfunded schemes to be contingent. Such obligations are included in the supplementary statistics, such as the UK National Accounts Table 29: Accrued-to-date pension entitlements in social insurance, but are not recorded on the public sector balance sheet in the core UK National Accounts publications such as the Blue Book, nor in the ESA 2010-based fiscal statistics.

2.2 Pensions in public sector finance statistics

Users with interest exclusively in pensions may find our article titled Pensions in the national accounts, a fuller picture of the UK's funded and unfunded pension obligations to be the most accessible and comprehensive source of pension data compiled in accordance with national accounts rules and guidelines. In the following sections, however, we focus exclusively on the presentation and impact of pensions in fiscal statistics.

Public sector finance (PSF) statistics are based on the same framework as the UK National Accounts. The two sets of statistics are conceptually consistent but with the coverage of PSF limited to the public sector, these statistics can be produced more frequently and operate a less restrictive revisions policy.

The concept of public sector in fiscal statistics predates the adoption of ESA 2010. Its boundary is not explicitly specified in the statistical guidance and under the preceding statistical framework, the European System of Accounts 1995 (ESA 1995), pension funds were not included in the measurement of fiscal aggregates. At the time, assets were deemed to match pension liabilities in the long run, and thus no net liability was recognised. Consequently, including pension funds within the statistical boundary for public sector would have inflated both sides of the public sector balance sheet, limiting impact on the fiscal aggregates to consequences of debt consolidation.

With the adoption of ESA 2010, PSF statistics were updated to reflect net pension liability associated with the largest funded public pension scheme, the Local Government Pension Scheme. The adoption of the new standards also led to a classification review of funded public sector pension schemes to identify other instances of public sector units either holding managerial responsibility for pensions, or controlling pension administrators1. The inclusion of these newly classified, funded public sector pension schemes, as well as the general improvements to methods and data sources, were implemented in the PSF release on 21 September 2017. An article titled Employment-related pensions in public sector finances was published alongside the release to explain the rationale for those improvements and to show how the pension changes affect the main fiscal aggregates at the time, notably public sector net borrowing (PSNB), public sector net debt (PSND) and public sector net financial liabilities (PSNFL).

The novelty of pension administrators for the PSF framework and the effects of their inclusion in the PSF statistics prompted the referral of the methods associated with the recording of public sector pensions to the Public Sector Finances Technical Advisory Group (PSFTAG), a group of experts, which advises on issues that arise when defining how organisations, transactions and balance sheet levels should be recorded in the PSF statistics. Through the June 2018 article Pensions in public sector finances: technical note and consultation document, we explained the options and consulted on the presentation of pension externally.

In November 2018, we responded to the consultation and announced our decision. Having carefully considered the responses to the consultation, we decided to implement the recommendations made by the PSFTAG, namely:

- to include all assets and liabilities of the funded public sector employment-related pension schemes in the fiscal aggregates

- to record the Pension Protection Fund in the public sector boundary

- to report obligations of the unfunded public sector pension schemes, both employment-related and those that cover the wider population, in a supplementary set of tables, but not in the main fiscal aggregates

In the view of PSFTAG, these recommendations best aligned the recording of public sector pensions with the principles of the Review of the PSF statistics in 2013, while also maintaining full compliance with international statistics guidelines for the reporting of national accounts and government finance statistics. PSFTAG noted that public pension administrators are part of the public sector and so their inclusion is necessary to ensure that the full range of public sector liabilities are reported transparently.

In relation to funded pension schemes, the explicit inclusion of pension administrators within the public sector boundary requires more granular presentation of their data compared with the scenario when only the net pension liability of pension managers is recorded.

In relation to unfunded pension schemes, the new treatment does not alter the statistics compiled in accordance with ESA 2010. As there is no separation between pension manager and pension administrator, the flows associated with unfunded pensions and the small amount of assets which may be held by them for liquidity purposes are already recorded in the government sector. The obligations under unfunded schemes are not recorded in ESA 2010-based fiscal statistics.

In June 2019, we began to publish statistics compiled in accordance with the International Monetary Fund's Government Finance Statistics Manual 2014 (GFSM 2014) enhancing transparency of our statistics and offering an alternative data presentation. Since October 2019, these GFSM 2014 statistics have included unfunded pension schemes. Despite both sets of statistics employing predominantly the same methods in estimating pension flows and balances, the presentation of pension data varies considerably. GFSM 2014, being limited to just the public sector, does not rearrange pension transactions in the same way as ESA 2010-based statistics do. This makes the GFSM 2014 presentation more concise and easier to follow.

Some differences go beyond pure presentation. GFSM 2014 treats obligations under unfunded employment-related pension schemes as liabilities, whereas ESA 2010 considers them contingent. This has implications for the recording of flows and net borrowing associated with such schemes, as the former framework allows measurement of the change in actuarial liability, whereas the latter follows cash flows more closely.

Notes for: Context

- The statistical notion of pension manager is broadly similar to the accounting concept of pension sponsor, but the two definitions also have important differences. We assess each pension scheme with public sector involvement according to statistical rules to establish which institutional unit, or sector, should bear the managerial responsibility.

3. Impact on fiscal aggregates

3.1 Public sector net financial liabilities

Funded schemes

The gross approach to presenting pensions in fiscal statistics can also be described as including pension administrators within the statistical boundary of the public sector. On the contrary, the net approach implicitly treats pension funds as being outside of the statistical boundary for the public sector, and so only recognises the net liability passed on to pension managers, as well as any pension contributions made by the public sector in its role as an employer.

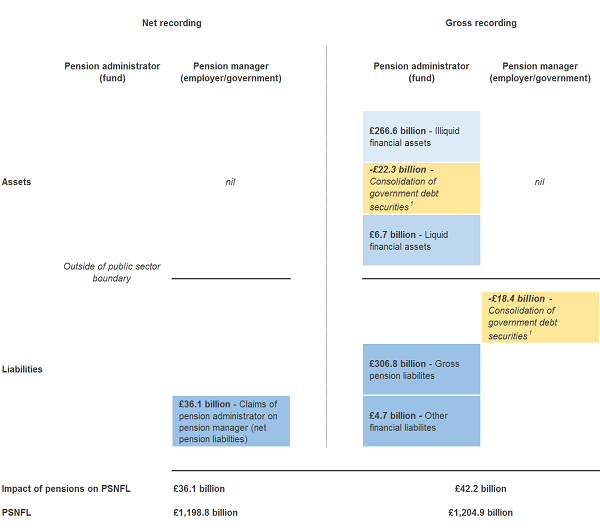

The application of either the previous net approach or the new gross treatment has a similar effect on public sector financial liabilities (PSNFL), which is predominantly impacted by the gap between total assets and total liabilities. Figure 1 shows how under the net liability approach, the gap is recorded explicitly as a net pension liability in the manager’s balance sheet. Under the gross liability, it is represented by the balance between total pension fund assets held jointly by the administrator and the manager and total (gross) accrued-to-date pension liabilities. Although PSNFL is similar under the two methods, it is not equal.

Figure 1: Recording of pensions on a gross basis will generally increase the level of public sector net financial liability

Public sector net financial liabilities (PSNFL) effects of net and gross recording of funded pension schemes, UK, financial year ending March 2013

Source: Public sector finances, UK: August 2019, Office for National Statistics

Notes:

- Many pension funds hold some government debt securities as part of their investment portfolios. These securities also represent a liability for government. When both the asset and the liability belong to units within the public sector boundary, consolidation is applied. This means that the government liability is reduced by the face value of debt securities held by public sector pension funds, but no asset is recorded.

Download this image Figure 1: Recording of pensions on a gross basis will generally increase the level of public sector net financial liability

.png (73.4 kB) .xlsx (26.8 kB)The first reason stems from the scope of this fiscal aggregate. PSNFL is based on the statistical concept of financial net worth, which measures the difference between the value of all financial assets and financial liabilities but does not cover non-financial assets. This means that under the gross approach, non-financial assets (such as real estate) directly held by pension funds are not included in the calculation of PSNFL. When the net approach is applied, the public sector’s net pension liability, denoted as claims of pension administrators on pension managers, is calculated as the difference between the present value of pension obligations and the value of all assets of funded public sector schemes including directly held non-financial assets. Provided pension schemes hold some non-financial assets, all else being equal, net pension liability explicitly recorded under the net presentation will be lower than the gap between financial assets and liabilities calculated under the gross presentation by the value of non-financial assets.

The second reason comes from the way government debt is valued in fiscal statistics. Many pension funds hold some government debt securities, notably gilts, as part of their investment portfolios. These securities also represent a liability for the government. When both the asset and the liability belong to units within the public sector boundary, consolidation is applied. This means that the government liability is reduced by the amount of debt securities held by public sector pension funds, but no asset is recorded on the pension fund’s balance sheet. In principle, consolidation is neutral in its effect on the balancing items. However, special rules are applied to valuation of government debt securities under the ESA 2010-based fiscal statistics, which makes their consolidation unbalanced. When recognised as a government liability, debt securities are recorded on a face-value basis, which represents the amount due to be repaid. In the pension funds’ balance sheet, the recording of debt securities issued by the government is done on a market-value basis, which tends to be higher than the face value. Consolidation is therefore likely to reduce public sector assets by more than it reduces the liability.

Figure 2: Consolidation of government debt securities and treatment of non-financial assets under gross recording increase the level of public sector net financial liabilities

Impact of pensions on public sector net financial liabilities, UK, financial year ending 1998 to financial year ending 20191,2

Source: Public sector finances, UK: August 2019, Office for National Statistics

Notes:

- All data are as published in Public sector finances, UK: August 2019. The data may be subject to revisions caused by incorporation of the latest actuarial valuation results.

- The Pension Protection Fund (PFF) combines the economic functions of pension manager and pension administrator. All PPF assets and liabilities are therefore included in both the net and the gross presentations.

Download this chart Figure 2: Consolidation of government debt securities and treatment of non-financial assets under gross recording increase the level of public sector net financial liabilities

Image .csv .xlsUnfunded schemes

Unfunded schemes do not use investment pots to generate return. They do not hold investment assets, although some schemes may keep small ring-fenced pools of liquid assets to manage any temporal mismatch between contributions receivable, benefits payable and any transfers they may receive from, or pay to other parts of the government. In statistics based on the European System of Accounts 2010 (ESA 2010), obligations under unfunded pension schemes are not included on the public sector balance sheet. This means that the direct effects of unfunded schemes on public sector net financial liabilities (PSNFL) are very limited.

The indirect effects are harder to quantify. The government may use any excess of contributions over benefit payments to fund other expenditure, thereby implicitly decreasing the amount of debt that would otherwise need to be raised. The opposite is equally true and any excess of benefits payable over contributions would have to be financed from other sources and may lead to higher government debt.

3.2 Public sector net debt

Funded schemes

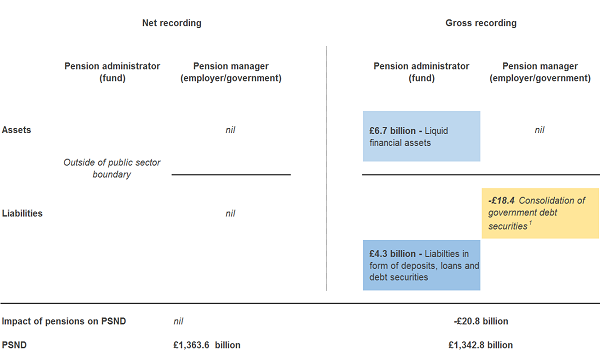

The net and gross approaches can significantly vary in their impact on the more restrictive public sector net debt (PSND) aggregate. If recorded on a net liability basis (in other words, if pension administrators remain outside of the PSF boundary), none of the assets or liabilities related to pensions affect this fiscal aggregate. However, recording on a gross liabilities basis leads to the consolidation of government debt securities held as investment assets by the pension administrator, and further recognises its liquid assets.

Figure 3: Recording of pensions on a gross basis decreases the level of public sector net debt

Public sector net debt (PSND) effects of net and gross recording of funded pension schemes, UK, financial year ending March 2013

Source: Public sector finances, UK: August 2019, Office for National Statistics

Notes:

- Many pension funds hold some government debt securities as part of their investment portfolios. These securities also represent a liability for the government. When both the asset and the liability belong to units within the public sector boundary, consolidation is applied. This means that government liability is reduced by the face value of debt securities held by public sector pension funds, but no asset is recorded.

Download this image Figure 3: Recording of pensions on a gross basis decreases the level of public sector net debt

.png (47.5 kB) .xlsx (28.2 kB)Therefore, as PSND by design does not include pension liabilities, the gross recording contributes to a reduction in this measure of debt through consolidation of debt securities and increased liquid assets, irrespective of whether the pension scheme is in surplus or in deficit.

Figure 4: Recording of pensions on a gross basis reduces level of public sector net debt mainly because of consolidation of government debt securities

Impact of pensions on public sector net financial liabilities, UK, financial year ending 1998 to financial year ending 20191,2

Source: Public sector finances, UK: August 2019, Office for National Statistics

Notes:

- All data are as published in Public sector finances, UK: August 2019. The data may be subject to revisions caused by incorporation of the latest actuarial valuation results.

- Under net presentations, pensions do not affect PSND.

Download this chart Figure 4: Recording of pensions on a gross basis reduces level of public sector net debt mainly because of consolidation of government debt securities

Image .csv .xlsUnfunded schemes

The direct impact of unfunded pension schemes on PSND is very similar to their effect on PSNFL – any holding of liquid assets that may be held by some schemes reduce both fiscal aggregates in equal measure. The ultimate impact on the two measures may vary slightly, as the balance between other accounts payable and receivable (often associated with timing differences between points when obligation to pay arises and cash moves hands) may affect PSNFL but not PSND.

3.3 Public sector current budget deficit and public sector net borrowing

Funded schemes

In economic statistics, employment-related pensions are considered a component of labour remuneration, which adds a layer of complexity to how the transactions are presented. In this section, we focus on the ultimate impact on the fiscal aggregates, starting from the older net presentation and expanding analysis to the gross presentation followed from September 2019. Section 4 explains the mechanics in more detail.

Under the net presentation of funded pension schemes, which reflected pension manager’s perspective and was followed in fiscal statistics prior to September 2019, the primary impact on public sector current budget deficit (PSCBD) and public sector net borrowing (PSNB) comes from actual and imputed contributions paid by the pension manager. The latter represent the amounts that the manager would need to contribute each time period to cover the change in actuarial liabilities. Although mostly positive, imputed contributions can sometimes be negative. This can happen for a number of reasons but most commonly reflects a situation where actual contributions are set above the level needed to finance change in pension liabilities over the period.

Additionally, unbalanced pension transfers – those where the value of assets transferred into the scheme does not equate to the value of assumed liability – changes pension managers’ net liability and affects PSNB. Such transfers are considered capital in nature and do not directly affect public sector current budget deficit, which only captures borrowing to fund day-to-day activities. While uncommon for the majority of employment-related pension schemes, this type of transaction is routine for the Pension Protection Fund (PPF) and tends to increase PSNB in periods when new schemes enter the PPF.

Under the net approach, the combination of pension contribution and transfers were the only transactions affecting public sector net borrowing. Under the gross presentation, we also include the value of transactions affecting net borrowing of pension administrators. Many of these are already accounted for by managers’ actual and imputed pension contributions and do not change net borrowing at the public sector level. Yet a smaller number of revenue and expenditure items are not directly passed to (or from) pension manager and are added to the calculation of PSCBD and PSNB.

The principal set of transactions falling under the latter category are those associated with finance costs. The discrepancy between the value of property income payable – unwinding of the discount rate – and interest and dividends on investment assets, which characterises defined benefit (DB) pension schemes, is transmitted to PSCBD and PSNB, likely increasing it compared with the net presentation.

In addition, direct net acquisitions of capital assets are treated as expenditure, even if conducted for investment purposes, and also increase PSNB. As all capital transactions, direct acquisitions of capital assets are excluded from the scope of public sector current budget deficit and do not affect this measure directly.

Unfunded schemes

ESA 2010 considers obligations under unfunded pension schemes to be contingent liabilities, which should not be reported on the balance sheet. By implication, this eliminates the effect of imputed flows reflecting change in actuarial liability from the measurement of PSCBD and PSNB.

Actual pension contributions are similarly made by public sector employers on behalf of employees. They are, however, deemed to be paid back to pension schemes by the employees without creating a financial liability for the government. Pension contributions therefore appear completely neutral on the public sector level, in contrast with funded pensions schemes whereby further adjustments are made to ensure that their ultimate effect on net borrowing is not neutralised.

In effect, that means that the ultimate impact on PSCBD and PSNB comes from the public sector’s actual expenditure on pension benefits. A much smaller impact may be caused by transfers of pension between schemes: the absence of liability means that members leaving or joining public sector schemes take away (or bring in) assets but not the associated liability.

Back to table of contents4. How pension statistics are compiled

4.1 Estimates of pension liability

Funded defined benefit schemes

Pensions differ from most elements of fiscal statistics in their heavy reliance on actuarial modelling. Most pensions in the public sector are provided by the so-called defined benefit (DB) schemes; although many are unfunded, local government employees and staff at some non-departmental public bodies are members of funded DB schemes. DB pension schemes use a formula to determine the size of the annuity or payout to which a retiree is entitled. The formula often includes considerations such as salary (either career average or final), length of service and age at retirement, among various other factors. As a result, the size of the pension liability recognised on the public sector balance sheet depends on demographic factors, such as life expectancy, economic assumptions such as pre-retirement wage of the scheme members, as well as the discount rates used in valuing the future liability.

The method of quantifying the value of pension liabilities in statistics is similar to that used in business accounting and is based on actuarial estimates for each scheme. However, there are important differences in assumptions between the accounting and statistical treatments. The full list of statistical assumptions is provided in our article Pensions in the national accounts: UK Table 29 methodology, but of particular relevance is the choice of the discount rate.

In accounting, discount rates depend on the advice of each scheme actuary at the time of compiling the scheme's accounts, which means that they vary scheme by scheme and across time. In statistics, the European System of Accounts 2010 (ESA 2010), through the Technical Compilation Guide for Pension Data in National Accounts, mandates the use of a single discount rate for government-managed pension schemes. Even though this rate may not reflect the economic climate in the short term, it is believed to be a reasonable approximation of the long-term interest rate faced by pension funds. It aims to limit volatility of pension estimates that would otherwise be transmitted into the fiscal aggregates, also improving comparability and consistency of estimates for various schemes and across countries. In turn, this allows the creation of a coherent measure of household wealth in the national accounts.

In the ESA 2010-based statistics, the rates had been historically set in compliance with the methodology underpinning The Ageing Report: Economic and Budgetary Projections for the EU member states, published by the European Economic and Financial Affairs Council's Economic Policy Committee. The report, alongside the underlying assumptions, is periodically updated. In practice, this means that a nominal rate of 5% (3% real) was used for the pension estimates up to the financial year ending (FYE) March 2018, and a nominal rate of 4% (2% real) has been used since.

The binding application of the statistical discount rate is limited to government-managed pension schemes. In relation to the public sector, this means that the liabilities of the Pension Protection Fund and schemes managed by public corporations (as defined for statistical purposes), such as the Bank of England, do not have to be estimated using the statistical discount rate and are to be based on the rate advised by the actuary.

Actuarial valuation is a complex process and most public sector schemes conduct it every three to four years. This creates a considerable time lag in the availability of the actuarial data, which can exceed four years. Until such valuation becomes available, we forecast the pension liability using our best knowledge of the economic climate. The replacement of the modelled estimates with the outturn data may cause retrospective revisions, which may impact the fiscal aggregates.

Funded defined contribution schemes

Defined contribution (DC) pension schemes cover a far smaller proportion of public sector employees than DB schemes. In addition to schemes for its own employees, the government also controls the National Employment Savings Trust, a scheme set up for automatic enrolment, available to private employers.

By convention, the liability of a DC scheme is equal to the value of its investment assets. We make extensive use of accounting data to create an estimate of such liability. The estimates of DC schemes’ liability are also timelier than those of DB schemes because they do not require complex actuarial valuations.

Unfunded schemes

While we do not include government obligations under employment-related unfunded pension schemes, such as the Civil Service, Teachers' or the NHS, in the ESA 2010-based fiscal statistics, we will include them in statistics based on the International Monetary Fund's Government Finance Statistics Manual 2014 (GFSM 2014).

Unfunded pension schemes are DB schemes by design. This means that in all of them, the size of the annuity or payout that a retiree is entitled to is determined through a formula and is normally linked to pre-retirement wages. As a result, the methods we use to compile the estimates are conceptually similar to those used for estimating funded DB scheme liabilities and are based on actuarial modelling.

All unfunded pension schemes in the public sector are managed by units classified to the government sector for statistical purposes. In accordance with the international rules, we use the same statistical discount rate to estimate the present value of all unfunded public sector pensions as we do for the funded DB schemes. This means that the unfunded pension liabilities reported in the GFSM 2014-based fiscal statistics are consistent with those in the supplementary ESA 2010 presentation, the UK National Accounts Table 29: Accrued-to-date pension entitlements in social insurance presentation.

4.2 Estimates of other assets and liabilities

Funded schemes

Estimating values of other assets and liabilities is similar to the process used for compiling other public corporations' financial balance sheets. Accounting data provide a good starting point, but as explained in the article Wider measures of the public sector balance sheet: public sector net worth, there are important differences in recognition of financial assets and liabilities under ESA 2010, and International Financial Reporting Standards (IFRS) or the generally accepted accounting practice in the UK (UK GAAP), which underpin the production of corporate accounts. Furthermore, even where both statistical and accounting frameworks recognise an asset or a liability in principle, the IFRS and UK GAAP financial instrument categories do not always align to ESA 2010 categories, and the same is true for valuation methods.

We therefore implement statistical adjustments to accounting source data, which sometimes affect the total value of assets and liabilities of the pension schemes. An example of this is the recording of the provisions of the Pension Protection Funds (PPF). These are included within the IFRS-based balance sheet in recognition of the fact that new schemes may be expected to enter the PPF. However, provisions are considered contingent obligations and therefore lie outside of the ESA 2010 recognition boundary. As a result, the public sector finance (PSF) statistics do not include provisions in the calculation of fiscal aggregates, such as public sector net financial liabilities (PSNFL).

A further challenge lies in the fact that although accounting and statistical taxonomies are relatively similar, they are not identical. We generally require very granular data to map accounting categories to statistical concepts. Historically, where that level of granularity was not available in accounting datasets, we used the Pension Funds Survey (PFS) to determine the appropriate categorisation of assets in statistics. In 2019, the PFS was replaced by the Financial Survey of Pension Schemes (FSPS). More information about the development of the ONS pension surveys can be found in the article titled UK pension surveys: redevelopment and 2019 results.

Unfunded schemes

In contrast to funded pensions, unfunded schemes do not use investment pots to generate return, as current income (contributions from employees) is used to pay current liabilities (pension benefits to retirees). As such, unfunded pension schemes do not hold investment assets, only liabilities.

The schemes may nonetheless hold relatively small ring-fenced pools of liquid assets to manage any temporal mismatch between contributions receivable and benefits payable on one side, and government transfers on the other. As all public unfunded schemes are classified to the general government sector, such assets would always have been included in the total government liquid assets.

4.3 Transaction estimates

Funded defined benefit schemes

The recording of pension flows in national accounts is complicated. In economic statistics, we recognise that employment-related pensions are a component of compensation of employees. These amounts, which include both employers’ contributions and parts of employees’ own wages, and salaries earmarked for pension contributions, are recorded as if they were initially paid to households, even if in practice the money was transferred by the employer directly to their pension scheme. Such rearrangement allows comprehensive measurement of labour remuneration and treats pensions as a form of deferred income for households.

The first step for fiscal statistics is therefore to record pension managers' or employers', actual expenditure on pension contributions. The data for this would generally come from the same sources as used to measure other types of expenditure by public sector units. For example, the vast majority of units classified to central government report their expenditure through HM Treasury's Online System for Central Accounting and Reporting (OSCAR), whereas local government units would report theirs through the department responsible for the local government data collection, presently the Ministry of Housing, Communities and Local Government.

We recognise that in defined benefit (DB) pension schemes, the amount of contributions received by the scheme and other inflows, less the amount of pension benefits paid and other outflows, may not be equal to the movement in actuarial pension liability. Alongside actual employers' contributions, we also calculate the additional amount that the employer (or the government in its stead) would need to contribute each time period to cover the change in actuarial liabilities. We then include this as an imputed expenditure item, or "employers' imputed social contributions", in the accounts of the managers of funded DB schemes. The methodology and assumptions used in calculating employers' imputed social contributions are described in our article titled Pensions in the national accounts: UK Table 29 methodology. Importantly, we calculate employers' imputed contributions consistently with the present value of pension liabilities, which involves using the same statistical discount rate for all schemes managed by central and local government units.

Under the gross presentation, we then add other transactions of pension administrators. Their recording adds some circularity, arising from rearrangement of transactions through the household sector in ESA 2010-based statistics and the view of contributions as revenue from the pension fund sector point of view. As shown by Table 1, the elimination of intra-public sector flows and rearranged transactions leaves a relatively small set of revenue and expenditure categories which impact the fiscal aggregates, public sector current budget deficit (PSCBD) and public sector net borrowing (PSNB).

| Pension administrator | Pension manager | Eliminated at public sector level (Yes/No) | |

|---|---|---|---|

| Resources | |||

| P.1 Market output | Yes | Statistical estimate of implied fees charged by pension administrators, based on their costs | |

| D.39 Subsidies on production | No | A transaction unique to the Pension Protection fund, reflecting the amount of fees it collects | |

| D.41 Property income receivable less interest on UK government debt securities | No | Estimate of dividends and interest accrued on investment assets. Inter-public sector interest is consolidated | |

| D.611 Employers' actual pension contributions | Yes | From administrator's point of view, contributions represent revenue | |

| D.612 Employers' imputed pension contributions | Yes | ||

| D.613 Employees' actual pension contributions | Yes | ||

| D.614 Households' pension contribution supplements | Yes | Property income payable by administrators to households. It is deemed to be immediately reinvested by householders back in the pension funds. For DB schemes, equal to unwinding of the discount rate. | |

| D.61SC (negative values) | Yes | Statistical estimate of implied fees charged by pension administrators, based on their costs. Equal to P.1 market output but negative, implying reduction in resources available to pay out pension benefits. | |

| D.99 Other capital transfers | No | Transfer of assets from other schemes or pension managers | |

| Uses | |||

| P.2 Intermediate consumption | Yes | Cost of goods and services used by pension administrators | |

| D.1 Compensation of employees | Yes | Administrators' own staff costs | |

| D.1 Compensation of employees | No | From managers' point of view, pension contributions are a cost | |

| includes D.121 Employers' actual pension contributions | |||

| includes D.122 Employers' imputed pension contributions | |||

| includes part of D.11 wages and salaries contributed by employees to pension schemes | |||

| D.4 Property income payable | No | Unwinding of the discount rate, equal to D.614 Households' pension contribution supplements | |

| D.622 Pension benefits | Yes | Cost of pension benefits payable | |

| D.8 Adjustment for the change in pension entitlement | Yes | An adjustment item applied to neutralise any excess of pension contributions and property income over pension benefits paid to households. Prevents this difference from affecting household saving and pension administrators' net lending. | |

| D.99 Other capital transfers | No | Transfer of liabilities from other schemes or transfer of assets to pension managers | |

| P.51g Gross fixed capital formation | No | Acquisitions less disposals of directly held fixed assets | |

| B.9 net lending/borrowing | Resources minus uses | ||

Download this table Table 1: Transactions of funded defined benefit pension schemes in ESA 2010-based statistics

.xls .csvThe appropriate categories of pension administrators' expenditure, such as on staff, goods and services, are passed to the pension manager and accounted for by employers' imputed pension contributions. Such costs are therefore eliminated in pension administrators' accounts. The only revenue and expenditure of the administrators to impact PSCBD and PSNB when moving from a net recording to a gross recording is that which has not been already considered as an actual or imputed expense for the pension manager.

The principal transaction in this category is administrators’ interest, or “property income” in statistical terminology. For DB schemes, the value of liabilities represents the present, or discounted, value of estimated future payments. The fact that these payments are nearer as the time passes means that expenditure should be recorded each period to reflect the unwinding of the discount rate. This expenditure is treated as property income payable by the administrator. Conventionally, for government-managed schemes, the unwinding of the discount rate is estimated as the nominal rate used in calculating the present value of pension liabilities times the opening balance of pension liabilities. For schemes managed by public corporations, the unwinding of the discount rate is based on the rate advised by the scheme’s actuary.

On the revenue side of the accounts, property income receivable by pension administrators is recorded. In principle, it is simply the value of interest and dividends received by pension schemes from its investment portfolio. To apply a consistent approach in valuing income and expenditure, for government-managed DB schemes, we use the statistical interest rate consistent with that used in deriving the present value of pension obligations, times the opening balance of investment assets, to estimate the value of property income receivable. For other public schemes, the values of property income receivable are derived from accounting sources. Just as with the expenditure, the nominal rate may not reflect the actual return on scheme’s investment in the short and medium term. However, it is important to remember that pension schemes exist for long periods of time, typically decades. The choice of a rate is therefore based on empirical observations of rates faced by schemes in the past and long-run projections of future rates.

We also need to know how much of the interest income of pension administrators is associated with UK Government debt securities, to consolidate inter-public sector flows. These more granular data are rarely available in accounting sources and we use pension surveys to estimate the amounts that need to be consolidated on a public sector level.

Finally, we consider pension schemes’ direct investment in capital assets. In economic statistics, capital assets are treated differently to financial assets, even if held as investments. This special treatment is motivated by the role that these assets play in production. We make a distinction between capital assets held directly by the pension funds and those held through pooled investment vehicles. Net acquisitions of directly held capital assets are recorded as expenditure, whereas acquisitions of shares in pooled investment vehicles are viewed as acquisitions of financial assets – from the pension funds’ point of view – and do not give rise to expenditure.

In cases where public sector units, such as the Pension Protection Fund (PPF), receive unbalanced transfers of pension liabilities – that is, assume either a higher or a lower pension liability than the value of the investment assets they receive – we apply statistical rules on debt assumption. The additional public sector expenditure (or revenue) is then estimated as a difference between the value of assets and liabilities transferred to a public sector scheme.

The PPF has other flows that are unique to this unit. It collects levies from eligible pension schemes. In accordance with the statistical rules, we consider these levies to be a form of taxes. In economic statistics, all taxes are recorded as collected by the government sector. This reflects the economic reality that only the government has legal powers to introduce taxes, whether it chooses to do so directly or by delegating this power to arm’s-length bodies. The receipt of the PPF levy is initially recorded in government accounts as tax revenue, which is then routed to the PPF and considered a subsidy for statistical purposes.

The fiscal statistics based on GFSM 2014 provides an alternative, and more concise, presentation of public sector expenditure on funded employment-related pensions which agrees with ESA 2010-based statistics on the ultimate net borrowing impact.

| Pension administrator | Pension manager | Eliminated at public sector level (Yes/No) | |

|---|---|---|---|

| Revenue | |||

| 141 Property income | No | Estimate of dividends and interest accrued on investment assets. Inter-public sector interest is consolidated | |

| 1421 Sales by market establishments | Yes | Statistical estimate of implied fees charged by pension administrators, based on their costs | |

| 1441 Current transfers not elsewhere classified | No | A transaction unique to the Pension Protection fund, reflecting the amount of fees it collects | |

| 1442 Capital transfers not elsewhere classified | No | Transfer of assets from other schemes or pension managers | |

| Expense | |||

| 21 Compensation of employees | No | From managers' point of view, pension contributions are a cost | |

| includes 2121 Employers' actual pension contributions | |||

| includes 2122 Employers' imputed pension contributions | |||

| 21 Compensation of employees | Yes | Administrators' own staff costs | |

| 22 Uses of goods and services | Yes | Cost of goods and services used by pension administrators | |

| 2813 Property expense for investment income disbursements | No | Unwinding of the discount rate | |

| 31 Net investment in non-financial assets | No | Acquisitions less disposals of directly held fixed assets | |

| B.9 net lending/borrowing | Revenue minus expense | ||

Download this table Table 2: Transactions of funded defined benefit pension schemes in GFSM 2014-based statistics

.xls .csvFunded defined contribution schemes

The recording of defined contribution (DC) schemes follows the same logic as that for DB schemes but is simpler because of the absence of potential mismatch between the growth in assets and in liabilities.

Employers’ actual contributions, as well as the share of employees’ wages and salaries earmarked for pension contributions, are recorded as expenditure, in a similar way to DB schemes. On the other hand, imputed contributions are not required for DC schemes, for which the pension liability is linked to the value of assets in the pension funds. Rather than applying a formula to estimate the change in pension liabilities and impute the amounts that pension manager ought to pay each period, the accounts of DC pension schemes follow actual inflows and outflows more closely. As a result, we make greater use of accounting data in compiling DC scheme statistics.

This includes property income, which is calculated as actual interest and dividends earned on investment assets. For DC schemes, property income simultaneously increases the value of the scheme’s investment assets and the value of liabilities by the same amounts, which makes the net effect of property income zero prior to consolidation of interest earned on government debt securities.

| Pension administrator | Pension manager | Eliminated at public sector level (Yes/No) | |

|---|---|---|---|

| Resources | |||

| P.1 Market output | Yes | Statistical estimate of implied fees charged by pension administrators, based on their costs. | |

| D.41 Property income receivable less interest on UK government debt securities | No | Estimate of dividends and interest accrued on investment assets. Inter-public sector interest is consolidated. | |

| D.611 Employers' actual pension contributions | Yes | From administrator's point of view, contributions represent revenue. | |

| D.613 Employees' actual pension contributions | Yes | ||

| D.614 Households' pension contribution supplements | Yes | Property income payable by administrators to households.It is deemed to be immediately reinvested by householders back in the pension funds. For DC schemes, equal to actual interest and dividends | |

| D.61SC (negative values) | Yes | Statistical estimate of implied fees charged by pension administrators, based on their costs. Equal to P.1 market output but negative, implying reduction in resources available to pay out pension benefits. | |

| D.99 Other capital transfers | Yes | Transfer of assets from other schemes or pension managers. For DC schemes, equal to transfer of liabilities. | |

| Uses | |||

| P.2 Intermediate consumption | Yes | Cost of goods and services used by pension administrators. | |

| D.1 Compensation of employees | Yes | Administrators' own staff costs. | |

| D.1 Compensation of employees | No | From managers' point of view, pension contributions are a cost. | |

| includes D.121 Employers' actual pension contributions | |||

| includes part of D.11 wages and salaries contributed by employees to pension schemes | |||

| D.4 Property income payable | No | Estimate of dividends and interest accrued on investment assets, equal to D.614 Households' pension contribution supplements. | |

| D.622 Pension benefits | Yes | Cost of pension benefits payable. | |

| D.8 Adjustment for the change in pension entitlement | Yes | An adjustment item applied to neutralise any excess of pension contributions and property income over pension benefits paid to households. Prevents this difference from affecting household saving and pension administrators' net lending. | |

| D.99 Other capital transfers | Yes | Transfer of liabilities from other schemes. For DC schemes, equal to transfer of assets. | |

| P.51g Gross fixed capital formation | No | Acquisitions less disposals of directly held fixed assets. | |

| B.9 net lending/borrowing | Resources minus uses | ||

Download this table Table 3: Transactions of funded defined contribution pension schemes in ESA 2010-based statistics

.xls .csvUnder GFSM 2014, defined contribution pension schemes are presented in a similar way to funded defined benefit schemes, as shown by Table 2. Just as under ESA 2010, imputed contributions are not recorded, meaning the two frameworks agree on the net borrowing impact of defined contribution schemes.

Unfunded schemes

The recording of unfunded schemes presents a special case. The European System of Accounts 2010 (ESA 2010), and the Government Finance Statistics Manual 2014 (GFSM 2014) differ in their approach to unfunded schemes.

In statistics compiled under GFSM 2014, we estimate transactions in the same way as we do for the funded DB schemes, with two caveats. Firstly, unfunded pension schemes are classified to the managers’ sector and not to the pension fund sector of the economy, meaning that all flows are recorded in the general government part of the public sector. This implicitly amalgamates some of the transactions of pension administrators into pension managers’ accounts. For example, the costs of administering the schemes may no longer be separately identifiable and could be captured in the general manager’s expenses.

Secondly, such schemes hold very small amounts of assets, and do so only for liquidity purposes. As a result, they do not have material amounts of property income receivable, nor do they engage in capital formation. The absence of ring-fenced pools of assets may require the government to provide regular transfers to schemes whose revenue from contributions is below the amounts that need to be spent on benefits. Similarly, schemes with an excess of contributions over benefits may surrender the surplus amounts. Such transfers are only explicitly recorded when taking place between different subsectors, for example, from a central government department to local pension schemes, and are consolidated at the public sector level.

| Pension administrator | Pension manager | Eliminated at public sector level (Yes/No) | |

|---|---|---|---|

| Revenue | |||

| 1441 Current transfers not elsewhere classified | Yes | Top-up grants from government to cover shortfall between contributions and benefits | |

| 1442 Capital transfers not elsewhere classified | No | Transfers of assets from other schemes | |

| Expense | |||

| 21 Compensation of employees | No | From managers' point of view, pension contributions are a cost | |

| includes 2121 Employers' actual pension contributions | |||

| includes 2122 Employers' imputed pension contributions | |||

| 2813 Property expense for investment income disbursements | No | Unwinding of the discount rate | |

| 2821 Current transfers not elsewhere classified | Yes | Top-up grants from government to cover shortfall between contributions and benefits | |

| 2822 Capital transfers not elsewhere classified | No | Transfer of assets to other pension schemes | |

| B.9 net lending/borrowing | Revenue minus expense | ||

Download this table Table 4: Transactions of unfunded pension schemes in GFSM 2014-based statistics

.xls .csvIn fiscal statistics compiled on the basis of ESA 2010, only a subset of these transactions impacts borrowing, albeit with more circular flows reflecting the amounts passed from pension managers to householders, and then back to the pension scheme. Unfunded pension obligations are viewed as contingent liabilities and are not included in the core accounts. By implication, imputed contributions and other adjustments associated with changes to pension entitlements do not affect the statistical aggregates, and the recording focuses on flows which measure the cumulative net expenditure on unfunded pension benefits. These transactions do not involve modelling and are compiled using the data from HM Treasury’s Online System for Central Accounting and Reporting (OSCAR) and the Ministry of Housing, Communities and Local Government statistics.

| Pension administrator | Pension manager | Eliminated at public sector level (Yes/No) | |

|---|---|---|---|

| Resources | |||

| D.611 Employers' actual pension contributions | Yes | From administrator's point of view, contributions represent revenue | |

| D.612 Employers' imputed pension contributions | |||

| D.613 Employees' actual pension contributions | |||

| D.73 Current transfers within general government | Yes | Top-up grants from government to cover shortfall between contributions and benefits | |

| D.99 Other capital transfers | No | Transfers of assets from other schemes | |

| Uses | |||

| D.1 Compensation of employees | Yes | From managers' point of view, pension contributions are a cost | |

| includes D.121 Employers' actual pension contributions | |||

| includes D.122 Employers' imputed pension contributions | |||

| includes part of D.11 wages and salaries contributed by employees to pension schemes | |||

| D.622 Pension benefits | No | Cost of pension benefits payable | |

| D.73 Current transfers within general government | Yes | Top-up grants from government to cover shortfall between contributions and benefits | |

| D.99 Other capital transfers | No | Transfer of assets to other pension schemes | |

| B.9 net lending/borrowing | Resources minus uses | ||

Download this table Table 5: Transactions of unfunded pension schemes in ESA 2010-based statistics

.xls .csv5. Conclusion

The treatment of pensions is one of the more complex subjects in the European System of Accounts 2010 (ESA 2010), the European adaptation of the United Nations’ System of National Accounts 2008. It involves recording a large number of flows to and from the household sector, designed to reflect householders’ income and savings associated with pensions. A subdivision of pension schemes into two institutional units – pension managers and administrators – each performing their distinct function in the economy, further complicates the recording.

Following a decision to bring all public sector pension administrators into the statistical public sector boundary of public sector finances, we have moved from a net recording of public sector employment-related pensions to a gross recording. As a result, the gross recording has the following properties relative to the older net basis of recording pensions:

liquid assets and government debt securities held by pension administrators are netted off public sector net debt (PSND) and shift PSND downwards

the difference between market value of government debt securities held as investment assets and their face value affects public sector net financial liabilities (PSNFL), likely increasing it

fixed assets directly held by pension funds are not netted off PSNFL, contributing to an increase in PSNFL

direct investment in non-financial assets, such as real estate, increases public sector net borrowing (PSNB) but not public sector current budget deficit (PSCBD)

the difference between the effect of time on the value of pension liabilities and interest and dividends on investment assets is transmitted to PSCBD and PSNB, likely increasing both measures

Many of the flows related to public sector pension schemes are ultimately eliminated at a public sector level. Nonetheless, they are still shown separately in fiscal statistics produced in accordance with ESA 2010. In contrast to ESA 2010-based statistics, tables compiled on the basis of the International Monetary Fund’s Government Finance Statistics Manual 2014 (GFSM) offer a more concise presentation of pension transactions, only recording those with an effect on the fiscal statistical aggregates.

Despite the differences in presentation, both frameworks agree on the ultimate impact of funded pensions on public sector accounts. Unfunded pension schemes, on the other hand, are recorded fundamentally differently.

ESA 2010 does not consider government obligations under unfunded pension schemes as liabilities, which in turn means that actuarial movements in liability (when these are not caused by actual transactions) do not impact statistical aggregates, only near-cash transactions such as actual contributions and benefits do.

Under GFSM 2014, government liabilities under employment-related unfunded schemes are recorded on the balance sheet. Consequently, the recording of such schemes focuses on the change in the actuarial liability, and imputed transactions, in addition to the actual ones, affect net borrowing of the public sector.

The UK fiscal aggregates are based on the ESA 2010 framework, which treats funded and unfunded pension schemes differently. In June 2019, we began to publish statistical tables compiled in accordance with GFSM 2014 enhancing transparency of our statistics and offering an alternative data presentation. From October 2019, these GFSM 2014 statistics includes unfunded pension schemes.

Back to table of contents