Table of contents

- Main points

- Things you need to know about this release

- The UK’s current account deficit widened to a historically significant £30 billion, or 5.6% of GDP, in Quarter 1 2019

- Other investment accounted for the majority of UK net inflows in Quarter 1 2019

- The UK net international investment position widens in the latest quarter

- Quality and methodology

1. Main points

The UK current account deficit widened by £6.3 billion to £30.0 billion in Quarter 1 (Jan to Mar) 2019, or 5.6% of gross domestic product (GDP); the fifth-highest on record as a percentage of GDP.

The UK total trade deficit more than doubled to a record £20.3 billion in Quarter 1 (Jan to Mar) 2019, or 3.7% of GDP, and was the main contributor to the UK’s widening current account deficit.

This marked the fifth consecutive quarter of deterioration for the UK’s total trade deficit; the last time the UK’s trade deficit was over 3% of GDP was Quarter 2 (Apr to June) 2002.

The value of goods imported increased by £12.1 billion in Quarter 1 2019 due largely to increased imports of unspecified goods (including non-monetary gold) and was the main contributor to the widened trade deficit.

The primary income deficit improved by £5.2 billion to £3.2 billion in Quarter 1 2019 as foreign earnings on direct investment in the UK fell by £5.6 billion.

The financial account recorded a net inflow into the UK of £17.0 billion in Quarter 1 2019, a decrease from an inflow of £35.8 billion in Quarter 4 (Oct to Dec) 2018.

The UK financed its current account deficit mainly through other investment, where UK investors withdrew overseas deposits while overseas investors increased their deposits with UK monetary financial institutions.

The value of the UK’s net liabilities was £195.0 billion at the end of Quarter 1 2019, with both the value of UK liabilities and assets recording a decrease.

2. Things you need to know about this release

In a change to our published revisions policy, the June Quarterly national accounts (QNA) releases will be open for revisions in Quarter 1 (Jan to Mar) 2019 only. Some caution is therefore advised when reconciling changes in the UK’s international investment position (that is, levels), transactions (flows) and revaluations between Quarter 4 (Oct to Dec) 2018 and Quarter 1 2019.

A brief introduction to the UK Balance of Payments (PDF, 92KB) and glossary (PDF, 123KB) provides an overview of the concepts and coverage of the UK Balance of Payments using the Balance of Payments Manual sixth edition.

Further information on the methods are available in the Balance of payments (BoP) Quality and Methodology Information (QMI) report.

Also available is an overview of how movements in foreign exchange rates can impact the balance of payments and international investment position.

Estimates derived from the International Passenger Survey (IPS) are used to help measure exports and imports of travel services. The IPS has recently transferred data collection from paper forms to tablet computers. Analysis of IPS data has detected no discontinuities as a result of the change in data collection mode, therefore we have replaced forecasts used in recent periods with IPS data within headline trade estimates. Please see our Travel and tourism release for more information about IPS.

Throughout this release Quarter 1 refers to January to March, Quarter 2 refers to April to June, Quarter 3 refers to July to September and Quarter 4 refers to October to December.

Users of the balance of payments and international investment position should be aware that the data in this release is all in current prices, over time price inflation will naturally lead to an increase in values.

Back to table of contents3. The UK’s current account deficit widened to a historically significant £30 billion, or 5.6% of GDP, in Quarter 1 2019

The UK’s current account deficit – a measure of the country’s balance of payments with the rest of the world in trade, primary income and secondary income – widened by £6.3 billion to £30.0 billion in Quarter 1 (Jan to Mar) 2019, or 5.6% of gross domestic product (GDP). This is the third consecutive quarter in which the current account deficit has widened and is the largest deficit recorded since Quarter 3 (July to Sept) 2016.

The UK’s current account deficit in Quarter 1 2019, as a percentage of GDP, is the fifth-highest since consistent records began in Quarter 1 1987. The four other occasions where it was higher than Quarter 1 2019 as a percentage of GDP, have all taken place in and around the last five years, as Figure 1 shows.

Figure 1: The UK’s current account deficit as a percentage of gross domestic product widened to a historically significant 5.6% in Quarter 1 2019

Contributions to the UK’s current account balance as a percentage of gross domestic product, Quarter 1 (Jan to Mar) 1987 to Quarter 1 (Jan to Mar) 2019

Source: Office for National Statistics – Balance of Payments

Notes:

Sum of components may not sum to total due to rounding.

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 1: The UK’s current account deficit as a percentage of gross domestic product widened to a historically significant 5.6% in Quarter 1 2019

Image .csv .xlsThe widening current account deficit in Quarter 1 2019 was due to worsening deficits on trade in goods (which widened by £10.1 billion) and secondary income (which widened by £0.7 billion), while the trade in services surplus narrowed by £0.7 billion. Slightly offsetting these movements was a £5.2 billion narrowing of the primary income account deficit.

The UK’s trade deficit more than doubled to a record £20.3 billion in Quarter 1 2019

The UK’s trade deficit more than doubled to a record £20.3 billion in Quarter 1 2019, or 3.7% of GDP (as Figure 2 shows) – marking the fifth consecutive quarter of deterioration. The last time the UK’s trade deficit was over 3% of GDP was Quarter 2 (Apr to June) 2002.

The widening of the total trade deficit was due to a worsening trade in goods deficit (of £10.1 billion) and a narrowing trade in services surplus (of £0.7 billion). From another perspective, the total trade deficit widened as the increase of total imports (£12.5 billion) more than offset the increase in total exports (£1.6 billion).

As a result of the increases in both exports and imports, the value of total trade (that is, the sum of total UK exports and imports) increased by 4.2% in Quarter 1 2019 compared with the previous quarter, due mainly to volume growth. This follows subdued global trade growth throughout 2018 where the UK’s total trade with the rest of the world, in volume terms, increased by only 0.4% – the slowest growth since 2008 when it fell by 8.4%.

Figure 2: The UK’s trade deficit more than doubled to a record £20.3 billion in Quarter 1 2019

UK trade in goods and services balances, Quarter 1 (Jan to Mar) 1997 to Quarter 1 (Jan to Mar) 2019

Source: Office for National Statistics – Balance of Payments

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 2: The UK’s trade deficit more than doubled to a record £20.3 billion in Quarter 1 2019

Image .csv .xlsTrade in goods

The value of goods imported increased by £12.1 billion in Quarter 1 2019 due largely to increased imports of unspecified goods (including non-monetary gold), which rose by £9.9 billion. Much of the increase in imports of unspecified goods was due to a rise of non-monetary gold as explained in UK trade: March 2019. This was slightly offset by a £1.3 billion fall in imports of oil, mainly attributed to oil prices falling for a second consecutive quarter.

Also contributing to the rise in imports in the latest quarter was an increase in trading activity of key commodities ahead of the initial deadline for the UK to leave the European Union on 31 March 2019.

Finished and unfinished manufactured products saw large increases in activity in Quarter 1 2019; particularly imports of medicinal and pharmaceutical products, cars, mechanical machinery, materials manufactures, and jewellery. This unusually high increase in imports in Quarter 1 2019 may suggest consumers and producers brought forward purchases that would have otherwise been spread over future periods, although we are unable to quantify the effect of this. The latest figures on UK trade: April 2019 are consistent with that expectation, as they already show significant falls in imports of these commodities in the first month of the second quarter (Apr to June) in 2019.

The value of goods exported increased by £2.0 billion in Quarter 1 2019, due largely to increases in finished manufactured goods (of £2.7 billion), which includes products like ships, aircraft, telecoms and sound equipment. This was partly offset by a fall in exports of unspecified goods (of £1.0 billion) and a fall in the value of oil exported (of £0.8 billion) as oil prices fell for the second consecutive quarter.

Trade in services

The trade in services surplus narrowed by £0.7 billion to £26.8 billion in Quarter 1 2019, equivalent to the average quarterly trade in services surplus throughout 2018. This slight narrowing was due to exports recording a fall of £0.4 billion to £73.2 billion and an increase of £0.3 billion in the imports of services.

Within exports of services, the largest falls were recorded in telecommunication, computer and information services (down £0.4 billion) and financial services (down £0.3 billion). These were slightly offset by a £0.4 billion increase in exports of intellectual property, attributed mainly to an increase in franchises and trademark licensing fees.

Within imports of services, the largest increase was recorded in other business (up £1.5 billion), particularly services between affiliated enterprises and recruitment services, partly offset by a fall in imports of financial services (down £0.5 billion) and travel services (down £0.3 billion).

Earnings by overseas investors on UK direct investments fell sharply in Quarter 1 2019, improving the UK’s primary income deficit

The primary income balance deficit – which records income the UK receives and pays on financial and other assets, along with compensation of employees – narrowed by £5.2 billion to £3.2 billion in Quarter 1 2019, the narrowest deficit recorded since Quarter 1 2012 when it was £2.7 billion.

Figure 3: The UK’s primary income deficit fell to its narrowest in seven years in Quarter 1 2019, at £3.2 billion

Contributions to the UK’s primary income balance, £ billion, Quarter 1 (Jan to Mar) 2009 to Quarter 1 (Jan to Mar) 2019

Source: Office for National Statistics – Balance of Payments

Notes:

Total includes reserve assets.

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 3: The UK’s primary income deficit fell to its narrowest in seven years in Quarter 1 2019, at £3.2 billion

Image .csv .xlsAs Figure 3 shows, the narrowing of the UK’s primary income account deficit is due to the improved surplus in direct investment earnings (that is, earnings made on investments where investors hold a significant and long-term interest in that company). It improved by £7.0 billion to £9.9 billion in Quarter 1 2019, its largest surplus since Quarter 4 (Oct to Dec) 2011.

The improved direct investment balance is due mainly to fewer UK payments to overseas investors (see Figure 4), as evidence indicates that overseas investors experienced lower profits in their UK investments in Quarter 1 2019. Further improving the direct investment balance was UK investors earning £1.4 billion more on their direct investments abroad in Quarter 1 2019 than they did in the previous quarter.

Figure 4: Earnings by overseas investors on UK direct investments fell sharply in Quarter 1 2019

UK foreign direct investment earnings, £ billion, Quarter 1 (Jan to Mar) 2011 to Quarter 1 (Jan to Mar) 2019

Source: Office for National Statistics – Balance of Payments

Notes:

FDI debits are shown as negative values for presentation purposes in this figure, highlighting the contribution of debits to net FDI. earnings (credits less debits).

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 4: Earnings by overseas investors on UK direct investments fell sharply in Quarter 1 2019

Image .csv .xlsThe improvement in the UK’s direct investment earnings balance was offset partly by an increase in the UK’s portfolio investment deficit and other investments deficit.

The UK’s portfolio investment deficit widened by £1.1 billion to £11.1 billion, the highest deficit since Quarter 4 2017 when it was £12.1 billion. This widening was due mainly to UK earnings on equity securities abroad falling by £1.1 billion, while overseas investors’ earnings on equity securities in the UK increased by £0.6 billion.

Back to table of contents4. Other investment accounted for the majority of UK net inflows in Quarter 1 2019

The UK has run a current account deficit in each quarter since Quarter 3 (July to Sept) 1998, or 1983 when considering annual totals. A current account deficit places the UK as a net borrower with the rest of the world, indicating that overall expenditure in the UK exceeds national income. The UK must attract net financial inflows to finance its current (and capital) account deficit, which can be achieved through either disposing of overseas assets to overseas investors or accruing liabilities with the rest of the world.

The total financial account showed a smaller net inflow (that is, more money flowing into the UK) of £17.0 billion in Quarter 1 (Jan to Mar) 2019; a decrease from net inflows of £35.8 billion in Quarter 4 (Oct to Dec) 2018. The net inflow in the latest quarter reflected a small net disinvestment by UK residents of their overseas assets and a small net investment by foreign investors into the UK. While the total net flows for assets and liabilities were comparatively small there were large offsetting movements between the functional categories (Figure 5).

Figure 5: Other investment accounted for the majority of UK net inflows in Quarter 1 2019

UK financial account balances, Quarter 2 (Apr to Jun) 2016 to Quarter 1 (Jan to Mar) 2019

Source: Office for National Statistics – Balance of Payments

Notes:

Total includes reserve assets.

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 5: Other investment accounted for the majority of UK net inflows in Quarter 1 2019

Image .csv .xlsUK residents’ investment in foreign debt securities was the highest in Quarter 1 2019 since Quarter 3 2010

Within the financial account, the other investment category recorded the largest net inflow in Quarter 1 2019 of £135.0 billion. This was due to a combination of UK residents withdrawing overseas deposits to the value of £60.2 billion while foreign investors increased their deposits with UK monetary financial institutions by £77.1 billion.

Partially offsetting other investment net inflows were net outflows in portfolio investment of £102.2 billion. These were due to a combination of UK residents investing in foreign debt securities and foreign investors reducing their investment in UK debt securities. The value that UK residents invested in foreign debt securities in Quarter 1 2019 was £51.5 billion, the largest value since Quarter 3 2010 (£54.4 billion). In addition, foreign investors reduced their exposure to UK debt securities by £41.1 billion, the largest value since Quarter 3 2012 (£67.5 billion).

Back to table of contents5. The UK net international investment position widens in the latest quarter

The international investment position (IIP) – which measures the UK’s international balance sheet with the rest of the world – recorded decreases in the value of both UK overseas assets and liabilities.

The UK’s stock of overseas assets was valued at £11.0 trillion at the end of Quarter 1 (Jan to Mar) 2019 (down £83.7 billion), while UK liabilities to overseas residents were valued at £11.2 trillion (down £31.5 billion) (Figure 6).

The larger decrease in the value of assets compared with liabilities resulted in the UK’s net external liabilities (that is, liabilities exceeding assets) widening to £195.0 billion at the end of Quarter 1 2019, from net liabilities of £142.8 billion at the end of Quarter 4 (Oct to Dec) 2018.

Figure 6: The UK net international investment position widens in the latest quarter

UK international investment position, Quarter 2 (Apr to June) 2016 to Quarter 1 (Jan to Mar) 2019

Source: Office for National Statistics – Balance of Payments

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 6: The UK net international investment position widens in the latest quarter

Image .csv .xlsThe decrease in the value of UK assets reflected mainly a decrease in the value of other investment (down £164.6 billion), due to a combination of UK residents’ withdrawal of deposits overseas and the strengthening of sterling against most foreign currencies leading to a revaluation impact.

Partially offsetting the decreases in other investment and the remaining functional categories was an increase in the value of portfolio investment assets. This increase is estimated to have been due mostly to a rebound in the value of stock markets from their recent low at the end of Quarter 4 2018, albeit still below the record highs seen in mid-2018, and UK residents investing in foreign debt securities.

The decrease in the value of UK liabilities was due mostly to a decrease in the value of inward direct investment (down £147.2 billion). Similar to assets, the decrease in most functional categories is estimated to have been offset partially by a rise in the value of the UK stock market, which led to an increase in portfolio investment liabilities (up £159.5 billion).

Strengthening sterling depresses the value of UK foreign assets

Changes in the value of UK overseas asset positions can be influenced by a number of factors, including investment flows, currency movements and price revaluations (such as stock market movements). Figure 7 presents estimates of changes in the value of UK overseas assets broken down by these different factors (excluding financial derivatives and reserves).

Figure 7: Strengthening sterling depresses the value of UK foreign assets

Drivers to changes in UK foreign asset values, Quarter 1 (Jan to Mar) 2012 to Quarter 1 (Jan to Mar) 2019

Source: Office for National Statistics – Balance of Payments

Notes:

Excludes financial derivatives and reserve assets.

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 7: Strengthening sterling depresses the value of UK foreign assets

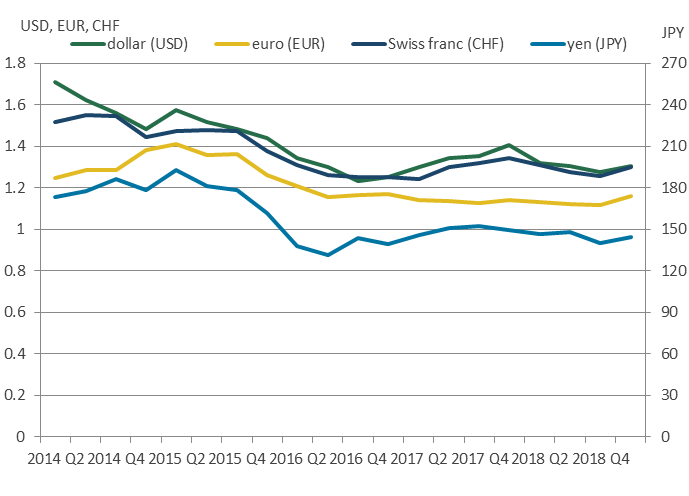

Image .csv .xlsBy the end of Quarter 1 2019, sterling had strengthened against most other major currencies following three quarters of weakening. The recent appreciation in sterling had a negative impact on the international investment position (negative £244.8 billion) as the value of foreign denominated assets falls when converted back into sterling. As shown in Figure 8, the sterling exchange rate appreciated by 2.0% against the dollar in Quarter 1 2019 quarter-on-quarter, 4.1% against the euro and 2.7% against the yen.

Figure 8: Sterling strengthens against major currencies

Sterling exchange rates with major trading partners, Quarter 2 (July to Sept) 2014 to Quarter 1 (Jan to Mar) 2019

Source: Office for National Statistics – Balance of Payments

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this image Figure 8: Sterling strengthens against major currencies

.png (29.9 kB) .xlsx (23.7 kB)Partially offsetting the revaluation impact of a strengthening currency on the value of UK overseas assets was a rebound in the valuation of foreign stock markets, following large falls towards the end of 2018. This had a positive impact on the UK’s international investment position (£153.8 billion), following the large negative impact seen in Quarter 4 2018 (negative £209.1 billion).

Back to table of contents6. Quality and methodology

The Balance of payments (BoP) Quality and Methodology Information report contains important information on:

the strengths and limitations of the data and how it compares with related data

uses and users of the data

how the output was created

the quality of the output including the accuracy of the data

Contact details for this Statistical bulletin

Related publications

- Quarterly economic commentary: January to March 2019

- Quarterly sector accounts, UK: January to March 2019

- Business investment in the UK: January to March 2019 revised results

- GDP quarterly national accounts, UK: January to March 2019

- Consumer trends, UK: January to March 2019

- Economic statistics sector classification – classification update and forward work plan: June 2019