Table of contents

- Main points

- Summary

- Understanding this release

- The latest public sector net borrowing position

- The latest public sector net debt position

- Net borrowing and debt statistics compared with OBR forecast

- International comparisons of borrowing and debt

- Public sector net cash requirement

- Central government receipts and expenditure

- Recent events and forthcoming methodological changes

- Revisions since previous bulletin

- New to the bulletin

- Consultation with users

- Changes to publication schedule for economic statistics

- Background notes

1. Main points

The data in this bulletin presents the latest fiscal position of the UK public sector as at 30 September 2016 and so includes 3 months of post-EU referendum data. However, estimates for the latest period always contain a substantial forecast element and the figures have to be considered in this light.

Public sector net borrowing (excluding public sector banks) decreased by £2.3 billion to £45.5 billion in the current financial year-to-date (April to September 2016), compared with the same period in 2015.

Public sector net borrowing (excluding public sector banks) increased by £1.4 billion to £10.6 billion in September 2016, compared with September 2015.

Public sector net debt (excluding public sector banks) at the end of September 2016 was £1,638.5 billion, equivalent to 83.9% of gross domestic product (GDP); an increase of £39.5 billion compared with September 2015.

This month debt as a percentage of GDP fell by 0.4 percentage point compared with September 2015. This is the fourth successive month of debt falling on the year as a percentage of GDP and indicates that GDP is currently increasing (year-on-year) faster than net debt excluding public sector banks.

Central government net cash requirement decreased by £9.5 billion to £36.6 billion in the current financial year-to-date (April to September 2016), compared with the same period in 2015.

Due to the volatility of the monthly data, the cumulative financial year-to-date borrowing figures provide a better indication of the progress of the public finances than the individual months.

EU government debt and deficit

On 20 October 2016, we published the latest UK Government Debt and Deficit for Eurostat statistical bulletin, consistent with last month’s public sector finance bulletin (21 September 2016). In this month’s public sector finance bulletin, we present largely unchanged estimates:

- general government deficit (Maastricht borrowing) in the financial year ending March 2016 (April 2015 to March 2016) was £76.2 billion, equivalent to 4.0% of GDP, a downward revision of £0.4 billion or 0.1 percentage point compared with the previous bulletin

- general government gross debt (Maastricht debt) at the end of March 2016 remains unchanged at £1,651.9 billion, equivalent to 87.8% of GDP

Please refer to section 7, International comparisons of borrowing and debt for further detail.

Back to table of contents2. Summary

This section provides a summary of the main messages of this statistical bulletin which you may find helpful. You may also like to receive Twitter updates by following @frasermunropsf. We recently published an article titled The debt and deficit of the UK public sector explained which you may also find useful.

The data in this bulletin presents the latest fiscal position of the UK public sector as at 30 September 2016 and so includes 3 months of post-EU referendum data. However, estimates for the latest period always contain a substantial forecast element and the figures have to be considered in this light.

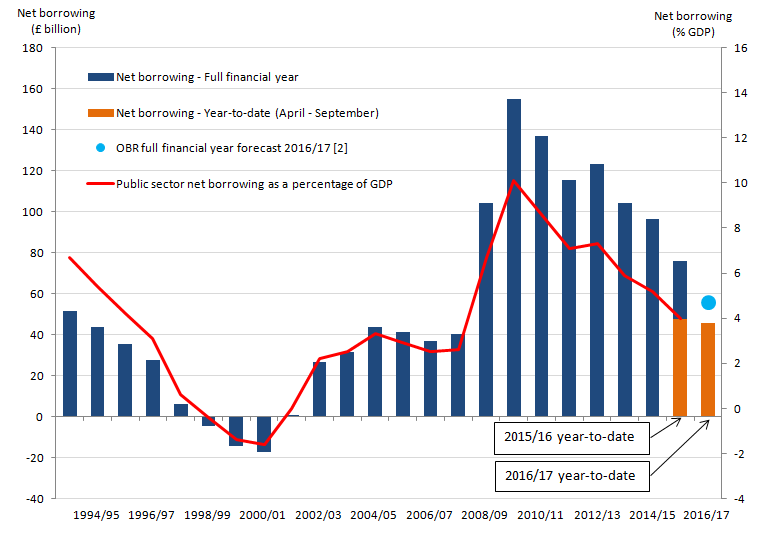

Figure 1: The amount borrowed by the public sector has been falling since the peak in the financial year ending March 2010

UK public sector borrowing, April 1993 to September 2016

Source: Office for National Statistics

Notes:

- Financial year 2016/17 represents financial year ending 2017 (April 2016 to March 2017).

- Office for Budget Responsibility (OBR) full financial year forecast of £55.5 billion for public sector net borrowing excluding public sector banks (March 2016 Economic and Fiscal Outlook).

Download this image Figure 1: The amount borrowed by the public sector has been falling since the peak in the financial year ending March 2010

.png (35.4 kB) .xls (60.4 kB)Public sector borrowing (or deficit)

In September 2016, the public sector spent more money than it received in taxes and other income. This meant it had to borrow £10.6 billion to balance the books.

Of this £10.6 billion, £7.4 billion related to the cost of the “day-to-day” activities of the public sector (the current budget deficit), while £3.2 billion related to the spending on infrastructure (net investment).

In the current financial year-to-date (April to September 2016), the public sector borrowed £45.5 billion. This was £2.3 billion lower than in the previous financial year-to-date (April to September 2015).

Annual borrowing has generally been falling since the peak in the financial year ending March 2010 (April 2009 to March 2010).

In the financial year ending March 2016 (April 2015 to March 2016), the public sector borrowed £76.0 billion. This was £20.2 billion lower than in the previous financial year and less than half of that in the financial year ending March 2010 (both in terms of £ billion and percentage of GDP).

The Office for Budget Responsibility (OBR), which produces economic and fiscal forecasts for government, recorded that the public sector would borrow £72.2 billion during the financial year ending March 2016. So, based on the latest estimate, borrowing in financial year ending March 2016 is £3.8 billion higher than OBR predicted. However, the estimates for the financial year ending March 2016 may still be subject to further revision as elements of provisional data are replaced with finalised and audited data.

OBR have estimated that the public sector will borrow £55.5 billion during the financial year ending March 2017; a reduction of £20.5 billion on the financial year ending March 2016.

Income and spending by central government

Central government’s income and spending make the largest contribution to the amount borrowed by the public sector. In the current financial year-to-date (April to September 2016), central government received £312.7 billion in income. This was around 4% higher than in the previous financial year-to-date (April to September 2015), largely due to receiving more Income Tax, Corporation Tax and National Insurance contributions, along with taxes on production such as VAT and Stamp Duty, compared with the previous year.

Over the same period (April to September 2016), central government spent £348.7 billion; around 2% higher than in the previous financial year-to-date. Of this amount, just below two-thirds was spent by central government departments (such as health, education and defence), around a third on social benefits (such as pensions, unemployment payments, Child Benefit and Maternity Pay) with the remaining being spent on capital investment and interest on the government’s outstanding debt.

Debt

While deficit represents the difference between income and spending over a period of time, debt represents the total amount of money owed at a point in time. Debt has been built up by successive government administrations over many years. When the government borrows, this adds to the debt total. So reducing the deficit is not the same as reducing the debt. The amount of money owed by the government to the private sector stood at £1.6 trillion at the end of September 2016, which equates to 83.9% of the value of all the goods and services currently produced by the UK economy in a year (or GDP).

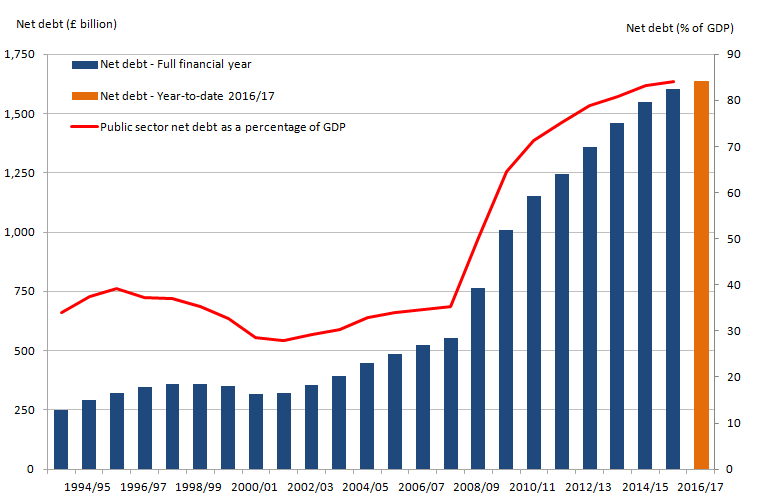

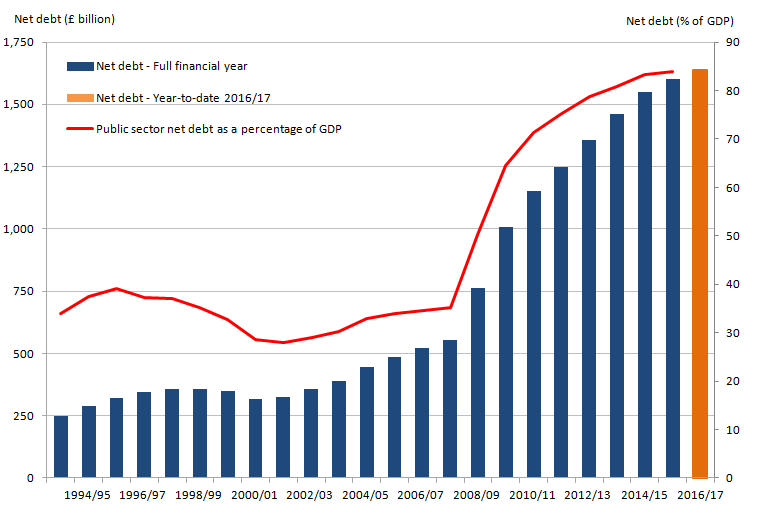

Figure 2 : Public sector debt increased rapidly following the banking crisis in the financial year1 ending March 2008

UK public sector debt, March 1994 to September 2016

Source: Office for National Statistics

Notes:

- Financial year 2016/17 represents financial year ending 2017 (April 2016 to March 2017).

Download this image Figure 2 : Public sector debt increased rapidly following the banking crisis in the financial year^1^ ending March 2008

.png (33.3 kB) .xls (39.9 kB)3. Understanding this release

This statistical bulletin provides important information on the UK government financial position. It enables government, the public, economists and financial analysts to monitor public sector expenditure, receipts, investments, borrowing and debt. By comparing these data with forecasts from the Office for Budget Responsibility (OBR) the current UK fiscal position can be evaluated.

Table 7: Terms to help you understand this release, located in the background notes of this bulletin, is intended to provide you with the important terms needed to understand the data within this bulletin. We recently published an article titled The debt and deficit of the UK public sector explained which you may also find useful.

Headline public sector finances data

This release presents the first estimate of September 2016 public sector finances, along with the financial year-to-date, April to September 2016. While public sector finance data are available on a monthly basis, due to the volatility of the monthly time series, it is often more informative to look at the financial year-to-date or complete financial year data in order to discern underlying patterns. Estimates are revised over time as additional data becomes available.

Table 1 summarises the latest headline public sector finances measures, comparing the latest month and cumulative totals for the financial year-to-date, with the equivalent period in the previous financial year.

Table 1: Headline public sector finances data, by month and full financial year

| UK, excluding public sector banks | £ billion1 (not seasonally adjusted) | |||||

| September | Financial year-to-date7 | |||||

| 2016 | 2015 | Change | 2016/178 | 2015/168 | Change | |

| Current budget deficit2 | 7.4 | 6.7 | 0.8 | 31.9 | 34.7 | -2.7 |

| Net investment 3 | 3.2 | 2.6 | 0.6 | 13.6 | 13.1 | 0.5 |

| Net borrowing 4 | 10.6 | 9.3 | 1.4 | 45.5 | 47.7 | -2.3 |

| Net debt 5 | 1,638.5 | 1,587.7 | 50.8 | 1,638.5 | 1,587.7 | 50.8 |

| Net debt as a percentage of annual GDP6 | 83.9 | 84.3 | -0.4 | 83.9 | 84.3 | -0.4 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Unless otherwise stated. | ||||||

| 2. Current budget deficit is the difference between current expenditure (including depreciation) and current receipts. | ||||||

| 3. Net investment is gross investment (net capital formation plus net capital transfers) less depreciation. | ||||||

| 4. Net borrowing is current budget deficit plus net investment. | ||||||

| 5. Net debt is financial liabilities (for loans, deposits, currency and debt securities) less liquid assets. | ||||||

| 6. GDP at current market price. | ||||||

| 7. Financial year-to-date refers to the period from April to September | ||||||

| 8. 2016/17 refers to financial year ending in March 2017 and 2015/16 refers to financial year ending in March 2016. | ||||||

Download this table Table 1: Headline public sector finances data, by month and full financial year

.xls (33.8 kB)Time series for each component are available in Table PSA1 in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

How the public sector finances fit together

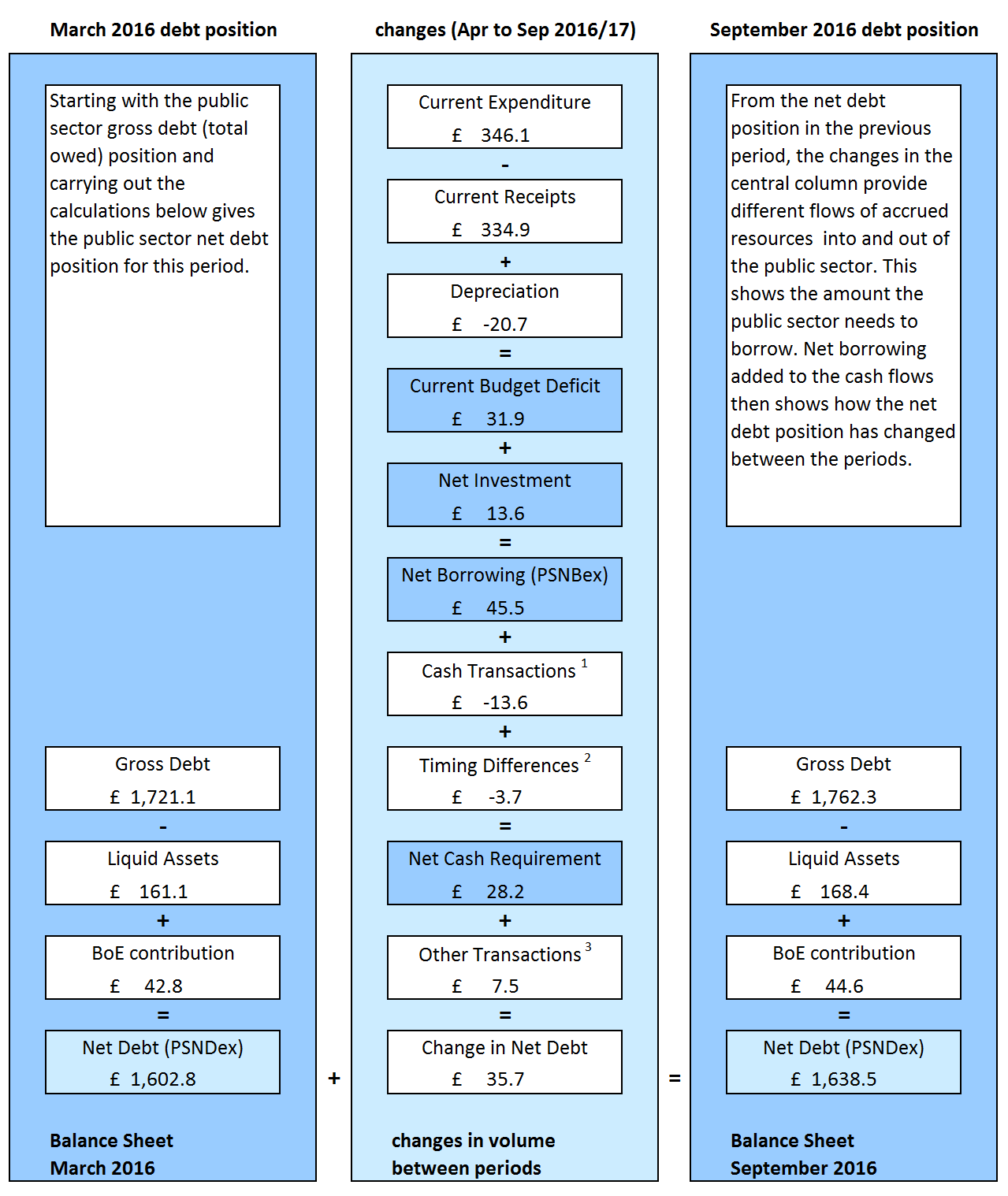

Figure 3 illustrates how the difference in income (often referred to as current receipts) and spending (often referred to as current expenditure) lead to the accumulation of debt.

The headline measures of current budget deficit, net borrowing, net cash requirement and net debt are highlighted in the diagram as they provide the important indicators for the performance of the UK public finances.

When expenditure is greater than income, the public sector runs a deficit, known as the current budget deficit. Net borrowing is made up of the current budget deficit plus net investment (spending on capital less capital receipts). The diagram shows how net borrowing contributes to the change in net debt.

The net cash requirement is closely related to net debt (the amount owed). It is important because it represents the cash needed to be raised from the financial markets to service the government’s borrowing deficit. Changes in net debt between 2 points in time are normally similar to the net cash requirement for the intervening period, though the relationship is not an exact one.

Figure 3: Changes in public sector finances (excluding public sector banks) financial year to date ending 2017 (£ billion)

Source: Office for National Statistics

Notes:

- Cash transactions in (non-financing) financial assets which do not impact on net borrowing.

- Timing differences between cash and accrued data.

- Revaluation of foreign currency debt (for example foreign currency) Debt issuances or redemptions above/below debt valuation (for example Bond premia/discounts and capital uplifts). Changes in volume of debt not due to transactions (for example Sector reclassification).

Download this image Figure 3: Changes in public sector finances (excluding public sector banks) financial year to date ending 2017 (£ billion)

.png (128.2 kB) .xls (41.5 kB)4. The latest public sector net borrowing position

In the UK, the public sector consists of 5 sub-sectors: central government, local government, public non-financial corporations, Bank of England and public financial corporations (that is, public sector banks).

Table 2 summarises the current monthly and financial year-to-date borrowing position of each of these sub-sectors along with the public sector aggregates.

Full time series for these data can be found in Table PSA2 in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

Table 2: Sub-sector breakdown of public sector net borrowing

| UK | £ billion (not seasonally adjusted) | ||||||

| September | Financial year-to-date1 | ||||||

| 2016 | 2015 | Change | 2016/172 | 2015/162 | Change | ||

| General government | 11.6 | 10.0 | 1.6 | 45.8 | 47.8 | -2.1 | |

| of which | |||||||

| Central government | 9.9 | 8.6 | 1.3 | 45.8 | 50.1 | -4.4 | |

| Local government | 1.7 | 1.4 | 0.3 | 0.0 | -2.3 | 2.3 | |

| Public non-financial corporations | 0.1 | 0.3 | -0.1 | 1.0 | 1.4 | -0.4 | |

| Bank of England | -1.1 | -1.0 | -0.1 | -1.3 | -1.5 | 0.3 | |

| Public sector ex (PSNB ex) | 10.6 | 9.3 | 1.4 | 45.5 | 47.7 | -2.3 | |

| Public financial corporations | -0.5 | -0.5 | 0.0 | -3.0 | -3.3 | 0.3 | |

| Public sector (PSNB) | 10.1 | 8.8 | 1.4 | 42.5 | 44.5 | -1.9 | |

| Source: Office for National Statistics | |||||||

| Notes: | |||||||

| 1. Financial year-to-date refers to the period from April to September. | |||||||

| 2. 2016/17 refers to financial year ending in March 2017 and 2015/16 refers to financial year ending in March 2016. | |||||||

Download this table Table 2: Sub-sector breakdown of public sector net borrowing

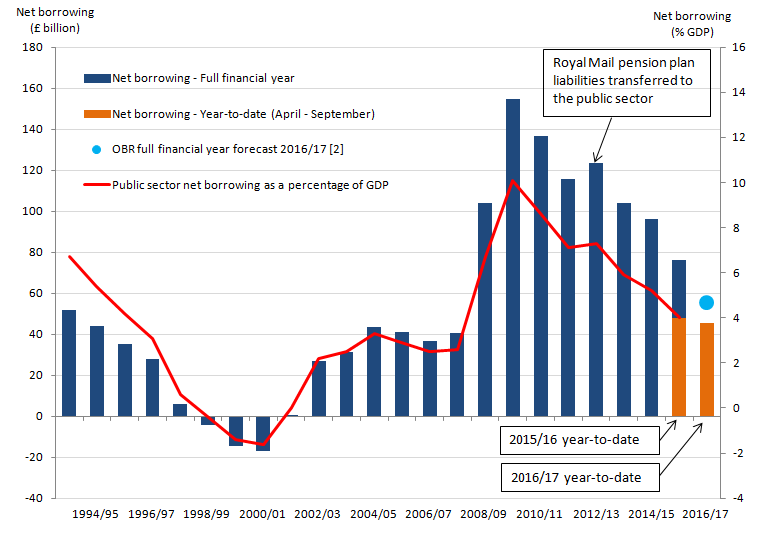

.xls (33.3 kB)Figure 4 illustrates public sector net borrowing excluding public sector banks (PSNB ex) for the last 23 financial years. For all but 3 years in the period the public sector has been in deficit and had to borrow to fund the gap between expenditure and revenue.

Figure 4: Public sector net borrowing excluding public sector banks; the financial year ending 1994 to the financial year ending 20171

UK, all data excluding public sector banks

Source: Office for National Statistics

Notes:

- Financial year 2016/17 represents financial year ending 2017 (April 2016 to March 2017).

- Office for Budget Responsibility (OBR) full financial year forecast of £55.5 billion for public sector net borrowing excluding public sector banks (March 2016 Economic and Fiscal Outlook).

Download this image Figure 4: Public sector net borrowing excluding public sector banks; the financial year ending 1994 to the financial year ending 2017^1^

.png (37.4 kB) .xls (62.5 kB)PSNB ex peaked in the financial year ending March 2010 (April 2009 to March 2010) as the effects of the economic downturn impacted on the public finances (reducing tax receipts while expenditure continued to increase).

In the financial year ending March 2016 (April 2015 to March 2016), the public sector borrowed £76.0 billion. This was £20.2 billion lower than in the previous financial year. These are not final figures and may be revised over the coming months as provisional data are replaced with finalised and audited data.

This latest estimate suggests that borrowing in the financial year ending March 2016 is less than half of that in the financial year ending March 2010; both in terms of £ billion (Table PSA2) and percentage of GDP (Table PSA5A).

PSNB ex has reduced since the financial year ending March 2010, although remained higher than before the financial year ending March 2008 (April 2007 to March 2008) and the 2007 global financial market shock.

PSNB ex in the financial year ending March 2013 (April 2012 to March 2013) was higher than in the previous financial year largely as a result of the recording of an £8.9 billion payable capital transfer in April 2012, as recognition that the liabilities transferred from the Royal Mail Pension Plan exceeded the assets transferred.

Net borrowing for the financial year-to-date (April to September 2016)

Due to the volatility of the monthly data, the cumulative financial year-to-date borrowing figures provide a better indication of the progress of the public finances than the individual months.

In the financial year-to-date (April to September 2016), public sector net borrowing excluding public sector banks (PSNB ex) was £45.5 billion; a decrease of £2.3 billion, or 4.7% compared with the same period in 2015.

In this period, there was a £4.4 billion decrease in central government net borrowing, along with a £0.4 billion decrease in the net borrowing of public corporations and a £2.3 billion increase (or decrease in surplus) in local government net borrowing.

Over the same period, Bank of England (BoE) net borrowing was £0.3 billion higher than in the previous financial year-to-date, almost entirely due to differences in the size of Asset Purchase Facility (APF) transfers to central government. The combined net borrowing of central government and the BoE in the financial year-to-date was £4.1 billion lower than in the previous financial year.

Central government receipts for the financial year-to-date (April to September 2016) were £312.7 billion, an increase of £11.0 billion, or 3.6%, compared with the same period in the previous financial year. Of which:

- social (National Insurance) contributions increased by £3.9 billion, or 7.0%, to £59.3 billion

- Income Tax-related payments increased by £2.1 billion, or 2.7%, to £78.7 billion

- VAT receipts increased by £1.5 billion, or 2.3%, to £65.9 billion

- interest & dividend receipts increased by £0.8 billion, or 9.0%, to £9.4 billion

- Corporation Tax increased by £0.7 billion, or 3.5%, to £21.0 billion

- Stamp Duty on land and property increased by £0.4 billion, or 7.1%, to £6.0 billion

Central government expenditure (current and capital) for the financial year-to-date (April to September 2016) was £348.7 billion, an increase of £5.9 billion, or 1.7%, compared with the same period in the previous financial year. Of which:

- other current expenditure (mainly departmental spending) increased by £2.1 billion, or 1.1%, to £204.1 billion; largely as a result of increases in departmental spending on goods and services, along with subsidies and contributions to the EU - these increases are being partially offset by decreases in transfers to local government

- debt interest increased by £1.9 billion, or 7.9%, to £25.8 billion; of this £25.8 billion, £7.0 billion is the interest payable to the Bank of England Asset Purchase Facility on its gilt holdings (see Table PSA9 in Table PSA1 in the Public Sector Finances Tables 1 to 10: Appendix A dataset) which are PSNB ex neutral

- central government net investment (capital expenditure) increased by £1.0 billion, or 6.8%, to £16.0 billion; largely as a result of an increase in capital transfers to central government from other sectors and an increase in gross capital formation, partially offset by falls in capital transfers from central government to other sectors

- net social benefits (mainly pension payments) increased by £0.8 billion, or 0.8%, to £102.7 billion; largely as a result of increases in state pension payments (within National Insurance Fund benefits) and public sector pension contributions

Local government net borrowing (LGNB) for the financial year-to-date (April to September 2016) was estimated to be zero, a £2.3 billion increase (or decrease in surplus) in local government net borrowing on the same period in the previous financial year. This decrease in surplus was largely due to decreases in grants received from central government, particularly in April, being partially offset by increases in tax receipts and decreases in expenditure on goods and services and net social benefits.

In August 2016, detailed budget data were incorporated into the estimation of LGNB, replacing estimates that were previously based on forecasts produced by the Office for Budget Responsibility in March 2016. Administrative source data are used for central government to local government transfers.

Detailed time series for each of the expenditure and revenue component series of local government net borrowing are presented in Tables PSA6G to 6K in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

Public corporations’ net borrowing (PCNB) for the financial year-to-date (April to September 2016) was estimated to be £1.0 billion, a decrease of £0.4 billion on the same period in the previous financial year.

Public corporations data for April to September 2016 are initial estimates based on a combination of provisional outturn data, OBR forecasts and figures for previous years.

Net borrowing in September 2016

In September 2016, public sector net borrowing (excluding public sector banks) was £10.6 billion; an increase of £1.4 billion, or 14.7% compared with September 2015.

This increase in borrowing was largely due to increases in both central government and local government net borrowing of £1.3 billion and £0.3 billion respectively.

The data for the latest month of every release contains some forecast data. The initial outturn estimates for the early months of the financial year contain more forecast data than other months, as profiles of tax receipts and departmental spending on OSCAR and local government spending are provisional. This means that the data for these months are typically more prone to revision than other months and can be subject to sizeable revisions in later months.

Central government receipts in September 2016 were £49.0 billion, an increase of £1.2 billion, or 2.6%, compared with September 2015. Of this:

- social (National Insurance) contributions increased by £0.7 billion, or 8.0%, to £9.8 billion

- VAT receipts increased by £0.2 billion, or 1.4%, to £11.1 billion

- Income Tax-related payments increased by £0.1 billion, or 1.2%, to £11.4 billion

- Fuel Duty increased by £0.1 billion, or 3.2%, to £2.4 billion

- Corporation Tax decreased by £0.2 billion, or 8.7%, to £2.3 billion

Central government expenditure (current and capital) in September 2016 was £57.2 billion, an increase of £2.4 billion, or 4.3%, compared with September 2015. Of this:

- other current expenditure (mainly departmental spending) increased by £1.0 billion, or 2.9%, to £33.9 billion; largely as a result of an increase in departmental spending on goods and services and contributions to the EU, with partially offsetting decreases in current transfers paid abroad and current transfers paid to local government

- debt interest in September 2016 increased by £0.9 billion, or 34.6%, to £3.3 billion; of this £3.3 billion, £1.2 billion is the net interest paid to the Asset Purchase Facility Fund (APF) on its gilt holdings (see Table PSA9 in the Public Sector Finances Tables 1 to 10: Appendix A dataset) which are PSNB ex neutral

- central government net investment (capital expenditure) increased by £0.5 billion, or 24.2%, to £2.8 billion; largely as a result of increases in gross capital formation and transfers from central government to other sectors

- there was no increase in September’s net social benefits (mainly pension payments) compared with September 2015; largely as a result of increases in State Pension payments (within National Insurance Fund benefits), offset by decreases in social assistance payments and public sector pension contributions

Detailed time series for each of the expenditure and revenue component series of central government net borrowing are presented in Tables PSA6B to 6F in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

In September 2016, local government net borrowing (LGNB) was estimated to be £1.7 billion; an increase of £0.3 billion compared with September 2015.

Local government data for September 2016 are initial estimates based on detailed budget data for the financial year ending March 2017. Administrative source data are used for central government to local government transfers.

Detailed time series for each of the expenditure and revenue component series of local government net borrowing are presented in Tables PSA6G to 6K in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

In September 2016, it was estimated that public corporations’ net borrowing (PCNB) was £0.1 billion, a decrease of £0.1 billion compared with September 2015.

Public corporations data for April to September 2016 are initial estimates based on a combination of provisional outturn data, OBR forecasts and figures for previous years.

Back to table of contents5. The latest public sector net debt position

Public sector net debt excluding public sector banks (PSND ex) represents the amount of money the public sector owes to UK private sector organisations and overseas institutions, largely as a result of government financial liabilities on the bonds (gilts) and Treasury bills it has issued.

While deficit represents the difference between income and spending over a period of time, debt represents the total amount of money owed at a point in time. This debt has been built up by successive government administrations over many years. When the government borrows (that is, runs a deficit), this adds to the debt total. So reducing the deficit is not the same as reducing the debt.

At the end of September 2016, PSND ex stood at £1,638.5 billion; an increase of £50.8 billion compared with September 2015. This increase in net debt is a result of:

- £73.8 billion of public sector net borrowing

- plus £6.3 billion in timing differences between cash flows for gilt interest payments and the accrued gilt interest flows

- less £29.2 billion in net cash transactions related to acquisition or disposal of financial assets of equivalent value (for example loans) and timing of recording

This bulletin uses the latest published values of GDP (published 30 September 2016) in the presentation of fiscal ratios.

At the end of September 2016, the provisional estimate of PSND ex as a percentage of GDP stood at 83.9%; a decrease of 0.4 percentage points compared with September 2015. This is the fourth successive month of debt falling on the year as a percentage of GDP and indicates that GDP is currently increasing (year-on-year) faster than net debt excluding public sector banks.

The methodology that underpins our presentation of fiscal aggregates as GDP ratios can be found in The use of GDP in public sector fiscal ratio statistics.

Figure 5 illustrates public sector net debt excluding banking groups (PSND ex) from the financial year ending March 1994 to date.

Figure 5: Public sector net debt excluding public sector banks; the financial year ending 1994 to financial year ending 20171

UK, all data excluding public sector banks

Source: Office for National Statistics

Notes:

- Financial year 2016/17 represents financial year ending 2017 (April 2016 to March 2017).

Download this image Figure 5: Public sector net debt excluding public sector banks; the financial year ending 1994 to financial year ending 2017^1^

.png (34.8 kB) .xls (39.9 kB)The increases in debt between the financial year ending March 2009 (April 2008 to March 2009) and the financial year ending March 2011 (April 2010 to March 2011) were larger than in the early part of the decade, as the economic downturn meant public sector net borrowing excluding public sector banks (PSNB ex) increased. Since then it has continued to increase but at a slower rate.

For the purposes of UK fiscal policy, net debt is defined as total gross financial liabilities less liquid financial assets, where liquid assets are cash and short-term assets which can be released for cash at short notice and without significant loss. These liquid assets mainly comprise foreign exchange reserves and bank deposits.

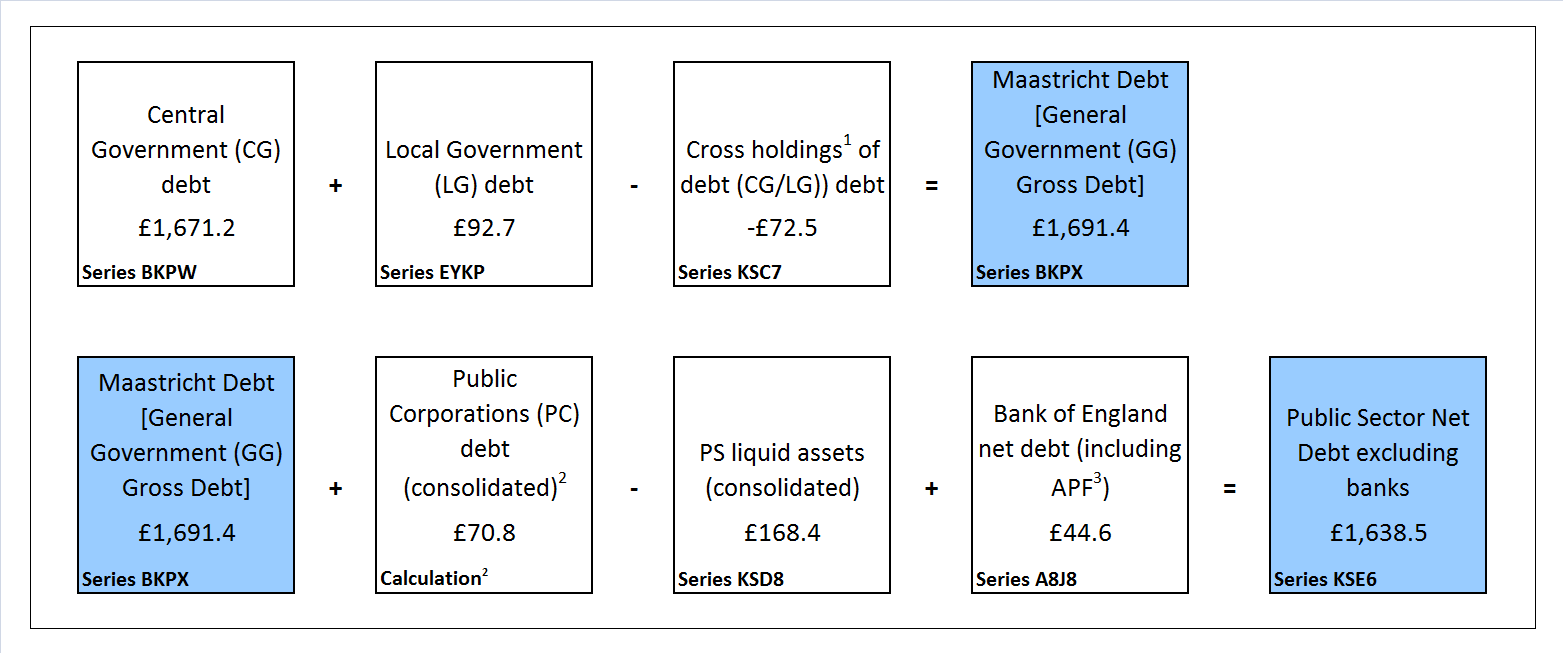

Figure 6 presents public sector debt (excluding public sector banks) at the end of September 2016 by sub-sector. Time series for each of these component series are presented in Tables PSA8A to D in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

Figure 6: Sub-sector split of public sector net debt excluding public sector banks at September 2016 (£ billion)

Source: Office for National Statistics

Notes:

- Cross-holdings between sub-sectors are removed in calculating public sector net debt, gross debt and liquid assets.

- Public corporations' debt (consolidated) = non-financial PC gross debt (EYYD) less CG/NFPCs' gross debt (KSC8) less LG/NFPCs' cross holdings of debt (KSC9).

- APF - Bank of England Asset Purchase Facility.

Download this image Figure 6: Sub-sector split of public sector net debt excluding public sector banks at September 2016 (£ billion)

.png (49.7 kB) .xls (165.9 kB)Changes in net debt between 2 points in time are normally similar to the net cash requirement for the intervening period, though the relationship is not an exact one because the net cash requirement reflects actual prices paid, while the net debt is at nominal prices. For instance, gilts are recorded in net debt at their redemption (or face) value, but they are often issued at a different price due to premia or discounts being applied. The net cash requirement will reflect the actual issuance and redemption prices, but net debt only ever records the face (or nominal) value.

Net cash requirement is discussed further in Section 8 of this bulletin.

Back to table of contents6. Net borrowing and debt statistics compared with OBR forecast

The Office for Budget Responsibility (OBR) normally produces forecasts of the public finances twice a year (normally in March and December). The latest OBR forecast was published on 16 March 2016.

Figure 7, Table 3 and Table 4 enable users to compare emerging data against the OBR forecasts. Caution should be taken when comparing public finance data with OBR figures for the full financial year, as data are not finalised until after the financial year ends. Initial estimates soon after the end of the financial year can be subject to sizeable revisions in later months. In addition, in-year timing effects on spending and receipts can affect year-to-date comparisons with previous years.

There can also be some methodological differences between OBR forecasts and outturn data. In its latest publication, OBR published a table within their Economic and Fiscal Outlook Supplementary Fiscal Tables – March 2016 titled “Table: 2.45 Items included in OBR forecasts that ONS have not yet included in outturn”.

Figure 7 illustrates the public sector net borrowing excluding public sector banks (PSNB ex) for the seventh provisional estimate of the complete financial year ending March 2016 (April 2015 to March 2016), along with the first provisional estimate of the current financial year-to-date (April to September 2016). These are not final figures and may be revised as provisional data are replaced with finalised and audited data.

Figure 7: Cumulative public sector net borrowing by month

UK, all data excluding public sector banks

Source: Office for National Statistics

Notes:

- For the financial year ending 2016 (April 2015 to March 2016) and the financial year ending 2017 (April 2016 to March 2017).

- OBR full financial year forecast for public sector net borrowing excluding public sector banks from March 2016 Economic and Fiscal Outlook (EFO).

Download this chart Figure 7: Cumulative public sector net borrowing by month

Image .csv .xlsPublic sector net borrowing (excluding public sector banks) decreased by £20.2 billion to £76.0 billion in the financial year ending March 2016 (April 2015 to March 2016), compared with the previous financial year. By comparison, the OBR forecast for the financial year ending March 2016 (April 2015 to March 2016) was £72.2 billion which is £3.8 billion below the latest outturn estimate.

In the current financial year-to-date (April to September 2016), public sector net borrowing (excluding public sector banks) decreased by £2.3 billion to £45.5 billion compared with the same period in 2015.

OBR have estimated that the public sector will borrow £55.5 billion during the financial year ending March 2017 (April 2016 to March 2017); a reduction of £20.5 billion on the provisional outturn for the financial year ending March 2016 (April 2015 to March 2016).

Table 3 compares the year-to-date (April to September 2016) estimate of the main public sector fiscal aggregates with the same period in the previous financial year. It contrasts these data with the percentage change between the latest full year outturn data for the financial year ending March 2016 (April 2015 to March 2016) and the OBR forecast for the financial year ending March 2017 (April 2016 to March 2017), as published in March 2016.

Table 3: Public sector latest outturn estimates vs Office for Budget Responsibility (OBR) forecasts

| UK, excluding public sector banks | £ billion1 (not seasonally adjusted) | ||||||

| Financial year-to-date7 | Full financial year8 | ||||||

| 2016/178 | 2015/168 | Increase/Decrease % | 2016/17 OBR Forecast9 | 2015/16 Outturn | Forecast Increase/Decrease % | ||

| Current budget deficit2 | 31.9 | 34.7 | -7.9 | 19.1 | 42.6 | -55.2 | |

| Net investment3 | 13.6 | 13.1 | 3.7 | 36.4 | 33.4 | 9.0 | |

| Net borrowing 4 | 45.5 | 47.7 | -4.7 | 55.5 | 76.0 | -27.0 | |

| Net debt 5 | 1,638.5 | 1,587.7 | 3.2 | 1,638.0 | 1,602.8 | 2.2 | |

| Net debt as a percentage of GDP6 | 83.9 | 84.3 | NA | 82.6 | 84.0 | NA | |

| Source: Office for National Statistics | |||||||

| Notes: | |||||||

| 1. Unless otherwise stated. | |||||||

| 2. Current budget deficit is the difference between current expenditure (including depreciation) and current receipts. | |||||||

| 3. Net investment is gross investment (net capital formation plus net capital transfers) less depreciation. | |||||||

| 4. Net borrowing is current budget deficit plus net investment. | |||||||

| 5. Net debt is financial liabilities (for loans, deposits, currency and debt securities) less liquid assets. | |||||||

| 6. GDP at current market price. | |||||||

| 7. Financial year-to-date refers to the period from April to September. | |||||||

| 8. 2016/17 refers to financial year ending in March 2017 and 2015/16 refers to financial year ending in March 2016. | |||||||

| 9. All OBR figures are from the OBR Economic and Fiscal Outlook published in March 2016. | |||||||

| 10. NA denotes 'not applicable'. | |||||||

Download this table Table 3: Public sector latest outturn estimates vs Office for Budget Responsibility (OBR) forecasts

.xls (34.8 kB)Table 4 presents the seventh provisional estimate of public sector net borrowing split by sub-sector for the complete financial year ending March 2016 (April 2015 to March 2016) along with the corresponding OBR forecast; published in Table 2.38 (General government transactions by economic category) of the Economic and Fiscal Outlook Supplementary Fiscal Tables - March 2016.

Table 4: Public sector provisional net borrowing estimates vs OBR forecasts

| UK, excluding public sector banks | |||||

| £ billion (not seasonally adjusted) | |||||

| Full financial year 2015/161 | |||||

| ONS | OBR | Difference | |||

| Central government | 69.2 | 69.3 | -0.1 | ||

| Local government | 7.0 | 3.8 | 3.2 | ||

| Public corporations2 | -0.2 | -1.0 | 0.8 | ||

| Public sector | 76.0 | 72.2 | 3.8 | ||

| Source: Office for National Statistics (ONS) and The Office of Budget Responsibility (OBR) | |||||

| Notes: | |||||

| 1. Full financial year ending 2016 (April 2015 to March 2016) | |||||

| 2. Includes Bank of England | |||||

Download this table Table 4: Public sector provisional net borrowing estimates vs OBR forecasts

.xls (27.1 kB)On the same day as this bulletin is released, the OBR publishes a commentary on the latest figures and how these reflect on its forecasts. The OBR provides this commentary to help users interpret the differences between the latest outturn data and the OBR forecasts by providing contextual information about assumptions made during the OBR’s forecasting process.

Back to table of contents7. International comparisons of borrowing and debt

The UK government debt and deficit for Eurostat statistical bulletin is published quarterly (in January, April, July and November each year), to coincide with when the UK and other European Union member states are required to report on their deficit (or net borrowing) and debt to the European Commission.

On 20 October 2016, we published the latest UK Government Debt and Deficit for Eurostat statistical bulletin. The data used to produce the 20 October 2016 publication are consistent with those used in the production of the public sector finances statistical bulletin published on 21 September 2016. We reported that:

- general government deficit (Maastricht borrowing) in the financial year ending March 2016 (April 2015 to March 2016) was £76.6 billion, equivalent to 4.1% of GDP

- general government gross debt (Maastricht debt) at the end of March 2016 was £1,651.9 billion, equivalent to 87.8% of GDP

In this month’s Public sector finance bulletin, we present largely unchanged estimates:

- general government deficit (Maastricht borrowing) in the financial year ending March 2016 (April 2015 to March 2016) was £76.2 billion, equivalent to 4.0% of GDP, a downward revision of £0.4 billion or 0.1 percentage point compared with the previous bulletin

- general government gross debt (Maastricht debt) at the end of March 2016 remains unchanged at £1,651.9 billion, equivalent to 87.8% of GDP

It is important to note that the GDP measure, used as the denominator in the calculation of the debt ratios in the UK government debt and deficit for Eurostat statistical bulletin, differs from that used within the Public sector finances statistical bulletin.

An article, The use of GDP in public sector fiscal ratio statistics explains that for debt figures reported in the monthly public sector finances, a 12 month GDP total centred on the month is employed, while in the UK government debt and deficit for Eurostat statistical bulletin the total GDP for the preceding 12 months is used.

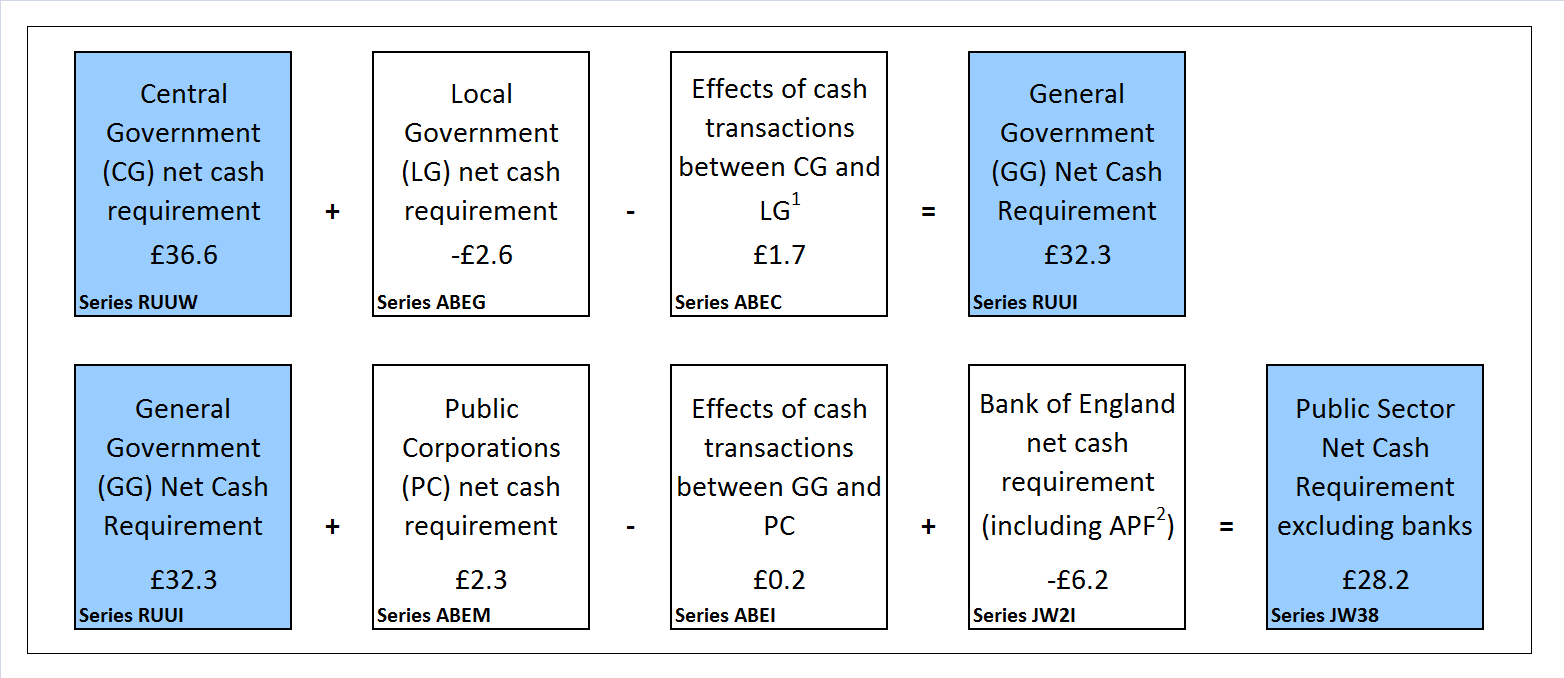

Back to table of contents8. Public sector net cash requirement

Net cash requirement is a measure of how much cash the government needs to borrow (or lend) to balance its accounts. In very broad terms, net cash requirement equates to the change in the level of debt.

Central government net cash requirement is reconciled against the change in central government net debt in Table REC3 in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

The public sector net cash requirement excluding public sector banks (PSNCR ex) follows a similar trend to that of public sector net borrowing by peaking in the financial year ending March 2010, though in recent years transfers from the Asset Purchase Facility have had a substantial impact on PSNCR ex but are PSNB ex neutral.

PSNCR ex in the current financial year-to-date (April to September 2016) was £28.2 billion; £7.9 billion, or 21.9% lower than in the same period in 2015.

Figure 8 presents public sector cash requirement by sub-sector for the financial year-to-date (April to September 2016). Time series for each of these component series are presented in Table PSA7A in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

Figure 8: Sub-sector split of public sector net cash requirement excluding public sector banks, financial year to date (April to May) ending 2017 (£ billion)

Source: Office for National Statistics

Notes:

- Effects of cash transactions between sub-sectors are removed in calculating public sector total net cash requirement (and consolidated expenditure and income totals).

- APF - Bank of England Asset Purchase Facility.

Download this image Figure 8: Sub-sector split of public sector net cash requirement excluding public sector banks, financial year to date (April to May) ending 2017 (£ billion)

.png (56.0 kB) .xls (152.6 kB)Central government net cash requirement (CGNCR) is a focus for some users, as it provides an indication of how many gilts (government bonds) the Debt Management Office may issue to meet the government’s borrowing requirements.

In the current financial year-to-date (April to September 2016), CGNCR was £36.6 billion; £9.5 billion, or 20.6% lower than in the same period in 2015.

Cash transfers from the Asset Purchase Facility (APF) were £0.6 billion higher in the current financial year-to-date (April to September 2016), than in the same period in the previous financial year-to-date. Without the impact of these transfers, CGNCR would have been £8.8 billion lower in the current financial year-to-date than in the same period in the previous year.

Recent events impacting on CGNCR

For the current financial year, ending March 2017 (April 2016 to March 2017) the following event has reduced the CGNCR to date:

- the transfers between the Bank of England Asset Purchase Facility Fund (BEAPFF) and central government

In the financial year ending March 2016 (April 2015 to March 2016) the following events reduced the CGNCR:

- the transfers between the Bank of England Asset Purchase Facility Fund (BEAPFF) and central government

- the sale of shares in Lloyds Banking Group

- the sale of shares in Eurostar

- the sale of shares in Royal Mail

- the sale of shares in Royal Bank of Scotland

- the sale of UK Asset Resolution Limited (UKAR) assets

- the re-imbursement of support payments made to Icesave

In the financial year ending March 2015 (April 2014 to March 2015) the following events reduced the CGNCR:

- the transfers between the BEAPFF and central government

- the sale of shares in Lloyds Banking Group

In the financial year ending March 2014 (April 2013 to March 2014) the following events reduced the CGNCR:

- the transfers between the BEAPFF and central government

- the sale of shares in Lloyds Banking Group

- the sale of shares in Royal Mail

In the financial year ending March 2013 (April 2012 to March 2013) the following events reduced the CGNCR:

- the transfers between the BEAPFF and central government

- the Royal Mail Pension Plan transfer and subsequent sale of assets

- the transfer of the Special Liquidity Scheme final profits between Bank of England and central government

- the 4G Spectrum sale

Public sector net cash requirement

Although the central government net cash requirement is the largest part of the public sector net cash requirement excluding public sector banks (PSNCR ex), the total public sector net cash requirement (PSNCR) can be very different. The reason is that the PSNCR includes the net cash requirement of the public sector banking groups. In recent years, the public sector banking groups have recorded large cash surpluses which have had a substantial impact on the public sector net cash requirement.

Back to table of contents9. Central government receipts and expenditure

Current receipts

The government receives income mainly from taxes but also from National Insurance contributions, interest and dividends, fines and rent.

As cash receipts are generally accrued back to earlier periods when the economic activity took place, the first monthly estimate for receipts is by nature provisional, and must include a substantial amount of forecast data.

Central government receipts follow a strong cyclical pattern over the year, with high receipts in April, July, October and January due to quarterly Corporation Tax returns being accrued to these months.

In both January and July (to a lesser extent) accrued receipts are particularly high due to receipts from quarterly Corporation Tax combining with those from Income Tax self-assessment. The revenue raised through Income Tax self-assessment, as well as primarily affecting January and July receipts, also tends to lead to high receipts in the following month (March and November respectively), although to a lesser degree.

Pay as you earn (PAYE) tends to vary little throughout the financial year on a monthly basis (excluding bonus months).

In recent years transfers from both the Bank of England Asset Purchase Facility Fund (BEAPFF) and the Special Liquidity Scheme (SLS) have boosted central government receipts. These transfers to central government have no impact on public sector borrowing due to the central government receipts being offset by the payments from the Bank of England.

Current expenditure

Current expenditure is the government’s spending on activities such as: social benefits (mainly pension payments), interest payments and other current expenditure including government departmental spending (excluding spending on capital assets).

Trends in central government current expenditure can be affected by monthly changes in debt interest payments, which can be volatile as they depend on the movements in the Retail Prices Index. Excluding debt interest makes this statistic less volatile.

There is however one regular peak in net social benefits, which are higher in November than in other months due to the annual payment of the winter fuel allowance.

Year-on-year growth in net social benefits is affected by the uprating of benefits to compensate for inflation based on the Consumer Prices Index (CPI).

For recent years these are: 2.7% in the financial year ending March 2015; 1.2% in the financial year ending March 2016 and negative 0.1% for the financial year ending March 2017 (meaning that the rates have remained frozen). These apply to benefits for pensioners (apart from the State Pension). Most benefits for people of working age are frozen for the financial year ending March 2017.

However, for State Pensions, the largest component within net social benefits, there is a “triple guarantee” that means that they are uprated by the highest of the CPI, increases in earnings or 2.5%. For the financial year ending March 2017, they were uprated by the rise in annual earnings which was 2.9%.

It can be difficult to compare the profile of monthly central government expenditure even when excluding both debt interest and net social benefits.

For the 4 years since the financial year ending March 2014, there have been continual changes to the profile of central government grants to local government.

In the financial year ending March 2016, the Revenue Support Grant (the main general grant paid to local authorities in England) was paid with a third of the total in April and the remainder in equal instalments in all the other months, whereas, in the financial year ending March 2015, more than half of it was paid in April with the bulk of the remaining balance paid in February and March. This financial year (ending March 2017) the monthly pattern of grants has changed again and is much flatter with 10% being paid in April and the remainder flat though the year. The overall level is also lower than last year.

Current budget deficit

The gap between current expenditure and current receipts (having taken account of depreciation) is referred to as the current budget. When current expenditure is greater than current receipts (income), the public sector runs a current budget deficit.

In September 2016, the central government current budget deficit was £7.1 billion, an increase of £0.7 billion, or 11.5% compared with September 2015.

The central government current budget deficit in the current financial year-to-date (April to September 2016) was £29.7 billion; which was £5.4 billion, or 15.3% lower than in the same period in 2015.

Figure 9 illustrates that the central government current budget deficit (as a percentage of GDP) has reduced since the financial year ending March 2010 (April 2009 to March 2010), but is still larger than before the global financial shock.

Figure 9: Central government receipts, expenditure and current budget deficit1 as a percentage of GDP by financial year; the financial year ending 1994 to the financial year ending 20162

UK, all data excluding public sector banks

Source: Office for National Statistics

Notes:

- Current budget deficit is receipts minus expenditure but also includes the effects of depreciation.

- Financial year 2015/16 represents the financial year ending 2016 (April 2015 to March 2016).

Download this chart Figure 9: Central government receipts, expenditure and current budget deficit^1^ as a percentage of GDP by financial year; the financial year ending 1994 to the financial year ending 2016^2^

Image .csv .xlsIn recent years the current budget has been in deficit in most months. January and July tend to be surplus months as these are the 2 months with the highest receipts.

Net investment

Net investment represents the government’s spending on capital assets, like infrastructure projects, property and IT equipment, both as grants and by public sector bodies themselves minus capital receipts from the sale of capital assets.

In the financial year-to-date (April to September 2016), central government’s net investment was £16.0 billion. This represents an increase of £1.0 billion, or 6.8%, on the same period in the previous year and is largely due to a decrease in capital transfers to central government from other sectors.

Central government net investment is difficult to predict in terms of its monthly profile as it includes some large capital grants (such as those to local authorities and education institutions) and can include some large capital acquisitions or disposals, all of which vary from year to year. Net investment in the last quarter of the financial year is usually markedly higher than that in the previous 3 quarters.

Central government net investment includes the direct acquisition minus disposal of capital assets (such as buildings, vehicles, computing infrastructure) by central government. It also includes capital grants to and from the private sector and other parts of the public sector. Capital grants are varied in nature and cover payments made to assist in the acquisition of a capital asset, payments made as a result of the disposal of a capital asset, transfers in ownership of a capital asset and the unreciprocated cancellation of a liability (that is conceding a debt will not be repaid).

The sum of net investment (spending on capital less capital receipts) and the current budget deficit constitute net borrowing.

Back to table of contents10. Recent events and forthcoming methodological changes

Classification decisions

Each quarter we publish a forward workplan outlining the classification assessments we expect to undertake over the coming 12 months. To supplement this, each month a classifications update is published which announces classification decisions made, and includes expected implementation points (for different statistics) where possible.

Classification decisions are reflected in the public sector finances at the first available opportunity and, where necessary outlined in this section of the statistical bulletin.

Lloyds Banking Group share sales

In recent years the government has entered a programme of selling shares in publicly owned organisations. For most share sales, the proceeds will reduce the central government net cash requirement (CGNCR) and public sector net debt (PSND) by an amount corresponding to the cash raised from the sale but have no impact on public sector net borrowing.

On 17 September 2013, the UK government began selling part of its share holdings in Lloyds Banking Group (LBG). A further share sale on 23 and 24 March 2014 meant that the UK government surrendered, in total, a 13.5% stake in the institution, a quantity sufficient to lead to LBG being re-classified from a public sector body to a private sector body.

Since December 2014, the government has continued reducing its shareholding in LBG via a pre-arranged trading plan, raising an estimated total of £16.2 billion to date.

On 7 October 2016 the government announced the next phase in their plan to sell the British taxpayers’ remaining 9.1% stake in Lloyds Banking Group, with Morgan Stanley International acting as broker (on behalf of HM Treasury) in the execution of the trading plan.

Bank of England Asset Purchase Facility Fund (BEAPFF)

The BEAPFF (often abbreviated to APF) currently holds government securities (gilts) on which it earns interest, and pays interest on the reserves created by the Bank of England to finance it. These interest flows are reflected in both the public sector net cash requirement (PSNCR ex) and the public sector net borrowing (PSNB ex) although the interest received on gilts is internal to the public sector whereas the financing interest paid is external. In addition to these interest flows there are regular transfers of excess cash in the APF to the Exchequer. These flows are internal to the public sector and so do not affect PSNB ex.

In September 2016, there were no transfers from the BEAPFF to HM Treasury, bringing the total money transferred to HM Treasury under the APF scheme to £5.0 billion in this financial year-to-date (April to September 2016).

The Bank of England entrepreneurial income for the financial year ending March 2016 (April 2015 to March 2016) was calculated as £11.9 billion. This is the total amount of dividend transfers that can impact on central government net borrowing in the financial year ending March 2017 (April 2016 to March 2017).

The net liabilities of the APF increase public sector net debt (PSND ex) as shown in Table 8D in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

The treatment of the recently announced Monetary Policy Committee economic package in public sector finances statistics

On 3 August 2016, the Monetary Policy Committee (MPC) voted to introduce a package of measures to support the economy. This package comprised:

- a 25 basis point cut in Bank Rate to 0.25%

- a new Term Funding Scheme to reinforce the pass-through of the cut in Bank Rate

- the purchase of up to £10 billion of UK corporate bonds

- an expansion of the asset purchase scheme for UK government bonds of £60 billion

The £60 billion expansion of the APF will take the total stock of government bond purchases to £435 billion. On top of this, the APF may purchase up to £10 billion of corporate bonds. The flows and liabilities related to the government bonds will be recorded in the same way as for the existing bond holdings with the impact on public sector net debt being limited to the difference between the purchase price of the bonds and their face value. However, any private sector corporate bonds purchased will lead to an increase in public sector net debt equal to the total purchase price of the bonds as the bonds are not liabilities of the public sector.

For more detail of transactions relating to the Asset Purchase Facility, see Table PSA9 in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

Term Funding Scheme

The Term Funding Scheme (TFS) is operated by the Bank of England through the Asset Purchase Facility Fund. It is designed to reinforce the transmission of Bank Rate cuts to those interest rates actually faced by households and businesses by providing term funding to banks at rates close to the Bank Rate.

We have classified the Bank of England’s TFS in accordance with international rules set out in the European System of Accounts 2010 (ESA 2010) and accompanying statistical manuals.

We have concluded that our economic statistics will reflect the TFS in the public sector balance sheet through both a loan asset for the TFS lending to banks and building societies, and a deposit liability relating to the creation of central bank reserves. However, as the classification decision also dictates that the loan assets are to be recorded as illiquid assets, the impact of the TFS on public sector net debt will be to increase it by the value of the central bank reserves created to fund the TFS lending (all else being equal).

We published a classification article, Economic statistics classification article; statistical treatment of the Bank of England’s Term Funding Scheme in UK National Accounts and public sector finances on 21 October 2016 detailing the classification of TFS. This article describes how the TFS, which became operational in September 2016, works and based on this how we have decided that the scheme transactions and stock are to be classified in the national accounts and related economic statistics. The classification review also took into account previous decisions on similar schemes, such as the Funding for Lending Scheme (FLS) and the Special Liquidity Scheme (SLS), and contrasts the classification decisions for the different schemes.

In September 2016, the Bank of England had made £50 million of loans through the Term Funding Scheme. These transactions have been financed by the creation of central bank reserves and so will increase public sector net debt accordingly. The transactions under TFS relating to the public sector balance sheet will be recorded for the first time in the Public sector finance statistical bulletin to be published 22 November 2016.

The Corporation Tax and Bank Corporation Tax surcharge

Corporation Tax and Bank Corporation Tax surcharge collected by HM Revenue and Customs (HMRC) are based on the taxable profits in companies’ accounting periods. These accounting periods are usually 12 months in duration and can start in any month, although many companies have either calendar year or financial year accounting periods.

Currently no timing adjustments are made to Corporation Tax or bank surcharge cash receipt estimates used in compiling public sector finance and national accounts statistics; with the cash received by HMRC used as a proxy for accrued receipts.

There are three distinct corporation tax payment regimes:

- non-oil companies or groups with chargeable profits over £1.5 million are required to pay their estimated Corporation Tax and/or Bank Corporation Tax surcharge liabilities in quarterly instalment payments (QIP). These payments are currently due by the middle of the months 7, 10, 13 and 16 after the start of the accounting period for such companies with year-long accounting periods

- small non-oil companies are required to pay their liabilities 9 months and 1 day after the end of their accounting period.

- oil companies (large and small) are required to pay North Sea Corporation Tax (also referred to as Ring Fenced Corporation Tax) in three equal instalments paid on the 14th day of July, October and January (months 7, 10 and 13 from the start of the accounting period).

At the summer Budget 2015, the then Chancellor of the Exchequer announced that from April 2017 onwards, the instalment payment due dates for non-oil companies or groups with chargeable profits over £20 million would be brought forward to the 3rd, 6th, 9th and 12th months of a year-long accounting period. Further, at Budget 2016, it was announced that the start date for this measure would be delayed such that the new earlier payment due dates for these companies or groups would only apply for accounting periods starting from April 2019 onwards.

Should it be implemented this revised payment schedule would mean that substantial amounts of corporation tax and bank corporation tax surcharge cash payments would be received earlier than would have otherwise have been the case. As corporation tax and bank corporation tax surcharge are currently accounted for on a receipts basis in public sector finance and national accounts estimates this would mean that estimated corporation tax and bank corporation tax surcharge revenues (and hence estimated total tax revenues) would be significantly higher during the period in which the new payment due dates start to take effect.

Since companies pay their Corporation Tax, Bank Corporation Tax surcharge and Bank Levy at the same time and in the same way, we are considering whether Bank Levy should also have the same time adjusted cash methodology applied to it as Corporation Tax and Bank Corporation Tax.

On the current (cash equals accrued receipts) basis, this large increase in the measure of Corporation Tax and Bank Corporation Tax surcharges would increase estimates of accrued receipts in public sector finances and national accounts, even though there will have been no change in actual accruals. At the Budget 2016, it was estimated that this increase would be around £6 billion for financial year ending March 2020 and over £3 billion in financial year ending March 2021.

We are currently working with HMRC and HM Treasury to improve the accruals approximation through the introduction of time-adjusted data for Corporation Tax and Bank Corporation Tax surcharge into the public sector finance and national accounts statistics. In line with normal accruals methodology this change would move cash receipts so that the 4 quarterly payments fell into the correct accounting year.

A different payment regime applies to the oil and gas sector and so a new methodology will require different movements to align cash receipts and the accounting period.

Based on the information currently available, we expect the impact of moving from cash-based to a time-adjusted cash based method of recording Corporation Tax would be:

- for non-oil companies or groups who follow a quarterly instalment plan (QIP payers) in the financial year ending March 2014, Corporation Tax would increase by £0.7 billion

- for smaller non-oil companies or groups who do not follow a quarterly instalment plan (non-QIP payers) in the financial year ending March 2014, Corporation Tax would increase by £0.9 billion

- for oil companies or groups in the financial year ending March 2014, Corporation Tax would decrease by £0.2 billion.

The net effect of these changes would be to increase central government current receipts by approximately £1.4 billion in the financial year ending March 2014 and reduce both central government and public sector net borrowing by a corresponding amount.

We aim to introduce these changes in early 2017, prior to the Budget 2017.

In addition to Corporation Tax, no timing adjustments to cash receipts are currently made to estimates of self assessed Income Tax, Capital Gains Tax and Stamp Duty Land Tax used in compiling public sector finance and national accounts statistics; with the cash received by HMRC again used as a proxy for accrued receipts. We will continue working with HMRC and HM Treasury to investigate and improve accruals approximation and introduce further time-adjusted data in due course.

As a further consequence of these changes, both central government and public sector net borrowing will follow a smoother monthly path, with the usual July surplus (as a result of the increased self assessment payments each July) no longer being a feature.

Housing associations (devolved administrations)

We are currently working with the devolved administrations with the intention of extending our coverage of the impact of the reclassification private registered providers of social housing (from the private to the public corporation sector) to cover not only England but also the devolved administrations.

Based on the financial year ending 2015 published accounts we expect the impact in the financial year ending 2016 to be an increase of between £6.5 and 7.0 billion on public sector net debt and approximately £0.4 billion on public sector net borrowing.

Dependant on our ability to source and quality assure the necessary data, we intend to introduce such changes in early 2017, ahead of the Budget 2017. The extent to which we can source historical data is yet to be determined, though we expect that initially we will only implement for recent years. We envisage the implementation of the back series all the way to 1996 (England and Wales), 1992 (Northern Ireland) and 2001 (Scotland) in the Public sector finances will be completed over a longer timescale.

National accounts will only be implementing the reclassification of English housing associations from the financial year ending 2009 onwards in Blue Book 2017, with the devolved housing associations (and pre-2008 English housing associations) to be implemented at a later date.

Housing associations (England)

The reclassification of English private registered providers of social housing (referred to in this bulletin as housing associations) from the private to the public corporation sector was reflected in public sector finances for the first time in the January 2016 statistical bulletin. This reclassification, announced on 30 October 2015, affects over 1,500 bodies providing social housing and applies back to July 2008 when the controls in the Housing and Regeneration Act 2008 came into force.

The impact on the borrowing and debt of public corporations of this reclassification is summarised in “Impact of the reclassification of housing associations into the public sector; Appendix E”.

It is important to realise that current estimates of the impact of the reclassification of housing associations are preliminary estimates which may be updated when new data become available or methodological improvements are made. At present, we are actively seeking alternative data sources to investigate the impact of smaller providers on net borrowing, net cash requirement and net debt.

We are also doing further work to test the assumptions that have been made in compiling the estimates. These were:

- all housing association debt is assumed to be held by the private sector – the Quarterly Survey of Private Registered Providers for March 2015 showed that banks, building societies and capital markets contributed 99% to agreed sources of funding

- the Global Accounts are collected for the entire financial year – monthly transactions were estimated by dividing the financial year figure by 12

- providers which own less than 250 properties (less than 2% of the total stock) are assumed to have no net debt and not be investing in new properties

- providers owning or managing between 250 and 1,000 properties are assumed to have the same gross debt per 1,000 properties as those owning or managing between 1,000 and 2,500 homes

- the relative impact of small providers on the accounts is assumed to be constant between financial year ending March 2009 and financial year ending March 2015 This reclassification has been introduced in public sector finances before implementation in the Quarterly National Accounts and Blue Book publications. Any work to improve the methods and data sources used in these estimates will be reflected in the National Accounts publications at the time the reclassification is implemented.

11. Revisions since previous bulletin

In publishing monthly estimates, it is necessary that a range of different types of data sources are used. A summary of the different sources used and the implications this has for data revisions is provided in the document Sources summary and their timing.

The Public Sector Finances Revision Policy provides information of when users of the statistics published in the public sector finances and UK government debt and deficit for Eurosts statistical bulletins should expect to see methodological and data related revisions.

More detail of the methodology and sources employed can be found in the Public Sector Finances Methodological Guide.

Revisions tend to be the result of both updated data sources and methodology changes. This month the reported revisions are solely the result data changes.

National Non-Domestic Rates data for Scotland

National Non-Domestic Rates (NNDR), also known as business rates, are collected by local authorities, but are classified as a central government tax on production.

Working with data suppliers, ONS identified that the estimated amount of business rates for Scotland was too low. We have therefore updated the amounts, based on those reported in the Scotland Provisional Outturn and Budget Estimates (POBE) publication.

The new data, introduced in this month’s publication has resulted in an upward revision to central government receipts in the current financial year-to-date of £0.2 billion, along with an upward revision to central government receipts of £0.7 billion for the financial year ending March 2016. The estimates will be updated again when final outturn data become available.

Public sector net borrowing excluding public sector banks (PSNB ex)

Revisions to PSNB ex are limited to the current financial year-to-date (April to August 2016), along with the previous two financial years (April 2014 to March 2015 and April 2015 to March 2016)

Revisions to net borrowing in the current financial year-to-date (April to August 2016)

PSNB ex in the current financial year-to-date has been revised up by £1.1 billion as a result of an increase in both central and local government net borrowing of £0.6 billion and £0.5 billion respectively.

The estimates of the central government current receipts (including taxes) were collectively revised down by £0.8 billion. Of this, estimates of Income Tax and National insurance contributions were revised downward £0.6 billion and £0.2 billion respectively. While taxes on production collectively revised down by £0.1 billion, with this category VAT revised downwards by £0.5 billion, while NNDR (see above) and stamp duty were revised upward by £0.2 billion and £0.1 billion respectively.

Over the same period, estimates of current expenditure have been revised upwards by £0.8 billion, largely due to increases in the estimate of departmental spending on goods and services.

The downward revisions to receipts and upward revisions to expenditure meant that the current budget deficit in the financial year-to-date increased by £1.6 billion.

Downward revisions to capital transfers from central government to other sectors and gross capital formation of £0.7 billion and £0.3 billion respectively, resulted in a decrease of £1.0 billion to the estimate of net investment.

The increase of £1.6 billion in the current account, combined with the £1.0 billion reduction in the capital account meant that central government net borrowing in the financial year-to-date was increased by £0.6 billion compared with the previous estimate published on 21 September 2016.

The estimate of local government net borrowing (LGNB) in the current financial year-to-date has been revised up by £0.5 billion, due to an increase in the estimate of expenditure on goods and services of £0.4 billion, along with earlier estimates of both capital and current transfers from central to local government being replaced by revised estimates.

Revisions to net borrowing in the earlier financial years

PSNB ex in the financial year ending March 2016 (April 2015 to March 2016) has been revised down by £0.4 billion as a result of a decrease to the estimate of central net borrowing of £1.3 billion, partially offset by an increase to the estimate of local government net borrowing of £0.9 billion.

The revision to CGNB was solely due to the increase to the estimates of receipts, where; NNDR (see above) and National insurance contributions were revised upward by £0.7 billion and £0.6 billion respectively. In the same period, the estimate of LGNB was revised up by £0.9 billion, due to an increase in the estimate for current expenditure on goods and services, specifically the estimate for Scotland.

PSNB ex in the financial year ending March 2015 (April 2014 to March 2015) has been revised down by £0.9 billion, entirely as a result of the estimate of LGNB, again due to an increase in the estimate for current expenditure on goods and services, specifically the estimate for Scotland.

Public sector net debt excluding public sector banks (PSND ex)

PSND ex at the end of August 2016 was revised upward by £0.9 billion. This increase was largely due new data supplied by the Department of Communities and Local Government covering the local government holdings of public corporations’ debt (£0.6 billion) and updated Network Rail data (£0.1 billion).

Public sector cash requirement excluding public sector banks (PSNCR ex)

In the current financial year-to-date (April to August 2016), PSNCR ex was revised upwards by £0.2 billion, while in the financial year ending March 2016 (April 2015 to March 2016), PSNCR ex was revised downward by £2.0 billion. These charges were largely due to updated public corporation cash data.

Table 5 summarises revisions between the data contained in this bulletin and the previous publication.

Table 5: Revisions between this bulletin and the previous bulletin

| UK, previous bulletin refers to the PSF bulletin published on 21 September 2016 | ||||||||

| £ billion1 (not seasonally adjusted) | ||||||||

| Net Borrowing | ||||||||

| Period | CG2 | LG3 | NFPCs4 | BoE5 | PSNB ex6 | PSND ex7 | PSND % of GDP | PSNCR ex8 |

| 2012/13 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 2013/14 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 2014/15 | 0.0 | 0.9 | 0.0 | 0.0 | 0.9 | 0.1 | 0.0 | 0.0 |

| 2015/16 | -1.3 | 0.9 | 0.0 | 0.0 | -0.4 | 0.5 | -0.2 | -0.2 |

| 2016/17 ytd10 | 0.6 | 0.5 | 0.0 | 0.0 | 1.1 | 0.9 | -0.2 | 0.2 |

| 2016 April | 0.3 | -0.2 | 0.0 | 0.0 | 0.1 | 0.7 | -0.1 | 0.2 |

| 2016 May | -0.1 | 0.2 | 0.0 | 0.0 | 0.1 | 0.7 | -0.2 | 0.0 |

| 2016 June | 0.5 | 0.0 | 0.0 | 0.0 | 0.4 | 0.7 | -0.2 | 0.0 |

| 2016 July | 0.0 | 0.1 | 0.1 | 0.0 | 0.1 | 0.8 | -0.1 | 0.1 |

| 2016 Aug | -0.1 | 0.4 | 0.0 | 0.0 | 0.3 | 0.9 | -0.2 | 0.0 |

| Source: Office for National Statistics | ||||||||

| Notes: | ||||||||

| 1. Unless otherwise stated. | ||||||||

| 2. Central government. | ||||||||

| 3. Local government. | ||||||||

| 4. Non-financial public corporations. | ||||||||

| 5. Bank of England. | ||||||||

| 6. Public sector net borrowing excluding public sector banks. | ||||||||

| 7. Public sector net debt excluding public sector banks. | ||||||||

| 8. Public sector cash requirement excluding public sector banks. | ||||||||

| 9. 2015/16 represents financial year ending 2016 (April 2015 to March 2016). | ||||||||

| 10. ytd = Year-to-date, April to August 2016. | ||||||||

Download this table Table 5: Revisions between this bulletin and the previous bulletin

.xls (34.8 kB)To provide an insight into the drivers of the historical revisions between publications, this bulletin presents 3 revisions tables:

- Table PSA1R complements PSA1 and provides a revisions summary (between the current and previous publication) to headline statistics in this release

- Table PSA2R complements PSA2 and provides the revisions (between the current and previous publication) to net borrowing by sector

- Table PSA6R complements PSA6B and provides the revisions (between the current and previous publication) to the components of central government net borrowing

Tables PSA1R and PSA6R are published in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

In addition, the Revisions analysis for Public Sector Finances: Appendix C dataset presents a statistical analysis of several main components of the central government account (current receipts, current expenditure, net borrowing and net cash requirement) to determine whether their average revisions are statistically significant.

Back to table of contents12. New to the bulletin

Monthly public sector finance statistics: UK Government interventions in the financial sector

This month we have updated our published list of UK Government interventions in the financial sector, providing a chronological breakdown of the UK Government interventions from September 2007 to date.

Housing Associations

In response to your feedback, this month we introduced a new table titled “Impact of the reclassification of housing associations into the public sector; Appendix E”, summarising the impact of the reclassification of English private registered providers of social housing (referred to in this bulletin as housing associations) from the private to the public corporation sector on the net borrowing and net debt of public corporations (and so also at a public sector level).

Public sector current receipts dataset