1. Main points

In the period July 2016 to June 2017, of all adults questioned, 40% believed employer pension schemes were the safest way to save for retirement; this is unchanged from the period July 2014 to June 2016.

In July 2016 to June 2017, 49% considered that property would make the most of their money, continuing the rising popularity for this option since July 2012.

Of eligible employees asked, 85% said they had heard of automatic enrolment prior to the interview, whereby all employers must now automatically enrol eligible employees into a workplace pension, introduced as part of the 2012 pension reforms.

Of eligible employees asked who indicated that they had heard of automatic enrolment prior to the interview, 78% said they were aware that their employer had begun automatically enrolling employees.

In the period July 2016 to June 2017, 61% of all eligible employees who were aware that their employer had begun automatically enrolling employees, reported having been automatically enrolled into a workplace pension since 2012.

In the period July 2016 to June 2017, 54% of men aged under 65 and women aged under 60 not already retired reported being fairly or very confident that their retired income would give them the standard of living they hope for. This increased from 51% in the period July 2014 to June 2016.

In July 2016 to June 2017, the percentage of adults who were able to keep up with bills and credit commitments without any difficulty increased to 63%, from 59% in July 2014 to June 2016.

Of all adults with non-mortgage debt, 8% considered it to be a heavy burden in the period July 2016 to June 2017; this decreased slightly from 9% in July 2014 to June 2016 and was the lowest value since the question was first asked in July 2010 to June 2012.

2. Things you need to know about this release

The Wealth and Assets Survey (WAS) is a longitudinal survey carried out by Office for National Statistics (ONS), which aims to address gaps identified in data about the economic well-being of households in Great Britain. It gathers information on, among others: level of assets, savings and debt; saving for retirement; how wealth is distributed among households or individuals; and factors that affect financial planning.

Respondents are questioned every two years with each two-year period forming a “wave”. Wave 1 covered the period July 2006 to June 2008, with subsequent waves carrying on continuously from this date. Wave 6 of the survey started in July 2016.

The previous edition of this report, published on 27 June 2017, provided early estimates from the full wave 5 dataset (covering the period July 2014 to June 2016) plus results from the first six months of wave 6 (July 2016 to December 2016). The main results from wave 5 were published on 1 February 2018. This bulletin now draws on initial data from the first year of wave 6 (July 2016 to June 2017) and is intended to provide more timely metrics and add value before the main delivery of data.

Early indicators are derived from simple frequency counts of variables included in the questionnaire. They are produced before any imputation is carried out. Imputation is crucial to the estimation of wealth measures, therefore, at present, measures of wealth will not be provided. The questions best suited to be used as early indicators are “opinion” questions or those relating to “ownership” of a particular asset. The set of indicators included in this release is not fixed and will be varied over time, taking into account the views and priorities of main users.

Some new questions, introduced in wave 6, concerning automatic enrolment into workplace pensions are included for the first time in this report.

Unless otherwise stated, questions were asked of all non-proxy eligible adults (those aged 16 and over and not in full-time education who responded in person to the questionnaire). In places, we refer to “non-retired adults”; more accurately, this should read all adults aged under 40 and adults aged 40 and over who are not retired, that is, we would include anyone aged under 40 who is retired (for example, medically retired) – but these numbers would be very small.

Full weighting of respondents has been applied to the data in this release to take account of the varying sampling probabilities and attrition between waves. For wave 4 (July 2012 to June 2014), wave 5 (July 2014 to June 2016) and wave 6 (July 2016 to June 2017), the non-proxy respondents have been grossed up to recognised population totals. For wave 3 (July 2010 to June 2012), the weighting grossed all respondents, including proxies, to recognised population totals. While this makes relatively little difference to the percentages in each category, it impacts on the weighted frequencies in the accompanying data tables.

No significance testing has been carried out on these data.

Back to table of contents3. Attitudes towards saving for retirement

Sources of savings for retirement

There are a variety of ways in which people can save for their retirement including pension schemes, savings accounts, investment in property and other investments. Non-retired adult respondents to the Wealth and Assets Survey (WAS) are asked to choose one option from a list of possible options to identify the one they consider to be the safest way to save for retirement (see Annex 1 for full details of the questions and answer options). In a separate question, they are also asked to select from the same list, the one option which they consider will make the most of their money.

Figure 1: Opinions on the safest way to save for retirement, non-retired adult population1

Great Britain, July 2010 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Notes:

- All adults aged under 40 plus non-retired adults aged 40 years and over. May include a small number of persons under 40 who have retired from paid work (for example, medical retirement).

Download this chart Figure 1: Opinions on the safest way to save for retirement, non-retired adult population^1^

Image .csv .xlsIn the period July 2016 to June 2017, employer pension schemes were considered to be the safest way to save for retirement with 40% identifying this as the safest way, compared with 30% for property, the next most popular option (Figure 1). These have been the top two options since July 2010.

Conversely, the percentage choosing personal pensions as the safest option increased from 11% in July 2014 to June 2016 to 13% in July 2016 to June 2017. Stocks and shares and premium bonds were considered the safest options by the fewest number of people. In contrast, the popularity of Individual Savings Accounts (ISAs) and savings accounts has been decreasing, possibly reflecting low interest rates over this period affecting people’s attitudes towards these types of investments.

Figure 2: Opinions on which method of saving for retirement makes the most of money, non-retired adult population1

Great Britain, July 2010 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Notes:

- All adults aged under 40 plus non-retired adults aged 40 years and over. May include a small number of persons under 40 who have retired from paid work (for example, medical retirement).

Download this chart Figure 2: Opinions on which method of saving for retirement makes the most of money, non-retired adult population^1^

Image .csv .xlsWhen considering which method of saving will make the most of an individual’s money, property was the most popular option, chosen by 49% of the population in July 2016 to June 2017, compared with 22% for employer pension schemes (Figure 2), the second most popular option.

Since July 2010 and continuing into the latest period of July 2016 to June 2017, the percentage of people identifying property as making the most of their money has been increasing, which may reflect a growing confidence in property prices over this period. However, as with opinions on the best way to save for retirement, the popularity of ISAs and savings accounts has followed a decreasing trend.

Figure 3 shows the top five expected sources of income in retirement. Respondents who have not yet retired were asked to select all the sources they expect to provide income in their retirement from a list of 15 options. The State Pension has been the top option consistently since July 2010, with a small increase in the number of people giving this as the top option in July 2016 to June 2017 (84%) compared with previous periods (82% in July 2014 to June 2016 and 81% in July 2012 to June 2014).

The next most popular option was occupational or personal pensions, with 68% of respondents in July 2016 to June 2017 giving this option as a source of money for their retirement. The percentage of people giving this as an option also increased in the latest period (from 62% in July 2014 to June 2016).

Figure 3: Top five expected sources of income in retirement, non-retired adult population1

Great Britain, July 2010 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Notes:

- All adults aged under 40 plus non-retired adults aged 40 years and over. May include a small number of persons under 40 who have retired from paid work (for example, medical retirement).

Download this chart Figure 3: Top five expected sources of income in retirement, non-retired adult population^1^

Image .csv .xlsThe next section considers people’s reasons for not contributing to a pension. Respondents aged under 60, not in receipt of a pension and not currently contributing to a pension, were asked to select all their reasons from a list of 15 possible reasons for not contributing to a pension.

Between July 2016 and June 2017, the most frequently reported reason was “low income or not working or still in education”, with 55% of respondents selecting this option (Figure 4). Although this has been the most frequently chosen reason since July 2010, the percentage of people choosing this option has been increasing over the period.

It should be noted that many individuals in this group may not be eligible for any automatic enrolment into a workplace pension. This is because they are less likely to meet the criteria of being an employee, aged 22 years or older and earning at least £10,000 per annum from a single job. Over half this group were either unemployed or economically inactive. As others in the population are automatically enrolled, this group forms a greater proportion of those left not contributing to a pension.

The percentage of people reporting that they “don’t know enough about pensions” also saw an increase in July 2016 to June 2017 (14% compared with 11% in July 2014 to June 2016). In contrast, in July 2016 to June 2017, the percentage of people reporting that they can’t afford to contribute to a pension (28%) continued the slowly declining trend observed over previous periods.

Figure 4: Top five reasons for not contributing to a pension, adult population aged under 60, not in receipt of a pension and not contributing to a pension

Great Britain, July 2010 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Download this chart Figure 4: Top five reasons for not contributing to a pension, adult population aged under 60, not in receipt of a pension and not contributing to a pension

Image .csv .xlsIn 2012, the government introduced major workplace pension reforms, known as automatic enrolment, to encourage more people to save for their retirement. This means that eligible employees are automatically enrolled into an employer pension scheme. The changes in the reported reasons for not contributing to a pension may have been affected by these reforms.

Understanding of pensions

Recent years have seen the introduction of major reforms to pensions. The Wealth and Assets Survey (WAS) contains a number of questions to assess respondents’ level of understanding of pensions, the reforms that have been made to them and the extent to which external factors influence decisions on pensions, savings or investments.

In the period July 2016 to June 2017, 42% of the adult population who were not retired indicated that they agreed, or strongly agreed that they had a sufficient understanding of pensions to make decisions about saving for retirement (Figure 5). This fell from 46% in the period July 2014 to June 2016 and was the lowest value since July 2010 to June 2012 (43%), when this question was first asked.

Figure 5: Opinions on whether respondent has sufficient understanding of pensions to make decisions about saving for retirement, non-retired adult population1

Great Britain, July 2010 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Notes:

- All adults aged under 40 plus non-retired adults aged 40 years and over. May include a small number of persons under 40 who have retired from paid work (for example, medical retirement).

Download this chart Figure 5: Opinions on whether respondent has sufficient understanding of pensions to make decisions about saving for retirement, non-retired adult population^1^

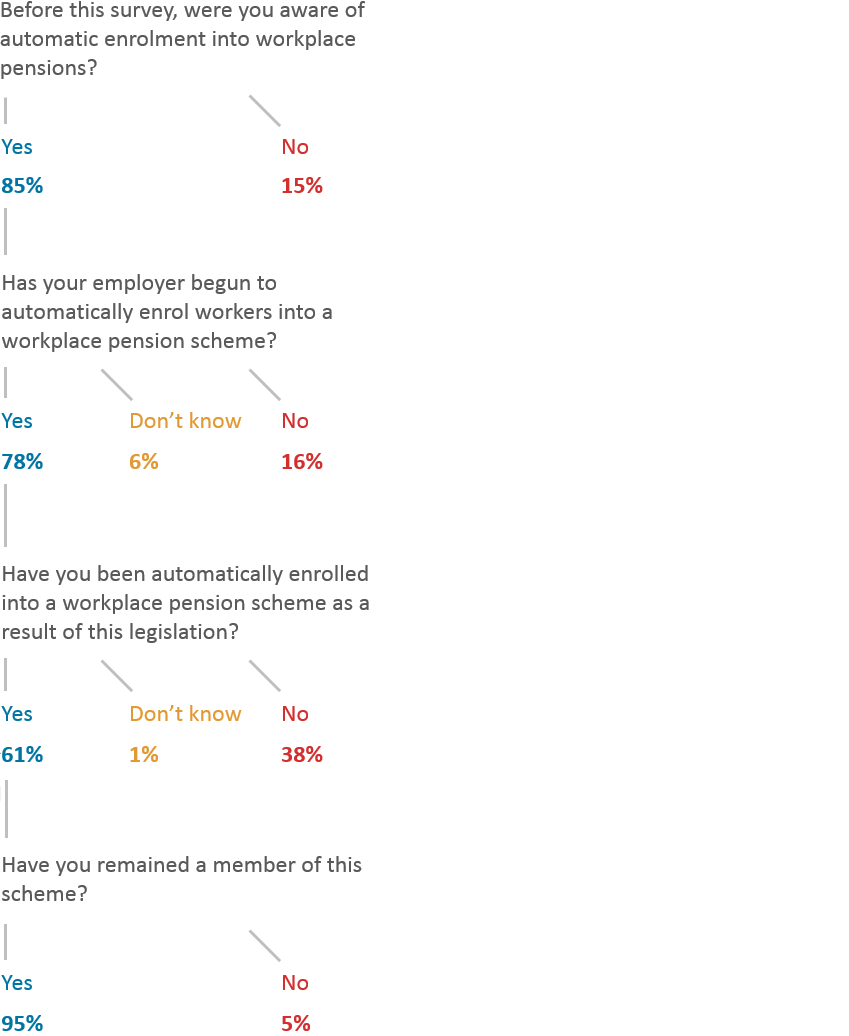

Image .csv .xlsAutomatic enrolment into workplace pensions

In July 2016, a number of new questions were introduced onto the Wealth and Assets Survey (WAS) for the period until June 2018. The aim was to give an indication of the public’s awareness of workplace pension reforms, with a particular focus on their experiences of automatic enrolment into workplace pension schemes.

The first question asked all employees aged 22 and over (the age at which automatic enrolment is compulsory for those earning £10,000 or more per annum) and not of State Pension age, “Before this survey, were you aware of automatic enrolment?” In the period July 2016 to June 2017, 85% of those who met the criteria of being aged 22 and over and earning at least £10,000 per annum indicated that they were aware (Figure 6).

Those in this group who responded that they were aware of automatic enrolment were then asked, “Has your employer begun to automatically enrol eligible workers into a workplace pension scheme?” During the period July 2016 to June 2017, 78% of those aged 22 and over and earning £10,000 or more per annum indicated that their employer had begun to do so, 16% indicated that they had not, with the remaining 6% indicating that they did not know.

Those who indicated that their employers had begun automatic enrolment were then asked, “Have you been automatically enrolled into a workplace pension scheme as a result of this legislation?” In the period July 2016 to June 2017, 61% of those aged 22 and over and earning £10,000 or more per annum reported that they had been automatically enrolled by their employer.

It is important to note that a proportion of those who responded that they hadn’t been automatically enrolled into a workplace pension scheme by their employer, in light of the new legislation, may already have been contributing to a pension scheme. Therefore, the new legislation would not affect them in their current roles. Those who indicated that they had been automatically enrolled into a workplace pension by their employers were then asked, “Have you remained a member of this scheme?” This allows us to measure whether those who have been enrolled have decided to continue to contribute to this pension scheme, or if they have instead decided to opt out of this.

In the period July 2016 to June 2017, 5% of those aged 22 and over and earning £10,000 per annum or more, who reported being automatically enrolled into a workplace pension by their employer, said they had opted out of it.

Figure 6: Automatic enrolment questions flow chart: employees aged 22 to state pension age earning £10,000 or more per annum1

Great Britain, July 2016 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Notes:

- Employees are eligible for automatic enrolment into a workplace pension if they are aged 22 years or more but are under State Pension age and have gross earnings of £10,000 or more per annum.

Download this image Figure 6: Automatic enrolment questions flow chart: employees aged 22 to state pension age earning £10,000 or more per annum^1^

.png (54.3 kB)Of all those aged 22 and over, below State Pension age earning £10,000 per annum or more and reported being aware of automatic enrolment into workplace pensions, 41% indicated that their employer had begun automatic enrolment (Figure 7).

As might be expected, (as more people in the older age groups would already be enrolled in an existing workplace pension) a larger proportion of the younger age bands (22 to 34 years and 35 to 44 years) reported having been automatically enrolled into a workplace pension by their employers than the older age bands (45 to 54 years and 55 and over).

Figure 7: Employees eligible for automatic enrolment, aware of automatic enrolment and have been automatically enrolled into a workplace pension by age band

Great Britain, July 2016 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Download this chart Figure 7: Employees eligible for automatic enrolment, aware of automatic enrolment and have been automatically enrolled into a workplace pension by age band

Image .csv .xlsAll non-proxy adults were then asked, “Have/will the workplace pension reforms influence(d) your decision to save into a workplace pension?” In the period July 2016 to June 2017, 27% indicated that this had affected their decision (Figure 8).

Figure 8: Respondents who indicated that workplace pension reforms have or will influence their decision to save into a workplace pension

Great Britain, July 2016 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Download this chart Figure 8: Respondents who indicated that workplace pension reforms have or will influence their decision to save into a workplace pension

Image .csv .xlsSome respondents (for example, those who are not employees) would not have been in a position for such a decision to be influenced, therefore Figure 9 restricts the analysis of this question to employees only.

In July 2016 to June 2017, 45% of employees who reported being aware of the fact that they had been automatically enrolled into a workplace pension by their employer, indicated that the reforms had affected their decisions as to whether or not to save into a workplace pension (Figure 9).

Figure 9: Employees aware of being automatically enrolled, who indicated workplace pension reforms influenced decision to save into a workplace pension

Great Britain, July 2016 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Download this chart Figure 9: Employees aware of being automatically enrolled, who indicated workplace pension reforms influenced decision to save into a workplace pension

Image .csv .xlsDecisions on whether or how to save for the future can be influenced by things happening in the outside world: for example, government policies related directly to saving for retirement such as automatic enrolment, but also other events such as the EU referendum (June 2016) can also have a major effect on such decisions.

All non-proxy adults were then asked more generally, “Were your decisions on pensions, savings or investments influenced by anything in the wider world in the last 12 months?” In the period July 2016 to June 2017, 18% indicated that their decisions had been influenced. This increased from 15% in July 2014 to June 2016 and was the highest value since July 2010 to June 2012, where 24% indicated that they had been influenced (Figure 10).

Figure 10: Adult population reporting that their decisions on pensions, savings or investments had been influenced by anything in the wider world in the last 12 months

Great Britain, July 2010 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Download this chart Figure 10: Adult population reporting that their decisions on pensions, savings or investments had been influenced by anything in the wider world in the last 12 months

Image .csv .xlsExpectations of retirement

The Wealth and Assets Survey includes a number of questions relating to expectations of retirement, specifically the expected age of retirement, the expected duration of retirement and the level of confidence in the standard of living that will be afforded by retirement income.

Expected age of retirement

In July 2016 to June 2017, a majority of those currently in work or not retired and intending to work in the future (59%) expected to retire between ages 65 and 69 years (Figure 11). This has been the most commonly reported expected age of retirement since July 2010. There was a decline in the percentage of people expecting to retire between ages 60 and 64 years between July 2010 to June 2012 and July 2012 to June 2014, from 27% to 21%, accompanied by increases in the percentages expecting to retire in the older age groups. Since then, expectations have remained fairly stable.

Figure 11: Expected age of retirement, adult population in work or not retired and intending to work in the future

Great Britain, July 2010 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Download this chart Figure 11: Expected age of retirement, adult population in work or not retired and intending to work in the future

Image .csv .xlsExpected duration of retirement

In July 2016 to June 2017, 32% of non-retired adult respondents had thought about how many years of retirement they might need to fund, a small increase from that seen in previous periods (29% in July 2014 to June 2016). As might be expected, the percentage who have thought about this increases with age (Figure 12). While only 13% of those aged 16 to 24 years reported that they had thought about it, 41% of those aged 55 and over reported that they had.

Figure 12: Individuals who have thought about how many years of retirement they might need to fund by current age, percentage non-retired adult population

Great Britain, July 2016 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Download this chart Figure 12: Individuals who have thought about how many years of retirement they might need to fund by current age, percentage non-retired adult population

Image .csv .xlsOf respondents who have thought about how many years of retirement they might need to fund, 38% expected to be retired for between 20 and 24 years in July 2016 to June 2017, which was by far the most common selection. The proportion of respondents reporting this option has remained broadly similar since July 2010 (Figure 13).

Figure 13: Expected number of years of retirement, adult population who have thought about how many years of retirement they might need to fund

Great Britain, July 2010 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Download this chart Figure 13: Expected number of years of retirement, adult population who have thought about how many years of retirement they might need to fund

Image .csv .xlsStandard of living in retirement

Among men aged under 65 and women aged under 60, in July 2016 to June 2017, confidence that their income in retirement will provide the standard of living that they hope for increased (Figure 14). In this period, 54% reported being fairly or very confident that it would, compared with 51% in 2014 to 2016. This was higher than the 41% reported in July 2012 to June 2014 and the 40% reported in July 2010 to June 2012.

Figure 14: Level of confidence that retirement income will provide hoped for standard of living, adult population men aged under 65 and women aged under 60 who are not retired

Great Britain, July 2010 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Download this chart Figure 14: Level of confidence that retirement income will provide hoped for standard of living, adult population men aged under 65 and women aged under 60 who are not retired

Image .csv .xlsConsidering the level of confidence that income in retirement would provide the hoped for standard of living by sex (Figure 15), men were more confident than women. In the period July 2016 to June 2017, 52% of men were very or fairly confident compared with 42% of women. This decreased from 56% for men and 46% for women in the period July 2014 to June 2016.

Figure 15: Level of confidence that retirement income will provide hoped for standard of living by sex, adult population men aged under 65 and women aged under 60 who are not retired

Great Britain, July 2016 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Download this chart Figure 15: Level of confidence that retirement income will provide hoped for standard of living by sex, adult population men aged under 65 and women aged under 60 who are not retired

Image .csv .xlsAttitudes towards credit commitments

All non-proxy adults were asked how well they were keeping up with their credit commitments. In the period July 2016 to June 2017, 63% indicated that they were keeping up with their commitments without any difficulties. This was the highest percentage to give this response since the question was first included for the period July 2010 to June 2012, and increased from 59% in the period July 2014 to June 2016.

In July 2016 to June 2017, 4% reported having no credit commitments. This was stable when compared with the period July 2014 to June 2016.

All other responses, which indicated varying degrees of difficulty in keeping up with credit commitments, returned a fall in the percentage of respondents reporting them, between the periods July 2014 to June 2016 and July 2016 to June 2017 (Figure 16). This indicates a reduction in the extent to which people are struggling to keep up with their credit commitments.

Figure 16: Ability to keep up with bills and credit commitment, adult population

Great Britain, July 2010 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Download this chart Figure 16: Ability to keep up with bills and credit commitment, adult population

Image .csv .xls4. Opinions on debt burden

All adults who indicated that they had some form of non-mortgage debt were asked to report the extent to which they found this a burden. In the period July 2016 to June 2017, the percentage of adults reporting that they found it a heavy burden was 8%, which fell slightly from 9% in the period July 2014 to June 2016. This was also the lowest value since the question was first asked in the period July 2010 to June 2012.

In addition to this, 72% reported that their non-mortgage debt was “not a problem at all”. This increased from 70% in the period July 2014 to June 2016 and was also the highest value since the question was first asked in the period July 2010 to June 2012.

In the period July 2016 to June 2017, 21% reported that their non-mortgage debt was “somewhat of a burden”, which has remained broadly similar throughout the four periods that the question has been asked (Figure 17).

Figure 17: Extent of financial burden of non-mortgage debt, adult population with financial liabilities1

Great Britain, July 2010 to June 2017

Source: Wealth and Assets Survey, Office for National Statistics

Notes:

- Financial liabilities include debt on bank accounts, credit or store cards, mail order, any hire purchase agreements, loans or in arrears with household bills.

Download this chart Figure 17: Extent of financial burden of non-mortgage debt, adult population with financial liabilities^1^

Image .csv .xls6. Quality and methodology

The Wealth and Assets Survey Quality and Methodology Information report contains important information on:

- the strengths and limitations of the data and how it compares with related data

- users and uses of the data

- how the output was created

- the quality of the output including the accuracy of the data

7. Annex: questions and answer options

Table 1: Question name: OSafeRet

| Asked of: non-proxy adults aged under 40 or 40 and over and not retired |

|---|

| Which of the options on this card do you think would be the safest way to save for retirement? |

| CODE ONE ONLY |

| 1. Paying into an employer pension scheme |

| 2. Paying into a personal pension scheme |

| 3. Investing in the stock market by buying stocks or shares |

| 4. Investing in property |

| 5. Saving into a high-rate savings account |

| 6. Saving into an ISA (or other tax-free savings account) |

| 7. Buying Premium Bonds |

| 8. Other |

| Source: Office for National Statistics |

Download this table Table 1: Question name: OSafeRet

.xls (32.8 kB)

Table 2: Question name: OMakeMost1

| Asked of: non-proxy adults aged under 40 or 40 and over and not retired |

|---|

| And which do you think would make the most of your money? |

| CODE ONE ONLY |

| 1. Paying into an employer pension scheme |

| 2. Paying into a personal pension scheme |

| 3. Investing in the stock market by buying stocks or shares |

| 4. Investing in property |

| 5. Saving into a high-rate savings account |

| 6. Saving into an ISA (or other tax-free savings account) |

| 7. Buying Premium Bonds |

| 8. Other |

| Source: Office for National Statistics |

| Notes: |

| 1. The variable OMakeMost was previously named OSafeRe2. The survey question remains the same as only the variable name has changed. |

Download this table Table 2: Question name: OMakeMost^1^

.xls (24.6 kB)

Table 3: Question name: OExpinc

| Asked of: non-proxy adults aged under 40 or 40 and over and not retired |

|---|

| Which of the options on this card do you expect to use to provide money for your retirement? |

| CODE ALL THAT APPLY |

| 1. State retirement pension, including Second State Pension (S2P, formerly the State Earnings Related Pension Scheme SERPS) |

| 2. Workplace or personal pension (including one from scheme not yet started) |

| 3. Savings or investments |

| 4. Downsizing or moving to a less expensive home |

| 5. Borrowing against the value of home |

| 6. Renting out rooms in your house |

| 7. Selling or renting out another property (other than your main home) |

| 8. Income from your own or partner’s business or sale of business |

| 9. Sale of valuables (including art, jewellery, antiques, etc) |

| 10. Inheritance in the future |

| 11. Pension or financial support from family or current partner |

| 12. Pension or financial support from former partner or someone in another household |

| 13. Earnings from work (including part-time or freelance) |

| 14. State benefits or tax credits (including Pension Credit) |

| 15. Other |

| 16. Don’t know or no opinion |

| Source: Office for National Statistics |

Download this table Table 3: Question name: OExpinc

.xls (33.8 kB)

Table 4: Question Name: Opens

| Asked of: non-proxy adults aged under 60 not receiving a pension and not currently contributing to a pension |

|---|

| Sometimes people save towards retirement, at different times and in different ways. What are your reasons for not currently contributing towards a pension? |

| CODE ALL THAT APPLY |

| 1. Low income or not working or still in education |

| 2. Too many other expenses, bills or debts |

| 3. Can't afford to (general) |

| 4. Too early to start a pension |

| 5. Too late to start a pension |

| 6. Don't know enough about pensions |

| 7. Not interested or not thought about it or got around to it |

| 8. Prefer alternative forms of saving |

| 9. Not eligible or employer doesn't offer a pension scheme |

| 10. Employers scheme not attractive or generous |

| 11. Not staying with employer or looking for a new job or recently changed jobs |

| 12. Past pension arrangements are adequate |

| 13. Don't think I will live that long |

| 14. Do not trust pension companies or schemes |

| 15. Other |

| 16. Don't know (spontaneous only) |

| Source: Office for National Statistics |

Download this table Table 4: Question Name: Opens

.xls (33.3 kB)

Table 5: Question name: OUnder

| Asked of: non-proxy adults aged under 40 or 40 and over and not retired |

|---|

| I feel I understand enough about pensions to make decisions about saving for retirement. |

| 1. Strongly agree |

| 2. Tend to agree |

| 3. Neither agree nor disagree |

| 4. Tend to disagree |

| 5. Strongly disagree |

| 6. Don't know or no opinion (spontaneous only) |

| Source: Office for National Statistics |

Download this table Table 5: Question name: OUnder

.xls (32.3 kB)

Table 6: Question name: AwareAutoEnrol

| Asked of: non-proxy employees aged 22 years and not of State Pension age |

|---|

| Automatic enrolment began in 2012 as part of the workplace pension reforms. This means employers will have to enrol all eligible workers into a work pension scheme. Before this survey, were you aware of this? |

| 1. Yes |

| 2. No |

Download this table Table 6: Question name: AwareAutoEnrol

.xls (31.7 kB)

Table 7: Question name: EmpBegunAuto

| Asked of: non-proxy employees aged 22 years and not of State Pension age who had heard of auto enrolment |

|---|

| Has your employer begun to automatically enrol eligible workers into a workplace pension scheme? |

| 1. Yes |

| 2. No |

| 3. Don't know |

| Source: Office for National Statistics |

Download this table Table 7: Question name: EmpBegunAuto

.xls (24.1 kB)

Table 8: Question name: BeenAutoEnrol

| Asked of: non-proxy employees aged 22 years and not of State Pension age, whose employers had introduced auto enrolment |

|---|

| Have you been automatically enrolled into a workplace pension scheme as a result of this legislation? |

| CODE "No" IF HAS ALREADY BEEN A MEMBER OR WAS ENROLLED BEFORE 2012 |

| 1. Yes |

| 2. No |

| 3. Don't know |

| Source: Office for National Statistics |

Download this table Table 8: Question name: BeenAutoEnrol

.xls (32.3 kB)

Table 9: Question name: RemAutoEnrol

| Asked of: non-proxy employees aged 22 years and not of State Pension age, who have been auto enrolled into a workplace pension |

|---|

| Have you remained a member of this scheme? |

| (If necessary: Have you continued to pay pension contributions and have contributions paid on your behalf by your employer) |

| 1. Yes |

| 2. No |

| Source: Office for National Statistics |

Download this table Table 9: Question name: RemAutoEnrol

.xls (24.1 kB)

Table 10: Question name: InflAutoEnrol

| Asked of: All non-proxy respondents |

|---|

| Have/will the workplace pension reforms influenced/influence your decision to save into a workplace pension? |

| 1. Yes |

| 2. No |

| Source: Office for National Statistics |

Download this table Table 10: Question name: InflAutoEnrol

.xls (31.7 kB)

Table 11: Question name: OSavExt

| Asked of: all non-proxy adults |

|---|

| Thinking back over the last 12 months, has anything in the wider world, or outside your household, influenced your decisions on pensions, savings or investments? |

| 1. Yes |

| 2. No |

| Source: Office for National Statistics |

Download this table Table 11: Question name: OSavExt

.xls (31.7 kB)

Table 12: Variable Name: PExpRet

| Asked of: adults who are working or not retired and intending to work in the future |

|---|

| At what age do you expect to retire (from your main job)? |

| ENTER AGE |

| Less than 55 |

| 55 to 59 |

| 60 to 64 |

| 65 to 69 |

| 70 to 74 |

| 75 or more |

| Source: Office for National Statistics |

Download this table Table 12: Variable Name: PExpRet

.xls (26.1 kB)

Table 13: Question name: OLong

| Asked of: non-proxy adults aged under 40 or 40 and over and not retired |

|---|

| Have you ever thought how many years of retirement you might need to fund? |

| 1. Yes |

| 2. No |

| Source: Office for National Statistics |

Download this table Table 13: Question name: OLong

.xls (31.7 kB)

Table 14: Question name: OLongYr

| Asked of: all adults who have thought about how many years of retirement they might need to fund |

|---|

| For how many years do you think you will be retired? |

| ENTER AGE |

| Less than 10 |

| 10 to 14 |

| 15 to 19 |

| 20 to 24 |

| 25 to 29 |

| 30 to 34 |

| 35 or more |

| Source: Office for National Statistics |

Download this table Table 14: Question name: OLongYr

.xls (24.1 kB)

Table 15: Question name: OStandL

| Asked of: non-retired males aged under 65 or non-retired females aged under 60 |

|---|

| How confident are you that your income in retirement will give you the standard of living you hope for? Would you say you were… |

| 1. Very confident |

| 2. Fairly confident |

| 3. Not very confident, or |

| 4. Not at all confident? |

| Source: Office for National Statistics |

Download this table Table 15: Question name: OStandL

.xls (26.1 kB)

Table 16: Question name: Commi

| Asked of: all non-proxy adults |

|---|

| Which of the following statements best describes how well you are keeping up with your bills and credit commitments at the moment? Are you: |

| 1. Keeping up with all of them without any difficulties |

| 2. Keeping up with all of them but it is a struggle from time to time |

| 3. Keeping up with all of them but it is a constant struggle |

| 4. Falling behind with some of them |

| 5. Having real financial problems and have fallen behind with many of them |

| 6. Don't have any commitments |

| Source: Office for National Statistics |

Download this table Table 16: Question name: Commi

.xls (32.8 kB)

Table 17: Question name: DBurd

| Asked of: all non-proxy adults with debt on bank accounts, credit or store cards, mail order catalogues, any hire purchase agreements or loans or is behind with bills |

|---|

| Thinking about the non-mortgage debt you have just told me about, to what extent is keeping up with the repayment of them and any interest payments a financial burden to you? |

| 1. Heavy burden |

| 2. Somewhat of a burden |

| 3. Not a problem at all |

| Source: Office for National Statistics |