1. Main points

London and the South East outperform other UK regions and countries in terms of productivity, human capital and wages, with little indication of the other regions and countries catching up.

Once housing costs are considered London is only slightly above the UK average level for household income, while the South East has the highest household income.

London tends to underperform on socio-economic variables such as cost of living, wealth inequality, and the personal well-being indicators.

The South East is the least unequal region of UK in terms of within-region wealth inequality using the Gini coefficient.

The South West and Northern Ireland ranked the highest for personal well-being indicators such as life satisfaction, feeling worthwhile and happiness.

2. Introduction

Typically the economy is considered at an aggregate level to judge the economic experience of individuals within a country. While aggregate measures like gross domestic product (GDP) provide valuable insights, they often mask the disparities between the experience of individuals living in different regions and countries of the UK. In this respect regional indicators give us more insight. Within the UK, Nomenclature of Territorial Units for Statistics (NUTS) areas and local administrative units (LAUs) can be used to identify regions and countries of the UK at a different level of detail.

In this article, we look at the regional picture for the UK at the NUTS 1 level¹, to give an understanding of how UK regions and countries vary in economic performance with respect to each other, and how this trend has changed over time. There is also an interactive tool for users to look at some personal well-being indicators such as life satisfaction, feeling worthwhile, happiness, and anxiety at a local area level.

With the government focusing on addressing regional disparities, such analysis is useful for identifying the lagging regions and countries. This analysis is valuable in helping us understand the economic and social experiences of the individuals living in different parts of the UK, and can ultimately help reduce the disparities within and between regions and countries.

Notes for Introduction

- NUTS 1 refers to the 9 regions of England (North East, North West, Yorkshire and The Humber, East Midlands, West Midlands, East of England, London, South East, South West), and the countries of Scotland, Wales, and Northern Ireland.

3. Macroeconomic variables

The macroeconomic variables we will consider are:

- estimates of productivity (in terms of output per hour)

- average (median) earnings

- an indicator for human capital

- household costs

- household income

London is by far the most productive and best-paid region

Gross value added (output) per hour gives an estimate for productivity across the NUTS 1 regions. That is, the greater the output per hour estimate for a region or country, the more productive it is. Economic theory stipulates that, all things being equal, higher productivity is associated with higher wages. A possible explanation for this is that, theoretically, an increase in worker productivity can lead to an increase in the demand for labour (all else constant) which should ultimately lead to an increase in wages (marginal productivity theory of wages¹).

This positive correlation can also be explained by the efficiency wage hypothesis. This hypothesis claims that firms will offer a wage greater than that of the labour market clearing wage to incentivise workers to increase their labour productivity. One potential driver for output per hour is capital investment. When considering the neoclassical production function, a greater stock of capital will increase the marginal productivity of labour, all else being equal. In practice, the relationship between productivity and wages is less straightforward.

Figure 1: Productivity and earnings are the highest in London and the South East

Nominal output per hour (all industries) and nominal median hourly earnings, indexed UK=100, NUTS 1 regions, 2018

Source: Office for National Statistics

Notes:

- Figures are based on where people work and not where they live. There will be people working in London who will not live there and will not necessarily be commuting from the South East.

- This chart compares regional performance with the UK average for two different concepts that have different collection and compilation methods. Please take caution when comparing the measures within each particular region.

Download this chart Figure 1: Productivity and earnings are the highest in London and the South East

Image .csv .xlsLondon and the South East were the top performers for output per hour and median hourly earnings.

The performance of regions and countries relative to the UK has generally stayed steady between 1998 and 2018. This means that the other regions and countries are not catching up with London and the South East. Some other points to note are:

- productivity and wages in London have been continuously higher (relative to the UK) than all other regions or countries, with the highest relative performance occurring in 2007 (36% above the UK average) and the highest relative median hourly earnings in 2011 (40% above the UK average)

- between 1998 and 2018, the NUTS1 regions with the lowest productivity and earnings were Wales and Northern Ireland

- the largest ratio between the highest (London) and lowest (Northern Ireland) annual estimates of productivity was in 2007, at 1.69, and for median hourly earnings was in 2010, at 1.58

- productivity in London (relative to the UK) increased between 1998 and 2007, and then gradually stalled following the 2008 economic downturn

- between 1998 and 2018, productivity in the East of England, relative to the UK average, declined from 96.7 to 95.0

- productivity in Scotland, relative to the UK average, increased from 89.7 in 1998 to 96.8 in 2018.

Figure 2: The gap between the regions and countries for productivity and wages has remained steady over time

Output per hour (all industries), constant price (CVM) (2016), and median hourly earnings, indexed UK=100, NUTS 1 regions, 1998 to 2018

Embed code

Notes

- Because we do not have figures for regional prices, we have used the UK level consumer price indices to deflate earnings. Indexing means that both the real and nominal values are the same.

- The data represent relative performance, so an increase in productivity in one region over time does not necessarily reflect growth in productivity for that region, but an improvement in performance relative to the UK.

London has the highest human capital per head across all regions and countries of the UK

Human capital is defined as the stock of skills, knowledge and experience of an individual or population, which can productively be applied in the economy; it is widely referred to as one of the main drivers of economic growth. The methodology for calculating human capital can be found in the Human capital estimates, UK: 2004 to 2018 release. We are in the process of expanding our measure of human capital following the consultation launched in September 2019.

Figure 3: London has the highest real human capital per head for all years between 2004 and 2018

Real human capital per head, Indexed UK=100, NUTS 1 regions and countries, 2004 and 2018

Source: Office for National Statistics

Download this chart Figure 3: London has the highest real human capital per head for all years between 2004 and 2018

Image .csv .xlsLondon and the South East have the highest human capital per head compared with all other regions and countries of the UK. Given that the UK’s high-skill service industries, such as financial services and technology, are concentrated in London, it attracts both domestic and international skilled labour to the region. As skilled labour is mobile, it is likely that people with a higher stock of human capital relocate to regions and countries that pay more and have better job opportunities. Over time, real human capital per head has generally increased for each NUTS1 region.

Figure 4: London had the greatest stock of real human capital per head for degree holders for all years between 2004 and 2018

Real human capital for individuals with degree or equivalent, per head (£ thousands, 2018 prices), NUTS 1 regions, 2004 and 2018

Source: Office for National Statistics

Download this chart Figure 4: London had the greatest stock of real human capital per head for degree holders for all years between 2004 and 2018

Image .csv .xlsLondon also has the highest real human capital per head estimate for people with a degree or equivalent qualification. The real human capital per head estimate for these individuals was lower in 2018 compared with 2004 for all regions and countries of UK. The differences across regions and countries in Figures 3 and 4 may be partially attributed to differences in the population composition, such as the average age of the economically active population in each region and country, and the amount of occupational mismatch for those with differing qualifications.

London residents spend a higher proportion of their household income on housing costs

Regions and countries with higher household income are also likely to have a higher household consumption³. This positive relationship is well established within economic theory, represented for example, by the Keynesian consumption function (Keynes, 1936)⁴. However, if the households in a certain region experience a higher cost of living, their residual income after housing costs will reduce, despite the higher income.

While London ranks top in performance of macroeconomic variables such as productivity, wages and human capital, the residents pay a higher proportion of their household income on housing costs. Between financial years ending (FYE) 2015 and 2017, housing costs (as measured by the median household weekly private rent) accounted for 43% of median weekly equivalised household income in London, compared with 21% in Northern Ireland.

Figure 5: London residents spend a higher proportion of their household income on housing costs

Ratio of median household weekly private rent to median weekly equivalised household income as a percentage², NUTS 1 regions, three-year average FYE 2015 to FYE 2017

Source: Department for Work and Pensions

Download this chart Figure 5: London residents spend a higher proportion of their household income on housing costs

Image .csv .xlsSome other things to note are:

- household weekly private rent in London was lower in FYE 2017 (£230), than FYE 2016 (£247) and FYE 2015 (£239)

- between FYE 2015 and 2017, weekly private rent rose in the South West, South East, West Midlands, North East, Scotland, and Northern Ireland, possibly because of strong growth in the housing market

The fall in median household weekly private rent in London between FYE 2017 and FYE 2016 could be partly explained by a steady fall in the growth in the House Price Index (HPI) and the Index of Private Housing Rental Prices (IPHRP) during this period. The volume of sales also declined during this period, partly the result of changes in stamp duty introduced in April 2016, and a slowdown in the buy-to-let market. For more details on the London housing market please see the Exploring recent trends in the London housing market article.

London is no longer the region with the highest household income, once housing costs are considered

The Department for Work and Pensions (DWP) publishes the Households below average income release. This contains information on equivalised disposable household income adjusted for household size and composition (called equivalisation), estimated on both a before and after housing costs basis. A better way to look at the difference in income between regions and countries is to use this equivalised household income and compare estimates both before and after housing costs.

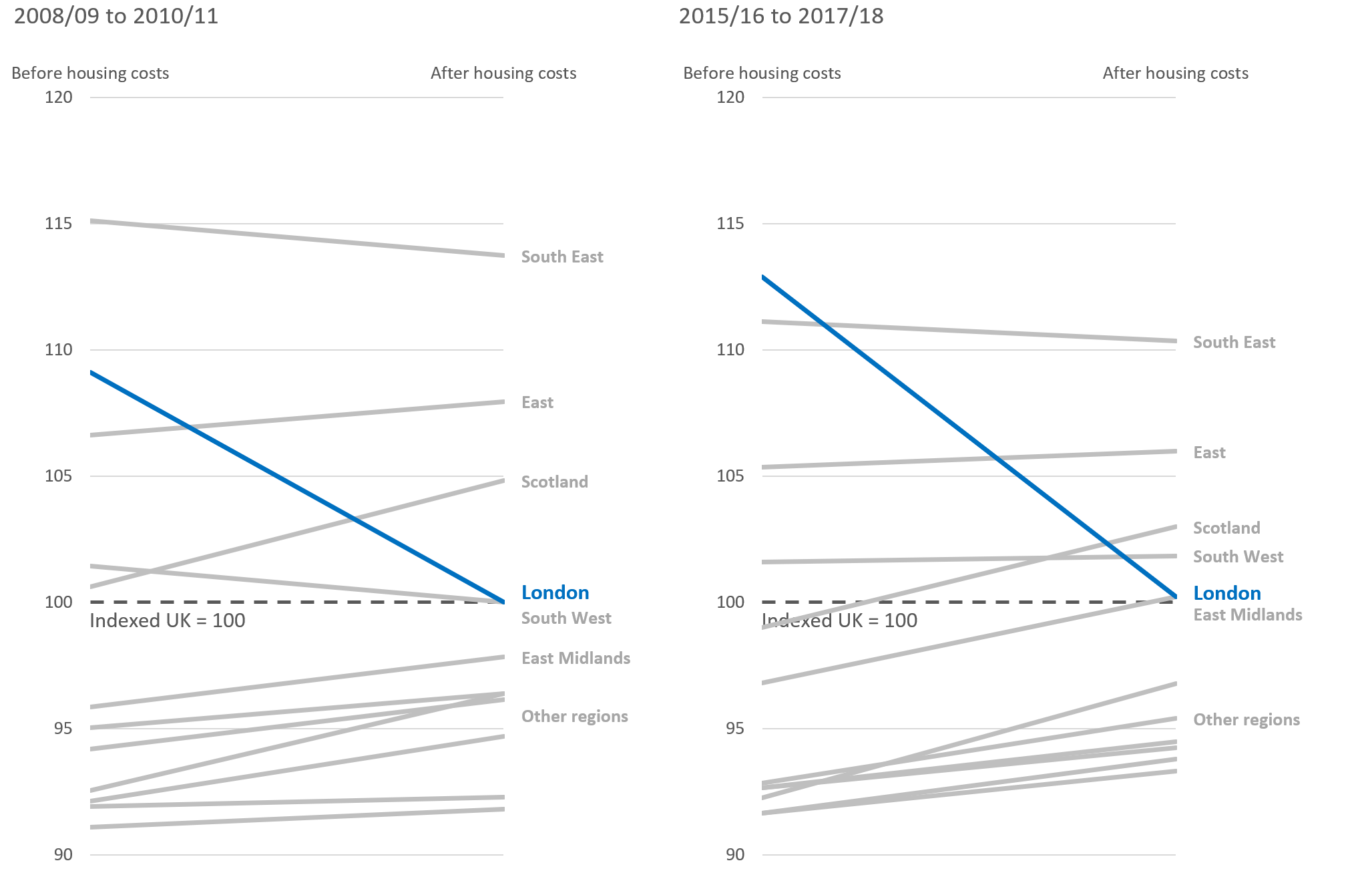

Figure 6 shows that before housing costs are accounted for, London has the highest median weekly household income, but after housing costs are considered, the South East overtakes it. London is only slightly above the UK average household income after considering housing costs, while the South East, East of England, Scotland, and South West regions or countries are above the UK average.

The East Midlands is below the UK average in terms of equivalised household income before housing cost, but is just above the average when housing costs are considered. Northern Ireland, Yorkshire and The Humber, the North West, West Midlands, Wales, and the North East remain below the UK average even after taking housing costs into consideration.

The difference between household income before and after housing costs has worsened for London between FYE 2009 to FYE 2011 and FYE 2016 to FYE 2018. An increase in housing costs can be partially explained by a shortage of housing supply relative to the demand. This shortage was much greater in London and the South East resulting in higher housing costs in these regions. Despite growth in the amount of homes supplied (PDF, 1.49MB) in recent years, housing demand has remained strong and continued to outstrip housing supply in these regions.

Figure 6: London is only slightly above the UK average household income after considering housing costs

Median weekly equivalised household income for all individuals in average FYE 2018 prices, indexed UK=100, NUTS 1 regions, FYE 2009 to FYE 2011 and FYE 2016 to FYE 2018

Source: Department for Work and Pensions

Download this image Figure 6: London is only slightly above the UK average household income after considering housing costs

.png (118.9 kB)This analysis does not include commuting costs. Both housing and commuting costs are important for the South East as London is a big employment centre for the region.

Notes for Macroeconomic Variables

- Pullen, J (2009), 'The Marginal Productivity Theory of Distribution: A Critical History', June 2009

- Assuming marginal propensity to consume is constant across the NUTS 1 regions.

-

- Keynes, J M (1936), 'The General Theory of Employment, Interest and Money', February 1936

4. Economic and personal well-being indicators

The Wealth and Assets Survey calculates the total wealth in Great Britain, which can shed some light on the wealth inequality within the different regions and countries. Data for Northern Ireland is unavailable, so the analysis focuses on Great Britain. Aggregate total net wealth is an estimate of the value of wealth held by all private households in Great Britain, including net property, net financial, private pension and physical wealth.

London is the most unequal region of Great Britain for wealth inequality

A common measure of calculating inequality within regions and countries is the Gini coefficient. The Gini coefficient can have a value between 0% (no inequality) and 100% (total inequality). Figure 7 shows, that for April 2016 to March 2018, London had the highest Gini coefficient (70%) in Great Britain and as such was the most unequal region in terms of wealth. In the same period, the South East had the lowest (58%) Gini coefficient and so is the least unequal region of Great Britain.

One thing to note is that the Gini coefficient does not reveal the source of inequality. Many factors, including demographic variations by region, can result in higher inequality. Other things to note in Figure 7 are:

- for the periods shown, the Gini coefficient varies for UK regions and countries, from 54% to 70%

- the North East had the second highest Gini coefficient (64%), while having the lowest value for aggregate total wealth from April 2016 to March 2018

- although the South East had the highest aggregate total wealth from April 2016 to March 2018, it was the least unequal region in Great Britain

- in contrast, London had the second highest aggregate total wealth and yet was the most unequal region in Great Britain

- Scotland and the South East, and to a lesser extent the West Midlands and the East of England, are the only NUTS 1 regions to have a lower Gini coefficient in April 2016 to March 2018 than when previously measured in July 2006 to June 2008

- the gap in Gini coefficients between London and the rest of the regions and countries of Great Britain has increased between July 2006 to June 2008, and April 2016 to March 2018

Figure 7: London is the most unequal region in terms of wealth inequality

Gini coefficients for total wealth, NUTS 1 regions¹, July 2006 to June 2008, and April 2016 to March 2018

Source: Office for National Statistics

Notes:

- Data for Northern Ireland are unavailable

Download this chart Figure 7: London is the most unequal region in terms of wealth inequality

Image .csv .xlsWhile London outperformed other NUTS1 regions of the UK in terms of macroeconomic variables such as productivity, human capital, and wages, once housing costs are considered, and looking at socio-economic variables like wealth inequality, London underperforms.

London underperforms on personal well-being indicators compared with other regions and countries of the UK

Our personal well-being explorer tool in Figure 8 allows you to observe well-being in one local area and compare it with other areas. Some of the most insightful comparisons may relate to how specific areas have progressed over time. For more information on well-being please see the Personal and economic well-being in the UK: February 2020 bulletin.

Figure 8: Personal well-being interactive map

Average ratings, UK, years ending March 2012 to March 2019

Embed code

It is possible to rank local authorities based on their average scores alone but this may be misleading for various reasons, such as different sample sizes, different confidence intervals and mode effects, and not comparing like with like (for example, we know that people in rural areas tend to rate their well-being more highly than people in urban areas). Comparisons between areas should be made with caution.

Focusing only on the NUTS 1 regions, the ratings for life satisfaction, feeling worthwhile, and happiness have generally increased between 2012 and 2019, while anxiety has generally decreased. In 2019, London ranked the lowest for life satisfaction and feeling worthwhile, and the highest for anxiety, while the South West and Northern Ireland ranked the highest for life satisfaction, feeling worthwhile and happiness.

London's underperformance on well-being indicators such as life satisfaction, feeling worthwhile and anxiety maybe because residents face a relatively high cost of living, higher commute times with an overcrowded transport network, and experience relatively higher levels of atmospheric pollution. In recent years London’s performance on life satisfaction has increased.

Notes for Economic and personal well-being indicators

- Calculated from the Lorenz curve (plot of the cumulative share of household income against the cumulative share of households). The Gini coefficient is the area between the Lorenz curve of the income distribution and the diagonal line of complete equality, expressed as a proportion of the triangular area between the curves of complete equality and inequality.