Table of contents

- Other pages in this release

- Main points

- Current trading status of businesses

- Businesses’ financial performance

- Comparison with monthly GDP estimates across waves

- Workforce

- Business resilience

- Government schemes

- Business Impact of Coronavirus (COVID-19) Survey data

- Glossary

- Measuring the data

- Strengths and limitations

- Related links

1. Other pages in this release

More commentary on the impacts of the coronavirus (COVID-19) pandemic on the UK economy and society is available on the following pages:

Coronavirus and the latest indicators for the UK economy and society: 22 October 2020

Coronavirus and the social impacts on Great Britain: 16 October 2020

2. Main points

The arts, entertainment and recreation industry had the lowest percentage of businesses currently trading, at 70%, compared with 86% across all industries.

Wave 15 (21 September to 4 October 2020), 48% of businesses experienced a decrease in turnover; since Wave 12 (10 to 23 August 2020), the trend has flattened compared with a previously steady decrease.

In Wave 15 (21 September to 4 October 2020), 9% of the workforce were on partial or full furlough leave, unchanged from Wave 14 (6 to 20 September 2020).

The accommodation and food service activities industry had the highest percentage of businesses with no cash reserves, at 7%, and had the highest percentage of businesses with a severe risk of insolvency, at 17%.

3. Current trading status of businesses

Final results from Wave 15 of the Business Impact of Coronavirus (COVID-19) Survey (BICS) are for the period 21 September to 4 October 2020, which closed on 18 October 2020.

For presentational purposes, has been trading for more than the last two weeks and started trading within the last two weeks after a pause in trading have been combined to currently trading, and paused trading but intends to restart in the next two weeks and paused trading and does not intend to restart in the next two weeks have been combined to temporarily closed or paused trading.

The breakdowns of these categories are available in the dataset in Section 9.

Figure 1: The arts, entertainment and recreation industry had the lowest percentage of businesses currently trading, at 70%, compared with 86% across all industries

Percentage of businesses, current trading status, broken down by industry, weighted, UK, 21 September to 4 October 2020

Source: Office for National Statistics – Business Impact of Coronavirus (COVID-19) Survey

Notes:

- Final weighted results, Wave 15 of the Office for National Statistics (ONS) Business Impact of Coronavirus (COVID-19) Survey (BICS).

- Bars may not sum to 100% because of rounding and percentages less than 1% being removed for disclosure purposes.

- Other services and Mining and quarrying have been removed for presentational purposes, but their totals are included in "All Industries".

- Businesses were asked for their current trading status and so responses will be from the point of completion of the questionnaire (5 October to 18 October 2020).

Download this chart Figure 1: The arts, entertainment and recreation industry had the lowest percentage of businesses currently trading, at 70%, compared with 86% across all industries

Image .csv .xlsAcross all industries:

84% of businesses had been trading for more than the last two weeks

2% of businesses had started trading within the last two weeks after a pause in trading

2% of businesses had paused trading but intended to restart in the next two weeks

9% of businesses had paused trading and did not intend to restart in the next two weeks

3% of businesses had permanently ceased trading

The arts, entertainment and recreation industry and the administrative and support service activities industry had the highest percentages of businesses that were temporarily closed or paused trading, at 30% and 21% respectively.

Figure 2 shows the trend in weighted trading status estimates between Wave 7 (1 to 14 June 2020) and Wave 15 (21 September to 4 October 2020).

Figure 2: In Wave 15 (21 September to 4 October 2020), 86% of businesses were currently trading, compared with 66% in Wave 7 (1 to 14 June 2020)

Percentage of businesses, current trading status, broken down by Wave, weighted, UK, 1 June to 4 October 2020

Source: Office for National Statistics – Business Impact of Coronavirus (COVID-19) Survey

Notes:

- Final weighted results, Wave 7 to Wave 15 of the Office for National Statistics (ONS) Businesses Impact of Coronavirus (COVID-19) Survey (BICS).

- Bars may not sum to 100% because of rounding, percentages less than 1% being removed for disclosure purposes, and those permanently ceased trading being removed.

- Businesses were asked for their current trading status and so responses will be from the point of completion of the questionnaire.

Download this chart Figure 2: In Wave 15 (21 September to 4 October 2020), 86% of businesses were currently trading, compared with 66% in Wave 7 (1 to 14 June 2020)

Image .csv .xlsTable 1 shows how larger businesses compare with micro businesses (businesses with fewer than 10 employees) in terms of trading status. In Wave 15, 85% of micro businesses were currently trading, compared with 97% of businesses with 250 or more employees.

| Size Band | Currently trading | Temporarily closed or paused trading | Permanently ceased trading |

|---|---|---|---|

| 0 - 9 | 85.1% | 12.2% | 2.7% |

| 10 - 49 | 94.8% | 3.9% | 1.3% |

| 50 - 99 | 96.6% | 2.5% | * |

| 100 -249 | 98.5% | 1.1% | * |

| 250 + | 97.2% | 2.3% | * |

| All Size Bands excluding 0 - 9 | 95.2% | 3.6% | 1.2% |

| All Size Bands | 86.1% | 11.3% | 2.6% |

Download this table Table 1: Percentage of businesses, current trading status, broken down by size band, weighted, 21 September to 4 October 2020

.xls .csvMore about coronavirus

- Find the latest on coronavirus (COVID-19) in the UK.

- All ONS analysis, summarised in our coronavirus roundup.

- View all coronavirus data.

- Find out how we are working safely in our studies and surveys.

4. Businesses’ financial performance

For presentational purposes, decreased turnover categories and increased turnover categories have been combined. The breakdowns of these categories are available in the accompanying dataset.

Figure 3: The arts, entertainment and recreation industry had the highest percentage of businesses experiencing a decrease in turnover, at 75%

Impact on turnover, businesses that are currently trading, broken down by industry, weighted, UK, 21 September to 4 October 2020

Source: Office for National Statistics – Business Impact of Coronavirus (COVID-19) Survey

Notes:

- Final weighted results, Wave 15 of the Office for National Statistics (ONS) Business Impact of Coronavirus (COVID-19) Survey; businesses currently trading.

- Bars may not sum to 100% because of rounding and percentages less than 1% being removed for disclosure purposes.

- Other services and Mining and quarrying have been removed for presentational purposes, but their totals are included in "All Industries".

- Businesses were asked for their experiences for the reference period 21 September to 4 October 2020. However, for questions regarding the last two weeks, businesses may respond from the point of completion of the questionnaire (5 October to 18 October 2020).

Download this chart Figure 3: The arts, entertainment and recreation industry had the highest percentage of businesses experiencing a decrease in turnover, at 75%

Image .csv .xlsAcross all industries, of businesses currently trading:

48% experienced a decrease in turnover, compared with what is normally expected for this time of year

34% experienced no impact on turnover

11% experienced an increase in turnover, compared with what is normally expected for this time of year

The arts, entertainment and recreation industry and the accommodation and food service activities industry had the highest percentages of businesses experiencing a decrease in turnover, at 75% and 68% respectively.

Conversely, the wholesale and retail trade industry had the highest percentage of businesses experiencing an increase in turnover, at 19%. Additional information on the wholesale and retail trade industry is available in Retail sales, Great Britain: August 2020.

Figure 4 shows the trend in weighted turnover estimates between Wave 7 (1 to 14 June 2020) and Wave 15 (21 September to 4 October 2020).

Figure 4: In Wave 15 (21 September to 4 October 2020), 48% of businesses experienced a decreased in turnover, continuing the flattened trend since Wave 12 (10 to 23 August 2020)

Impact on turnover, businesses that are currently trading, broken down by Wave, weighted, UK, 1 June to 4 October 2020

Source: Office for National Statistics – Business Impact of Coronavirus (COVID-19) Survey

Notes:

- Final weighted results, Wave 7 to Wave 15 of the Office for National Statistics (ONS) Businesses Impact of Coronavirus (COVID-19) Survey (BICS); businesses currently trading.

- Bars may not sum to 100% because of rounding and percentages less than 1% being removed for disclosure purposes.

- Businesses were asked for their experiences for the reference period. However, for questions regarding the last two weeks, businesses may respond from the point of completion of the questionnaire.

Download this chart Figure 4: In Wave 15 (21 September to 4 October 2020), 48% of businesses experienced a decreased in turnover, continuing the flattened trend since Wave 12 (10 to 23 August 2020)

Image .csv .xlsIn Wave 15 (21 September to 4 October 2020), 48% of businesses experienced a decrease in turnover. Since Wave 12 (10 to 23 August 2020), the trend has flattened, compared with a previously steady decrease.

An unweighted regional break down of the impact of turnover for businesses’ financial performance can be found in the accompanying dataset.

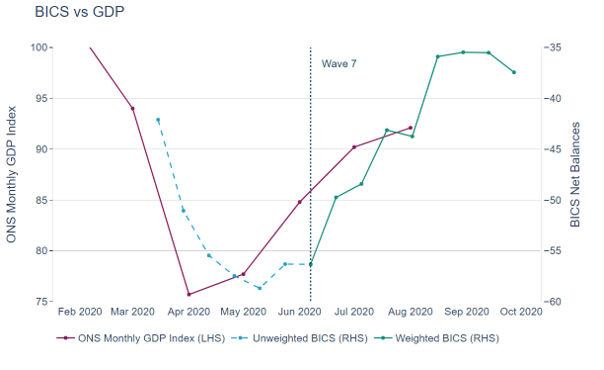

Back to table of contents5. Comparison with monthly GDP estimates across waves

Figure 5 shows how the fortnightly turnover estimates from the Businesses Impact of Coronavirus (COVID-19) Survey (BICS) broadly reflect the published UK monthly gross domestic product (GDP) estimates. This is despite the fact that BICS is published much earlier than the official monthly GDP estimates.

Figure 5: Fortnightly turnover estimates from BICS broadly reflect the published UK monthly GDP estimates

Net turnover balances of businesses currently trading against gross domestic product (GDP) monthly estimates, UK, 1 February to 4 October 2020

Source: Office for National Statistics – Business Impact of Coronavirus (COVID-19) Survey

Notes:

- Final unweighted results, Wave 1 to Wave 6, and final weighted results, Wave 7 to Wave 15, of the Office for National Statistics (ONS) Business Impact of Coronavirus (COVID-19) Survey (BICS).

- Weighted net balances have been calculated from Wave 7 onwards only. The sample redesign in Wave 7 improves our coverage for the small sized businesses, allowing for weighted results to be truly reflective of all businesses.

- Monthly GDP publications can be found here.

- Net balances have been calculated by subtracting the weighted by turnover number of businesses who have reported a decrease in turnover from the weighted by turnover number of businesses with an increase in turnover, all divided by the total weighted number of businesses currently trading for that wave.

Download this image Figure 5: Fortnightly turnover estimates from BICS broadly reflect the published UK monthly GDP estimates

.png (53.7 kB) .xlsx (83.8 kB)6. Workforce

Surveyed businesses that have not permanently stopped trading will have differing approaches to the management of employees, whether furloughing staff, working as normal or other scenarios. Because of the complex nature of this, the data in this section primarily focus on proportions of the workforce within responding businesses as opposed to proportion of businesses as is the case for other sections.

The workforce proportions are based on the responses provided by businesses. These are then apportioned to derive proportions of employees in those businesses using the employment recorded for each reporting unit on the Inter-Departmental Business Register (IDBR).

Figure 6: The arts, entertainment and recreation industry had 28% of its workforce on partial or full furlough leave, compared with 9% across all industries

Working arrangements, businesses that have not permanently stopped trading, broken down by industry, weighted, UK, 21 September to 4 October 2020

Source: Office for National Statistics – Business Impact of Coronavirus (COVID-19) Survey

Notes:

- Final weighted results, Wave 15 of the Office for National Statistics (ONS) Business Impact of Coronavirus (COVID-19) Survey; businesses that have not permanently stopped trading.

- Bars may not sum to 100% because of rounding, percentages less than 1% being removed for disclosure purposes, and those off sick or in self-isolation due to coronavirus (COVID-19), permanently made redundant or 'Other' have being removed.

- Other services and Mining and quarrying have been removed for presentational purposes, but their totals are included in “All Industries”.

- Businesses were asked for their experiences for the reference period 21 September to 4 October 2020. However, for questions regarding the last two weeks, businesses may respond from the point of completion of the questionnaire (5 October to 18 October 2020).

Download this chart Figure 6: The arts, entertainment and recreation industry had 28% of its workforce on partial or full furlough leave, compared with 9% across all industries

Image .csv .xlsAcross all industries, of businesses not permanently stopped trading:

9% of the workforce were on partial or full furlough leave

28% of the workforce were working remotely instead of at their normal place of work

59% of the workforce were working at their normal place of work

The arts, entertainment and recreation industry and the accommodation and food service activities industry had the highest proportions of their workforce on partial or full furlough leave under the terms of the UK government’s Coronavirus Job Retention Scheme (CJRS), at 28% and 24% respectively.

Meanwhile, the information and communication industry and the professional, scientific and technical activities industry had the highest proportions of their workforce working remotely instead of at their normal place of work, at 77% and 63% respectively.

For a more detailed outline of “Other” working arrangements across waves, please see the Coronavirus and the experiences of UK businesses, textual analysis: March 2020 to July 2020 article, which outlines how these “Other” working arrangements have changed over Waves 2 to 9.

Figure 7 shows the trend in weighted workforce status estimates between Wave 7 (1 to 14 June 2020) and Wave 15 (21 September to 4 October 2020).

Figure 7: In Wave 15 (21 September to 4 October 2020), 9% of the workforce were on partial or full furlough leave, unchanged from Wave 14 (6 to 20 September 2020)

Working arrangements, businesses that have not permanently stopped trading, broken down by Wave, weighted, UK, 1 June to 4 October 2020

Source: Office for National Statistics – Business Impact of Coronavirus (COVID-19) Survey

Notes:

- Final weighted results, Wave 7 to Wave 15 of the Office for National Statistics (ONS) Businesses Impact of Coronavirus (COVID-19) Survey (BICS); businesses that have not permanently stopped trading.

- Bars may not sum to 100% because of rounding, percentages less than 1% being removed for disclosure purposes, and those off sick or in self-isolation because of COVID-19, permanently made redundant or “other” being removed.

- Businesses were asked for their experiences for the reference period. However, for questions regarding the last two weeks, businesses may respond from the point of completion of the questionnaire.

Download this chart Figure 7: In Wave 15 (21 September to 4 October 2020), 9% of the workforce were on partial or full furlough leave, unchanged from Wave 14 (6 to 20 September 2020)

Image .csv .xlsIn Wave 15 (21 September to 4 October 2020), 9% of the workforce were on partial or full furlough leave, unchanged from Wave 14 (6 to 20 September 2020), after a steady decrease from 30% in Wave 7 (1 to 14 June 2020).

For an overview of the similarities and differences between the fortnightly Businesses Impact of Coronavirus (COVID-19) Survey (BICS) furlough estimates and HM Revenue and Customs’ (HMRC’s) CJRS data, over the period 1 May to 31 July, please see Comparison of furloughed jobs data: May to July 2020.

Figure 8: Across all industries, 9% of the workforce who were still on partial or full furlough leave returned from leave in the last two weeks

Proportions of the workforce who have returned to work in the last two weeks, businesses currently trading, broken down by industry, weighted, UK, 21 September to 4 October 2020

Source: Office for National Statistics – Business Impact of Coronavirus (COVID-19) Survey

Notes:

- Final weighted results, Wave 15 of the Office for National Statistics (ONS) Business Impact of Coronavirus (COVID-19) Survey (BICS); businesses currently trading.

- Bars may not sum to 100% because of rounding, percentages less than 1% being removed for disclosure purposes, and businesses do not have to report workforce proportions that sum to 100%.

- Other services and Mining and quarrying have been removed for presentational purposes, but their totals are included in “All Industries”.

- Businesses were asked for their experiences for the reference period 21 September to 4 October 2020. However, for questions regarding the last two weeks, businesses may respond from the point of completion of the questionnaire (5 October to 18 October 2020).

Download this chart Figure 8: Across all industries, 9% of the workforce who were still on partial or full furlough leave returned from leave in the last two weeks

Image .csv .xlsWhen interpreting the proportion of the workforce estimates returning from furlough leave or from remote working in the last two weeks, consideration of the industries that had a higher proportion of their workforce furloughed is needed.

Across all industries, of businesses currently trading, 9% of the workforce returned from furlough leave in the last two weeks and 5% of the workforce moved from remote working to the normal workplace in the last two weeks.

Back to table of contents7. Business resilience

For presentational purposes, in Figure 9, cash reserve categories between zero and three months have been combined. The breakdowns of these categories are available in the accompanying dataset.

Figure 9: The accommodation and food service activities industry had the highest percentage of businesses with no cash reserves, at 7%

Cash reserves, businesses that have not permanently stopped trading, broken down by industry, weighted, UK, 21 September to 4 October 2020

Source: Office for National Statistics – Business Impact of Coronavirus (COVID-19) Survey

Notes:

- Final weighted results, Wave 15 of the Office for National Statistics (ONS) Business Impact of Coronavirus (COVID-19) Survey; businesses that have not permanently stopped trading.

- Bars may not sum to 100% because of rounding and percentages less than 1% being removed for disclosure purposes.

- Other services and Mining and quarrying have been removed for presentational purposes, but their totals are included in “All Industries”.

- Businesses were asked for their experiences for the reference period 21 September to 4 October 2020. However, for questions regarding cash reserves, businesses may respond from the point of completion of the questionnaire (5 October to 18 October 2020).

Download this chart Figure 9: The accommodation and food service activities industry had the highest percentage of businesses with no cash reserves, at 7%

Image .csv .xlsAcross all industries, of businesses not permanently stopped trading:

4% had no cash reserves

23% had less than three months’ cash reserves

16% had between four to six months’ cash reserves

35% had more than six months’ cash reserves

The accommodation and food service activities industry had the highest percentage of businesses that had no cash reserves, at 7%. This was followed by the arts, entertainment and recreation industry and the transportation and storage industry, both at 6%.

Conversely, the information and communication industry and the wholesale and retail trade industry had the highest percentages of businesses that had cash reserves to last more than six months, at 46% and 45% respectively.

Businesses that had not permanently stopped trading were also asked about their risk of insolvency.

Figure 10: The accommodation and food service activities industry had 17% of businesses with a severe risk of insolvency, compared with 5% across all industries

Risk of insolvency, businesses that have not permanently stopped trading, broken down by industry, weighted, UK, 21 September to 4 October 2020

Source: Office for National Statistics – Business Impact of Coronavirus (COVID-19) Survey

Notes:

- Final weighted results, Wave 15 of the Office for National Statistics (ONS) Business Impact of Coronavirus (COVID-19) Survey; businesses that have not permanently stopped trading.

- Bars may not sum to 100% because of rounding, percentages less than 1% being removed for disclosure purposes, and businesses that have become insolvent being removed.

- Other services and Mining and quarrying have been removed for presentational purposes, but their totals are included in “All Industries”.

- Businesses were asked for their experiences for the references period 21 September to 4 October 2020. However, for questions regarding risk of insolvency, businesses may respond from the point of completion of the questionnaire (5 October to 18 October 2020).

Download this chart Figure 10: The accommodation and food service activities industry had 17% of businesses with a severe risk of insolvency, compared with 5% across all industries

Image .csv .xlsAcross all industries, of businesses not permanently stopped trading:

5% had a severe risk of insolvency

13% had a moderate risk of insolvency

46% had a low risk of insolvency

25% had no risk of insolvency

The accommodation and food service activities industry and the administrative and support service activities industry had the highest percentages of businesses with a severe risk of insolvency, at 17% and 9% respectively.

Conversely, the real estate activities industry had the highest percentage of businesses with no risk of insolvency, at 70%.

Back to table of contents8. Government schemes

Data regarding the percentages of businesses applying for and receiving the different government schemes and initiatives (including the Coronavirus Job Retention Scheme (CJRS)) can now be found in the accompanying dataset.

Back to table of contents10. Glossary

Coronavirus

Coronaviruses are a family of viruses that cause disease in people and animals. They can cause the common cold or more severe diseases, such as COVID-19.

COVID-19

COVID-19 is the name used to refer to the disease caused by the SARS CoV-2 virus, which is a type of coronavirus. The Office for National Statistics (ONS) takes COVID-19 to mean presence of SARS-CoV-2 with or without symptoms.

Furlough

Furlough is a temporary absence from work allowing workers to keep their job while the coronavirus (COVID-19) pandemic continues.

Reporting unit

The business unit to which questionnaires are sent is called the reporting unit. The response from the reporting unit can cover the enterprise as a whole or parts of the enterprise identified by lists of local units.

Back to table of contents11. Measuring the data

The Business Impact of Coronavirus (COVID-19) Survey (BICS) is voluntary and may only reflect the characteristics of those that responded; the results are experimental.

| Wave | 24 September 2020 Publication Wave 13 | 8 October 2020 Publication Wave 14 | 22 October 2020 Publication Wave 15 |

|---|---|---|---|

| Sample | 23,900 | 23,912 | 24,353 |

| Response | 5,998 | 5,522 | 5,970 |

| Rate | 25.10% | 23.10% | 24.50% |

Download this table Table 2: Sample and response rates for Waves 13, 14 and 15 of Business Impact of Coronavirus (COVID-19) Survey

.xls .csvThe business indicators are based on responses from the voluntary, fortnightly BICS, which captures businesses’ views on the impact on turnover, workforce prices, trade and business resilience. Wave 15 data relate to the period 21 September to 4 October 2020. The survey questions are available.

The different experiences of businesses during the coronavirus pandemic

In the final results of Wave 15, of 24,353 businesses surveyed, 5,970 businesses (24.5%) responded.

The Wave 15 survey was live for the period 5 to 18 October 2020, and businesses were asked about their experience for the two-week survey reference period, 21 September to 4 October 2020. Dependent on responses to certain questions, businesses are asked different questions.

For questions or response options referring to the “last two weeks” or expectations of the “next two weeks”, businesses could respond from the point of completion of the questionnaire based on their current experiences. This means that businesses’ responses may cover any two-week time period across the following reference periods respectively: 21 September to 4 October 2020 and 5 to 18 October 2020. More detail on the type of questions asked are available in the accompanying dataset.

Weighting

Weighted estimates for the BICS have now been developed for all variables that are collected at a UK level. A detailed description of the weighting methodology and its differences to unweighted estimates is available in Business Impact of Coronavirus (COVID-19) Survey (BICS): preliminary weighted results.

We currently do not produce country/regional breakdowns on a weighted basis. Work is ongoing to enable this and hope to include these for future waves of BICS outputs. Our aim is to produce sub-national weighted estimates should the sample and response allow. We currently provide unweighted estimates with a country and regional split for selected variables in our detailed dataset. These should be treated with caution when used to evaluate the impact of the coronavirus pandemic across the UK.

When unweighted, each business is assigned the same weight regardless of turnover, size or industry, and businesses that have not responded to the survey or that are not sampled are not taken into account. Weighted estimates for Scotland for businesses with greater than 9 employees are available from the Scottish Government and can be found here.

Coverage

The approach for the sample design has been to use three standard Office for National Statistics (ONS) surveys – the Monthly Business Survey (MBS), Retail Sales Inquiry (RSI) and Construction – as a sampling frame. Each of these survey samples are drawn from the Inter-Departmental Business Register (IDBR), which covers businesses in all parts of the economy, except those that are not registered for Value Added Tax (VAT) or Pay As You Earn (PAYE); this includes very small businesses, the self-employed, those without employees and those with low turnover. Some non-profit-making organisations are also not registered on the IDBR.

The MBS covers the UK for production and only Great Britain for services. The RSI and Construction are Great Britain-focused. Therefore, BICS will be UK for production-based industries but Great Britain for the other elements of the economy covered.

The industries covered are:

non-financial services (includes professional, scientific, communication, administrative, transport, accommodation and food, private health and education, and entertainment services)

distribution (includes retail, wholesale and motor trades)

production (includes manufacturing, oil and gas extraction, energy generation and supply, and water and waste management)

construction (includes civil engineering, housebuilding, property development and specialised construction trades such as plumbers, electricians and plasterers)

The following industries are excluded from the survey:

agriculture

public administration and defence

public provision of education and health

finance and insurance

Reporting unit

The business unit to which questionnaires are sent is called the reporting unit. The response from the reporting unit can cover the enterprise as a whole or parts of the enterprise identified by lists of local units. Other than for a minority of larger business or businesses that have a more complex structure, the reporting unit is the same as the enterprise.

Where more than one type of economic activity is carried out by a local unit or enterprise, its principal activity is the activity in which most of the people are employed, and it does not necessarily account for 50% or more of the total employment of the unit. There are detailed rules for determining Standard Industrial Classification (SIC) for multiple-activity economic units.

Regional estimates

Regional BICS estimates are produced by taking the survey return from each reporting unit and then applying this to the reporting unit’s local sites. If a business has a site or several sites (also known as local units) within a country, using information from the IDBR, then this business is defined to have presence there.

The business is then allocated once within each region (regardless of the number of sites) and the information provided by the reporting unit as a whole is copied and used within each country.

Aggregates of Nomenclature of Territorial Units for Statistics (NUTS1) regions such as the UK or England may have higher or lower response proportions than any of their constituent regions because of differences in the sample composition in terms of company workforce.

Since the larger, aggregate regions such as the UK or England generally have a larger proportion of smaller companies, if there is a substantial difference between the response proportions of larger and smaller companies, this will be reflected in the top-line figures.

Sample

For unweighted data only, the businesses that have responded to Wave 15 of BICS are represented, and as such these are not fully representative of the UK as a whole.

The sampling frame used in BICS was designed to achieve adequate coverage of the listed industries from the MBS. Coverage and response rate of the medium to largest businesses in terms of total employment are satisfactory to produce estimates on this basis.

To help interpret the data, we have presented results based on the number of employees in each business, grouping fewer than 250 employees and those with 250 employees or more.

All businesses with an employment of greater than 250 employees and that are included within the three monthly surveys (MBS, RSI and Construction) are included in the BICS sample with a random sample of 1% for those with an employment between 0 and 249.

As the sample is selected fortnightly, the same businesses will be selected for at least two waves depending on how many coronavirus survey selections there are between the selection of these feeder surveys. Because of the randomly selected element, there will be differences in this part of the sample once the feeder surveys have been redrawn. As this is a voluntary survey, businesses may or may not choose to respond to the different waves. Response coverage can be mixed between the different waves.

While we have the ability to align the reporting unit to lower-level detail, and also increased detail on the SIC, it is not advisable given the sparseness of response in certain industries and size bands.

Back to table of contents12. Strengths and limitations

Business Impact of Coronavirus (COVID-19) Survey

The Business Impact of Coronavirus (COVID-19) Survey (BICS) is voluntary. Unweighted estimates should be treated with caution, as results reflect the characteristics of those that responded and not necessarily the wider business population.

The survey was designed to give an indication of the impact of the coronavirus pandemic on businesses and a timelier estimate than other surveys.

Comparison of waves

A detailed description of the weighting methodology and its differences to unweighted estimates across waves can be found in BICS: preliminary weighted results.

The production of weighted BICS estimates will allow for comparisons between waves, as any imbalances caused by non-responding and non-sampled businesses are corrected. This means that weighted estimates in every wave represent the experiences of all businesses rather than just those that have responded.

Some BICS variables remain unweighted while development continues to weight all the BICS variables. Therefore, comparison of unweighted estimates between waves should still be treated with caution because of the voluntary nature of the survey, the difference in response rates and dependency on those businesses that only responded in particular waves. For a time series analysis on how the unweighted estimates changed between Wave 2 (23 March to 5 April 2020) and Wave 7 (1 to 14 June 2020), please see Insights of BICS: 23 March to 5 April (Wave 2) to 1 to 14 June (Wave 7) 2020.

Back to table of contentsContact details for this Statistical bulletin

Related publications

- Coronavirus and the latest indicators for the UK economy and society: 22 October 2020

- Coronavirus and the social impacts on Great Britain: 1 April 2022

- Business Insights and Conditions Survey, analysis over time, UK: 24 August 2020 to 4 April 2021

- Business Impact of Coronavirus (COVID-19) Survey: preliminary weighted results

- Coronavirus and the experiences of UK businesses, textual analysis: March 2020 to July 2020

- Business Impact of Coronavirus (COVID-19) Survey, expectation responses over time, UK: 1 June to 23 August 2020 (Waves 6 to 11)

- Comparison of furloughed jobs data, UK: March 2020 to June 2021