1. Introduction

We have ambitious plans to transform our economic statistics over the coming years, informed by our Economic Statistics and Analysis Strategy and with the aim of increasing the robustness and quality of UK economic statistics. Working in partnership with the Bank of England, a key element of our transformation work is the development of enhanced financial accounts – in particular more detailed “flow of funds” statistics – to meet evolving user needs.

Assessment of events leading to the last financial crisis drew attention to an urgent need to improve the quality, coverage and detail of financial statistics, to better support financial stability and prudential analysis. Counterparty information (‘whom-to-whom’ statistics) on stocks and transactions in the financial accounts (the ‘flow of funds’) was identified as a particular need. This can help to assess the build-up of financial risks across economic sectors, and to better understand their interconnections. It is of particular importance to the UK, with its large and international financial sector, that good quality, detailed financial statistics are available to drive the robust analyses required by policy-makers, economists and market analysts.

The development of enhanced financial statistics has become an increasing priority for the UK over the past few years. The National Statistics Quality Review of National Accounts and Balance of Payments (Baker, 2014) recommended the implementation of flow of funds matrices into the National Accounts. More recently, the Independent Review of UK Economic Statistics (Bean, 2016) articulates the need for more detailed and complete flow of funds statistics to address established statistical limitations. This is supported by the International Monetary Fund’s (IMF) G20 Data Gaps Initiative Phase 2 (DGI) – a set of 20 recommendations on the enhancement of economic and financial statistics. The recommendations for the enhanced financial accounts for the UK are consistent with, and go further than, the recommendations of the G20 DGI.

This article sets out what flow of funds is, and why it is important to the UK. It introduces the enhanced financial accounts, the proposed approach and progress so far, and sets out the priorities for development.

Back to table of contents2. What is flow of funds?

‘Flow of funds’ is the flow of money (financial investment) between various sectors of the economy. Financial flows have been published by both the Bank of England (the Bank) and ONS and its forerunners since the 1960s, as the UK’s financial accounts.

At present, the financial accounts are published as total assets and total liabilities, by sector and instrument, with little counterparty information. One of the key aims of the enhanced financial accounts is to introduce full whom-to-whom information, so that for each instrument, both the sector holding the asset and the sector incurring the liability are presented. This should better assist policymakers to see when and where risk is beginning to build within the financial system.

Analysis following the last financial crisis highlighted the need for close monitoring of financial flows both within the UK economy and at the global level, and the requirement for improved statistics to address that need. These have a wide range of applications, including informing monetary and financial policy and the assessment of financial stability through the identification of the build-up of risks in specific areas of the financial sector. In particular, the crisis showed the importance of monitoring the composition of balance sheets with an eye on mismatches (maturity, currency, etc) as well as the interconnections between the different sectors and sub-sectors of the economy.

The key objectives for the UK’s enhanced financial accounts are to:

- improve the quality, coverage and granularity of the UK’s financial accounts, including whom-to-whom statistics

- produce a fully integrated, enhanced set of stock and flow accounts

- meet the enhanced need for these data identified by the Bank, International Monetary Fund (IMF) and Financial Stability Board (FSB) in the wake of the economic crisis

- deliver the IMF’s Special Data Dissemination Standard plus (SDDS+) and G20 Data Gaps Initiative (DGI) for the UK

- improve flexibility to meet new or ad hoc demands for financial statistics in the future

- improve access to data for researchers

The ambition is that this can be obtained mainly from administrative, regulatory and commercial record-level data sources. However, it is likely that surveys will continue to be required to complete the coverage of all financial instruments across the UK economy, where non-survey data are not available.

Back to table of contents3. Why are the UK financial accounts important?

3.1 International significance

The UK’s financial system is large and has grown rapidly in recent decades to achieve a significant global importance. Figure 1 shows that the UK could be considered to have the largest financial system in the G7, as measured by the size of total financial assets as a proportion of gross domestic product (GDP). In 2014, total financial assets amounted to over 1600% of GDP.

Figure 1: The size of the financial sector: total financial assets as a percentage of nominal GDP, 2014

Source: OECD

Notes:

- Estimates for the US exclude financial derivatives.

- Japan has been excluded from this chart, because they do not compile their National Accounts on an exactly comparable basis.

Download this chart Figure 1: The size of the financial sector: total financial assets as a percentage of nominal GDP, 2014

Image .csv .xlsAround 40% of global foreign exchange trading is transacted in the UK, showing the international importance of the UK financial system. Analysis by the Bank of England (the Bank) shows that foreign banks account for a large proportion of UK banking sector assets on a residency basis. At the end of March 2016, there were 147 deposit-taking foreign branches and 92 deposit-taking foreign subsidiaries in the UK from 56 different countries.

A more detailed comparison of international financial systems and financial statistics can be found in the article Economic Statistics Transformation Programme: Flow of funds – the international context.

3.2 A clear UK policy imperative

Enhanced flow of funds statistics will be a very powerful tool for meeting existing and future policy demands. Traditionally, flow of funds statistics have been used largely to support macroeconomic policymaking and debate. However, since the financial crisis the range and detail required to meet policy demands has expanded.

One of the policy responses to the financial crisis around the world was to put greater emphasis on the importance of macro-prudential policy. Macro-prudential policy aims to reduce the risk and macroeconomic costs of financial instability. It seeks to fill a gap between macroeconomic policy and microeconomic regulation by looking beyond the safety and soundness of individual firms to risks to the financial system as a whole that might occur because of the combined behaviour of, and in particular the interconnections between, individual firms and markets. In the UK, the Bank of England’s Financial Policy Committee was set up to oversee the Bank’s objective for maintaining financial stability.

Developing high-quality UK flow of funds statistics is crucial to policy makers such as the Bank. These would enable a more effective analysis of financial stability risk, and would help to prepare more effective policy to alleviate these risks.

Back to table of contents4. Introducing the enhanced financial accounts

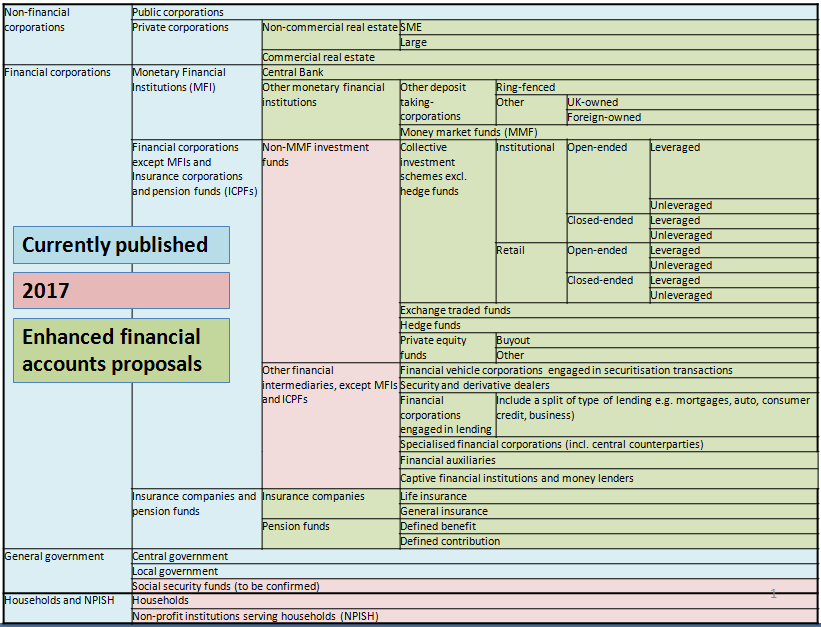

Figure 2 presents a visual representation of the proposal for enhanced financial accounts for the UK based on a sectoral breakdown. It highlights where these data are already published by ONS in the recently introduced flow of funds chapter of the Blue Book and where they are not already published but will be extended to 11 sectors in 2017.

In terms of the enhanced financial accounts, ONS and the Bank of England are proposing a substantial expansion of the financial corporation sub-sectors, particularly with respect to non-money market investment funds. The additional granularity here is essential in identifying the build-up of risks in the financial sector.

A split of private non-financial corporations into commercial and non-commercial real estate companies is also proposed, including a further breakdown of these corporations by size into small and medium-sized, and large companies.

Figure 2: Proposed sector breakdown with comparison against current publications, and improvements planned for 2017

Source: Office for National Statistics

Download this image Figure 2: Proposed sector breakdown with comparison against current publications, and improvements planned for 2017

.png (41.5 kB)Delivering the enhanced financial accounts sector breakdowns listed in Figure 2 across the 37 financial assets and liabilities required in ESA10 is an ambitious aim. Our ability to deliver the full breakdown will depend on the availability of suitable source data.

Back to table of contents5. Proposed approach

ONS’s preferred approach is to achieve full whom-to-whom financial accounts and balance sheets from record-level (ideally non-survey) data. This allows much greater flexibility to evolving requirements for granularity than surveys do, as new breakdowns can be created from different cuts of the same data.

Experimental statistics will be released at the earliest opportunity, on an incremental basis before full implementation into the national accounts. This will give users early sight of developments and an opportunity to offer feedback, but it means there are likely to be inconsistencies between experimental and official statistics until the changes are fully implemented.

Although surveys, which have traditionally been used by ONS, have the advantage that information on the exact concept required can be asked on questionnaires, the use of non-survey data has 5 key advantages:

- it reduces the burden on businesses.

- it often covers the population more completely than sampled surveys, allowing robust estimates of much more fine-grained (but still non-disclosive) aggregates.

- in the case of regulatory data already used by the Bank of England (the Bank), Prudential Regulatory Authority (PRA) and Financial Conduct Authority (FCA) for supervisory purposes, aggregates can be created from the same underlying data. This means that supervisory approaches can be based on the same data as macro prudential policy.

- higher-level aggregates will be based on the same data source as lower-level data, improving the consistency of estimates across all levels of aggregation.

- flexibility to new requirements and ad hoc demands, which are likely as the financial sector changes and continue to innovate, can be much improved, by allowing different cuts of the same data to meet new demands, rather than requiring the lengthy process of survey (questionnaire) development.

Where non-survey data are not available, surveys will continue to be used to complete any gaps. This approach, of predominantly using non-survey data, should allow more fine-detailed financial statistics to be produced. For example, the ambition is to produce:

- more detailed breakdowns of the financial sector by activity

- more detailed splits of bonds and loans by maturity, and the publication of these by residual maturity in addition to original maturity

- the private non-financial corporations (PNFC) sector split by industry and business size

- information on the size of the unsecured loans market

5.1 Progress so far

Since December 2014, ONS and the Bank have been working in partnership to progress the development of flow of funds statistics for the UK. Building on this initial work, from April 2016, ONS and the Bank have embarked on a significant project to develop an enhanced set of financial accounts for the UK, including its transactions with the rest of the world.

Progress to date has been very positive. In July 2015, an article providing an introduction to UK flow of funds was published on the ONS and Bank of England websites. The article included the publication of counterparty estimates for balance-sheet levels of loans as experimental statistics.

This was followed by a second article in November 2015, which completed the first stage of the project. The article presented, for the first time, a set of experimental statistics covering the currently available whom-to-whom statistics for the UK, together with an assessment of their quality. This quality assessment represented the most comprehensive review of the financial accounts for many years.

Since then the project has been responsible for the publication of improved historical financial accounts data in January 2016, and also for a series of improvements that were implemented in the UK Economic Accounts (UKEA) in June 2016, and were described in articles published in February, April and June 2016.

An article identifying sectoral interconnectedness in the UK economy was published in March 2016. This article included innovative interactive visualisations of the UK’s sector-to-sector interactions for financial balance sheets by financial instrument, based on the experimental statistics published in November 2015.

Back to table of contents6. Priorities for flow of funds development

The following questions and areas have so far been identified as priorities by the Bank of England (the Bank), wider users of ONS financial statistics and the IMF’s Special Data Dissemination Standard plus (SDDS+) and G20 Data Gaps Initiative (DGI). These cover not only domestic flows and balance sheets, but also the UK’s interaction with the rest of the world:

- whom-to-whom statistics for debt securities, equity and investment fund shares and units

- other financial corporations (SDDS+ and G20 DGI-2): financial corporations except monetary financial institutions, insurance corporations and pension funds, and their sub-sectors, including whom-to-whom statistics – the sub-sectors to be more detailed than the ESA 2010 sectors, and to include in particular, venture capital, private equity funds, shadow banking and mutual funds (see Figure 2)

- private non-financial corporations – improvements to data sources and methodology; breakdown by commercial real estate, and non-commercial real estate; large enterprises and small and medium enterprises (SMEs); breakdown of loans by use, especially commercial real estate

- households – to replace, where feasible, residual-based estimates with reported data; breakdowns by income quintile; and a breakdown of loans by use or type (for example, mortgages, consumer goods, other, unsecured or secured)

- breakdown of bank lending to the rest of the world by country

- money market funds – separation from other sectors, whom-to-whom statistics and instrument maturities (note: this sector may be insignificant in the UK)

- peer-to-peer lending

Development of these statistics would answer the following questions:

- who owns UK government debt

- what proportion of UK assets are foreign-controlled

- who holds the assets issued by UK securitisation vehicles

- who owns UK shares

- how big is the UK hedge fund sector

- how big is the UK’s unsecured loans market

Feedback and comments on these priorities are welcome at FlowOfFundsDevelopment@ons.gov.uk.

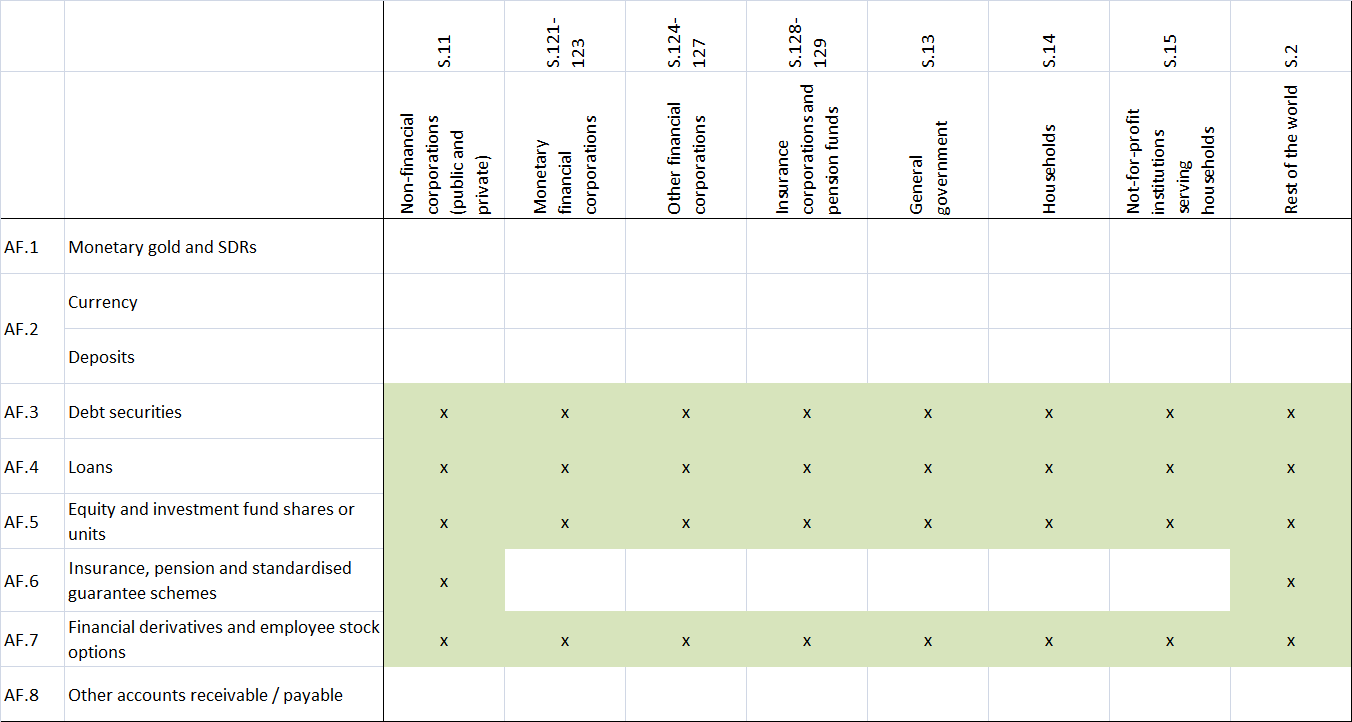

Table 1 presents a prioritisation matrix for the issues listed above, with an assessment by policy and user interest (both national and international). ONS, working in partnership with the Bank, will continue to validate these priorities with users as the project progresses. Figure 3 represents these priority areas by sector and instrument.

Table 1: priority matrix for enhanced financial accounts, by sector and policy interest, UK

| Issue | Sector(s) | Instrument(s) | User interest 3 = high | Notes | ||||

| Private non-financial corporations (PNFCs) - data quality improvement and breakdowns | Private non-financial corporations | All - especially securities ('bonds and shares') | 3 | |||||

| Households (HH): breakdown by income quintile, and breakdown of loans by use | Households | All | 3 | |||||

| Who owns UK government debt? | Government | Securities (i.e. debt and equity), loans | 3 | |||||

| Residency - what proportion of UK assets are foreign-controlled? | All | All | 3 | |||||

| Securities whom-to-whom statistics, including share ownership | All | Securities | 3 | SDDS+ /G20 DGI-2 requirement | ||||

| How big is the UK hedge fund sector? | Other financial institutions | Securities, financial derivatives | 3 | |||||

| Other financial corporations, including shadow banking | Other financial institutions | Securities, loans, financial derivatives | 3 | SDDS+ / G20 DGI-2 requirement | ||||

| Breakdown of bank lending to the rest of the world by country | Monetary financial institutions | Loans | 2 | |||||

| Money market funds (SDDS+ and G20 DGI-2) | Monetary financial institutions | Debt securities | 1 | Small sector in UK, SDDS+ / G20 DGI-2 requirement | ||||

| More detailed sector breakdowns | All, especially other financial institutions | All | 3 | |||||

| Peer-to-peer lending | Households, private non-financial corporations, other financial institutions | Loans | 2 | Small at present, but growing rapidly | ||||

| Source: Office for National Statistics | ||||||||

Download this table Table 1: priority matrix for enhanced financial accounts, by sector and policy interest, UK

.xls (21.5 kB)

Figure 3: Summary of priority areas for the enhanced financial accounts, by sector and instrument – priorities are in the green cells, marked with an x

Source: Office for National Statistics

Download this image Figure 3: Summary of priority areas for the enhanced financial accounts, by sector and instrument – priorities are in the green cells, marked with an x

.png (38.7 kB)7. High-level timetable for delivery

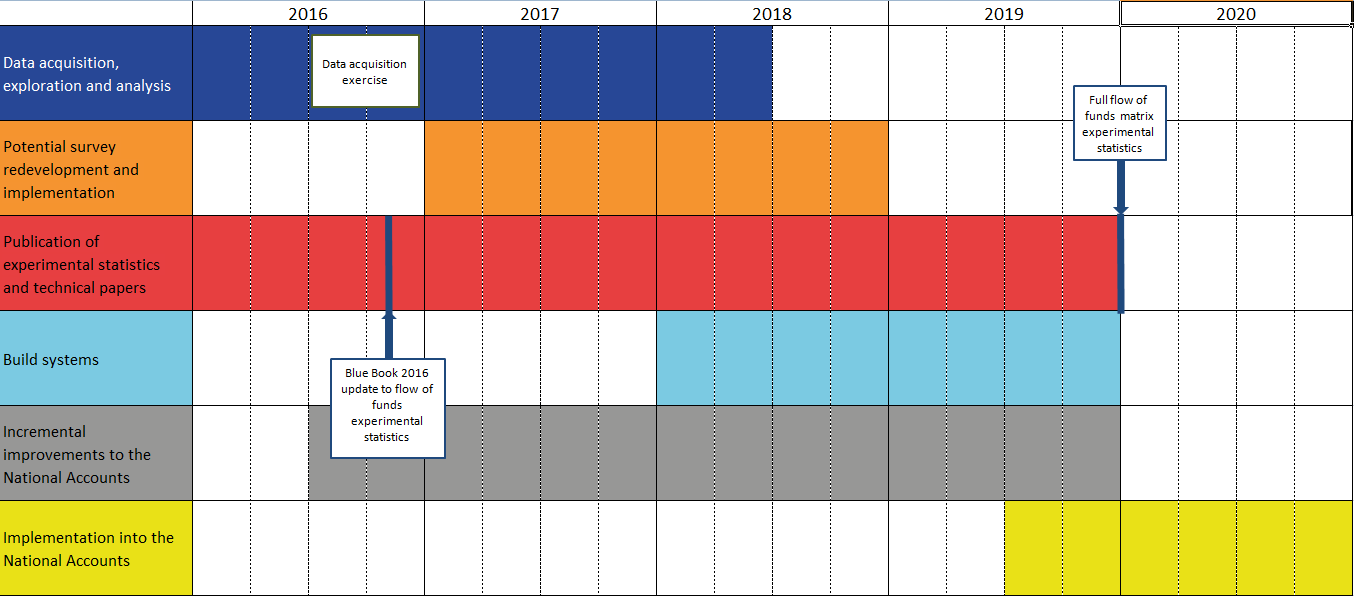

The aim is to deliver the enhanced financial accounts in 5 years, with implementation of flow of funds into the national accounts in 2020. The key deliverables of the project in the first 2 years will be as follows.

in 2016 and 2017 :

- a list of data requirements, including consultation with user groups

- further exploration of potential data sources

- publications of experimental statistics as new data become available

- publication of articles and technical papers detailing work undertaken on this project

- incremental improvements to the sector and financial accounts

in 2017 and 2018:

- further improvements to the sector and financial accounts

- further exploration of potential data sources

- possible survey redevelopment to fill gaps not covered by non-survey data

- further publications of experimental statistics as new data become available

- further publication of articles and technical papers detailing work undertaken on this project

ONS will continue to publish further experimental statistics and articles after 2018, with a full set of experimental flow of funds statistics anticipated in 2019, and full implementation into the national accounts to take place in 2020. An indicative timeline for development, showing the development phases and the incremental approach to data acquisition, is shown in Figure 4. This timeline will be continually reviewed and refined.

Figure 4: Indicative timeline for the development and implementation of the enhanced financial accounts based on record-level data

Source: Office for National Statistics

Download this image Figure 4: Indicative timeline for the development and implementation of the enhanced financial accounts based on record-level data

.png (38.2 kB)8. Further information

Flow of Funds archived background information

10 March 2016 Article – Identifying Sectoral Interconnectedness in the UK Economy

24 February 2016 Article – Improvements to the Sector & Financial Accounts

12 January 2016 Article – Historical Estimates of Financial Accounts & Balance Sheets

6 November 2015 Article – Comprehensive Review of the UK Financial Accounts including explanatory notes for each financial instrument covered in the article

13 July 2015 Article – Introduction Progress & Future Work

Financial Statistics Expert Group

7 December 2015 can be requested from FlowofFundsDevelopment@ons.gov.uk

22 July 2015

22 January 2015

21 October 2014

Contact details for this Article

Related publications

- Economic Statistics Transformation Programme: UK flow of funds experimental balance sheet statistics, 1997 to 2015

- Economic Statistics Transformation Programme: Flow of funds - the international context

- Economic Statistics Transformation Programme: The UK Flow of Funds Project: Improvements to the Sector and Financial Accounts

- Economic Statistics Transformation Programme: Historical estimates of financial accounts and balance sheets

- Economic Statistics Transformation Programme: The UK Flow of Funds Project - comprehensive review of the UK financial accounts

- Economic Statistics Transformation Programme: The UK Flow of Funds Project: introduction, progress and future work

- Economic Statistics Transformation Programme: the UK flow of funds project: identifying sectoral interconnectedness in the UK economy