Table of contents

- Labour productivity, Q2 2014

- About this release

- Interpreting these statistics

- General commentary

- Whole economy labour productivity

- Unit labour costs

- Manufacturing labour productivity

- Services labour productivity

- Market sector (experimental statistics) labour productivity

- Revisions

- Notes on sources

- Background notes

- Methodology

1. Labour productivity, Q2 2014

- UK Labour Productivity as measured by output per hour was unchanged in the second quarter of 2014 compared with the previous quarter, and 0.3% lower than a year earlier.

- Output per hour fell by 0.1% in the second quarter in service industries, and grew by 0.7% in the production industries.

- Whole economy unit labour costs increased slightly in Q2 but have fallen a little over the last year. A similar pattern holds for manufacturing unit wage costs.

- Extensive revisions to measures of economic output (and to a lesser extent to measures of labour input) have significantly revised the productivity record prior to the downturn, and especially over 2008-12. However, these revisions do not materially dispel the 'productivity conundrum': in Q2 2014 output per hour was some 16% lower than would have been the case had the pre-downturn trend continued.

2. About this release

This release reports labour productivity statistics for the second quarter of 2014 for the whole economy and a range of industries, together with selected data on unit labour costs. Labour productivity measures the amount of real (inflation-adjusted) economic output that is produced by a unit of labour input (in terms of workers, jobs and hours worked) and is a key indicator of economic performance. Since labour costs account for around two-thirds of the cost of production of UK economic output, unit labour costs provide an indication of inflationary pressures in the economy.

Output statistics in this release are consistent with the latest Quarterly National Accounts published on 30 September 2014. Labour input measures are consistent with the latest labour market statistics as described further in the 'General commentary' and 'Notes on sources' sections below.

Back to table of contents3. Interpreting these statistics

Whole economy output (gross value added – GVA) increased by 0.9% in the second quarter of 2014, while the Labour Force Survey (LFS) shows that the number of workers, jobs and hours increased by 0.5%, 0.6% and 1.0% respectively over this period1. Since growth of labour productivity can be decomposed as growth of GVA minus growth of labour input, this combination of movements in output, workers, jobs and hours implies that UK labour productivity increased a little in terms of output per worker and output per job, and was unchanged in terms of output per hour2.

Differences between growth of output per worker and output per job reflect changes in the ratio of jobs to workers. This ratio increased a little in Q2. Differences between these measures and output per hour reflect movements in average hours which, though typically not large from quarter to quarter, can be material over a period of time. For example, a shift towards part-time employment will tend to reduce average hours. For this reason, output per hour is a more comprehensive indicator of labour productivity and is the main focus of the commentary in this release.

Unit labour costs (ULCs) reflect the full labour costs, including social security and employers’ pension contributions, incurred in the production of a unit of economic output, while unit wage costs (UWCs) are a narrower measure, excluding non-wage labour costs3. Growth rates of these series can be decomposed as growth of labour costs per unit of labour input minus growth of labour productivity. For example, with labour productivity remaining unchanged on an output per hour basis in the second quarter, the 0.1% increase in ULCs implies that labour costs per hour increased by 0.1% across the economy as a whole. In the manufacturing sector, the combination of output per hour growth of 1.2% and an increase of 0.3% in unit wage costs implies an increase in wage costs per hour of around 1.5% over the quarter.

Most of the series in this release are designated as National Statistics, meaning their production has been subject to rigorous quality assurance and methodological scrutiny. However, some service industry estimates use component series from the Index of Services (IOS) which are designated as experimental statistics (that is, not yet accredited as National Statistics, for example because the methodology is under development or reflecting concerns over data sources). Labour productivity estimates that use these series as their numerators are also labelled as experimental statistics. Market sector productivity estimates are also experimental series. More information on the experimental IOS series is available on the Guidance and methodology section of the ONS website.

Notes for interpreting these statistics

Growth rates for whole economy workers, jobs and hours shown in Table 10 may differ slightly from growth rates based on LFS aggregate data due to different methods of seasonal adjustment.

The evolution of output per hour (unchanged in Q2) differs slightly from that implied by growth of GVA and hours. This is due to rounding.

Both measures include labour costs of the self-employed.

4. General commentary

GVA estimates published on 30 September 2014 incorporate the most extensive programme of changes to the National Accounts for a decade, including changes arising from the adoption of a new accounting standard (ESA10) and other improvements alongside the normal Blue Book processes of balancing, benchmarking to administrative data, updating of weights etc. ONS has published a number of articles describing these changes (available here). Some information on the impact of these changes on GVA by industry is available in this article published on 30 September 2014.

Revisions to labour inputs include normal revisions to jobs estimates for the previous quarter, plus revisions to overall labour input reflecting the impact of re-weighting Labour Force Survey (LFS) estimates to take account of revised working population estimates arising from the 2011 Census, described in this article. At this stage, these LFS revisions are only available as aggregate benchmarks and only up to the October-December quarter of 2013. This release uses component level pre-Census LFS data (as published in Labour Market Statistics on 13 August 2014), scaled as appropriate to the post-Census aggregates. Additionally, post-Census proxy estimates for Q1 and Q2 2014 are estimated by extrapolation, using growth rates as published on 13 August 2014.

The net effect of all revisions is to raise the growth of output per hour by 2.3 percentage points between Q1 2008 and Q1 2014 compared with the last Labour Productivity release on 1 July 2014. All of this improvement in productivity occurs between 2008 and Q3 2012; growth of output per hour is very slightly weaker since Q3 2012 in the current vintage of data than in the previous vintage.

By contrast, productivity growth has been revised down slightly between 1997 and 2007, from an average of approximately 2.4% pa to approximately 2.2% pa.

Changes to productivity are overwhelmingly due to changes to output rather than to labour input. The latest data show stronger (or less negative) output growth in each year from 2008 to 2012, but unchanged growth in 2013. The revisions to labour input generate very slightly stronger growth of hours worked in 2008 and 2009, no change in 2010 and 2011, and very slightly slower growth in 2012 and 2013.

Revisions to the growth of overall output per hour are reflected in higher productivity growth across most industries, reflecting broad-based upward revisions to GVA growth. Exceptions are agriculture (section A), mining and quarrying (B) and arts, entertainment and recreation services (R), where in each case output growth has been revised downwards since 2008. Thus while growth of manufacturing output per hour has been revised upwards by 3.0 percentage points (pps) between Q1 2008 and Q1 2014 compared with the previous release, growth of output per hour in the production industries (manufacturing plus B, D and E) has been revised upwards by 2.1 pps.

Over the same period, growth of services output per hour has been revised upwards by 3.2 pps, although the pattern is not uniform across all service industries. As noted above, output growth of industry R has been revised downwards, with a corresponding impact on labour productivity, and there are comparatively small upward revisions to productivity growth in information and communication services (J) and government services (O-Q). By contrast, productivity growth has been revised sharply higher since 2008 in transport and storage services (H), and in real estate activities, where output includes the imputed flow of housing services from owner-occupied dwellings.

Figure 1 shows cumulative contributions to productivity growth since 2008 by broad industry. The height of each bar reflects labour productivity movements in that industry and weight of the industry, which in turn is a function of its weight in hours worked and output1. In Q2 2014, whole economy output per hour was 2.2% lower than in Q1 2008. This is approximately 16% lower than had productivity maintained its pre-downturn trend.

Comparing with the same figure in the previous release, the negative contribution of industry group ABDE is more pronounced, while all other components have been revised upwards (because the negative revision to industry R is outweighed by upward revisions to other service industries). A notable feature of Figure 1 in this release is the pronounced recovery in output per hour between Q4 2009 and Q3 2011 (that is, through calendar 2010 and 2011). The pattern since then is little changed compared with the previous vintage of data, although the level of output per hour relative to Q1 2008 is around 2 pps higher than previously estimated.

Figure 1: Cumulative contributions to quarter on quarter growth of whole economy output per hour

Seasonally adjusted

Source: Office for National Statistics

Notes:

- ABDE refers to Agriculture, Forestry and Fishing (section A), Mining and Quarrying (section B) Electricity, Gas, Steam and Air Conditioning Supply (section D) and Water Supply; sewerage, waste management and remediation activities (section E).

Download this chart Figure 1: Cumulative contributions to quarter on quarter growth of whole economy output per hour

Image .csv .xlsUnsurprisingly, since aggregate labour productivity growth has been revised up since 2008, growth of unit labour costs (ULCs) has been revised down. In fact, while the level of overall labour costs has been revised upwards in line with the general direction of revisions to aggregate current price GDP, the growth of labour costs since 2008 has been revised downwards2.

The upshot is that growth of whole economy ULCs is significantly slower since 2008 in the current vintage of data, by around 1% pa (averaging 1.4% pa compared with 2.4% pa in the previous vintage). Growth of manufacturing unit wage costs has also been revised downwards, from 1.7% pa to 1.1% pa.

Over the period 1997-2007, prior to the downturn, growth of whole economy ULCs has been revised down by 0.4% pa on average in the current vintage of data.

This release also includes section-level ULCs (216 Kb Excel sheet) updated to be consistent with Blue Book estimates of self-employment income by industry. These estimates show downward revisions to growth of ULCs of 1% pa for service industries as a whole, and especially large downward revisions in certain service industries including financial services.

Notes for general commentary

The decomposition is exact for periods over which the National Accounts have been balanced through the supply-use framework, that is to 2012. Small inconsistencies arise from Q1 2013 because the GVA weights are currently fixed for these periods.

Revisions to labour costs principally reflect revisions to non-wage labour costs, reflecting changes to the treatment of funded defined benefit pension schemes in the National Accounts, together with revisions to self-employment income.

5. Whole economy labour productivity

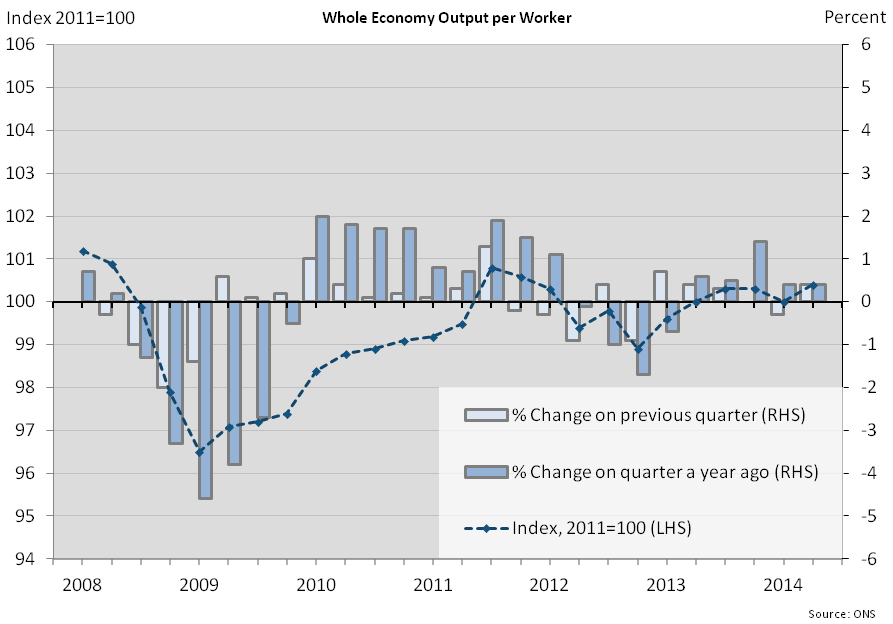

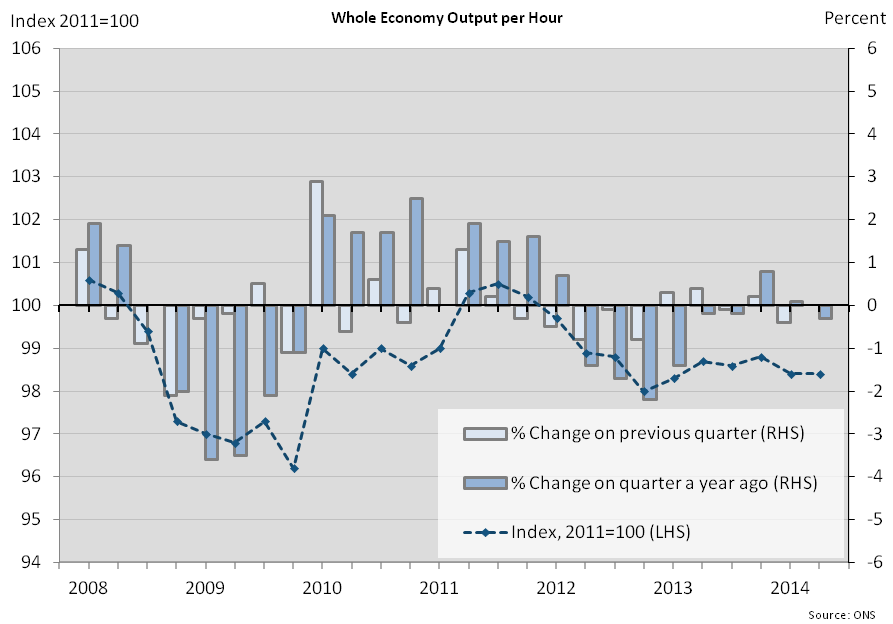

Figure 2 shows whole economy output per worker in terms of index levels and percentage changes. Figure 3 shows whole economy output per hour, and Figure 4 provides a breakdown of the components of labour productivity over recent quarters. More information is available in the Reference Tables (233.5 Kb Excel sheet) section of this release, and in the tables at the end of the PDF version of this statistical bulletin.

Figure 2: Whole economy output per worker

Seasonally adjusted

Source: Office for National Statistics

Download this image Figure 2: Whole economy output per worker

.png (49.6 kB) .xls (1.8 MB)

Figure 3: Whole economy output per hour

Seasonally adjusted

Source: Office for National Statistics

Download this image Figure 3: Whole economy output per hour

.png (48.9 kB) .xls (1.8 MB)

Figure 4: Whole economy labour productivity components

Seasonally adjusted

Source: Office for National Statistics

Download this chart Figure 4: Whole economy labour productivity components

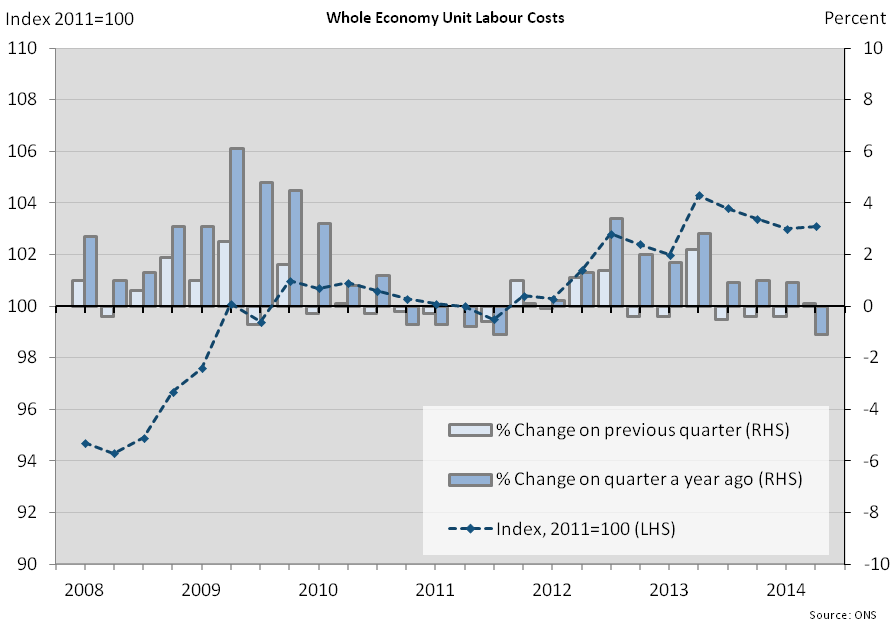

Image .csv .xls6. Unit labour costs

Figure 5 shows whole economy ULCs in terms of index levels and percentage changes on the previous quarter and on the previous year. New and improved estimates of unit labour costs are published as a table component (211.5 Kb Excel sheet) alongside this statistical release. These estimates include some minor methodological changes at the whole economy level; however, the overall time series is very similar between the new series and the existing series (identifier LNNL).

Figure 5: Whole economy unit labour costs

Seasonally adjusted

Source: Office for National Statistics

Download this image Figure 5: Whole economy unit labour costs

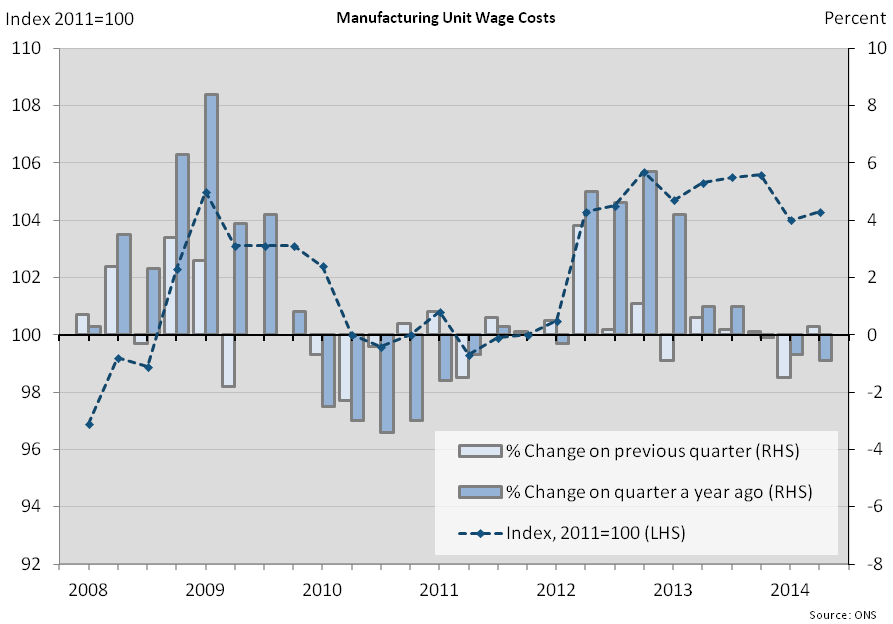

.png (46.4 kB) .xls (1.8 MB)Manufacturing unit wage costs (Figure 6) increased by 0.3% in the second quarter and were 0.9% lower than a year earlier. As well as being a narrower measure than unit labour costs, the manufacturing unit wage cost series currently uses average weekly earnings in manufacturing (a measure of employee earnings) to proxy the earnings of self-employed workers in manufacturing, which is inconsistent with other ONS data on incomes of the self employed.

Figure 6: Manufacturing unit wage costs

Seasonally adjusted

Source: Office for National Statistics

Download this image Figure 6: Manufacturing unit wage costs

.png (50.5 kB) .xls (1.8 MB)ONS published proposals for replacing manufacturing UWCs with a broader and more consistently derived measure of manufacturing ULCs in an article 'Sectional unit labour costs' on 28 November 2012. Estimates of manufacturing ULCs are published as a table component (211.5 Kb Excel sheet) alongside this release. The overall pattern of the time series is broadly similar to that of the existing UWC series (identifier DIX4). However, in the latest period, manufacturing ULCs are estimated to have decreased by 0.6% compared to the previous quarter, compared with an increase of 0.3% for DIX4. Over the period 2008-13, growth of manufacturing ULCs averages ~1.6% pa compared with average growth of ~1.1% for DIX4 over this period.

More information on unit labour costs and unit wage costs is available in Table 2 in the Reference Tables section of this release, and in the tables at the end of the PDF version of this statistical bulletin.

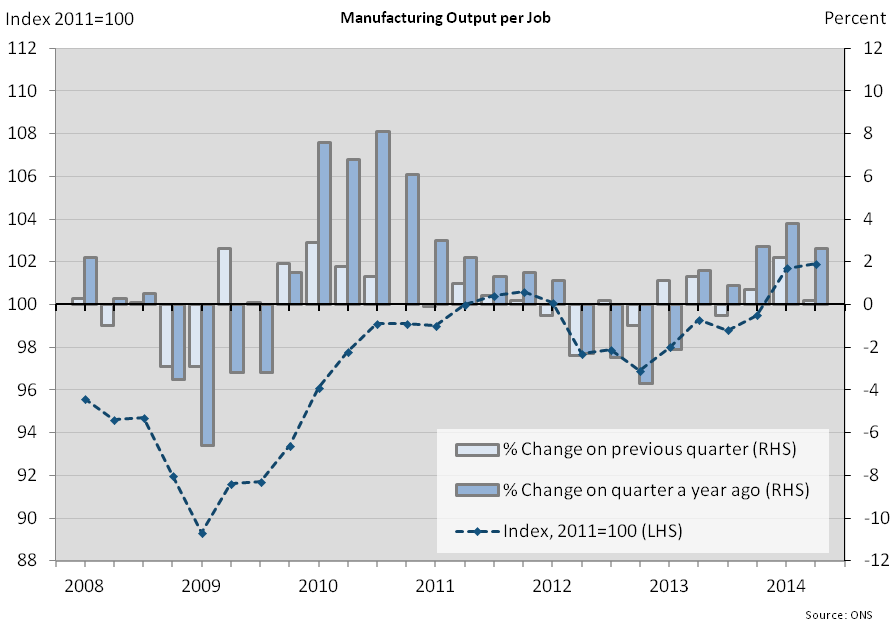

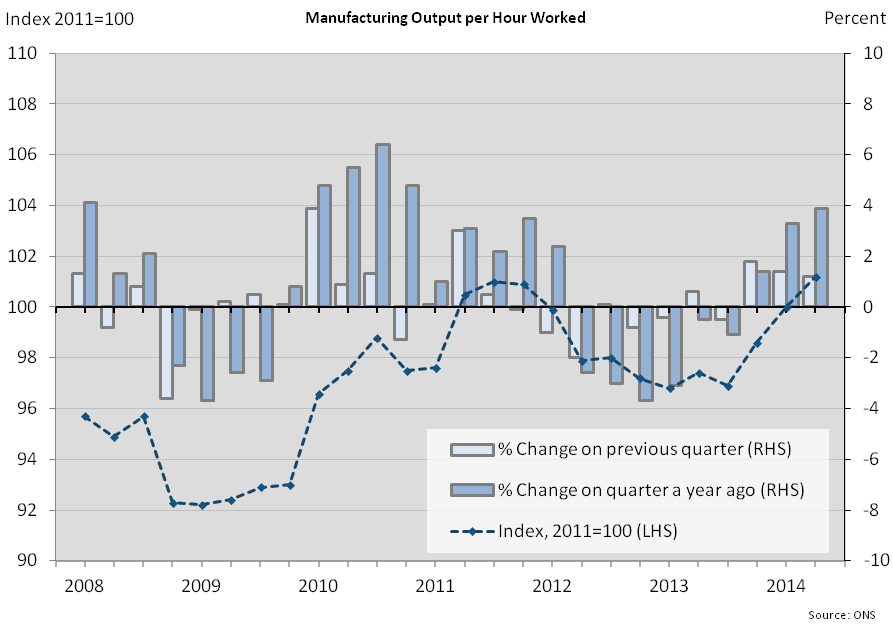

Back to table of contents7. Manufacturing labour productivity

Figures 7 and 8 show movements in labour productivity in manufacturing in terms of levels and percentage changes on the previous quarter and on the previous year. Figure 9 provides information on the component movements in manufacturing output and labour inputs.

Figure 7: Manufacturing output per job

Seasonally adjusted

Source: Office for National Statistics

Download this image Figure 7: Manufacturing output per job

.png (49.0 kB) .xls (1.8 MB)

Figure 8: Manufacturing output per hour worked

Seasonally adjusted

Source: Office for National Statistics

Download this image Figure 8: Manufacturing output per hour worked

.png (49.2 kB) .xls (1.8 MB)

Figure 9: Components of manufacturing productivity measures

Seasonally adjusted

Source: Office for National Statistics

Download this chart Figure 9: Components of manufacturing productivity measures

Image .csv .xlsFigure 10 shows the cumulative contributions to growth of manufacturing output per hour since 2008. This analysis highlights the large negative contribution to productivity of industries 20-21 (Chemicals and Pharmaceuticals), particularly since 2010. By contrast, industries 26-30 (Equipment industries) have made strongly positive contributions to productivity growth since 2010.

Figure 10: Cumulative contributions to quarter on quarter growth of manufacturing output per hour

Seasonally adjusted

Source: Office for National Statistics

Notes:

- 10-19 refers to Food products, beverages and tobacco (10-12), Textiles, wearing apparel & leather (13-15), Wood & paper products & printing (16-18) and Coke & refined petroleum products (19). 31-33 refers to Other Manufacturing.

- 20-21 refers to Chemical and Pharmaceutical products.

- 22-25 refers to Rubber, plastics & other non-metallic minerals (22-23), Basic metals and metal products (24-25).

- 26-30 refers to Computer products, Electrical equipment (26-27), Machinery & equipment (28) and Transport equipment (29-30).

Download this chart Figure 10: Cumulative contributions to quarter on quarter growth of manufacturing output per hour

Image .csv .xlsMore information on labour productivity of sub-divisions of manufacturing is available in the Reference Tables (330 Kb Excel sheet) section of this release (Tables 3 and 4), and in the tables at the end of the PDF version of this statistical bulletin. Care should be taken in interpreting quarter on quarter movements in productivity estimates for individual sub-divisions, as small sample sizes of the source data can cause volatility.

Tables 3 and 4 now include estimates for the level of productivity in £ terms for the National Accounts base year of 2011. These are estimates of GVA per unit of labour input and are not necessarily related to pay rates. Output per job (Table 3) varied from £39.3k in Wood and paper products (divisions 16-18) to £134.4k in Chemicals & Pharmaceuticals (divisions 20-21). The average for the whole of manufacturing was £57.5k and the average for the whole economy was £47.2k in 2011.

Chemicals & Pharmaceuticals was also top of the distribution for output per hour in 2011 (£75.2), with Wood, paper products, & printing (divisions 16-18) and Basic metals & metal products (divisions 24-25) at the bottom of the distribution. On this basis the average for manufacturing as a whole was £31.1 and the average for the whole economy was £30.0 per hour.

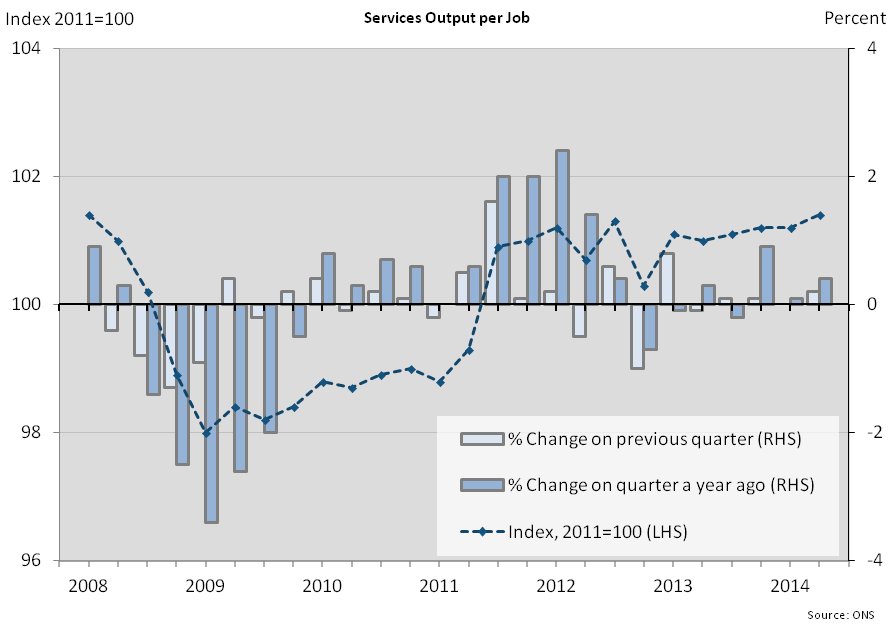

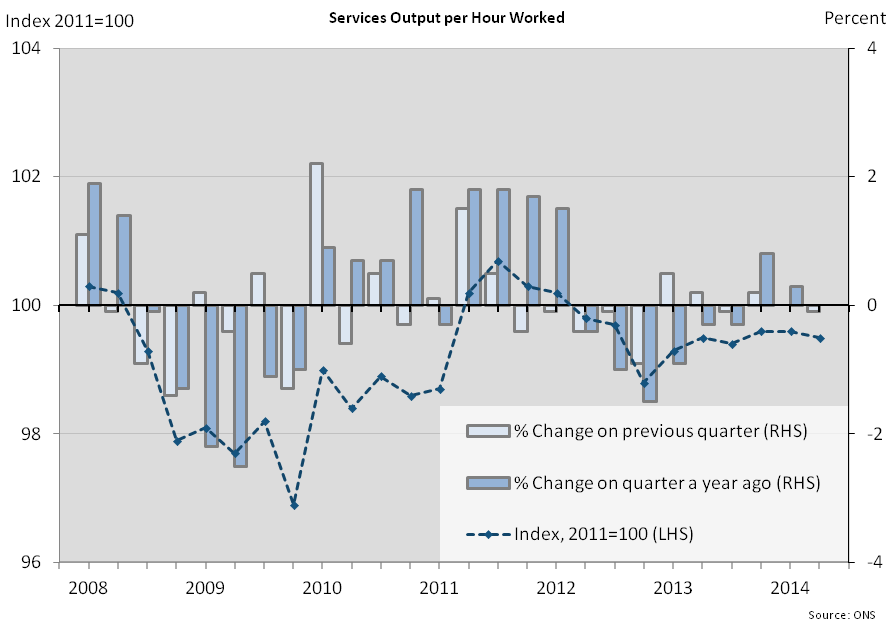

Back to table of contents8. Services labour productivity

Figures 11 and 12 show movements in labour productivity in services in terms of index levels and percentage changes on the previous quarter and on the previous year. Figure 13 provides information on the component movements in services output and labour inputs.

Figure 11: Services output per job

Seasonally adjusted

Source: Office for National Statistics

Download this image Figure 11: Services output per job

.png (47.1 kB) .xls (1.8 MB)

Figure 12: Services output per hour

Seasonally adjusted

Source: Office for National Statistics

Download this image Figure 12: Services output per hour

.png (48.2 kB) .xls (1.8 MB)

Figure 13: Components of services productivity measures

Seasonally adjusted

Source: Office for National Statistics

Download this chart Figure 13: Components of services productivity measures

Image .csv .xlsFigure 14 shows the cumulative contributions to growth of services output per hour since the economic downturn. From the beginning of 2008 to the second quarter of 2014, industries O-Q (Government services) and industry K (Financial and insurance activities) have made the largest negative contributions to services output per hour. In the case of O-Q the negative contribution mainly reflects hours rising faster than output, particularly over the period 2008-11. In the case of K, the negative contribution mainly reflects falling output over the whole period since 2008, not matched by falls in hours worked.

Industry L (Real estate activities) has made the largest positive contribution to services output per hour since 2008. This mainly reflects growth of imputed value-added from owner-occupied housing., for which there is no corresponding labour input.

Figure 14: Cumulative contributions to quarter on quarter growth of services output per hour

Seasonally adjusted

Source: Office for National Statistics

Notes:

- G,H,I refers to Wholesale and retail trade; repair of motor vehicles and motorcycles (G), Transportation and storage (H) and Accommodation and food service activities (I).

- J refers to Information and communication.

- K refers to Financial and insurance activities.

- L refers to Real Estate activities.

- M,N refers to Professional, scientific and technical activities (M), Administrative and support service activities (N).

- O,P,Q refers to Government Services.

- R,S,T,U refers to Other Services.

Download this chart Figure 14: Cumulative contributions to quarter on quarter growth of services output per hour

Image .csv .xlsMore information on labour productivity of services industries is available in Tables 5 and 6 in the Reference Tables section of this release, and in the tables at the end of the PDF version of this statistical bulletin.

In general, the dispersion of labour productivity growth rates across service industries is less pronounced than within manufacturing. At face value, the dispersion of productivity levels is more pronounced. However, it should be borne in mind that labour productivity in industry L is affected by the National Accounts concept of output from owner-occupied housing, which adds to the numerator but without a corresponding component in the denominator. Excluding this industry, output per job (Table 5) varied from £21.6k in Accommodation & food services (section I) to £106.2k in Finance & insurance (section K) in 2011. These industries were also at the bottom and top of the productivity distribution in terms of output per hour (Table 6).

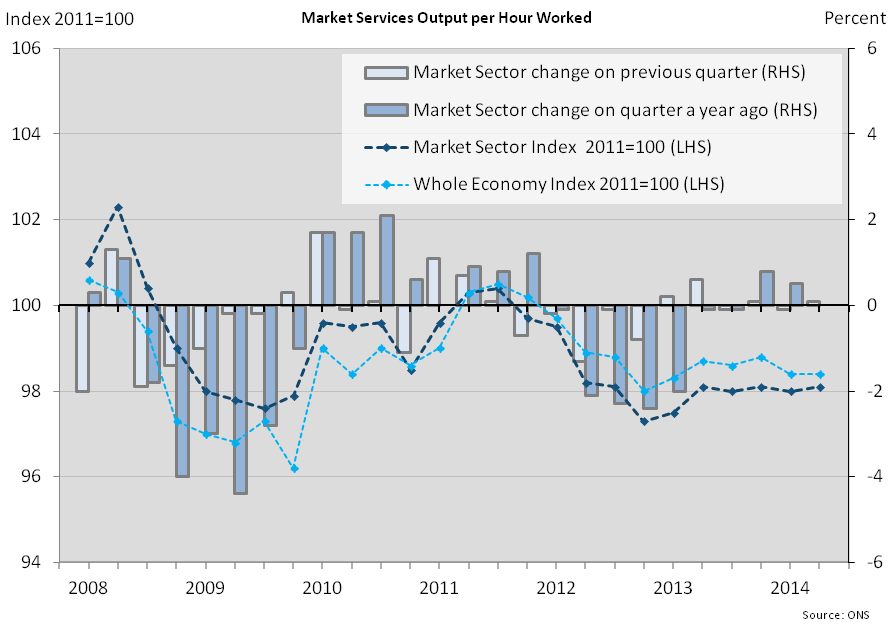

Back to table of contents9. Market sector (experimental statistics) labour productivity

Figure 15 shows movements in labour productivity in the market sector with the whole economy series plotted for comparison purposes. In the latest data, market sector output per hour fell less than the whole economy estimate during the downturn. Since 2012, the paths of the two series have been similar, with market sector output per hour falling a little more than the whole economy estimate.

Figure 15: Market sector output per hour

Seasonally adjusted

Source: Office for National Statistics

Download this image Figure 15: Market sector output per hour

.png (60.1 kB) .xls (1.8 MB)Longer time series on market sector labour productivity are available in Table 7 of the Reference Tables section of this release, and in the tables at the end of the PDF version of this statistical bulletin.

Back to table of contents