Table of contents

- Executive summary

- Introduction

- Background

- Current treatment

- Decision

- Implications of the new decision for fiscal statistics

- Partitioning student loans into a loan and transfer element

- Issues still to be decided

- Next steps

- Links to related statistics

- Annex A: Overview of the UK student loan system

- Annex B: Engagement with the international statistical community

1. Executive summary

This article sets out the decision that Office for National Statistics (ONS) has reached on the recording of student loans in the national accounts and public sector finances and provides background on why we have been reviewing the treatment of student loans. We have decided that the best way to reflect student loans within these statistics is to treat part as financial assets (loans), since some portion will be repaid, and part as government expenditure (capital transfers), since some will not. We describe this as the partitioned loan-transfer approach.

This decision means that the impact of student loans on public sector net borrowing and the value of the loan asset recorded on the balance sheet will better reflect government’s financial position. This is because government revenue will no longer include interest accrued that will never be paid; and government expenditure related to cancellation of student loans will be accounted for in the periods that loans are issued rather than at maturity.

In April 2018, we announced that we were reviewing the treatment of student loans. The stock of student loans has grown rapidly in recent years and a significant proportion of the total value of the loan book is now expected to be cancelled at maturity. Our review of student loans is driven by these concerns and in response to reports published by the Treasury Select Committee and House of Lords Economic Affairs Committee. Both reports recommended that ONS should re-examine the classification of student loans as financial assets for government. Since the commencement of the review, we have engaged with the international statistical community to ensure that the way these loans are treated reflects how the system works in practice and is in line with international statistical guidance.

Once the new methodology has been implemented, some fiscal aggregates will be affected. In particular, public sector net borrowing and public sector net financial liabilities will both increase as a result of applying the new methodology. In its October 2018 Economic and fiscal outlook, the Office for Budget Responsibility estimated that public sector net borrowing in the financial year ending 2019 would rise by approximately £12 billion as a result of changing from the current approach to the new partitioned loan-transfer approach.

A great deal of progress has been made in establishing a new methodology for recording student loans, however, some areas of detail remain undecided. Over the coming months we will work further to develop the methodology with the aim of implementing in the public sector finances, and possible wider national accounts, in September 2019. Unlike commercial accounting, methodology changes must be applied consistently over a time series. This means that all previously issued student loans and future loans will be recorded in the same manner in the statistics. Prior to implementation, from June 2019, we intend to publish in the public sector finances provisional estimates of the fiscal impacts from the change in methodology. It should be noted though, that based on the scale and complexities of the work, any planned implementation dates can only be provisional.

Back to table of contents2. Introduction

In April 2018, we announced that we were reviewing the treatment of student loans within both the public sector finances (PSF) and the wider national accounts. Student loans in the UK are different from typical loans; they have a high degree of contingency in that repayments are conditional on future income, and under certain conditions the loan obligation itself may be cancelled. Estimates of the proportion of student loans that will be cancelled in the future have been rising in recent years, and are now a significant proportion of the total value of the loan book. The Department for Education expects that only around 30% of the full-time English undergraduates starting in academic year 2017 to 2018 will fully repay their loans.

The Treasury Select Committee published the report of its inquiry into the student loan system and related financial implications on 18 February 2018 and the House of Lords Economic Affairs Committee published its report on Treating Students Fairly: The Economics of Post-School Education on 11 June 2018. Both reports recommended that Office for National Statistics (ONS) should re-examine the classification of student loans as financial assets for government and consider whether there is a basis to treat them differently from other loans in the UK National Accounts and PSF.

In response to these concerns, ONS commenced engagement with the international statistical community on the topic of income contingent loans and announced a review of the statistical treatment in April 2018. We concluded through this assessment that the income contingent loans, and specifically the UK student loans, are best recorded in national accounts and PSF statistics by partitioning the outlay into loan (financial asset for government) and transfer (expenditure) elements. This new approach is a departure from our current practice of recording student loans as financial assets for government in their entirety. The following sections explain the rationale for this decision and provide information about its practical application.

Back to table of contents3. Background

Student loans were first introduced in the UK in 1990. At first, they were limited in scope, only providing funds to assist students in meeting their living costs. In 1998, student-met tuition costs were introduced in UK universities and student loans were extended in scope to include payments for tuition costs. The structure of loans was also changed at this point, with the level of repayment of the loan becoming contingent on the income of the borrower.

Prior to 1998, borrowers on low incomes could only defer beginning to repay the loan. A number of further changes followed in the years after. The most significant of these changes, in terms of their impact on statistics, took place in 2012 when tuition fees in England rose significantly and student loan limits were raised accordingly.

At the same time, average interest rates paid by students on the loans were raised. This has led to a rapid rise in the stock of student loans, with a current nominal value1 of around £120 billion or 6% of gross domestic product (GDP). Over the coming years, this stock is projected, by the Office for Budget Responsibility (OBR), to rise further to nearly 20% of GDP by 2040. For more information on the evolution of student loans in the UK, please see Annex A.

Student loans in the UK are extended and administered by the Student Loans Company (SLC), a central government body. This is different to the arrangement in a number of other countries where loans are often provided by private sector financial institutions, with government providing support by guarantees over those loans.

Notes for: Background

- Nominal value is defined as the principal extended plus interest accrued, less repayments and debt cancellations.

4. Current treatment

Currently, UK student loans are recorded as conventional loans in the national accounts and public sector finances (PSF); the same way as any other loan assets held by the UK government and recorded at nominal value. A consequence of the current student loan policy is that a significant proportion of the money lent out and interest charged on it will be cancelled rather than repaid. This can be for a number of reasons, but most notably because a student’s earnings may remain below the earnings threshold for the 30 years after they graduate, or may rise above it too infrequently or by too small an amount to repay both their principal and the interest on it before the loan matures. As the income contingent nature of the student loans is not considered under the current approach, recording UK student loans as conventional loans within the national accounts framework leads to the following three issues:

government revenue includes accrued interest on student loans that will never be paid

government expenditure is currently little affected by student loan cancellation but it is clear that decades in the future there will be a significant impact on government expenditure as a result of policy decisions being made in the present

government can sell tranches of loans below the loan nominal value without any effect on government expenditure either at the time of sale or in the future

The Office for Budget Responsibility (OBR) has argued that each of these issues can be seen as “fiscal illusions”. By this, they mean accounting treatments that do not necessarily reflect the true health of the fiscal position.

Advantages of current treatment

Reflects debtors’ (students) financial position.

Does not require the use of economic models and assumptions about future loan repayments.

Disadvantages of current treatment

Does not fully comply with the European System of Accounts 2010: ESA 2010 definition of a loan being unconditional debt that is repaid at maturity.

Does not recognise expected losses at inception and shifts the associated government expenditure decades into the future.

Overestimates government revenue in form of interest receivable during the life time of the loans.

Does not reflect creditor’s (government’s) true financial position by recording a nominal value that is significantly above the true value of the asset.

When portions of the loan book are sold, this flatters the government accounts, as future debt cancellation of the loans sold does not impact government expenditure.

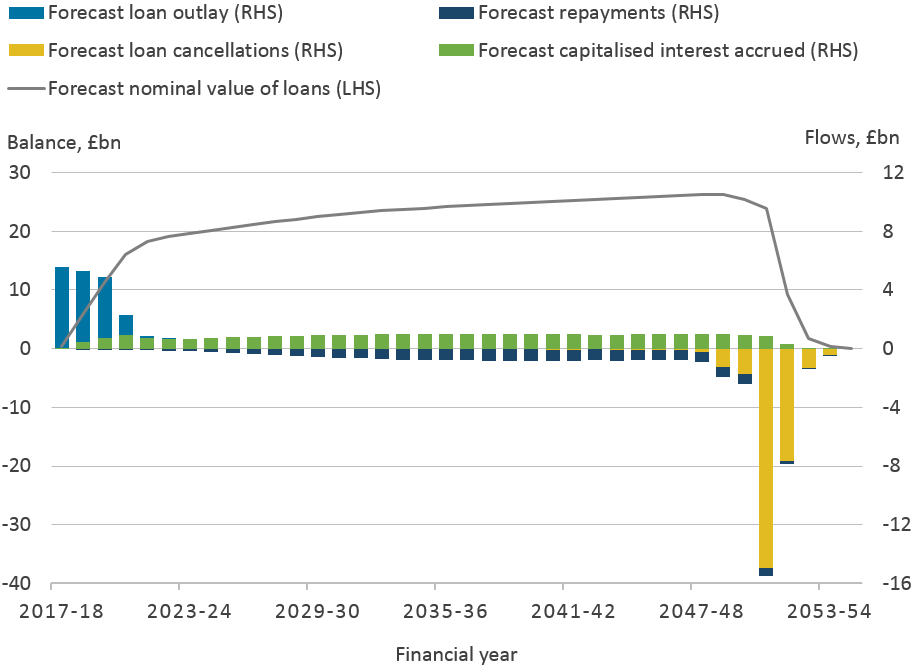

Figure 1: Current treatment – illustrative impact on net borrowing for a cohort of students1

England

Source: Office for National Statistics using Department for Education’s forecasts

Notes:

- By cohort we understand this to be a group of students that receive the first part of their student loans in a given academic year.

Download this image Figure 1: Current treatment – illustrative impact on net borrowing for a cohort of students^1^

.png (33.9 kB) .xlsx (23.7 kB)5. Decision

The Looking ahead – developments in public sector finances article, of July 2018, described four possible treatments of UK student loans.

The statistical manuals that provide the guidance used to compile the public sector finances (PSF) statistics, that is, the European System of Accounts 2010: ESA 2010 and Manual on Government Deficit and Debt 2016: MGDD 2016, are generally definitive in relation to their treatment of loans. However, student loans have a high degree of contingency and therefore do not fit fully with current guidance. These instruments, although loans in a legal sense, do not fully meet the criteria of loans as defined in ESA 2010. Therefore, we engaged with international statistical organisations and other national statistical institutions on the most appropriate recording.

Aligning the UK National Accounts and PSF statistics with international guidance promotes the comparability of economic statistics between countries. Office for National Statistics (ONS) has therefore sought to find a solution that would comply with the emerging international statistical guidance.

Following this engagement with the international statistical community, we have reflected on the contributions received and decided that the best way to reflect student loans within the UK National Accounts and PSF statistics is to treat part as loans, since some portion will be repaid, and part as capital transfers, since some will not.

We considered this partitioned loan-transfer approach (also referred to as the hybrid approach in our July 2018 article) best to reflect the economic substance of income contingent loans, such as UK student loans, from the perspectives of both the students and the government.

This ONS decision is supported by Eurostat (the statistical body of the European Commission) and much of the wider international statistical community. As such, we anticipate that the 2019 update to the Manual on Government Deficit and Debt will include a chapter on income contingent loans, allowing a part loan, part capital transfer statistical treatment.

The partitioned loan-transfer approach takes the concept of ESA 2010 (paragraph 20.121) and applies it to a loan book, as distinct from an individual loan:

“Loans (F.4) include, in addition to loans to other government units, lending to foreign governments, public corporations, and students. Loan cancellations are also reflected here with a counterpart entry under capital transfer expenditure. Loans granted by government not likely to be repaid are recorded in the ESA as capital transfers, and are not reported here.”

In simple terms, the idea is that a portion of the student loan outlay is considered to be a capital transfer to the borrower (this can be thought of as government cancelling this portion of the loan at inception), with the remaining portion treated as a genuine loan asset or liability. Adopting the partitioned loan-transfer approach addresses most of the issues with the current treatment.

Advantages of new treatment

Better reflects the economic substance of student loans from both the creditor’s and the debtors’ perspective.

Interest recorded as government revenue is only that which accrues on the portion of the outlay expected to be repaid.

Government expenditure related to the cancellation of student loans is accounted for in the period loans are issued to students, rather than at maturity.

The value of the loan asset recorded on the government’s balance sheet better reflects the true value of the loan and so the government’s financial position.

The sale of portions of the loan book no longer flatters the government accounts as the expected loan cancellations, for the sold loans have already been recorded in government expenditure at the time the loans are originally provided.

Approach in PSF statistics is similar to that followed in departmental accounts where loan assets are recorded at their fair value and provisions are recorded for future expected loan cancellations.

Disadvantages of new treatment

This is not currently a standard approach in international guidance, so there is no precedent on implementation.

Movements in important fiscal aggregates could be sensitive to assumptions about long-term repayment trajectories and interest rates for student loans.

Uses a modelled approach for expected future student loan repayments and so requires an approach to reconciliation of this forecast and the actual outturn data.

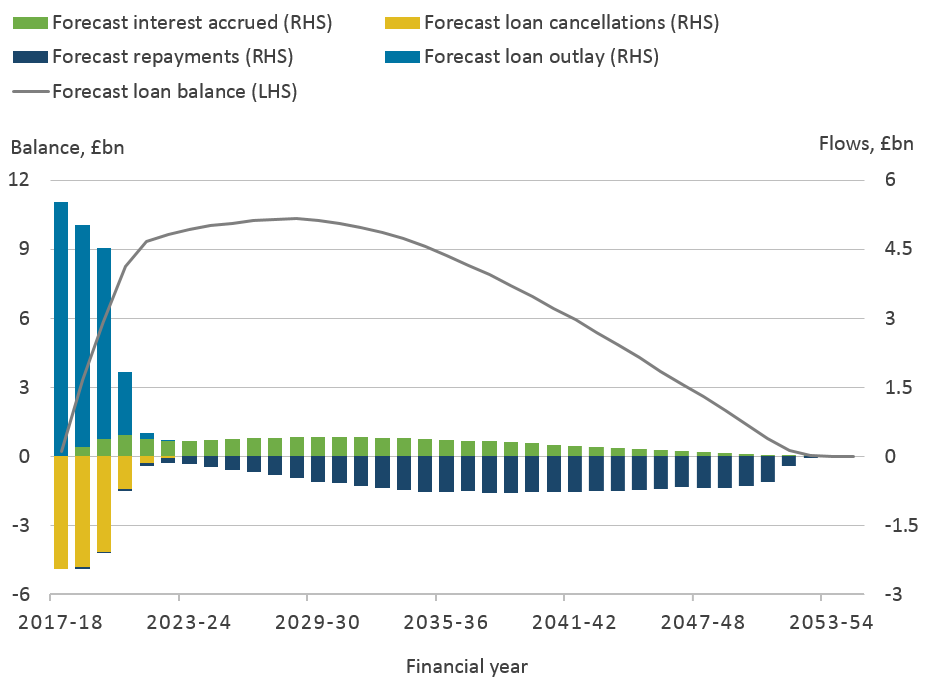

Figure 2: Partitioned loan-transfer approach - estimated impact on government net borrowing of a cohort of students

England

Source: Office for National Statistics using Department for Education’s forecasts

Download this image Figure 2: Partitioned loan-transfer approach - estimated impact on government net borrowing of a cohort of students

.png (34.0 kB) .xlsx (23.3 kB)6. Implications of the new decision for fiscal statistics

Fiscal impacts of the partitioned loan-transfer approach vary considerably to the current loan approach, namely for public sector net borrowing (PSNB) and public sector net financial liabilities (PSNFL). Table 1 compares the fiscal impacts of the new approach with the current approach. In its October 2018 Economic and fiscal outlook, the Office for Budget Responsibility estimated that PSNB in the financial year ending 2019 would rise by approximately £12 billion as a result of changing from the current approach to the new partitioned loan-transfer approach.

| Transaction | Public sector net borrowing (PSNB) | Public sector net debt (PSND) | Public sector net financial liabilities (PSNFL) | |

|---|---|---|---|---|

| Extension of student loan | Partitioned | Increases by value of loans not expected to be repaid | Increases by full value of outlay | Increases by value of loans not expected to be repaid |

| Conventional lending | No effect | Increases by full value of outlay | No effect | |

| Interest accrual on student loan | Partitioned | Decreases by value of interest accrued on loans expected to be repaid | No effect | Decreases by value of interest accrued on loans expected to be repaid |

| Conventional lending | Decreases by value of interest accrued on all student loans | No effect | Decreases by value of interest accrued on all student loans | |

| Repayment of student loan | Partitioned | No direct effect¹ | Decreases by full value of repayment | No direct effect¹ |

| Conventional lending | No effect | Decreases by full value of repayment | No effect | |

| Write-offs at maturity | Partitioned | No effect² | No effect | No effect² |

| Conventional lending | Increases by the nominal value of loans written off | No effect | Increases by the nominal value of loans written off |

Download this table Table 1: Comparison of direct effects of student loan transactions under partitioned loan-transfer and conventional lending approaches

.xls .csv7. Partitioning student loans into a loan and transfer element

Under the partitioned loan-transfer approach, the extension of “loans” to students is seen as a combination of lending and transferring funds to students. Conceptually, the government expenditure in the form of a transfer can be seen as cancelling at inception loans that are unlikely to be repaid. As such, lending should capture student loans that are expected to be repaid; the transfer – those that are not. Those student loans that are expected to be repaid would give rise to accrued interest, just as any conventional loans. In contrast, student loans recorded as a transfer at inception are not financial assets for the government (creditor) and cannot be directly associated with any interest or repayments.

This means that the reported interest on the total loan book needs to be adjusted in accordance with the calculated transfer component. As such, the following simple identities need to be true.

At inception:

Outlay = Lending + Transfer

Over life of loan:

Repayments = Lending + Interest

In a situation where an income contingent loan has a fixed contractual interest rate, it is relatively easy to calculate the interest accruing on the student loans recorded as a financial instrument. However, in the case of UK student loans, the interest rate, as well as the repayment level, are both contingent on the borrower income. This means there is more uncertainty when estimating interest that is expected to accrue on the UK student loans than there might be otherwise.

As a result, the following estimates are needed to calculate the lending and transfer components of the loan outlay in any particular year:

the level of future repayments related to all outlaid student loans

the interest rates that will be applied to all outlaid student loans

In the case of UK student loans, forecasts of future repayments and interest rates are available through the Department for Education’s (DfE) student repayment model.

Given the complexity of any model, the number of assumptions that have to be made, as well as the long loan term, it is highly unlikely that any estimates made at inception of future losses will hold over the loan term. Examples of new information that could impact estimates, include:

outturn repayment data differ from modelled expectations

economic forecast data used in expected losses model become outdated

policy changes, for example, a change in the repayment threshold or eligibility criteria

Further work is still needed on how each form of new information is best treated within the new partitioned loan-transfer approach and what, if any, impact there is on the fiscal aggregates as a result.

Back to table of contents8. Issues still to be decided

While a great deal of progress has been made in establishing a new methodology for recording student loans, some areas remain undecided. These areas can be summarised as:

remaining conceptual issues – such as deciding how to treat new information and the impact of sales of student loans

modelling and deriving fiscal statistics requirements – finalising the methodology used to derive the required statistical estimates, including historical time series

implementation and ongoing management of statistics – establishing business processes for implementation, for example, how revisions from new information will be incorporated; this also requires establishing a process for ongoing quality assurance and review of the modelling outputs

The scale of work involved to implement the new approach is large and requires continued engagement with other bodies such as the Department for Education, HM Treasury, the Office for Budget Responsibility and the devolved administrations.

Back to table of contents9. Next steps

In July 2018, we explained our strategy around improving the visibility and explanation of methodological changes. Our strategy includes three broad elements:

publication of ongoing and planned public sector finance (PSF) methodology and classification work to give users early sight of changes that might impact the fiscal aggregates

packaging together PSF methodological changes so that they occur, where possible, at a single point in the year to provide increased predictability to users

publishing more information on the impacts of major changes to allow users to identify movements in the fiscal aggregates that are solely a result of our methodology improvements

The new methodology surrounding the recording of student loans will continue to be communicated and implemented in line with this strategy.

The complexities of modelling the partitioned loan-transfer approach, outstanding detailed methodological decisions and the need to apply the new approach consistently to historical data, mean that it will take some time before we are able to implement the new approach.

Prior to implementation we will publish estimated fiscal impacts in the public sector finances, for at least the more recent period. Alongside this we will publish a detailed methodological article relating to the new partitioned loan-transfer approach.

Our current aim is to publish the methodology guide and provisional fiscal estimates from June 2019, with full implementation of the new approach in the PSF, and possibly wider national accounts, in September 2019. However, applying the new approach to the historical time series and developing and quality assuring the new model, to underpin the methodological approach, are substantial tasks. This means that, at this stage, any planned implementation dates can only be provisional.

Outside of methodological articles, we will communicate updates to this work through the monthly public sector finances bulletin.

Back to table of contents11. Annex A: Overview of the UK student loan system

The UK student loans scheme for higher education students was first introduced through the Education (Student Loans) Act 1990 and the Student Loans Company (SLC) was established to administer the scheme. Unlike student loans systems in many countries, where private banks provide the loans to students and government guarantees all, or some, of those loans, in the UK the SLC directly extends the loans to students. The SLC is a non-profit making, government-owned organisation and as such, it is classified within the central government subsector.

The UK student loan system for higher education is complex and varies depending on:

whether the loan is for a graduate or postgraduate course

where the student was domiciled when taking out the loan (England, Wales, Scotland or Northern Ireland)

where the university to which the loan related was based (England, Wales, Scotland or Northern Ireland)

As the greater part of the UK student loan stock relates to English universities, this annex presents a simplified picture of the UK loan system based on an English domiciled student taking out a loan for a single undergraduate course at an English university. For such a student, the conditions of the loan would have been different depending on whether the loan was taken out prior to September 1998, prior to September 2012, or later. Prior to September 1998, the loans taken out by students were maintenance loans to cover their living costs, while from September 1998 onwards, the loans were not restricted only to maintenance but also covered student tuition fees.

September 1990 to August 1998

Initially, loans were provided by SLC to students only to provide students with financial help towards their living costs. The conditions of the loans were that:

they only had to be repaid once the borrower (graduate) was earning more than a specified threshold (set at 85% of average annual earnings for full-time workers), known as the deferment threshold

graduates earning less than the deferment threshold could annually choose to defer the loan repayments for a period of 12 months

once the loan repayments commenced then the full repayment was to be made over 60, or 84, equal monthly instalments

interest rates were set annually and were based on the Retail Prices Index (RPI)

interest was applied throughout the life of the loan, from the date of original extension of the loan to the final date of repayment

loans were cancelled if: the borrower died; the borrower suffered a disability which made them permanently unfit to work; the borrower reached the age of 50 years (and took out the loan when aged below 40 years); the borrower reached the age of 60 years (and took out the loan when aged 40 years or over); or the borrower took out the student loan more than 25 years ago

September 1998 to August 2012

The Teaching and Higher Education Act 1998 introduced tuition fees for higher education students, capped initially at £1,000 for an academic year. This cap was increased to £3,000 in 2006 and was incrementally increased after this to £3,465 in 2012. The 1998 legislation also changed the eligibility criteria for maintenance grants so that less students would be eligible for grants and consequently more students would require maintenance loans as financial support towards their living costs. Alongside these other changes, the SLC restructured the student loans it extended and for the period between the academic year 1998 to 1999 and 2011 to 2012, the conditions of the loans were that:

they only had to start to be repaid once the borrower (graduate) was earning more than a specified threshold, set lower than the previous deferment threshold, and known as the repayment threshold

graduates earning above the repayment threshold were required to pay 9% of their gross income above this threshold

loan repayments continued until the original loan principal plus accrued interest were fully paid

interest rates were based either on RPI or the Bank of England base rate plus 1%, whichever was lower

interest was applied throughout the life of the loan, from the date of original extension of the loan to the final date of repayment

loans were cancelled if: the borrower died; the borrower suffered a disability which made them permanently unfit to work; the borrower reached the age of 65 years (and took out the loan prior to September 2006); or the borrower graduated from the course to which the loan relates more than 25 years ago (and the loan was taken out after August 2006)

September 2012 onwards

In September 2012, the tuition fee cap was increased significantly to £9,000 for an academic year. Alongside this, the loan conditions were restructured again so that:

as before, they only had to start to be repaid once the borrower (graduate) was earning more than a specified repayment threshold, but that repayment threshold was higher than previously

as before, graduates earning above the repayment threshold were required to pay 9% of their gross income above this threshold

as before, loan repayments continued until the original loan principal plus accrued interest were fully paid

interest rates during the higher education course were set at RPI plus 3% and thereafter the interest rate will vary between RPI and RPI plus 3%, depending on the income of the graduate (the higher rate being for those with higher earnings)

as before, interest was applied throughout the life of the loan, from the date of original extension of the loan to the final date of repayment

loans were cancelled if: the borrower died; the borrower suffered a disability which made them permanently unfit to work; or the borrower graduated from the course to which the loan relates more than 30 years ago

Value of loans extended

The value of UK student loans extended in a particular academic year has been increasing year-on-year. To provide an indication of the size of the UK student loan market, the value of income contingent loans extended to English domiciled undergraduate students in the academic year 2016 to 2017 was £12.8 billion. The equivalent figure for the academic year 2010 to 2011 was £5.6 billion and for 1995 to 1996 was £0.7 billion. The earlier 1995 to 1996 figure being for all UK students and not just English domiciled ones.

In 2016 to 2017, approximately 63% of the total extended loan value was in relation to tuition fees, whereas in 2011 to 2012 this percentage was much lower at 44%, largely reflecting the increase in tuition fees since September 2012.

Loan take-up

Not all eligible students opt to take out student loans, with figures from the SLC estimating that 87% of eligible students took out income contingent maintenance loans during the period September 2010 to August 2016. Over the same period, 90% of eligible students took out income contingent tuition fee loans.

Back to table of contents12. Annex B: Engagement with the international statistical community

As explained in this article, Office for National Statistics (ONS) has been engaging with the international statistical community on the treatment of UK student loans and similar “income contingent loans” since early 2018. This engagement has been through papers, questionnaires, meetings and bilateral discussions. Some of the main events in the statistical debate on the treatment of UK student loans are:

7 to 9 March 2018 – ONS presents a paper on the statistical treatment of “income contingent loans” to the Task Force on EDP Methodological Issues

24 April 2018 – ONS formally announces that it has begun a review on the most appropriate statistical treatment for UK student loans

June 2018 – Eurostat issues a first questionnaire on income contingent loans

20 to 22 June 2018 – results of the questionnaire on income contingent loans are discussed at the EDP Statistics Working Group

17 July 2018 – ONS publishes an article on future developments in UK public sector finances with a large section devoted to the work on UK student loans

17 July 2018 – the Office for Budget Responsibility (OBR), the independent body responsible for UK fiscal forecasts, publishes a working paper on the options for recording UK student loans in fiscal statistics

August 2018 – Eurostat issues a second questionnaire on income contingent loans

11 to 13 September 2018 – results of the second questionnaire on income contingent loans and the proposed way forward are discussed at the Task Force on EDP Methodological Issues

10 to 12 December 2018 – draft text on income contingent loans for the 2019 update to the Manual on Government Deficit and Debt is discussed at the EDP Statistics Working Group

In addition to the statistical methodology work and publications, there has been considerable interest in the issues presented by UK student loans from a wide range of commentators, most notably two different UK Parliamentary committees and the National Audit Office.

The House of Commons Treasury Committee published a student loans report in February 2018, while the House of Lords Economic Affairs Committee published a report on the funding of higher education in June 2018 and the National Audit Office published a review of the December 2017 student loan sale in July 2018.

Back to table of contentsContact details for this Article

Public.Sector.Accounts@ons.gov.uk

Telephone: +44 (0)1633 455668