1. Abstract

This article describes early progress made to estimate the value of other accounts receivable or payable in the UK economy using company account data.

Other accounts receivable or payable are the financial assets and liabilities that arise due to a timing difference between when a transaction takes place and a corresponding payment is made.

This work is part of the UK’s Enhanced Financial Accounts (also known as flow of funds) initiative, which is a partnership between Office for National Statistics (ONS) and the Bank of England (the Bank).

Included within this article is a description of other accounts receivable or payable, requirements for these data and potential data sources (which originate from company accounts), which could be used to develop improved estimates. The article goes on to outline how these data could potentially be used to measure the value of other accounts receivable or payable to the UK economy under the European System of Accounts (ESA) framework. Whereas the increased use of surveys is a possibility to improve the estimation of other accounts receivable or payable, this is not considered in depth in this article.

Back to table of contents2. Context

We have ambitious plans to transform our economic statistics over the coming years, informed by our Economic Statistics and Analysis Strategy and with the aim of increasing the robustness and quality of UK economic statistics. Working in partnership with the Bank of England, an important element of our transformation work is the development of enhanced financial accounts – in particular more detailed “flow of funds” statistics – to meet evolving user needs.

This article describes progress made to estimate the value of other accounts receivable or payable in the UK economy using company account data. Whereas the increased use of surveys is a possibility to improve the estimation of other accounts receivable or payable, this is not considered in depth in this article.

Other accounts receivable or payable are the financial assets and liabilities that arise due to a timing difference between when a transaction takes place and a corresponding payment is made. There are two goals for this in the context of the Enhanced Financial Accounts initiative (EFA); to improve the quality of other accounts receivable or payable in the national accounts and to provide policymakers and the public with an improved understanding of the performance of UK companies.

In most cases, company accounts report the value of what a company is owed and what it owes to others, but not specifically who it is going to receive money from, or pay money to. Moreover, company accounts are generally produced on an annual basis, whereas we require data on a quarterly basis. This means it will not be straightforward to use company accounts to produce “whom to whom” statistics.

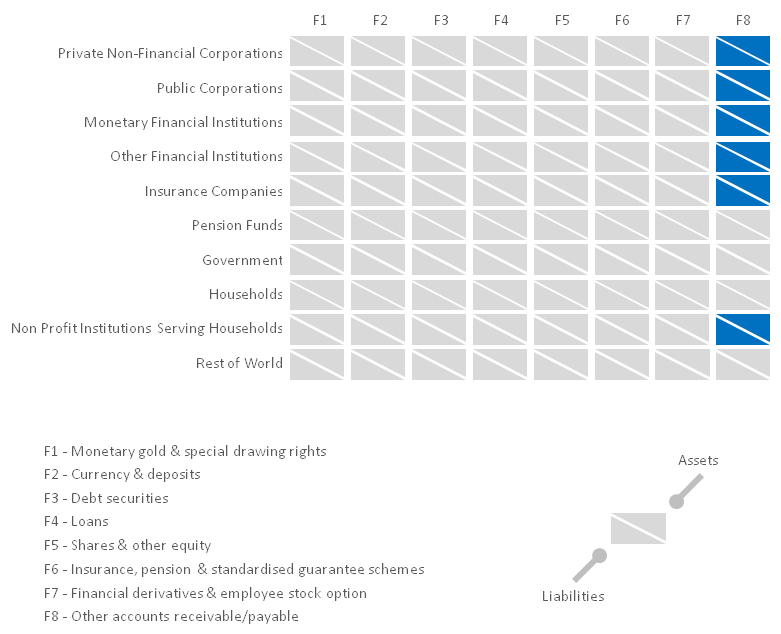

Figure 1 shows national accounts sectors (areas of the economy) and transaction type (means of moving money). The proposed improvements to the estimates of other account receivable or payable have an impact on the darker (blue) areas highlighted. Within the European System of Accounts (ESA) financial asset classification, other accounts receivable or payable are classified as transaction type F8 and are both assets and liabilities. While all sectors have the potential to hold other accounts’ receivables or payables, our focus is on those sectors within which organisations will submit company accounts.

Figure 1: Other accounts receivable or payable - Flow of Funds Matrix Impact Visualisation

Source: Office for National Statistics

Download this image Figure 1: Other accounts receivable or payable - Flow of Funds Matrix Impact Visualisation

.png (44.3 kB)3. Definitions and requirements

Other accounts receivable or payable are a kind of financial transaction in the national accounts, which are created when there is a timing difference between, for example, the provision of a good or service and when payment is actually made. As well as relating to the provision of goods or services, other accounts receivable or payable can also relate to wages and salaries, interest payments and purchases and sales of financial assets where payments are yet to be made. Other accounts receivable or payable are currently estimated at being worth almost £500 billion to the UK economy (see Table 13.3.8 of the 2016 Blue Book).

Other receivables

Other receivables are all monetary amounts, which are due to be received at a future point in time. Examples include trade receivables (goods that a company has sold but not received payment for) and income insurance claims (a company has made an insurance claim but hasn’t received the payment yet).

Other payables

Other payables are monetary amounts, which are due to be paid at a future point in time. Examples include trade payables (goods that a company has purchased but not paid for yet) and Value Added Tax (VAT) liability (VAT that a company owes but hasn’t paid yet).

Requirements

Other accounts receivable or payable are recorded within financial transaction type F8 in line with the European System of Accounts – ESA. Other accounts receivable are assets and other accounts payable are liabilities. The amounts are recorded within F8 and the asset and liability components are identifiable within the UK National Accounts Blue Book publication. Within the national accounts, receivables and payables are further split into trade credits (F81), which relate to the purchases of goods and services, and other receivables or payables (F89), which relate to timing differences.

The International Monetary Fund (IMF) has identified other accounts receivable or payable as an important element of assets and liabilities. Under their Special Data Dissemination Standards Plus initiative, countries are required to report on accounts receivable or payable to help build up a complete picture of assets and liabilities.

In meeting the aims of the Enhanced Financial Accounts initiative, we would ideally want levels of other accounts receivable or payable split by each sector of the economy and understand the “whom to whom” flows between each sector. As a minimum we would look to improve the quality of information on accounts receivable or payable across sectors of the economy highlighted in Figure 1.

Back to table of contents4. Data sources

The national accounts balance sheet requires monetary values for other accounts receivable or payable. The purpose of a balance sheet is to itemise assets and liabilities at a point in time, therefore company balance sheets are the natural data source in terms of completeness of information and would take account of revaluations. However, there are challenges around frequency of reporting which we discuss in section 5. We have identified three main data sources of balance sheet data, which are Companies House, Bureau Van Dyke (BVD) and HM Revenue and Customs (HMRC).

Companies House

Companies House receive UK company account (balance sheets) data and data for overseas companies that have a physical presence in the UK. Although dormant companies do not have to file statutory accounts because they are not actively trading they would have to file a balance sheet to Companies House annually. Companies have to file accounts 9 months after their year end and public limited companies have to file their accounts 6 months after their year end.

At present, companies have the option to file in paper format to Companies House. Accounts submitted on paper can be viewed in pdf format.

Bureau Van Dyke

Bureau Van Dyke (BVD) is a data provider that uses information and data filed at Companies House as well as other data in the public domain. BVD formats all data sources and puts this information into an accessible format.

Many companies still file their accounts on paper. BVD processes the summary variables from all company accounts, including those companies who have filed their accounts on paper and formats this onto their software platform. BVD data would not contain all the detailed note information that Companies House data includes. However, the data are in a more accessible format for analysis purposes than Companies House data and includes additional intelligence BVD has gained from the public domain.

HM Revenue and Customs

Companies have to submit and comply with HM Revenue and Customs (HMRC) regulations and the Corporation Tax Act 2010. Companies have to file company accounts and Corporation Tax computations to HMRC. Company data has to be delivered to HMRC 12 months after a company’s year end, electronically in Extendable Business Related Language (XBRL).

Preferred source

In determining the most appropriate source, we considered the granularity of information available from each source, the theoretical degree of complexity involved in deriving estimates from the source and the timeliness of the source.

Our preferred data source is HMRC. This is because it would give the most detailed breakdown for the greatest number of companies. Companies House data may be abbreviated depending on entity size and BVD data would not contain all the detailed note information. HMRC data is in a format that would enable data processing and analysis to be conducted efficiently. We will consider the potential of other data sources to address the timeliness issues with HMRC data.

Back to table of contents5. Data challenges

There are three main challenges that will need to be overcome in deriving estimates of other accounts receivable or payable from company accounts. These relate to the:

- different ways companies can report their accounts

- differences in reporting schedules for company accounts compared with national accounts reporting requirements

- differences in how long-term valuation takes place; these challenges are described in detail in this section

Accounting frameworks

There are five different accounting frameworks in operation within the UK, which have different methods of valuation. This means there is a potential for assets not matching liabilities as the holder of the asset may follow a different reporting framework to the holder of the liability.

Assets could be impaired (value reduced) by one party, which would not be reflected by adjusting the liability of another. The party who holds the receivable asset could make an adjustment for the likelihood for not receiving the total amounts due and therefore reduce a receivable asset value on their balance sheet. The corresponding (liability) counter party would still have the obligation to settle their obligation regardless of the assets holder’s opinion and therefore would retain the value to fulfil their obligation to repay the debt. Therefore the liability holder would report the liability due and the asset holder would have reduced (impaired) the value reported.

The accounting framework used by a company is disclosed within its company accounts. We will be able to use this information to understand where assets and liabilities don’t match and from this ascertain whether the size of differences is material in nature. If this is the case, we will use this information to help us and develop modelling approaches to address this issue.

Reporting period

National accounts produces data on a quarterly basis; whereas company accounts are produced on an annual basis. Consideration would need to be given for balance sheet changes over the course of the accounting period and calendar year. Therefore a method to obtain quarterly balances, where annual balances are currently produced would be required.

There are two approaches that could be made to resolve this issue should we wish to use company accounts data. The first is to use a rolling average approach (using the balance sheets from the last four quarters). The second approach would be to estimate balances based on company activity available on a quarterly basis (for example, turnover). In theory, the rolling average approach would be easier to implement and would require less estimation, but may not produce robust estimates of the balance sheets of new companies and those going through significant change. The company activity approach assumes a link between company activity and balance sheet. Both of these methods would have to be developed and tested.

A further approach would be to consider the use of surveys to gain the information on a quarterly basis, either to supplement or use instead of company account information. While the use of surveys is outside the scope of this article, this is an option we will consider as part of the Enhanced Financial Accounts initiative.

Fair value

Fair value is a valuation method used by large and medium-sized companies to take into account the time value of money. If an obligation is due to be settled at a significant time in the future, an element of the transaction amount would relate to interest and servicing the obligation. In this scenario the amount reported in the balance sheet would be reduced to take into account the time value of money. Small companies would report nominal value, which is the original purchase price.

In the national accounts, valuation needs to be reported at nominal value. This means that, for large and medium-sized companies, estimates of nominal value would have to be calculated. This could be achieved through conducting a study of historic company account information to assess common practice and using this as the basis for deriving an estimation method. Fair value adjustments for current assets and current liabilities may be deemed immaterial due to the short-term maturity of the instruments. This information may be contained within notes of some company accounts, but this will need to be tested.

Back to table of contents6. Conclusion

This article describes early progress made to estimate the value of other accounts receivable or payable in the UK economy using company accounts data.

While there are differences between the ways that other accounts receivable or payable are recorded in company accounts and defined in the national accounts, these are not large and the underlying principles are aligned. This means that company accounts data are potentially a suitable source for measuring other accounts receivable or payable in the national accounts.

Data sources from Companies House, Bureau Van Dyke (BVD) and HM Revenue and Customs (HMRC) have been considered. Companies House data is the timeliest, but contains limited information for smaller companies and is not formatted for analytical purposes. BVD takes Companies House accounts and processes the accounting data so that it can be analysed more easily. HMRC data is more detailed and complete, but with the weakness of being less timely (though all three data sources suffer from timeliness issues).

These timeliness issues could be overcome through estimation. Companies House and VAT data from the sales and purchase of goods and services could be used as the basis of an estimation method. This would need to be developed and tested.

Back to table of contents7. Next Steps

We are currently working with HM Revenue and Customs to determine whether access can be given to the necessary data to further our investigation into the improvement of our estimates of other accounts receivable or payable. Once we have access to these data, we will assess its quality and develop the approaches to using these data and addressing the challenges outlined in section 5. Our current working assumption is that we will get access to these data in the first part of 2018.

We will also consider whether surveys could be used instead of, or to augment the use of company account data, and to consider whether Companies House and Bureau Van Dyke data could be used should there be a delay in access to the HM Revenue and Customs data.

We welcome your thoughts on the contents of this article and whether there are other avenues of investigation that we should pursue.

Please contact us via email at FlowOfFundsDevelopment@ons.gov.uk or by telephone at +44 (0)1633 456315 if you have any views that you would like to share with us.

Back to table of contents8. Relevant links

Flow of Funds archived background information

21 July 2017 Article – Economic Statistics Transformation Programme: enhanced financial accounts (UK flow of funds) improving the measurement of company quarterly profits

3 July 2017 Article - Economic Statistics Transformation Programme: Enhanced financial accounts (UK flow of funds) progress on financial derivatives data

31 May 2017 Article – Economic Statistics Transformation Programme: Enhanced financial accounts (UK flow of funds) commercial data use

31 May 2017 Article – Economic Statistics Transformation Programme: Enhanced financial accounts (UK flow of funds) improving the economic sector breakdown

27 April 2017 Article – Economic Statistics Transformation Programme: Enhanced financial accounts (UK flow of funds) employee stock options

29 March 2017 Article – Economic Statistics Transformation Programme: Enhanced financial accounts (UK flow of funds) government tables for the special data dissemination standards plus (SDDS plus)

30 January 2017 Article – The UK Enhanced Financial Accounts: changes to defined contribution pension fund estimates in the national accounts; part 2 – the data

16 January 2017 Article – The UK Enhanced Financial Accounts: changes to defined contribution pension fund estimates in the national accounts; part 1 – the methodology

8 August 2016 Article – Economic Statistics Transformation Programme: UK flow of funds experimental balance sheet statistics, 1997 to 2015

14 July 2016 Article – Economic Statistics Transformation Programme: Flow of funds - the international context

14 July 2016 Article – Economic Statistics Transformation Programme: Developing the enhanced financial accounts (UK Flow of Funds)

10 March 2016 Article – Identifying sectoral interconnectedness in the UK Economy

24 February 2016 Article – Improvements to the Sector and Financial Accounts

12 January 2016 Article – Historical Estimates of Financial Accounts and Balance Sheets

6 November 2015 Article – Comprehensive Review of the UK Financial Accounts including explanatory notes for each financial instrument covered in the article

13 July 2015 Article – Introduction Progress and Future Work

Financial Statistics Expert Group minutes:

- 21 October 2014

- 22 January 2015

- 22 July 2015

- 7 December 2015 can be requested from: FlowOfFundsDevelopment@ons.gov.uk

- 2 August 2016 can be requested from: FlowOfFundsDevelopment@ons.gov.uk