Table of contents

- Main points

- Things you need to know about this release

- The UK’s current account balance deficit widened to 4.9% of GDP in Quarter 3 2018

- The UK recorded its largest net inflows in over two years in Quarter 3 2018

- The UK net international investment position narrows in the latest quarter

- Quality and methodology

1. Main points

The UK’s current account deficit widened by £6.6 billion to £26.5 billion in Quarter 3 (July to Sept) 2018, or 4.9% of gross domestic product (GDP) – the largest deficit recorded since Quarter 3 2016 in both value and percentage of GDP terms.

All of the main components contributed to the worsening current account balance, with worsening primary income, trade and secondary income balances.

The primary income balance deficit worsened by £3.6 billion to £11.1 billion in Quarter 3 2018, driven by an increase in the profits generated by overseas investors on their UK foreign direct investment (FDI).

Partially offsetting the decline in the primary income balance was a continued increase in the UK’s income from overseas currency deposits – attributable to rising overseas interest rates.

The UK’s overall trade balance deficit widened by £1.8 billion to £8.8 billion, mainly due to a fall in the UK’s trade in services surplus.

The UK attracted net financial inflows to finance its overall current (and capital) account deficit in Quarter 3 2018; this was mainly achieved through net portfolio investment inflow, with UK investors divesting foreign equities, along with increases in equity and debt security liabilities accrued by UK residents with the rest of the world.

The value of the UK’s international liabilities fell by more than the fall recorded in the value of assets, resulting in the UK’s net liabilities reducing to £113.7 billion at the end of Quarter 3 2018.

2. Things you need to know about this release

In accordance with the National Accounts Revisions Policy, the revision period for this release is open from Quarter 1 (Jan to Mar) 2017. Revisions from Quarter 1 2017 reflect the introduction of annual benchmarks from the 2017 Foreign Direct Investment (FDI) Survey and the Financial Inquiries Surveys, new and revised survey data, new estimates from the Bank for International Settlements and a reassessment of seasonal factors.

The FDI Survey has also published revised data for 2016 but they are not reflected in this release due to the length of the revisions window. These revisions will be taken on when the revisions window is open for 2016 when we publish the Balance of payments Quarter 2 (April to June) 2019 release on 30 September 2019. Indicative estimates of the revisions to FDI asset and liability positions and income for 2016 are available in an annex of the latest FDI statistical bulletin.

A brief introduction to the UK Balance of Payments (PDF, 92KB) and glossary (PDF, 123KB) provides an overview of the concepts and coverage of the UK Balance of Payments using the Balance of Payments Manual sixth edition.

Further information on the methods are available in the Balance of payments (BoP) Quality and Methodology Information (QMI) report.

Also available is an overview of how movements in foreign exchange rates can impact the balance of payments and international investment position.

Estimates derived from the International Passenger Survey (IPS) are used to help measure exports and imports of travel services. The IPS has recently transferred data collection from paper forms to tablet computers. Analysis of IPS data has detected no discontinuities as a result of the change in data collection mode, therefore we have replaced forecasts used in recent periods with IPS data within headline trade estimates. Please see our Travel and Tourism release for more information about IPS.

Throughout this release Quarter 1 refers to January to March, Quarter 2 refers to April to June, Quarter 3 refers to July to September and Quarter 4 refers to October to December.

Back to table of contents3. The UK’s current account balance deficit widened to 4.9% of GDP in Quarter 3 2018

The UK’s current account deficit – a measure of the country’s balance of payments with the rest of the world in trade, primary income and secondary income – widened to £26.5 billion in Quarter 3 (July to Sept) 2018, or 4.9% of gross domestic product (GDP). The current account deficit in the latest quarter is the largest recorded since Quarter 3 2016 and has widened by £6.6 billion when compared with the revised deficit of £20.0 billion (3.8% of GDP) for Quarter 2 (Apr to June) 2018 (Figure 1).

Figure 1: UK current account balances as a percentage of gross domestic product

Quarter 4 (Oct to Dec) 2015 to Quarter 3 (July to Sept) 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 1: UK current account balances as a percentage of gross domestic product

Image .csv .xlsThe widening of the current account deficit in Quarter 3 2018 reflects deteriorations in the balances of all major components of current account:

the total trade account deficit widened by £1.8 billion to £8.8 billion

the primary income account deficit widened by £3.6 billion to £11.1 billion

the secondary income account deficit widened by £1.2 billion to £6.6 billion

The UK’s trade deficit worsened in Quarter 3 2018

The UK’s international trade deficit widened to £8.8 billion in Quarter 3 (July to Sept) 2018, from a deficit of £7.0 billion in Quarter 2 (Apr to June) 2018. The latest deficit is the highest recorded since Quarter 3 2016 and is mainly due to a fall in the UK trade in services surplus. In addition, the trade in goods deficit also saw a small increase (Figure 2).

Figure 2: UK trade in goods and services balances (seasonally adjusted)

Quarter 4 (Oct to Dec) 2015 to Quarter 3 (July to Sept) 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 2: UK trade in goods and services balances (seasonally adjusted)

Image .csv .xlsThe UK’s trade in services surplus decreased to £26.2 billion in Quarter 3 2018, compared with a revised surplus of £27.6 billion in Quarter 2 2018. The fall in the surplus was due to a fall in exports that was coupled with a rise in imports. The main contributions to the decline in exports were falls in exports of financial services, which fell by £1.5 billion, and intellectual property services, which fell by £0.5 billion. These decreases were slightly offset by exports of other business services, which increased by £0.7 billion.

Also reducing the UK’s trade in services surplus was an increase in services imports, which rose by £0.3 billion in Quarter 3 2018. This was mainly attributable to an increase of travel services imports – up £0.5 billion on the quarter – which was partially offset by smaller decreases elsewhere.

The trade in goods deficit also widened by £0.4 billion to £35.0 billion in Quarter 3 2018, which was due to the increase in imports (up £3.3 billion) exceeding that of exports (up £2.9 billion). Imports of all broad commodities except for the import of unspecified goods saw an increase in the latest quarter, with the imports of oil and finished manufactured products – particularly mechanical and electrical machinery – seeing the largest increases. Partially offsetting these increases was a fall in the import of unspecified goods.

Similarly, the largest increases in goods exports were finished manufactured goods – mainly mechanical machinery – which rose by £1.7 billion, and oil, which increased by £1.4 billion.

Notes for: Trade

- Users of the balance of payments and international investment position should be aware that the data in this release is all in current prices, over time price inflation will naturally lead to an increase in values.

The primary income balance widened to its largest deficit since Quarter 2 2016

The primary income balance deficit – which records income the UK receives and pays on financial and other assets, along with compensation of employees – widened by £3.6 billion to £11.1 billion in Quarter 3 (July to Sept) 2018, the largest deficit recorded since Quarter 2 (Apr to June) 2016 (£13.9 billion). The UK’s net income on foreign direct investment was the driver behind the worsening primary income balance, with balances on the other two components – portfolio and other investment incomes – improving (Figure 3).

Figure 3: UK primary income account balances (seasonally adjusted)

Quarter 4 (Oct to Dec) 2015 to Quarter 3 (July to Sept) 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 3: UK primary income account balances (seasonally adjusted)

Image .csv .xlsThe widening primary income deficit was due to an increase in incomes payable (debits) to overseas investors on their UK-based investments, which increased by £5.1 billion to £64.8 billion in Quarter 3 2018. Partially offsetting the rise in income payments to overseas investors was a rise in income received by UK residents on their investments abroad (credits), which increased by £1.5 billion to £53.7 billion.

Falling net FDI earnings were the main contributor to the worsening primary income balance

The main driver behind the worsening primary income balance was net income on foreign direct investment (FDI). This saw a sharp rise in the amount overseas investors generate on their UK-based FDI (debits), which rose by £5.4 billion to £24.8 billion in Quarter 3 (July to Sept) 2018 – the largest quarterly value recorded since comparable records began in 1997. The pick-up in debits in the latest quarter reflects a broad improvement in the profitability of UK-based investments.

The value of FDI debits has seen a broad upward rise since 2010, reflecting both resilient returns generated by foreign-owned UK businesses, along with continuing inward mergers and acquisitions activity, particularly in 2016.

The rise in FDI debits in recent quarters has also offset some of the recovery recorded in the earnings by UK investors on their overseas FDI, which reached £24.4 billion in Quarter 3 2018. While the latest quarter’s FDI credits are £1.6 billion lower than the same quarter one year ago, they remain well above the low recorded in Quarter 1 2016 – largely explained by an improvement in the profitability of the UK’s overseas assets.

The increases in the value of FDI debits, along with declines in the FDI credits, have resulted in the FDI income balance declining over the past four quarters and reaching a negative balance of £0.4 billion in Quarter 3 2018. The last time the FDI earnings balance was in deficit was in Quarter 2 (Apr to June) 2016 (Figure 4).

Figure 4: Quarterly foreign direct investment earnings (seasonally adjusted)

Quarter 4 (Oct to Dec) 2011 to Quarter 3 (July to Sept) 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 4: Quarterly foreign direct investment earnings (seasonally adjusted)

Image .csv .xlsIncome on other investment contributed positively to the primary income balance

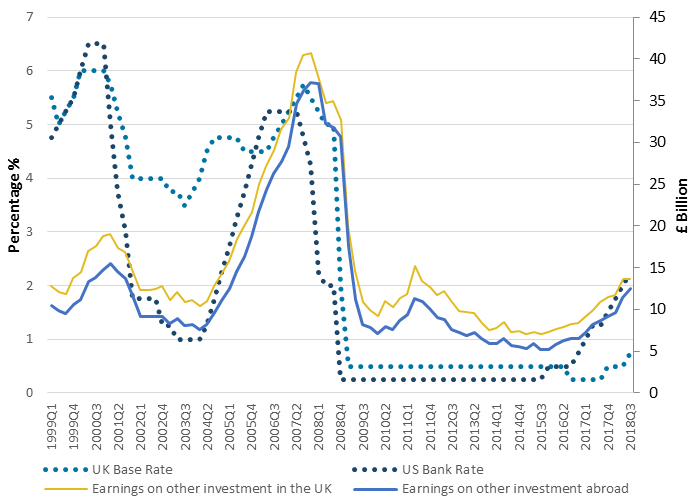

While net FDI income contributed negatively to the overall primary income balance in Quarter 3 (July to Sept) 2018, other major components recorded improvements in their balances. The largest positive contribution to the overall primary income balance was earnings on other investment abroad (credits), which increased by £1.1 billion to £12.6 billion in Quarter 3 2018 – the highest since Quarter 1 (Jan to Mar) 2009 (£17.6 billion).

The “other investment” functional category records international transactions related to currency and deposits, trade credit, loans, and other assets and liabilities. The two main components are deposits and loans, the earnings on which are influenced by interest rates.

The latest increase in other investment credits in Quarter 3 2018 continues the upward trend seen in the series since Quarter 4 (Oct to Dec) 2015, with nearly two-thirds of the increase since then being attributable to increases in income on foreign currency deposits. The rise in credits over this period coincides with a gradual increase in US interest rates by the Federal Reserve, which have incrementally risen from 0.25% in Quarter 2 (Apr to June) 2015 to 2.25% in Quarter 3 2018. A rise in US interest rates is expected to increase the income payments recorded in the balance of payments, as financial institutions increase the interest rate offered to depositors.

Other investment debits have also increased since Quarter 3 2015, although the increase has been more subdued, with a decline in Quarter 3 2018 (Figure 5). While UK interest rates are expected to play a larger role in other investment debits, overseas interest rates, particularly those in the US, will also play a role given the UK’s position as a financial centre, where foreign currencies and bonds are held and traded.

Figure 5: Base rate and earnings on other investment abroad and in the UK (seasonally adjusted)

Quarter 1 (Jan to Mar) 1999 to Quarter 3 (July to Sept) 2018

Source: Office for National Statistics, Bank of England and the Federal Reserve

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this image Figure 5: Base rate and earnings on other investment abroad and in the UK (seasonally adjusted)

.png (52.5 kB) .xlsx (22.9 kB)4. The UK recorded its largest net inflows in over two years in Quarter 3 2018

The UK has run a current account deficit in each quarter since Quarter 3 (July to Sept) 1998, or 1983 when considering annual totals. A current (and capital) account deficit places the UK as a net borrower with the rest of the world, indicating that overall expenditure in the UK exceeds national income. The UK must attract net financial inflows to finance its current (and capital) account deficit, which can be achieved through either disposing of overseas assets to overseas investors, or accruing liabilities with the rest of the world.

The total financial account showed a larger net inflow (that is, more money flowing into the UK) of £34.1 billion in Quarter 3 2018; an increase from the revised net inflow of £10.4 billion in Quarter 2 (Apr to June) 2018 (Figure 6). The net inflow in the latest quarter reflected a larger disinvestment of UK overseas assets relative to overseas investors’ disinvestment of UK-based assets.

Figure 6: UK financial account balances (not seasonally adjusted)

Quarter 4 (Oct to Dec) 2015 to Quarter 3 (July to Sept) 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec). Total includes reserve assets.

Download this chart Figure 6: UK financial account balances (not seasonally adjusted)

Image .csv .xlsPortfolio investment was the main negative component of UK net inflows in Quarter 3 2018, with a net inflow of £51.5 billion. This was mainly due to overseas residents increasing their holdings of UK equities (£10.0 billion) and debt securities (£34.5 billion). In addition, UK residents continued to reduce their portfolio investment assets by £7.0 billion – the fifth consecutive quarterly net disinvestment. The latest quarter’s disinvestment was mainly due to UK residents reducing their exposure to foreign equities (£26.9 billion), which have been at recent highs, partially offset by increased holdings of foreign debt securities (£19.9 billion).

Direct investment recorded a net outflow (that is, UK overseas investment exceeded overseas investment into the UK) of £4.1 billion in Quarter 3 2018 – the first net outflow since Quarter 3 2017. The positive outflow was due to increases in equity acquisitions and reinvested earnings by UK investors overseas, and a relatively low amount of foreign direct investment (FDI) inflows in the latest quarter – in part reflecting a fall in inward mergers and acquisitions activity relative to recent quarters. While the latest estimate for FDI inflows in Quarter 3 2018 inflows (£8.5 billion) is the lowest recorded since Quarter 3 2015, it is worth noting that flows data can be volatile and can be dominated by one or two large transactions in any one quarter.

Net other investment was virtually zero in Quarter 3 2018. UK residents reduced their foreign other investment assets by £96.2 billion in Quarter 3 2018, mostly withdrawing deposits from foreign banks. This was almost fully offset by non-residents reducing their other investment assets by £96.1 billion in Quarter 3 2018. This was due to a combination of non-residents withdrawing deposits at UK banks and UK other financial institutions reducing their short-term loans with non-residents.

Financial derivatives and employee stock options showed net settlement receipts of £13.4 billion in Quarter 3 2018, following net settlement payments of £10.4 billion in Quarter 2 2018.

Back to table of contents5. The UK net international investment position narrows in the latest quarter

The international investment position (IIP) – which measures the UK’s international balance sheet with the rest of the world – recorded decreases in both the value of the UK’s overseas assets and its liabilities.

The UK’s stock of overseas assets was valued at £10.9 trillion at the end of Quarter 3 (July to Sept) 2018 (down £60 billion), while UK liabilities to overseas residents were valued at £11.0 trillion (down £155.1 billion). The larger decline in the value of the UK’s international liabilities compared with assets resulted in the UK’s net external liabilities (that is, liabilities exceeding assets) falling to negative £113.7 billion at the end of Quarter 3 2018, down from negative £208.9 billion at the end of Quarter 2 (Apr to June) 2018 (Figure 7).

Figure 7: UK international investment position (not seasonally adjusted)

Quarter 4 (Oct to Dec) 2015 to Quarter 3 (July to Sept) 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 7: UK international investment position (not seasonally adjusted)

Image .csv .xlsThe decrease in the value of UK assets mainly reflected falls in the value of financial derivatives (down £91.7 billion) and other investment (down £60.7 billion) – with the latter mainly reflecting a fall in the stock of currency and deposits held by UK residents overseas due to disinvestment (see financial account commentary in Section 4). Partially offsetting the decline in the value of overseas UK assets was a rise in the value of overseas portfolio investment, which was mainly attributable to increased overseas stock prices and the value of currency deposits due to exchange rates. In addition, foreign direct investment (FDI) stocks also increased, which coincided with a positive outflow in the financial account.

Similar to assets, the falls in the value of UK liabilities were also attributable to financial derivatives (down £103.9 billion) and other investment (down £74.4 billion) – with the latter mainly reflecting a reduction in short-term loans by overseas residents to the UK. Partially offsetting these falls was a rise in the value of portfolio investment and FDI held by overseas residents in the UK.

Back to table of contents6. Quality and methodology

The Balance of payments (BoP) Quality and Methodology Information report contains important information on:

the strengths and limitations of the data and how it compares with related data

uses and users of the data

how the output was created

the quality of the output including the accuracy of the data