1. Main points

Private rental prices paid by tenants in the UK rose by 1.5% in the 12 months to August 2020, up from 1.4% in the 12 months to July 2020.

Private rental prices grew by 1.5% in England, 1.4% in Wales and 0.5% in Scotland in the 12 months to August 2020.

London private rental prices rose by 1.3% in the 12 months to August 2020.

The Office for National Statistics (ONS) has released a public statement on the coronavirus (COVID-19) and the production of statistics; Section 8: Measuring the datadescribes the situation in relation to the Index of Private Housing Rental Prices (IPHRP).

2. UK private rental prices

Figure 1: The UK annual private rental price growth has been between 1.4% and 1.5% since November 2019

Index of Private Housing Rental Prices percentage change over 12 months, UK and Great Britain, January 2012 to August 2020

Source: Office for National Statistics – Index of Private Housing Rental Prices

Notes:

- Data presented in this dataset are classified as Experimental Statistics and subject to revisions if improvements in the methodology are identified. Results should be interpreted with this in mind.

Download this chart Figure 1: The UK annual private rental price growth has been between 1.4% and 1.5% since November 2019

Image .csv .xlsPrivate rental prices paid by tenants in the UK increased by 1.5% in the 12 months to August 2020, up from 1.4% in the 12 months to July 2020. For example, a property that was rented for £500.00 per month in August 2019 that had a rent increase of the average UK rate would be rented for £507.50 in August 2020.

Growth in private rental prices paid by tenants in the UK has generally slowed since the beginning of 2016, driven mainly by a slowdown in London over the same period. Rental growth has started to pick up since the end of 2018, driven by strengthening growth in London. Rental growth has remained broadly flat since November 2019.

In the 12 months to August 2020, rental prices for the UK excluding London increased by 1.6%, unchanged since June 2020 (Figure 1). London private rental prices increased by 1.3% in the 12 months to August 2020, up from 1.1% in the 12 months to July 2020.

The Association of Residential Letting Agents (ARLA) reported in their Private Rented Sector Report, July 2020 that the number of new prospective tenants reached a record high, breaking the previous record, which was in January 2020. The number of rental properties available has continued to rise in July 2020, reaching an all-time high for the month of July.

The Royal Institution of Chartered Surveyors' (RICS') August 2020 Residential Market Survey reported that tenant demand continued to rise sharply, while landlord instructions were broadly flat following a modest pick-up in July. Rental growth expectations over the near term have now strengthened in each of the past three months.

These supply and demand pressures can take time to feed through to the Index of Private Housing Rental Prices (IPHRP), which reflects price changes for all private rental properties, rather than only newly advertised rental properties.

Focusing on the long-term trend, between January 2015 and August 2020, private rental prices in the UK increased by 9.5% (Figure 2).

Figure 2: UK rental prices have increased by 9.5% since January 2015

Index of Private Housing Rental Prices indices, UK, January 2015 to August 2020

Source: Office for National Statistics – Index of Private Housing Rental Prices

Notes:

- Data presented in this dataset are classified as Experimental Statistics and subject to revisions if improvements in the methodology are identified. Results should be interpreted with this in mind.

Download this chart Figure 2: UK rental prices have increased by 9.5% since January 2015

Image .csv .xls3. UK private rental growth rates by country

In England, private rental prices grew by 1.5% in the 12 months to August 2020, up from 1.4% in the 12 months to July 2020. When London is excluded from England, privately rented properties increased by 1.7% in the 12 months to August 2020, unchanged since May 2020.

Private rental prices in Wales grew by 1.4% in the 12 months to August 2020, down from 1.6% in the 12 months to July 2020.

Rental growth in Scotland increased by 0.5% in the 12 months to August 2020, down from 0.6% in the 12 months to July 2020. Scotland's rental growth has remained weaker than that of the rest of the UK since August 2016.

The annual rate of change for Northern Ireland in August 2020 (2.4%) was higher than that of the other countries of the UK. Northern Ireland data have been copied forward since June 2020; the next update to Northern Ireland data will be in the release published on 16 December 2020. The Northern Ireland annual growth rate has remained broadly consistent (around 2%) since 2018. However, in recent months there has been an increase in the annual growth rate.

Figure 3: The annual rental growth in Scotland has been lower than other countries of the UK since August 2016

Index of Private Housing Rental Prices percentage change over 12 months for countries of the UK, January 2012 to August 2020

Source: Office for National Statistics – Index of Private Housing Rental Prices

Notes:

- Data presented in this dataset are classified as Experimental Statistics and subject to revisions if improvements in the methodology are identified. Results should be interpreted with this in mind.

- Northern Ireland data are only available every three months. Northern Ireland data are copied forward until the next data are obtainable, which will be in the November 2020 bulletin released on 16 December 2020.

Download this chart Figure 3: The annual rental growth in Scotland has been lower than other countries of the UK since August 2016

Image .csv .xlsAll UK countries experienced a rise in their private rental prices between January 2015 and August 2020, with rental prices in England and Northern Ireland increasing more than those in Wales and Scotland across the data time series (Figure 4).

Figure 4: Rental prices have increased more in England and Northern Ireland than in Wales and Scotland since 2015

Index of Private Housing Rental Prices indices for countries of the UK, January 2015 to August 2020

Source: Office for National Statistics – Index of Private Housing Rental Prices

Notes:

- Data presented in this dataset are classified as Experimental Statistics and subject to revisions if improvements in the methodology are identified. Results should be interpreted with this in mind.

- Northern Ireland data are only available every three months. Northern Ireland data are copied forward until the next data are obtainable, which will be in the November 2020 bulletin released on 16 December 2020.

Download this chart Figure 4: Rental prices have increased more in England and Northern Ireland than in Wales and Scotland since 2015

Image .csv .xls4. UK private rental growth by English regions

Focusing on the English regions, the largest annual rental price increase in the 12 months to August 2020 was in the South West, at 2.5%, unchanged since May 2020 (Figure 5). This was followed by the East Midlands, at 2.4%.

The lowest annual rental price growth was in the North East and the South East where rental prices increased by 1.0% in the 12 months to August 2020.

Figure 5: Strongest annual rental price growth is in the South West

Index of Private Housing Rental Prices percentage change over the 12 months to August 2020, by English region

Source: Office for National Statistics – Index of Private Housing Rental Prices

Download this chart Figure 5: Strongest annual rental price growth is in the South West

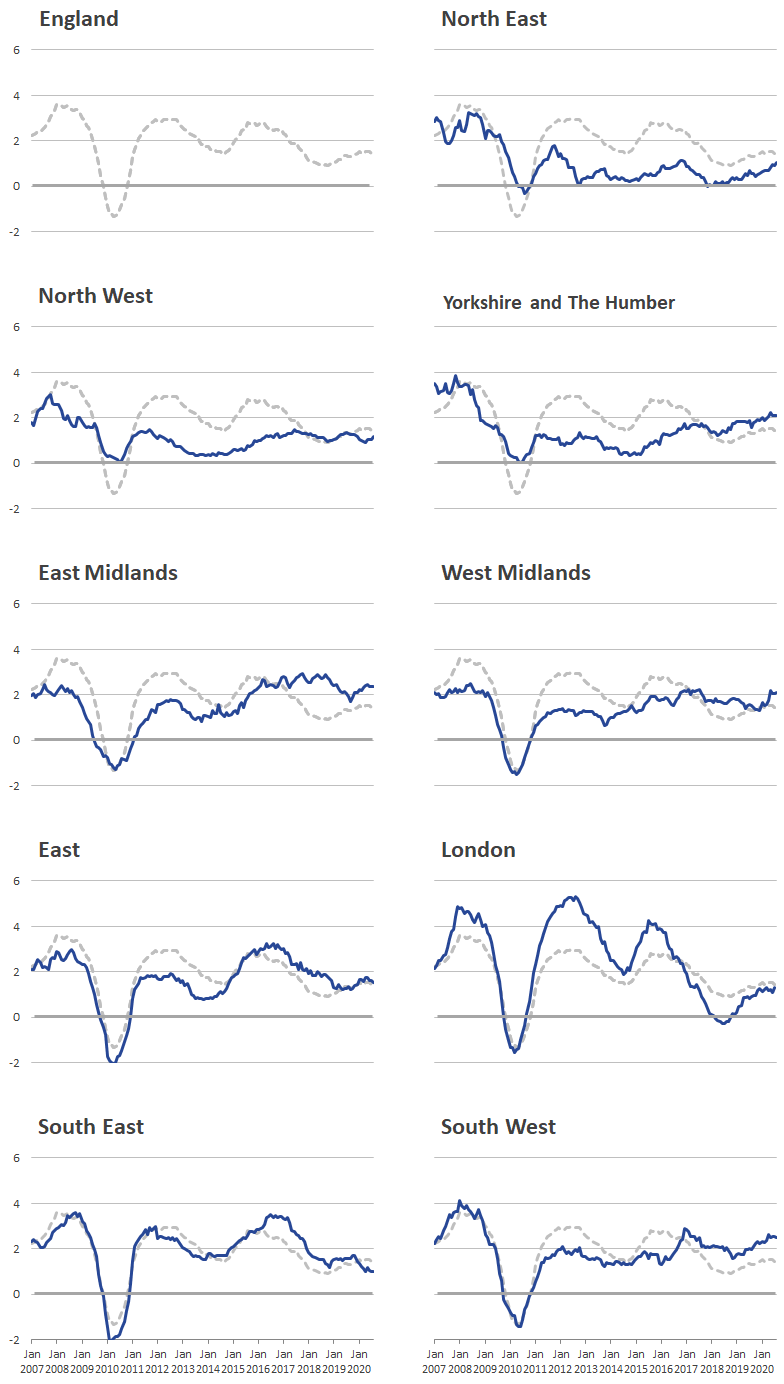

Image .csv .xlsFigure 6 shows the historical 12-month percentage growth rate in the rental prices of each of the English regions.

Figure 6: London rental prices experienced larger peaks and troughs than other regions

Index of Private Housing Rental Prices percentage change over 12 months by English region, January 2007 to August 2020

Source: Office for National Statistics – Index of Private Housing Rental Prices

Notes:

- The grey line shows England’s 12-month average private rental price growth.

Download this image Figure 6: London rental prices experienced larger peaks and troughs than other regions

.png (104.6 kB) .xls (88.1 kB)5. Measures of owner occupiers’ housing costs

Owner occupiers' housing costs (OOH) are the costs of housing services associated with owning, maintaining and living in one's own home. This is distinct from the cost of purchasing a house, which is purchased partly for the accumulation of wealth and partly for housing services.

OOH is an important component of the household consumption basket. In the Consumer Prices Index including owner occupiers' housing costs (CPIH), the OOH component is measured using the rental equivalence approach, OOH(RE). However, there are alternative ways of measuring OOH in the UK: the net acquisitions approach (OOH(NA)) and the payments approach (OOH(payments)).

In the 12 months to June 2020, OOH(RE) grew by 1.2%, OOH(NA) grew by 2.3% and OOH(payments) decreased by 1.2%. The annual growth rate for OOH(RE) has remained broadly consistent, fluctuating between 1.0% and 1.3% since December 2017. In June 2020, the annual growth rate of OOH(NA) was 1.1 percentage points greater than the growth rate of OOH(RE). The annual growth rate of OOH(payments) was 2.4% less than the growth rate of OOH(RE).

Figure 7: OOH(payments) is the only measure of owner occupiers’ housing costs to show a negative annual growth rate in Quarter 2 2020

Measures of owner occupiers’ housing costs growth rate, percentage change over 12 months, January 2006 to June 2020, UK

Source: Office for National Statistics – Measures of owner occupiers' housing costs

Download this chart Figure 7: OOH(payments) is the only measure of owner occupiers’ housing costs to show a negative annual growth rate in Quarter 2 2020

Image .csv .xlsThe Mortgage Interest Payments component was the main driving factor for the decrease in the annual growth rate of OOH(payments). This decrease follows the Bank of England's cut to the UK's interest rate from 0.75% to 0.25% on 11 March 2020. This was then further cut to 0.1% on 19 March 2020.

For OOH(NA), growth was driven by the "other services related to the acquisition of dwellings" contribution, which includes transfer costs and Stamp Duty. In the periods of interest, there had been no changes to the rules to how Stamp Duty was calculated, nor had there been changes to the equivalent taxes in Scotland and Wales, which are also measured. Therefore, it follows that a rise in house prices in June 2020 is responsible for the growth of Stamp Duty. Further detail on the contributions towards the growth can be found in the Measures of owner occupiers' housing costs datasets.

Back to table of contents6. Private rental data

Index of Private Housing Rental Prices, UK: annual weights analysis

Dataset | Released 25 March 2020

Aggregate weights information used in the experimental Index of Private Housing Rental Prices (IPHRP).

Index of Private Housing Rental Prices, UK: monthly estimates

Dataset | Released 16 September 2020

Rental price index historical time series (index values and annual percentage change).

Measures of owner occupiers' housing costs

Dataset | Released 16 September 2020

Owner occupiers' housing costs historical time series (index values, annual percentage change and contributions to the growth rate) - payments, rental equivalence and net acquisitions.

Measures of owner occupiers' housing costs: weights analysis

Dataset | Released 16 September 2020

Aggregate inflation measure for owner occupiers' housing costs historical time series (index values, percentage change and weights) aggregated with the Consumer Price Index (CPI) - payments, rental equivalence and net acquisitions.

7. Glossary

Index of Private Housing Rental Prices (IPHRP)

The Index of Private Housing Rental Prices (IPHRP) measures the change in the price tenants face when renting residential property from private landlords.

Administrative data

Administrative data are data that people have already provided to the government through day-to-day activities, for example, health records, social security payments or educational attainment information.

Owner occupiers’ housing costs – rental equivalence approach

Assumes a dwelling is a capital good and therefore not consumed, but instead provides a flow of services that are consumed each period. Rental equivalence imputes owner occupiers’ housing costs from the rents paid for equivalent rented properties. Measures the ongoing consumption of owner occupiers’ housing services.

Owner occupiers’ housing costs – net acquisitions approach

Treats a house as the purchase of a good that is part asset (the land) and part consumable (the house). Includes costs associated with buying and maintaining a house, for example, major repairs, transfer costs and dwellings insurance. Measures the cost of acquiring and maintaining owner occupiers’ housing.

Owner occupiers’ housing costs – payments approach

Directly measures what households pay as owner occupiers when consuming housing. Includes mortgage interest payments, transaction costs and running costs. Measures payments relating to the ownership of owner occupiers’ housing.

Back to table of contents8. Measuring the data

Coronavirus

The Office for National Statistics (ONS) is working to ensure that the UK has the vital information needed to respond to the impact of the coronavirus (COVID-19) pandemic on our economy and society; this includes how we measure the Index of Private Housing Rental Prices (IPHRP). The price collection for this publication has not been affected.

The ONS remains committed to providing the best and most accurate information we can, serving the public good at a time when it is needed the most. As this situation evolves, we are developing several solutions to meet potential scenarios depending on the amount of data that are able to be collected by our data suppliers, and to consider how we produce forthcoming publications. Users will be informed of any changes to how the data are measured.

The ONS has released a public statement on the coronavirus and the production of statistics. Specific queries must be directed to the Media Relations Office.

After EU withdrawal

As the UK leaves the EU, it is important that our statistics continue to be of high quality and are internationally comparable. During the transition period, those UK statistics that align with EU practice and rules will continue to do so in the same way as before 31 January 2020.

After the transition period, we will continue to produce our inflation statistics in line with the UK Statistics Authority's Code of Practice for Statistics and in accordance with internationally agreed statistical guidance and standards.

Sources

The IPHRP is constructed using administrative data. This means that the index makes use of data that are already collected for other purposes to estimate rental prices. The sources of private rental prices are the Valuation Office Agency (VOA), Scottish Government, Welsh Government and Northern Ireland Housing Executive (NIHE). Data for Northern Ireland also include data provided by Propertynews.com. Estimates are based on a known sample rather than a census.

The sources of the annually updated expenditure weights are the Ministry of Housing, Communities and Local Government (MHCLG), Scottish Government, Welsh Government, NIHE and VOA.

The IPHRP's indices are updated on a monthly basis with the new monthly estimate. Data are indexed with January 2015 as a base year. Data for England are provided from January 2005, data for Wales from January 2009 and data for Scotland from January 2011. UK data are from January 2015.

Quality

More quality and methodology information on strengths, limitations, appropriate uses, and how the data were created is available in the IPHRP QMI.

Back to table of contents9. Strengths and limitations

Strengths

The Index of Private Housing Rental Prices (IPHRP) is constructed using large administrative sources, specified in Section 8: Measuring the data. Annually, over 450,000 private rental prices are collected in England, 30,000 in Wales, 25,000 in Scotland and 15,000 in Northern Ireland.

The index does not only measure the change in newly advertised rental prices but reflects price changes for all private rental properties.

Limitations

The IPHRP is published as price indices, rather than average prices. It is also only published down to a country and regional level. While actual rental prices cannot currently be published in the IPHRP because of data access constraints, we are actively working to acquire the necessary data.

The IPHRP is released as an Experimental Statistic.

Back to table of contents